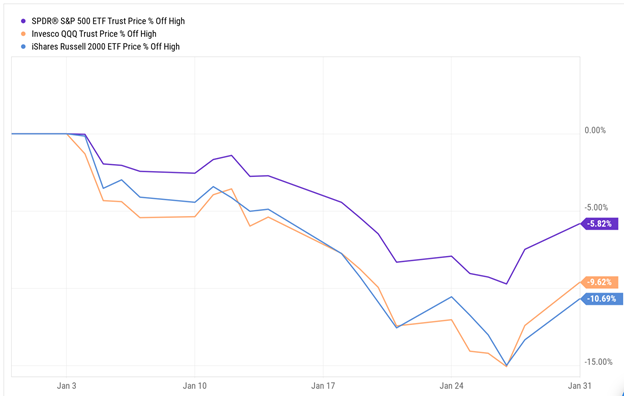

A quick little thread on those invested in “Long Vol” strats not seeing a big January when the Nas was down -14% at lows, SP down -5% for the month, and VIX up 44% ->

1/12 First of all, on the VIX was up 40% angle, @bennpeifert will haunt you – don’t quote VIX movements in percents

https://twitter.com/bennpeifert/status/1216021932631445504

2/12 Still… VIX did go from a low of about 17 to a high of around 32, meaning there was an increase in some options (the ones in the VIX calc) in those few weeks.

3/12 3.This is just the sort of market down, Vol up that is supposed to benefit a well diversified portfolio with exposure to the otherwise negatively performing asset of vol

https://twitter.com/bennpeifert/status/1362908520945913858

4/12 Problem is - here’s what Jan looked like for some publicly available tail hedge and hedged equity programs:

$TAIL -0.78%

$HEGD -3.69%

$SPD -4.96%

$TAIL -0.78%

$HEGD -3.69%

$SPD -4.96%

5/12 Others, like @mutinyFund Long Vol program were up small, while some popular VolTwit names were down on the month in their long vol focused private funds/accounts.

6/12 What’s happening here – why didn’t so called “Long Vol” pay out when there’s an obvious down move in the underlying index (SP) and a spike in volatility??

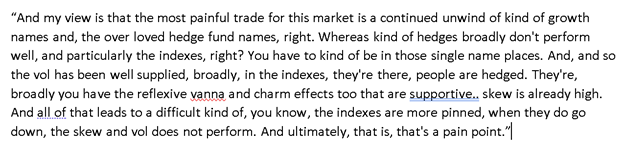

7/12 One of my favs, @Ksidiii explained it thusly:

https://twitter.com/Ksidiii/status/1484300768886890499?s=20&t=qa9AYMZwkmWXQ-1IQ6JTHA

8/12 While @jam_croissant sort of predicted it on our pod recorded back in Dec

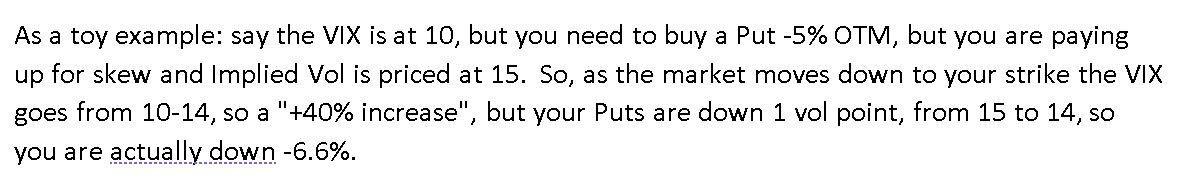

9/12.Finally - here’s a nice explanation I ripped from an email @JasonMutiny copied me on….

10/12Now, we could take this to mean there’s too much tail protection and put skew and the rest where the next sell off won’t provide the same sort of payoff for these type of strats…Indeed, yours truly posited that in a post back in Aug ’21

rcmalternatives.com/2021/08/youre-…

rcmalternatives.com/2021/08/youre-…

11/12BUT, that seems to be overcomplicating the matter. The simpler explanation is that a -5% move down isn’t a tail risk. And that the VIX does not represent volatility (especially in the tails) and in what the pros call fixed strike vol

12/12 While at the same time... it often feels like you have to be some sort of Jedi of Vol to understand it...

f.hubspotusercontent20.net/hubfs/313774/V…

f.hubspotusercontent20.net/hubfs/313774/V…

• • •

Missing some Tweet in this thread? You can try to

force a refresh