0/ What platforms are leading the L2 TVL charge?

In today’s Delphi Daily, we examined #bitcoin breaking through key resistance levels and TVL of L2s and options protocols.

For more 🧵👇

In today’s Delphi Daily, we examined #bitcoin breaking through key resistance levels and TVL of L2s and options protocols.

For more 🧵👇

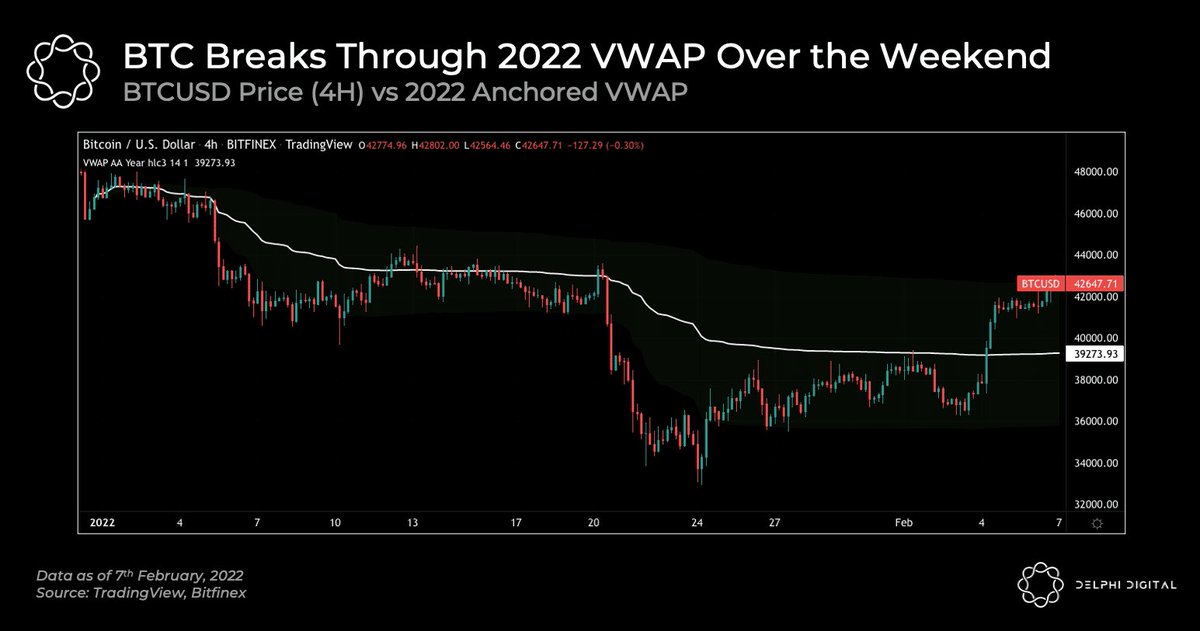

1/ Over the weekend, Bitcoin rallied through the $38.5k and $39-$41k resistance levels we had been watching.

The 2022 yearly VWAP (pictured above in white) was acting as a key resistance level. With Bitcoin now trading around $42.5K, the VWAP was breached convincingly on Friday.

The 2022 yearly VWAP (pictured above in white) was acting as a key resistance level. With Bitcoin now trading around $42.5K, the VWAP was breached convincingly on Friday.

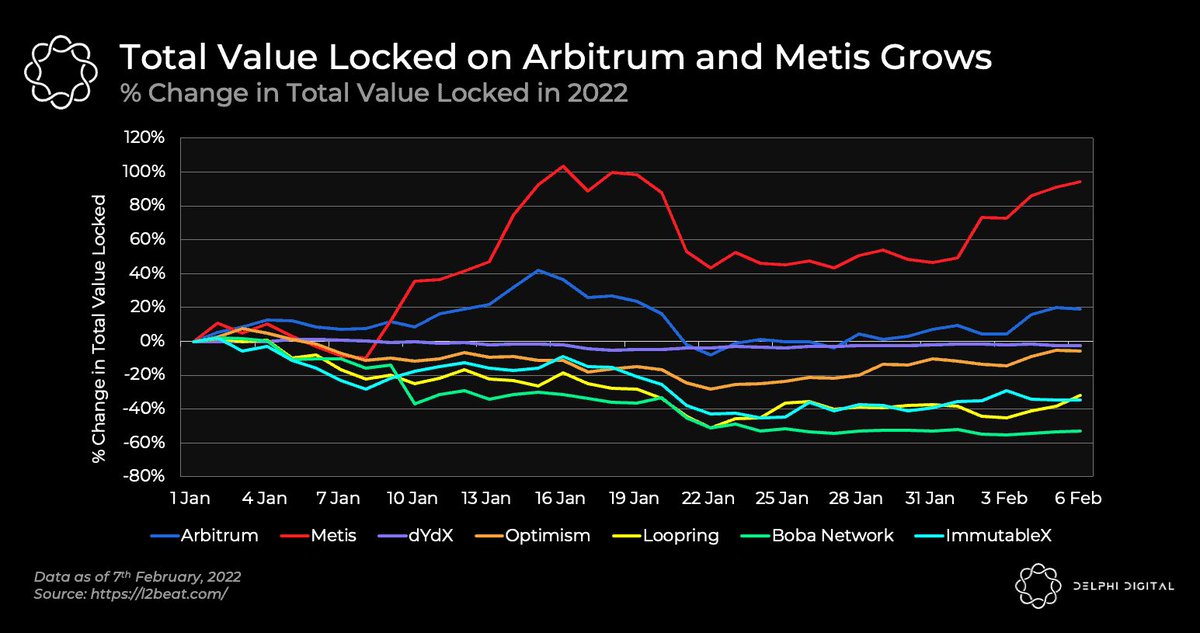

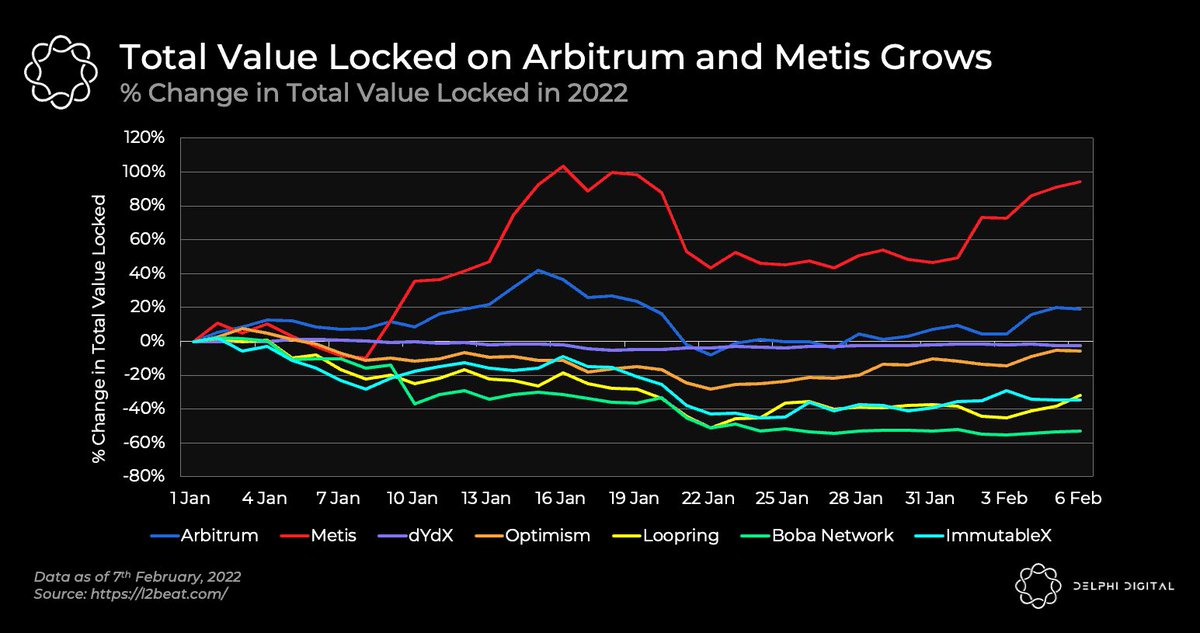

2/ TVL on L2s has risen back to levels seen at the beginning of the year (~$6bn)

This growth is driven primarily by @Aribtrum and @MetisDAO.

Among the seven largest L2s by TVL, only Arbitrum (+19% YTD) and Metis (+94% YTD) have seen positive growth in 2022.

This growth is driven primarily by @Aribtrum and @MetisDAO.

Among the seven largest L2s by TVL, only Arbitrum (+19% YTD) and Metis (+94% YTD) have seen positive growth in 2022.

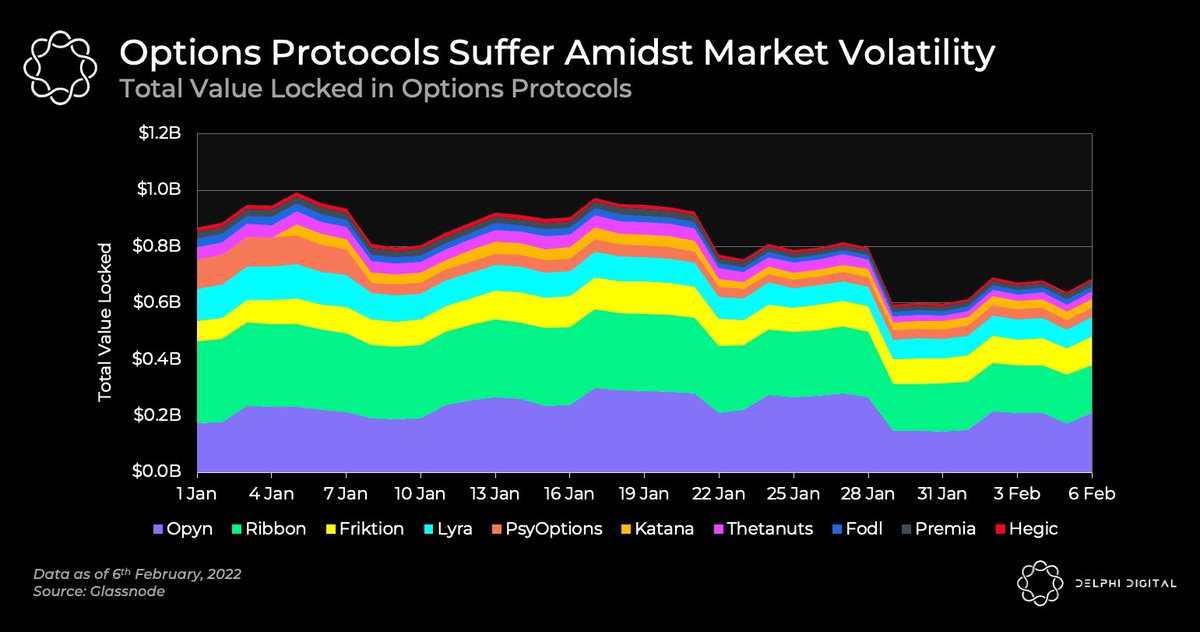

3/ TVL in option protocols has dropped across the board since the start of the year, with the exception of @Opyn_

The drop is likely attributable to falling asset prices. Lower asset prices result in poor performance for put-selling vaults causing investors to withdraw capital.

The drop is likely attributable to falling asset prices. Lower asset prices result in poor performance for put-selling vaults causing investors to withdraw capital.

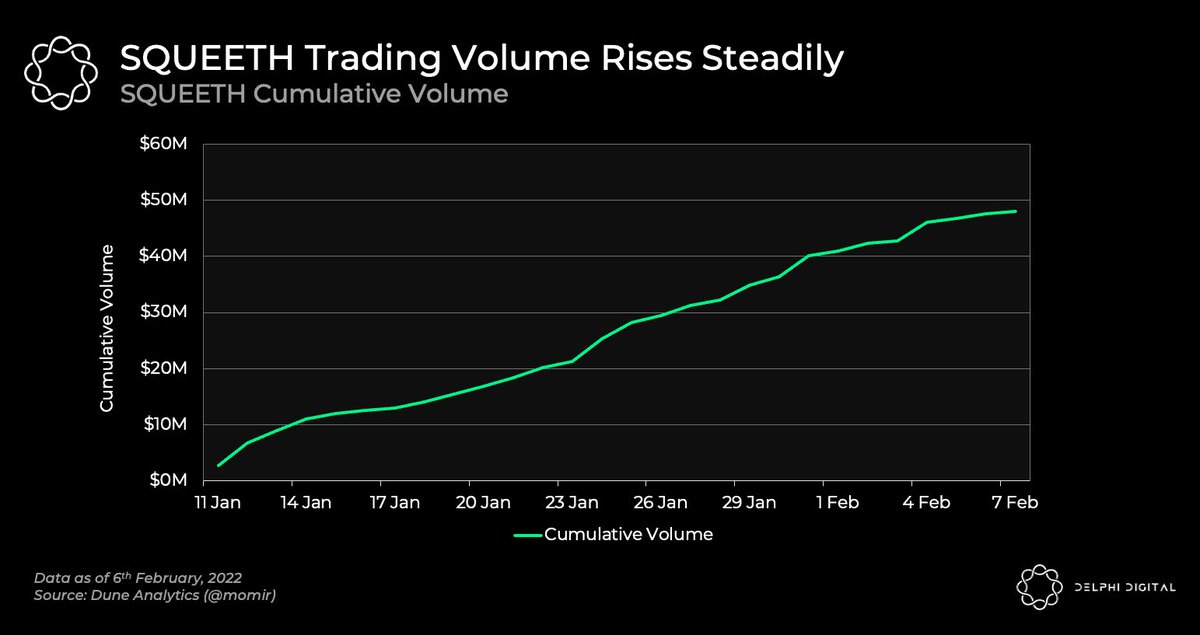

4/ Opyn’s growth in TVL was an outlier to other options protocols. This can be attributed to their new product SQUEETH, a new financial primitive.

Trading volume of SQUEETH has risen steadily over the past month, but its take-up rate hasn’t been outstanding.

Trading volume of SQUEETH has risen steadily over the past month, but its take-up rate hasn’t been outstanding.

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh