High Court ruled that Nkosana Makate is entitled to 5% of the total voice revenue generated from the micro-text service from Mar 2001-Mar 2021.

Thread will cover;

When & how was Vodacom formed?

Major shareholder of Vodacom?

What is the court case involving Nkosana Makate about?

Thread will cover;

When & how was Vodacom formed?

Major shareholder of Vodacom?

What is the court case involving Nkosana Makate about?

Vodacom was incorporated in 1993 as a joint venture between Telkom (50%), Vodafone (35%) and VenFin (15%).

This is how Vodafone got involved with Vodacom.

1993, Vodacom was awarded a mobile cellular telecoms licence in SA and launched

commercial services in 1994.

This is how Vodafone got involved with Vodacom.

1993, Vodacom was awarded a mobile cellular telecoms licence in SA and launched

commercial services in 1994.

1996, Vodafone and VenFin sold a 5% stake in Vodacom Group to a BEE company, Hosken Consolidated Investments for R118 million.

2002, Hosken made a killing when it sold the 5% stake back to Vodafone and VenFin for

R1.5 billion.

2002, Hosken made a killing when it sold the 5% stake back to Vodafone and VenFin for

R1.5 billion.

VenFin (then venture capital subsidiary of Rembrandt) looked around and realised that there is money to be made here.

2006, VenFin wanted out of the joint venture. Telkom didn't put up a fight. Vodafone had a clear landing strip.

Vodafone bought Venfin’s 15% stake for ~R16bn.

2006, VenFin wanted out of the joint venture. Telkom didn't put up a fight. Vodafone had a clear landing strip.

Vodafone bought Venfin’s 15% stake for ~R16bn.

As a result of Vodafone acquiring VenFin's 15% stake, its shareholding in Vodacom grew to 50%.

In 2008, Telkom sold 15% of its Vodacom stake to Vodafone for ~R22.5bn and distribute the remaining 35% to its shareholders through Vodacom’s JSE listing.

Vodafone now owned 65%.

In 2008, Telkom sold 15% of its Vodacom stake to Vodafone for ~R22.5bn and distribute the remaining 35% to its shareholders through Vodacom’s JSE listing.

Vodafone now owned 65%.

Vodafone became the parent company of Vodacom and Vodacom rebranded (changed colours).

R400 million was spent on the rebranding campaign split over 2 FYs.

Separation of Absa Group from Barclays was more expensive. Barclays contributed R12.6bn in 2017 towards the 3yr separation.

R400 million was spent on the rebranding campaign split over 2 FYs.

Separation of Absa Group from Barclays was more expensive. Barclays contributed R12.6bn in 2017 towards the 3yr separation.

Nov 2021,Vodacom announced that it is buying Vodafone’s 55% stake in Vodafone Egypt for R41bn.

80% of R41bn will be settled by issue of 242m new Vodacom shares at R135.75/share to Vodafone and 20% will be paid in cash of ~R8.2bn.

Vodafone’s stake in Vodacom will increase 65.1%.

80% of R41bn will be settled by issue of 242m new Vodacom shares at R135.75/share to Vodafone and 20% will be paid in cash of ~R8.2bn.

Vodafone’s stake in Vodacom will increase 65.1%.

What is the court case involving Nkosana Makate about?

Kenneth Nkosana Makate, was employed by, Vodacom, as a trainee accountant.

In November 2000 he conceived the Please Call Me idea which he intended to sell to a willing buyer.

Kenneth Nkosana Makate, was employed by, Vodacom, as a trainee accountant.

In November 2000 he conceived the Please Call Me idea which he intended to sell to a willing buyer.

He approached Philip Geissler, who at the time was Vodacom’s Director and Head of Product Development.

They reached an oral agreement that Vodacom would experiment with the idea and, if it proved commercially viable,Makate would be paid a share of proceeds from the product.

They reached an oral agreement that Vodacom would experiment with the idea and, if it proved commercially viable,Makate would be paid a share of proceeds from the product.

Vodacom implemented the idea in March 2001.

After Makate’s demands on Vodacom to honour the oral agreement were unsuccessful, he instituted a claim against Vodacom in July 2008 in the then South Gauteng High Court.

After Makate’s demands on Vodacom to honour the oral agreement were unsuccessful, he instituted a claim against Vodacom in July 2008 in the then South Gauteng High Court.

High Court found that Makate had proved that he had entered into an agreement with Geissler.

However, it dismissed the claim on the basis that Makate did not plead the ostensible authority (the seeming or apparent authority) of Geissler to contract on behalf of Vodacom.

However, it dismissed the claim on the basis that Makate did not plead the ostensible authority (the seeming or apparent authority) of Geissler to contract on behalf of Vodacom.

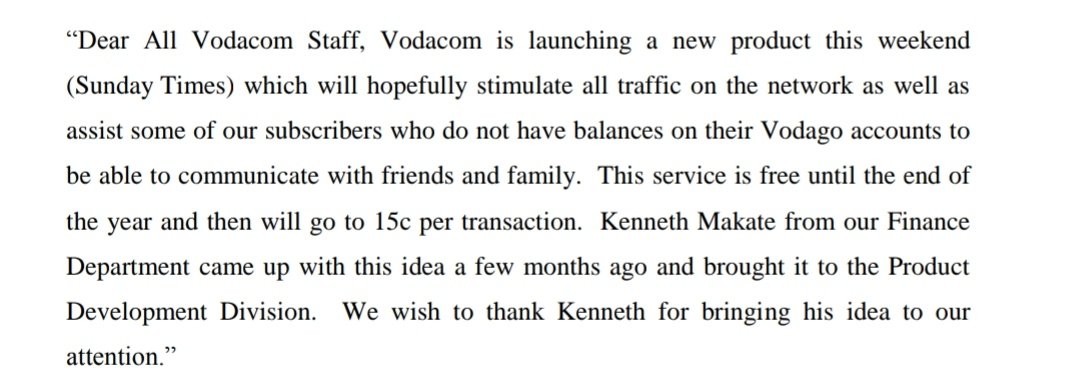

In 2001, Vodacom had acknowledged that Nkosana Makate was the inventor of the "Please Call Me" idea in Vodacom’s newsletter that was published in March 2001.

Despite these facts, Messrs Knott-Craig and Geissler later claimed that it was the CEO’s idea.😂

Despite these facts, Messrs Knott-Craig and Geissler later claimed that it was the CEO’s idea.😂

This untrue story appears to have been part of a stratagem to deny the Nkosana Makate compensation for the idea.

Vodacom first accused him of having stolen the idea from MTN, its competitor.

Vodacom first accused him of having stolen the idea from MTN, its competitor.

Things went to the Constitutional Court in 2016.

The court rejected the claim on the basis that the claim had prescribed (2.5yrs after the product was developed and launched, Makate terminated his employment with Vodacom and only 4yrs later did he start to pursue his claim).

The court rejected the claim on the basis that the claim had prescribed (2.5yrs after the product was developed and launched, Makate terminated his employment with Vodacom and only 4yrs later did he start to pursue his claim).

It was decided Makate had taken too long to approach the court.

The claim was also refused on the basis that Makate could not

show that Geissler who had concluded the verbal agreement with him had the authority to do so.

The claim was also refused on the basis that Makate could not

show that Geissler who had concluded the verbal agreement with him had the authority to do so.

Makate did not prove that

Vodacom had full knowledge of the facts including details of the

negotiations and the agreement between Makate and Geissler

(Voda director) and that with such knowledge, Vodacom adopted

the director’s unauthorised act.

Vodacom had full knowledge of the facts including details of the

negotiations and the agreement between Makate and Geissler

(Voda director) and that with such knowledge, Vodacom adopted

the director’s unauthorised act.

The court ruled that even though the Vodacom board had authorised

the launch of the product, there was no proof that it was aware of the detail of the negotiations, including the director’s agreement to pay for the idea and the promise to negotiate the amount of the payment.

the launch of the product, there was no proof that it was aware of the detail of the negotiations, including the director’s agreement to pay for the idea and the promise to negotiate the amount of the payment.

Vodacom stated that it will be appealing the matter of Nkosana Makate been entitled to 5% of the total voice revenue generated from the micro-text service from Mar 2001 to Mar 2021 as the earlier deals were made in good faith.

Earlier deal quoted tweet

Earlier deal quoted tweet

https://twitter.com/MaanoMadima/status/1380541716516589573?t=a3uBqfSdtsV7q4scEakTLg&s=19

Vodacom will be publishing its FY22 AFS soon and it will be interesting to see if they will disclose a contingent liability in terms IAS 37 or worse a provision (after the appeal) and the size of the compensation payable to Nkosana Makate.

Makate should be licking his lips now.

Makate should be licking his lips now.

Market participants: "In FY21, Vodacom’s cash balances including overdraft stood at R15.21bn. Do you think you have the capacity to give to Nkosana Makate what belongs to Nkosana Makate?"

Vodacom’s CEO:

Vodacom’s CEO:

With Vodacom’s cash balances including overdraft standing at R15.21bn relative to the size of the compensation (5% of the total voice revenue generated from the micro-text service from March 2001 to March 2021) Vodacom will most likely settle this in stages or as an annuity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh