0/ Are Solana and Avalanche the next to benefit from the NFT craze?

In today’s Delphi Daily, we examined NFT data on @solana and @avalancheavax, @axieinfinity’s SLP hyperinflation, and Daniele-related tokens suffer.

For more 🧵👇

In today’s Delphi Daily, we examined NFT data on @solana and @avalancheavax, @axieinfinity’s SLP hyperinflation, and Daniele-related tokens suffer.

For more 🧵👇

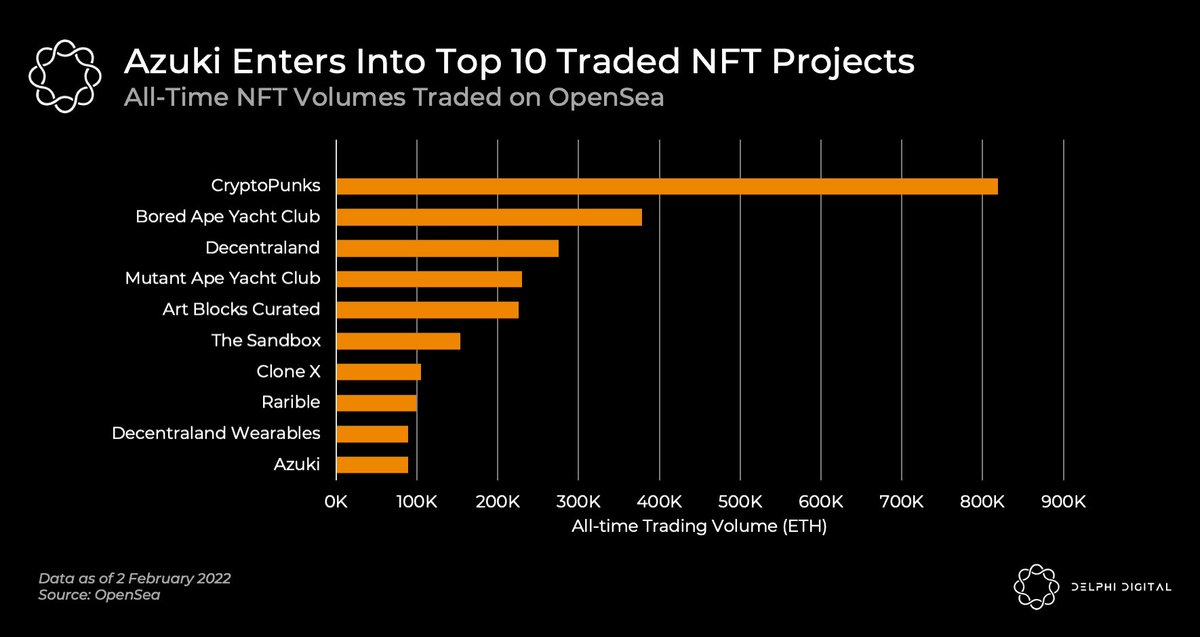

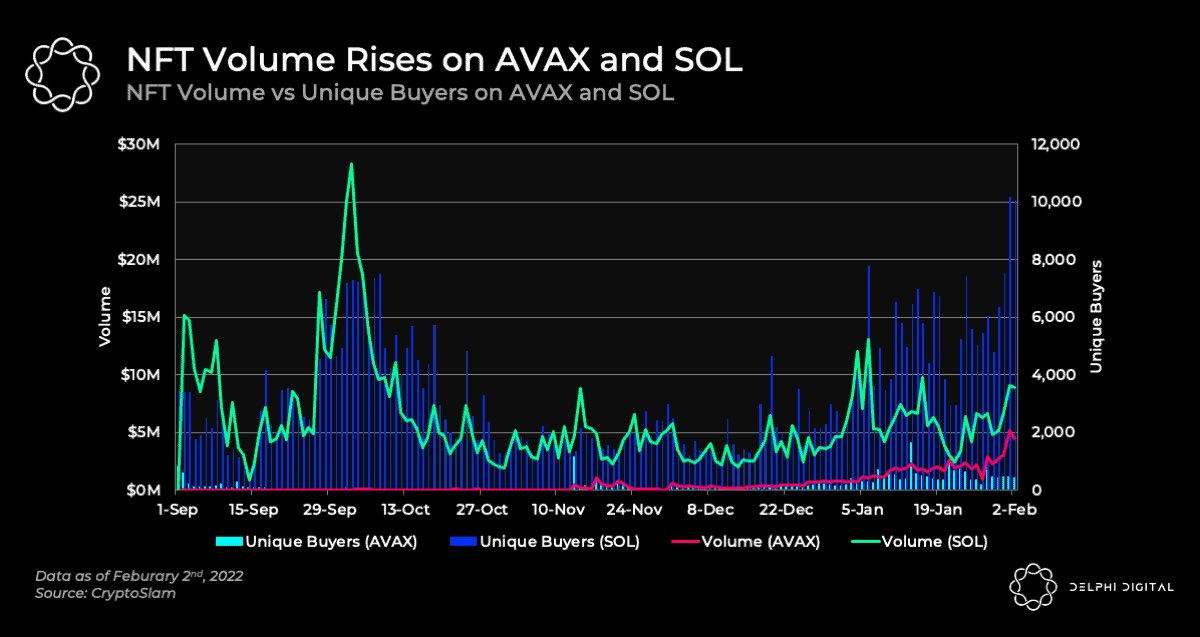

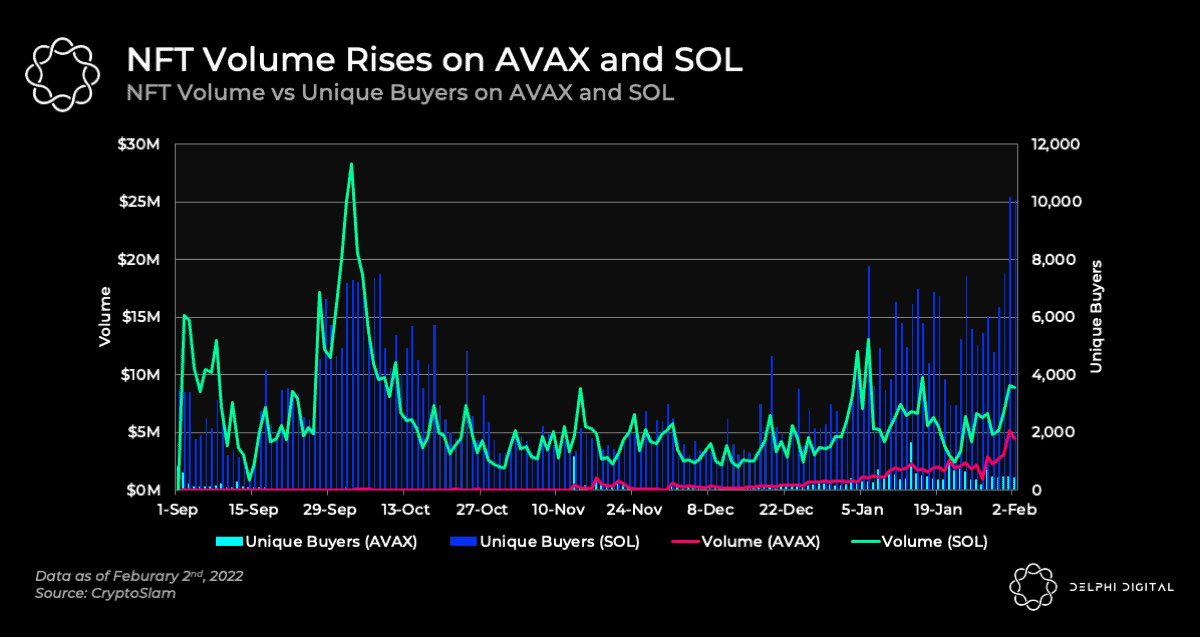

1/ The NFT craze is going strong on Ethereum, but the traction is spilling over into @Solana.

Solana has recently hit its ATH of 10k unique daily NFT buyers, surpassing its peak in September.

@Avalancheavax has also recently hit its peak NFT volume at 5M.

Solana has recently hit its ATH of 10k unique daily NFT buyers, surpassing its peak in September.

@Avalancheavax has also recently hit its peak NFT volume at 5M.

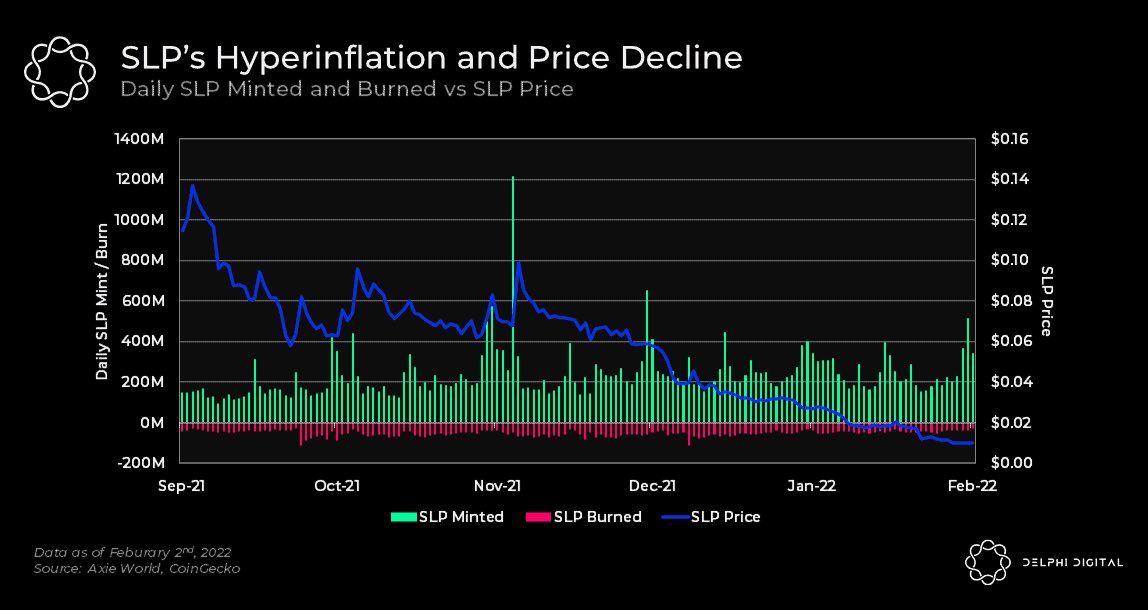

2/ @AxieInfinity has been affected by the hyperinflation of SLP, a result of a high SLP minting rate but a low SLP burning rate.

The hyperinflation has resulted in immense sell pressure on SLP.

We have seen SLP prices drop to under $0.01 today, from its previous highs of $0.35

The hyperinflation has resulted in immense sell pressure on SLP.

We have seen SLP prices drop to under $0.01 today, from its previous highs of $0.35

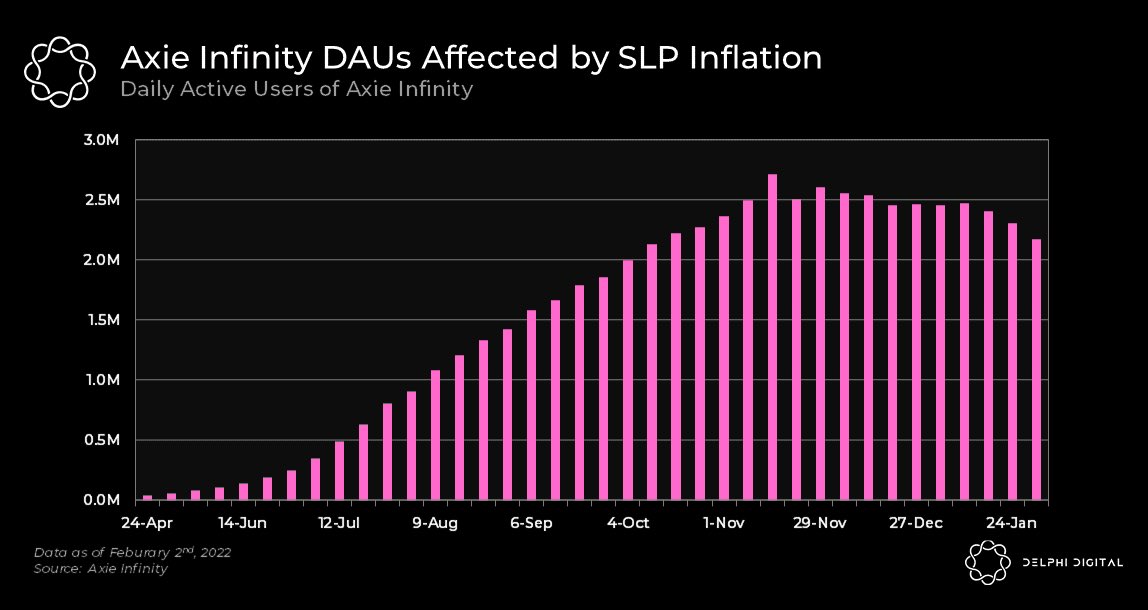

3/ Axie Infinity DAUs grew from 38k in April 21 to 2.7M in November 21.

However, as SLP prices dip, players suffer as they cannot earn as much when compared to a few months back.

At its peak, a player could have earned $35 per day on July 21 vs $1 today at current prices.

However, as SLP prices dip, players suffer as they cannot earn as much when compared to a few months back.

At its peak, a player could have earned $35 per day on July 21 vs $1 today at current prices.

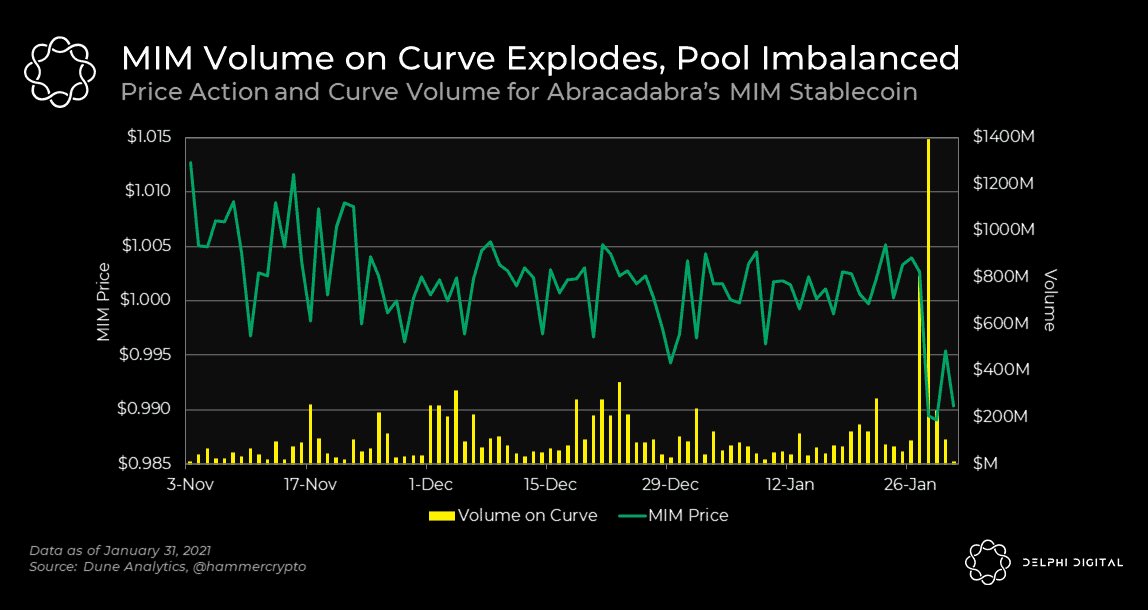

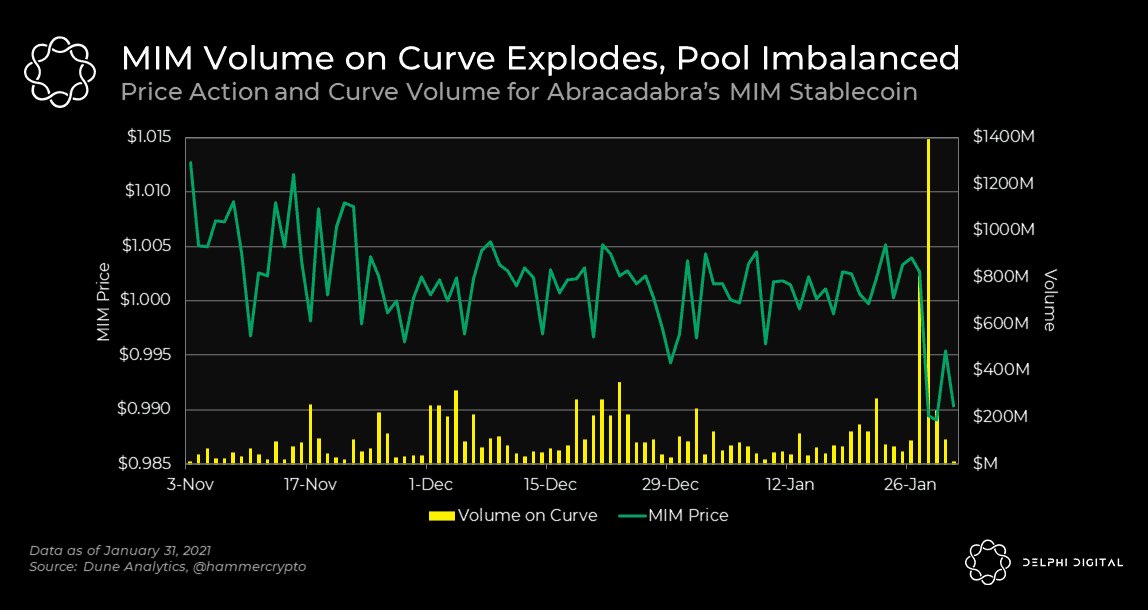

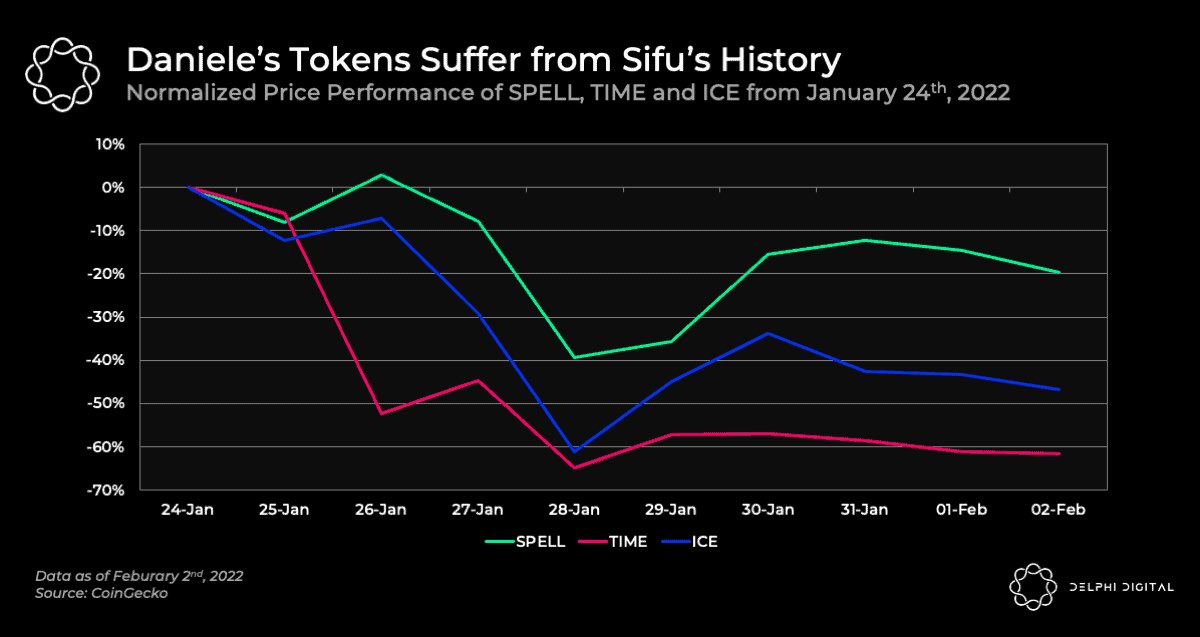

4/ Daniele-related tokens have been marred by allegations of treasury mismanagement on Wonderland by 0xSifu, its ex-CFO.

Zachxbt, an anon on Twitter, doxxed Sifu to be Michael Patryn, co-founder of QuadrigaCX, a notorious Canadian crypto exchange accused of defrauding investors

Zachxbt, an anon on Twitter, doxxed Sifu to be Michael Patryn, co-founder of QuadrigaCX, a notorious Canadian crypto exchange accused of defrauding investors

5/ Tweets of the day!

Dune Analytics Raised $69.420M

Dune Analytics Raised $69.420M

https://twitter.com/DuneAnalytics/status/1488875118835163139

6/ Friktion’s Research on Optimizing Options Auction Execution

https://twitter.com/friktion_labs/status/1488813149113438211

7/ Chainalysis Analyzes Wash Trading and Money Laundering in NFTs

https://twitter.com/cryptounfolded/status/1488863953606295557

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh