1/ massive narrative shift under way right now

after a rough 2020 (who can forget crude futures flipping negative) the energy sector is entering a new era of profitability and cash flows

for 2021, exxon $XOM reported $23B of profits. chevron $CVX reported $15.6B net income.

after a rough 2020 (who can forget crude futures flipping negative) the energy sector is entering a new era of profitability and cash flows

for 2021, exxon $XOM reported $23B of profits. chevron $CVX reported $15.6B net income.

2/ i expect the energy sector and the crypto sector will become fast friends over the next decade

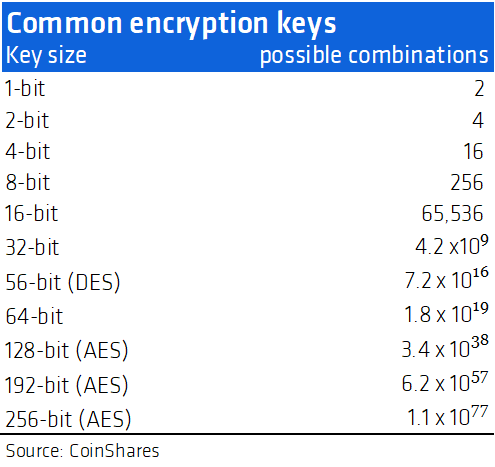

bitcoin mining and other types of specialized computation that supports the security and efficacy of blockchain networks require colocation with abundant energy sources

bitcoin mining and other types of specialized computation that supports the security and efficacy of blockchain networks require colocation with abundant energy sources

3/ this is already beginning in the middle east and the nordics, where billions is being spent on data center development colated with cheap energy

in 2021, data centers accounted for 3% of global energy demand, and this trend will only grow over time

arabnews.com/node/1889796/b…

in 2021, data centers accounted for 3% of global energy demand, and this trend will only grow over time

arabnews.com/node/1889796/b…

4/ so back to $XOM and $CVX and the energy majors. with billions of cash on hand, many energy companies have been focused on share buybacks to drive shareholder value.

what if instead, they spent that capital investing in crypto compute and colocation at scale?

what if instead, they spent that capital investing in crypto compute and colocation at scale?

5/ i believe the energy sector and the crypto sector are meant to be together, they're perfect complements for one another

energy x crypto = abundant cryptographically secure financial computation

energy x crypto = abundant cryptographically secure financial computation

6/ you can't have "blockchain" without energy flowing through a chip - doesn't matter what your consensus model is

the real opportunity is this - instead of nation states and corporations owning this infra, what if decentralized public networks did?

the real opportunity is this - instead of nation states and corporations owning this infra, what if decentralized public networks did?

7/ ok that's really all that's in my brain rn

energy cycle on upswing = record profits and cash flows

crypto cycle on upswing = massive treasuries

put the two together and the story tells itself

DM me if you're thinking about this still missing some pieces but it has legs

energy cycle on upswing = record profits and cash flows

crypto cycle on upswing = massive treasuries

put the two together and the story tells itself

DM me if you're thinking about this still missing some pieces but it has legs

• • •

Missing some Tweet in this thread? You can try to

force a refresh