Something interesting is happening in the Alts space of late, with more and more Alts folks moving into stocks.

Is this creating somewhat of a hidden stock market bid, hiding here in plain sight?

Time for a thread

👇👇👇

Is this creating somewhat of a hidden stock market bid, hiding here in plain sight?

Time for a thread

👇👇👇

1) How do you watch the US stock market go up 300%+ over the past 12 years when you’re doing non-correlated alternative investments which may or may not produce positive returns at the same time?

2) typically in the hedge fund world, the reaction looks something like this:

3) It is beyond painful, and not surprisingly, led a few Alts players to adopt the old line:

If you can’t beat ‘em, join ‘em

If you can’t beat ‘em, join ‘em

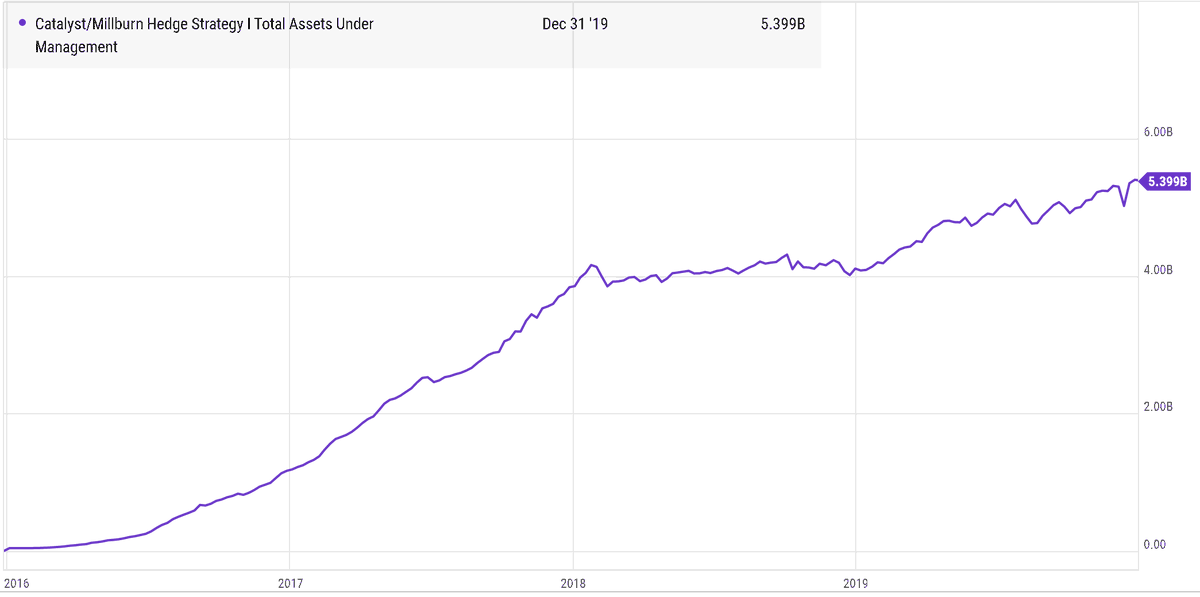

4) One of the first to jump in here was Milburn, who converted their private fund w/ essentially 50% equities & 50% trend following into the Catalyst/Milburn Hedge Strategy ($MBXIX) in 2015. The conversion was..shall we say, rather successful, raising more than $5.3 Billion

5) Asset management is a bit of a copycat league (to borrow an NFL line), and you don’t raise $5 Billion without people taking notice. It wasn’t long before we saw other Alts groups adding an always on equity component to their programs.

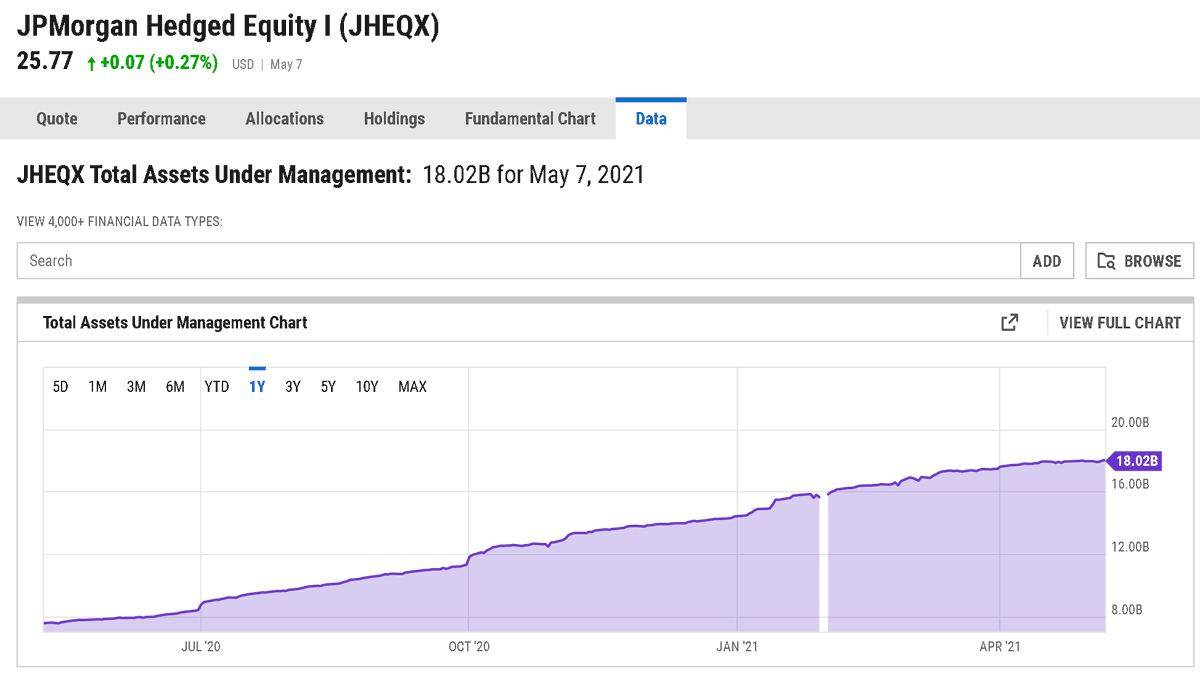

6) Now, there’s long been equity focused groups who’ve added option overlays or other down market protection to a program. See JP Morgan Hedged Equity and it’s $18 Billion in assets!

(they've added about $10B in the last yr, btw)

(they've added about $10B in the last yr, btw)

7) And of course, risk parity/dynamic asset allocation groups like Ray Dalio’s Bridgewater or @gestalltu $RDMIX or @AstorInvMgmt $GBLMX who have an equity component.

RDMIX = rcmalternatives.com/2018/04/three-…

GBLMX = morningstar.com/funds/xnas/gbl…

RDMIX = rcmalternatives.com/2018/04/three-…

GBLMX = morningstar.com/funds/xnas/gbl…

8) But we’re talking Alts groups (hedge funds, managed futures groups, etc) going into equities, and actually creating the blend for investors – versus investors just adding the Alts themselves to go with their existing beta exposure

9) I talked with Eric Crittendon who launched @StandpointFunds to do equities plus trend following, but with a more global reach.

10) And he’s one of the most open about what is happening here – saying in essence it’s better for clients because they don’t ditch the negative line item on their statements

The blended line item is much easier to stick with, which really helps long term compounding

The blended line item is much easier to stick with, which really helps long term compounding

11) Other Alts groups like Covenant, Blackbear, Drury, and more added a beta component to their existing non to negatively correlated, positively skewed, alpha strategies

These are private funds you need to register to see more on:

info.rcmalternatives.com/rcm-database-r…

These are private funds you need to register to see more on:

info.rcmalternatives.com/rcm-database-r…

12) Rational Equity Armor, @JoeTigay, and @luke_rahbari took over a mutual fund ($HDCTX) and matched their VIX replication strategy with a Beta component.

Their also overlaying on the Nasdaq now ($CLPAX)

podcasts.apple.com/us/podcast/val…

Their also overlaying on the Nasdaq now ($CLPAX)

podcasts.apple.com/us/podcast/val…

13) And @jasonmutiny followed up their first of a kind Vol trader fund of funds with a series which is half equities, trying to capture a little of the long/short vol rebalancing effect @bennpeifert outlined here

https://twitter.com/bennpeifert/status/1362908517305180160

14) For a bit of a different twist, you have @djkshreveport and the $ACXIX mutual fund, which adds some VIX and trend following to a fixed income portfolio.

15) And the newest effort, the recently launched $CONVX mutual fund from @certezaAM which gets its beta (and the convex protection) synthetically via option strategies.

16)

17) A few thoughts:

A. Is this a sort of a hidden bid in equity markets? These groups all used to be on the other side of the equity trade, but are now a growing buying force

A. Is this a sort of a hidden bid in equity markets? These groups all used to be on the other side of the equity trade, but are now a growing buying force

17B. For example...

An investor maybe used to sell equities to put 10% into Alts, and now puts that same 10% into an ALT which has an equal amount of equity exposure via the magic of leverage (portable alpha used to be the term)

And now that 10% equity sale isn't a sale at all

An investor maybe used to sell equities to put 10% into Alts, and now puts that same 10% into an ALT which has an equal amount of equity exposure via the magic of leverage (portable alpha used to be the term)

And now that 10% equity sale isn't a sale at all

17C. The contrarian in me worries this demand/desire for more S&P exposure is a signal the end is near.

Of course, these blends don't really care if that is the case because they are essentially/hopefully on both sides of the trade now.

Of course, these blends don't really care if that is the case because they are essentially/hopefully on both sides of the trade now.

17D. What's more... this is a very S&P 500/US centric approach so far in terms of products.

Nobody I've seen is doing it with a 50/50 blend with DAX or Hang Seng or Nikkei or Value

Yes, that's been the best over the past 10yrs. Will it be for the next 10?

Nobody I've seen is doing it with a 50/50 blend with DAX or Hang Seng or Nikkei or Value

Yes, that's been the best over the past 10yrs. Will it be for the next 10?

17E. Where/when/how does this stop…. if there’s a rebalancing premium and more volatile assets produce more of that premium…

Why not 50/50 blend with Nasdaq, with FAANG, with TSLA, with #Bitcoin , with #dogecoin

Why not 50/50 blend with Nasdaq, with FAANG, with TSLA, with #Bitcoin , with #dogecoin

Thoughts?

Messed up the handle here - should be @GestaltU

• • •

Missing some Tweet in this thread? You can try to

force a refresh