Lead Economist & Senior Manager on @Glassdoor's Economic Research team. Maryland born and raised.

Now on: https://t.co/bk1NdkeLTU

How to get URL link on X (Twitter) App

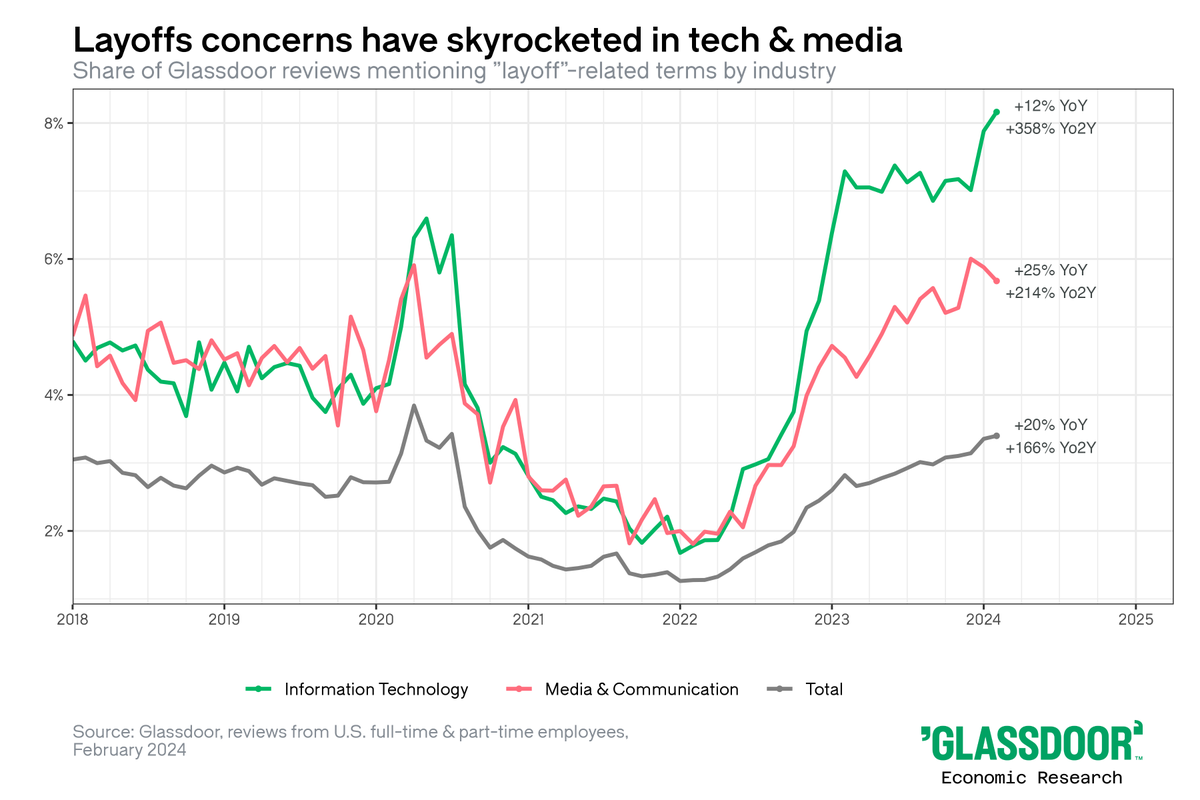

Discussions of layoffs in @Glassdoor reviews have skyrocketed over the last 2 yrs in tech & media. In tech, they're actually higher than even the worst of Covid.

Discussions of layoffs in @Glassdoor reviews have skyrocketed over the last 2 yrs in tech & media. In tech, they're actually higher than even the worst of Covid.

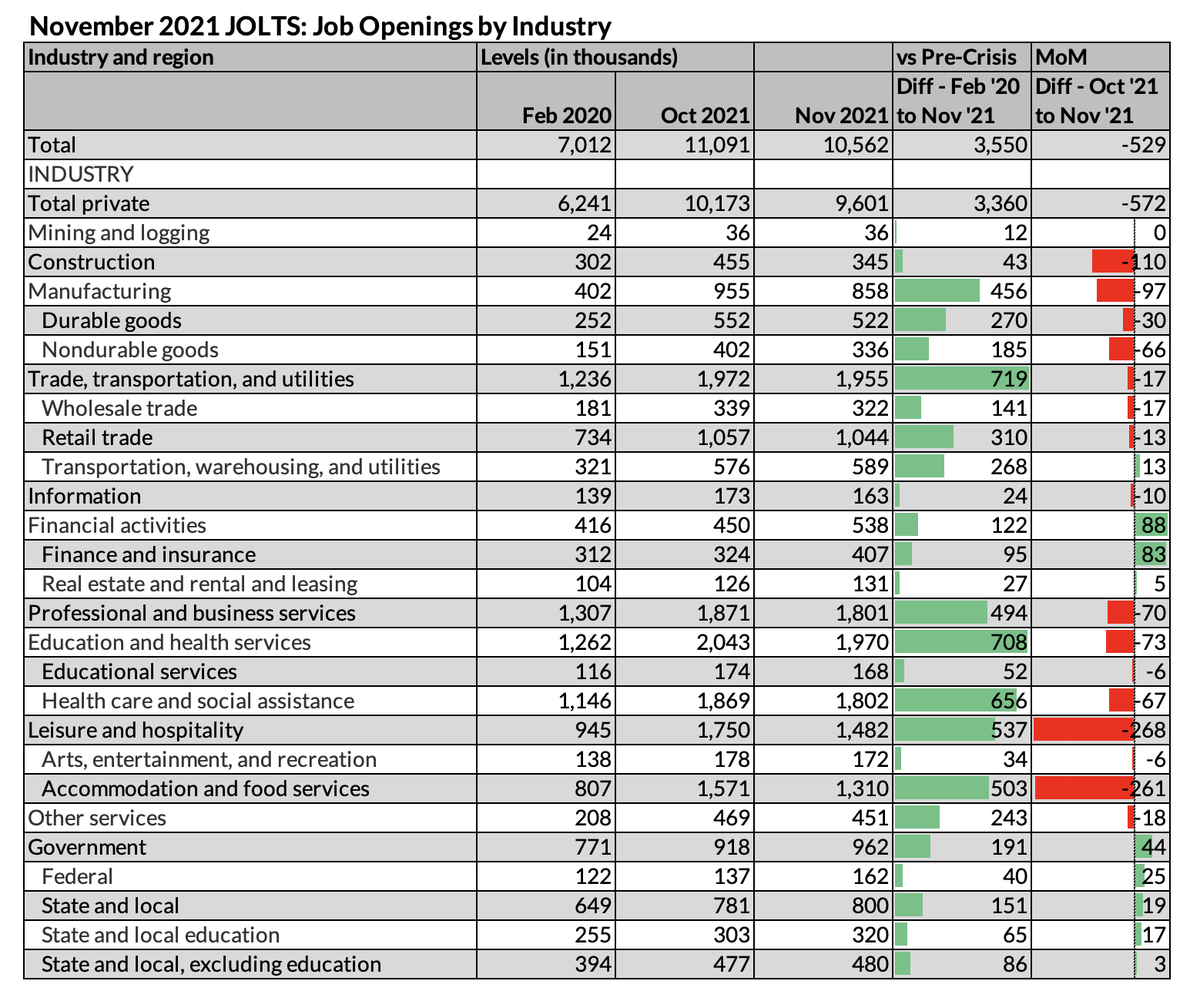

Job openings fell most sharply in some of the service sectors that have driven much of the recent jobs recovery:

Job openings fell most sharply in some of the service sectors that have driven much of the recent jobs recovery:

Like the discussion of competing on science vs execution vs China. US can compete on advanced science but less so on manufacturing at low cost. China executes best where science is mature. Clean tech is an important case where US is still playing catch-up

Like the discussion of competing on science vs execution vs China. US can compete on advanced science but less so on manufacturing at low cost. China executes best where science is mature. Clean tech is an important case where US is still playing catch-up

The drop in job openings and jump in unemployment in Aug pushed the ratio of openings to unemployed workers to 1.67, down from 1.97 in Jul.

The drop in job openings and jump in unemployment in Aug pushed the ratio of openings to unemployed workers to 1.67, down from 1.97 in Jul.

The drop in job openings was primarily driven by professional & business services (-325,000) and #manufacturing (-208,000). Prof & biz services openings dropped 14% MoM as hiring freezes crimped demand & pushed it back to late-2021 levels.

The drop in job openings was primarily driven by professional & business services (-325,000) and #manufacturing (-208,000). Prof & biz services openings dropped 14% MoM as hiring freezes crimped demand & pushed it back to late-2021 levels.

The increase in job openings in Dec was concentrated in accommodation & food services, despite the impact of Omicron. Job openings in the sector are lower than the summer peak of 1.67 million, but still up significantly over the pre-pandemic record of 1.02 million.

The increase in job openings in Dec was concentrated in accommodation & food services, despite the impact of Omicron. Job openings in the sector are lower than the summer peak of 1.67 million, but still up significantly over the pre-pandemic record of 1.02 million.

The slowdown was primarily in accommodation & food services (no surprise worker demand there falls as the pandemic worsens). Job openings in accommodation & food services are at their lowest since April 2021, though they're still up 62% over the course of the pandemic.

The slowdown was primarily in accommodation & food services (no surprise worker demand there falls as the pandemic worsens). Job openings in accommodation & food services are at their lowest since April 2021, though they're still up 62% over the course of the pandemic.

The increase in job openings was concentrated in accommodation & food services as employers felt more comfortable hiring with the Delta wave starting to wane in Oct. Remains to be seen whether that will continue in Nov given the slow #jobsreport we saw last Fri.

The increase in job openings was concentrated in accommodation & food services as employers felt more comfortable hiring with the Delta wave starting to wane in Oct. Remains to be seen whether that will continue in Nov given the slow #jobsreport we saw last Fri.

Consistent w/ the rough comparisons in state employment data released this morning as well. See @bencasselman's thread for findings & appropriate caveats (most of which apply to the JOLTS data too):

Consistent w/ the rough comparisons in state employment data released this morning as well. See @bencasselman's thread for findings & appropriate caveats (most of which apply to the JOLTS data too):https://twitter.com/bencasselman/status/1451562508360237071?s=20

https://twitter.com/DanielBZhao/status/1450910555418550272

And this pairs nicely with new research from @LaurenTEcon out today finding employee discussions of mental health & burnout on @Glassdoor have more than doubled since the pandemic began:

And this pairs nicely with new research from @LaurenTEcon out today finding employee discussions of mental health & burnout on @Glassdoor have more than doubled since the pandemic began: https://twitter.com/LaurenTEcon/status/1451224358815477766?s=20

Initial PUA claims have dropped to 2K as backdated claims fade post-expiration.

Initial PUA claims have dropped to 2K as backdated claims fade post-expiration.

Vaccine mandates were also mentioned in 6 sections. Discussions mostly about turnover, though more forward-looking as mandates start to take effect.

Vaccine mandates were also mentioned in 6 sections. Discussions mostly about turnover, though more forward-looking as mandates start to take effect.

https://twitter.com/jasonfurman/status/1394284652983115778And respondents self-report impact to their work availability: