🚨🚨 BlockFi Rug-pulling is in progress. It starts with withdrawal restrictions. 🚨🚨

Minimum withdrawal amounts to fleece retail bag holders and only one withdrawal a month.

For the love of god, stop sending your money to these scammers.

Minimum withdrawal amounts to fleece retail bag holders and only one withdrawal a month.

For the love of god, stop sending your money to these scammers.

BlockFi will also slow down your withdrawals by asking for all your KYC/AML information *again* and then drag their feet approving your information again which they will already have. The sooner you withdraw, the better.

But BlockFi is insolvent and they can’t pay everyone.

But BlockFi is insolvent and they can’t pay everyone.

They’ll need a multi-hundred million dollar bailout or Tether gang to step up, and Tether isn’t printing fake money right now.

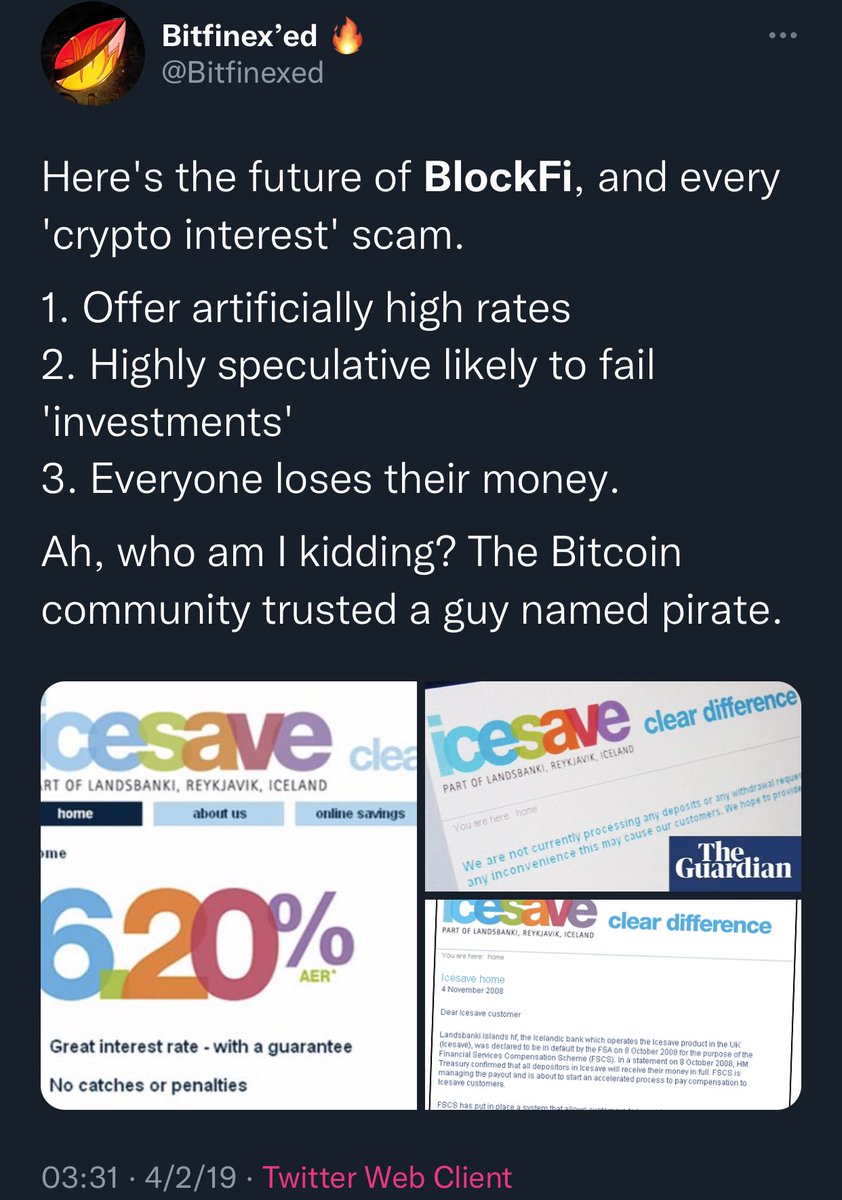

BlockFi has been a Ponzi since 2019.

BlockFi has been a Ponzi since 2019.

BlockFi has also loaned your money to a company called Babel Finance which is connected closely with the bitfinex/tether fraud.

• • •

Missing some Tweet in this thread? You can try to

force a refresh