Today's January #JobsReport is significantly stronger than expected. Job gains totaled 467,000 even as Omicron drove record high COVID cases. Unemployment ticked up to 4.0%

Huge payroll revisions too: Dec up to 510,000 from 199,000. Nov up to 647,000 from 249,000.

1/

Huge payroll revisions too: Dec up to 510,000 from 199,000. Nov up to 647,000 from 249,000.

1/

Charts will be slow this morning, but 2 more things:

-Labor force participation ticks up to 62.2%

-Weekly hours were down 0.2 hrs, employee absence due to illness up to 3.6 million, a new record high; showing Omicron had impact even if it reverse slow jobs growth

#JobsReport 2/

-Labor force participation ticks up to 62.2%

-Weekly hours were down 0.2 hrs, employee absence due to illness up to 3.6 million, a new record high; showing Omicron had impact even if it reverse slow jobs growth

#JobsReport 2/

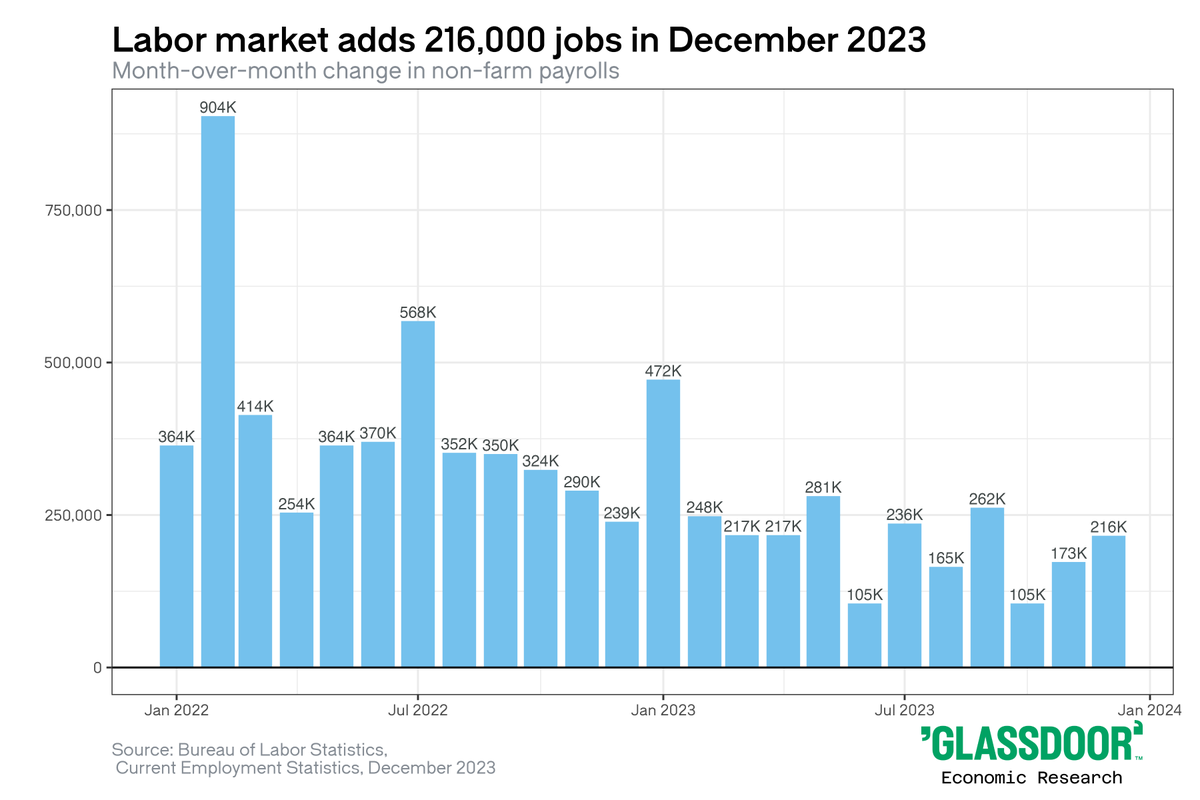

Slipping in a few charts while I can: we added 467,000 jobs in January. In hindsight, the end of year slowdown no longer looks as dramatic. Despite Omicron now *and* Delta in the late fall, jobs growth stayed surprisingly strong.

#JobsReport 3/

#JobsReport 3/

Job gains were broad-based. Even COVID-sensitive sectors like leisure & hospitality added 151,000 jobs. #Retail (+61,400), transportation & warehousing (+54,200) saw large gains despite the end of the holiday season, perhaps as employers held onto temp workers.

#JobsReport 4/

#JobsReport 4/

The surge in payroll gains now leaves us 2.9 million short of pre-crisis levels (or -1.9%). But you can see visually how much revisions have helped the picture. Now seems like the job market recovery was plowing ahead through the last few months.

#JobsReport 5/

#JobsReport 5/

One place that the Omicron impact *did* show up is a drop in average weekly hours from 34.7 to 34.5 as Omicron rippled thru the workforce & employees worked less due to illness, quarantine, family obligations, etc.

#JobsReport 6/

#JobsReport 6/

Average hourly earnings rose 5.7 percent year-over-year, though unclear whether that might be due to compositional effects with lower-wage workers more exposed to COVID and more likely to work less during January

#JobsReport 7/

#JobsReport 7/

That being said, wage growth in leisure & hospitality—one of the most COVID-exposed sectors—for production & nonsupervisory workers moderated only slightly to 15% year-over-year.

#JobsReport 8/

#JobsReport 8/

On the household survey: the unemployment rate ticked up to 4.0 percent from 3.9 percent. Still fairly low and on the back of strong labor force participation gains (+0.3 pp to 62.2 percent). Employers are still hiring & workers are still looking.

#JobsReport 8/

#JobsReport 8/

Looking at it again, seems like most of the labor force participation gains are coming from the population revisions. So not so much that LFP rose last month; more that it was actually slightly stronger in 2021 than initially estimated

#JobsReport 10/

#JobsReport 10/

The Black unemployment rate fell to 6.9%, though improvement has been unsteady. Even now the Black unemployment rate is more than double the white unemployment rate for the 2nd month in a row.

#JobsReport 11/

#JobsReport 11/

And another place where Omicron impact is showing up is employee absences due to illness, which surged to a record high of 3.6 million in Jan. Even if Omicron is less severe, its wide spread still has an extremely disruptive impact on workers & businesses alike.

#JobsReport 12/

#JobsReport 12/

Now to some of the nitty-gritty... Benchmark revisions! Payroll employment for March 2021 was revised upward 374,000 despite initial estimates of -166,000. Basically, jobs growth was much smoother in 2021 than initially reported.

#JobsReport 13/

#JobsReport 13/

Alas, the benchmark revisions do mean that the >1 million job gains from last June have been revised away. But happy to "trade away" a 1-million-job month for a few extra hundred thousand jobs.

#JobsReport 14/

#JobsReport 14/

Here are the pre/post-revision numbers on an annual basis. 2020 and 2021 both slightly better than initially reported. 2021 saw 6.7 million gains (up from 6.4 million), a even higher record high.

#JobsReport 15/

#JobsReport 15/

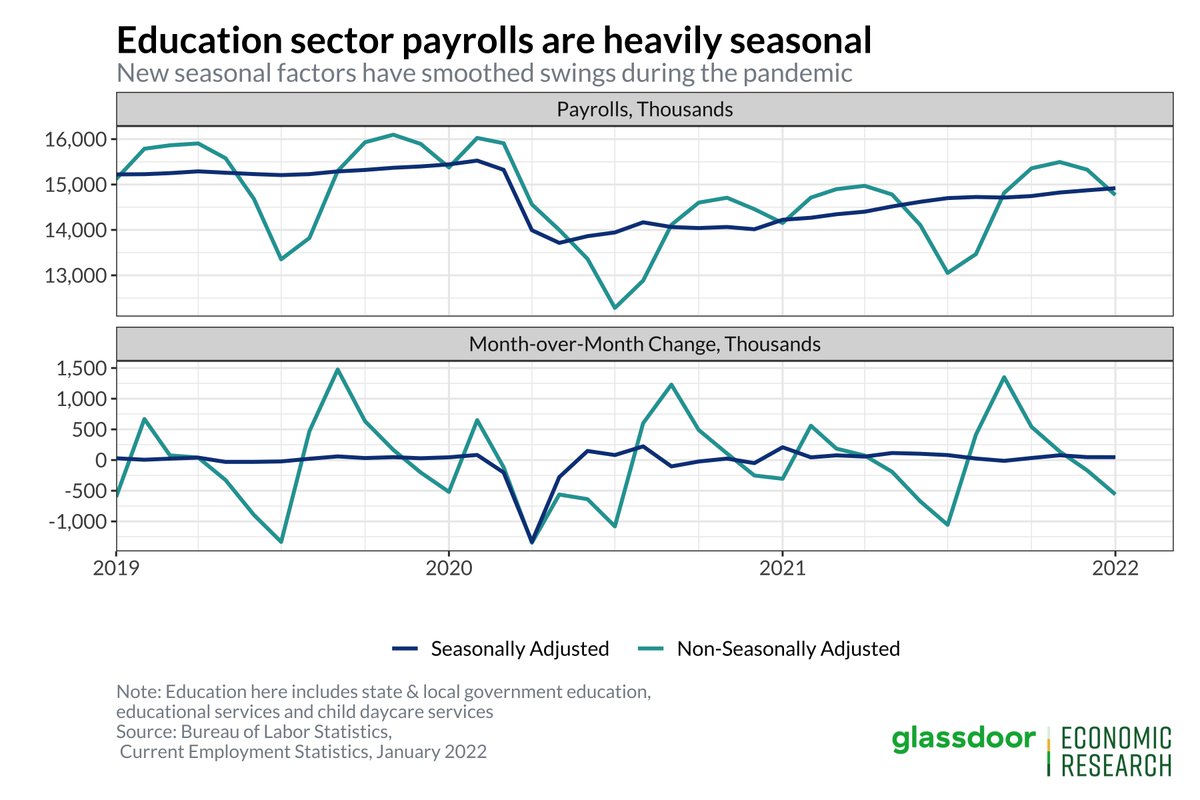

Here are the revisions by industry. Some interesting notes:

-Government seasonal adjustments have been smoothed out! 🥳

-Weaker growth in leisure & hospitality than initial ly reported

-Transportation & warehousing on a tear

#JobsReport 16/

-Government seasonal adjustments have been smoothed out! 🥳

-Weaker growth in leisure & hospitality than initial ly reported

-Transportation & warehousing on a tear

#JobsReport 16/

Look how smooth those seasonally adjusted education payrolls are now! (linked tweet has what the SA looked like prior to this week)

#JobsReport 17/

https://twitter.com/DanielBZhao/status/1489426948078112769?s=20&t=S_OLA2FrB1f3qRIb6km2qw

#JobsReport 17/

Accidentally skipped this chart earlier, but post-revisions, professional & business services + transportation & warehousing are now well above pre-pandemic levels. Job shortfalls are still heavily concentrated in leisure & hospitality, education, health care

#JobsReport 18/

#JobsReport 18/

#Remotework surged in January as Omicron pushed employers to reverse return-to-office plans.

Probably will be my last charts for today (but no promises)

#JobsReport 19/

Probably will be my last charts for today (but no promises)

#JobsReport 19/

• • •

Missing some Tweet in this thread? You can try to

force a refresh