1/ 🧵 A Newbie Guide to @LiquidDriver

Fantom's first liquidity mining dApp providing liquidity-as-a-service

Earn high yield rewards paid out in $LQDR $LINSPIRIT $BOO $SPELL $BEETS

BONUS!! Get in early on the "Spirit Wars"

#LQDRv3 #FTM

Fantom's first liquidity mining dApp providing liquidity-as-a-service

Earn high yield rewards paid out in $LQDR $LINSPIRIT $BOO $SPELL $BEETS

BONUS!! Get in early on the "Spirit Wars"

#LQDRv3 #FTM

/2 If you're new here, welcome! I write threads to help fellow crypto newbs better understand the projects they invest in.

Threads are based on my own personal research because I'm not trying to get rekt out here and I don't want that for YOU either

Threads are based on my own personal research because I'm not trying to get rekt out here and I don't want that for YOU either

3/ In this Liquid Driver thread we will cover the following

🔎 What is Liquid Driver?

🔧 How does it work?

🤝 Team

🔒 Security

👻 Spirit Wars

🗺 Roadmap / Upcoming Features

📚 Additional Resources

Ready? Let's go...

🔎 What is Liquid Driver?

🔧 How does it work?

🤝 Team

🔒 Security

👻 Spirit Wars

🗺 Roadmap / Upcoming Features

📚 Additional Resources

Ready? Let's go...

4/ Concepts

Ok newbs, here are some concepts we should be familiar with / research before using Liquid Driver (these are not explained in this thread)

- DEXs (Decentralized Exchanges)

- Liquidity Pools / Farming

- DAOs & governance

- Impermanent loss

Ok newbs, here are some concepts we should be familiar with / research before using Liquid Driver (these are not explained in this thread)

- DEXs (Decentralized Exchanges)

- Liquidity Pools / Farming

- DAOs & governance

- Impermanent loss

5/ 🔎 What is Liquid Driver?

The simple answer is in the name:

Liquid Driver "drives liquidity" to DEXs in the Fantom ecosystem

The OG version provided liquidity to @SushiSwap but has since shifted to native Fantom DEXs

The simple answer is in the name:

Liquid Driver "drives liquidity" to DEXs in the Fantom ecosystem

The OG version provided liquidity to @SushiSwap but has since shifted to native Fantom DEXs

https://twitter.com/Dr_Liquid_/status/1481179991383711745

6/ Liquid Driver has a slight learning curve, so let's walk through it step by step, some of it might not make sense at first but we'll put it all together at the end.

The first part of LD, is the farms. You earn two different yields here

- Trading fees

- $LQDR rewards

The first part of LD, is the farms. You earn two different yields here

- Trading fees

- $LQDR rewards

7/ 🔧 How Does it Work?

You deposit LP tokens into the farms which are connected to liquidity pools on Spirit Swap, Spooky Swap, and Beethoven-x

LD incentivizes you to farm with them by offering higher rewards than the native pools in the form of $LQDR

You deposit LP tokens into the farms which are connected to liquidity pools on Spirit Swap, Spooky Swap, and Beethoven-x

LD incentivizes you to farm with them by offering higher rewards than the native pools in the form of $LQDR

8/ What can I do with my $LQDR?

LQDR is LD's native token. It's value comes from the ability to lock up the token in exchange for xLQDR, which takes it off the market.

95% of the rewards that LD farms in it's partner pools (w/ the LP tokens you deposited) go to xLQDR holders

LQDR is LD's native token. It's value comes from the ability to lock up the token in exchange for xLQDR, which takes it off the market.

95% of the rewards that LD farms in it's partner pools (w/ the LP tokens you deposited) go to xLQDR holders

9/ If this isn't making sense yet, keep following and we'll bring it full circle. I promise.

To recap:

1) Deposit LP tokens in Liquid Driver farm

2) Earn LQDR rewards

3) Lock LQDR in exchange for xLQDR

4) Earn rewards from LD's Revenue Sharing Vault

To recap:

1) Deposit LP tokens in Liquid Driver farm

2) Earn LQDR rewards

3) Lock LQDR in exchange for xLQDR

4) Earn rewards from LD's Revenue Sharing Vault

10/ This graphic from liquiddriver.finance puts it all together

Notice the user's interaction, after depositing LPs, is strictly in LQDR / xLQDR until you collect your daily rewards from the Revenue Sharing Vault

Let's talk about those rewards next...

Notice the user's interaction, after depositing LPs, is strictly in LQDR / xLQDR until you collect your daily rewards from the Revenue Sharing Vault

Let's talk about those rewards next...

11/ Revenue Sharing Vault

Rewards here come in the form of

$LQDR (newly minted)

$WFTM (via @FantomFDN incentive program)

$LINSPIRIT (SpiritSwap)

$BOO (SpookySwap)

$SPELL (Abracadabra)

$BEETS (Beethoven-x)

Rewards here come in the form of

$LQDR (newly minted)

$WFTM (via @FantomFDN incentive program)

$LINSPIRIT (SpiritSwap)

$BOO (SpookySwap)

$SPELL (Abracadabra)

$BEETS (Beethoven-x)

12/ Revenue Sharing Vault pt2

As you can see in the last graphic, APR for xLQDR holders is currently 103.84%

This is the sum of the APR from each token

Most rewards come from LD farming LP tokens you originally deposited, but gives you exposure to a much wider range of tokens

As you can see in the last graphic, APR for xLQDR holders is currently 103.84%

This is the sum of the APR from each token

Most rewards come from LD farming LP tokens you originally deposited, but gives you exposure to a much wider range of tokens

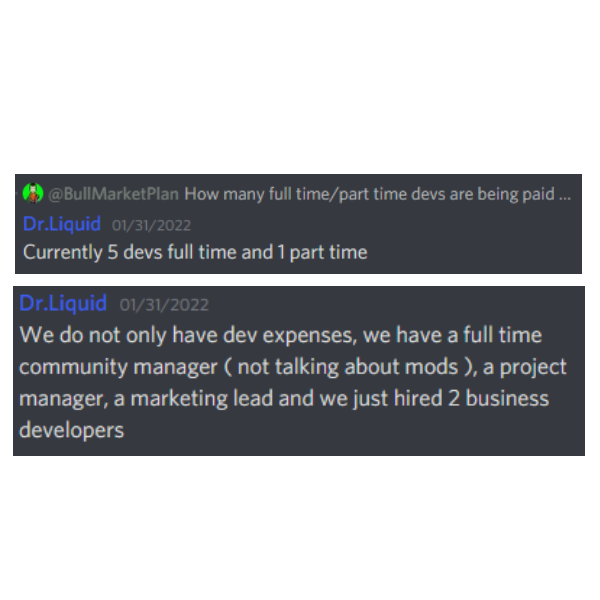

13/ 🤝 Team

Let's take a break from the technical stuff for a second to talk about the team

AFAIK the team is completely anon, so DYOR

On Twitter we have

@Dr_Liquid_ (Lead Dev)

@eth_carter (Community Manager)

Other team members are active on Discord discord.gg/liquiddriver

Let's take a break from the technical stuff for a second to talk about the team

AFAIK the team is completely anon, so DYOR

On Twitter we have

@Dr_Liquid_ (Lead Dev)

@eth_carter (Community Manager)

Other team members are active on Discord discord.gg/liquiddriver

15/ 🔒 Security

The LD team appears to take security seriously

- No migrator code (can be used for rug pulls)

- $120k bug bounty program powered by @immunefi

- Clean audit by @SolidityFinance - results linked here

solidity.finance/audits/LiquidD…

The LD team appears to take security seriously

- No migrator code (can be used for rug pulls)

- $120k bug bounty program powered by @immunefi

- Clean audit by @SolidityFinance - results linked here

solidity.finance/audits/LiquidD…

16/ 👻 Spirit Wars

Now for some fun stuff. Still a bit complicated, so strap in.

Briefly, the Spirit Wars are an attempt by protocols to own enough @Spirit_Swap governance tokens to control it's rewards

LD currently controls >30% and they're working towards full control

Now for some fun stuff. Still a bit complicated, so strap in.

Briefly, the Spirit Wars are an attempt by protocols to own enough @Spirit_Swap governance tokens to control it's rewards

LD currently controls >30% and they're working towards full control

17/ I won't go in-depth into the Spirit Wars here but I'll link some great resources at the end.

What you need to know is that LD accomplishes this via linSPIRIT - their version of wrapped inSPIRIT

What you need to know is that LD accomplishes this via linSPIRIT - their version of wrapped inSPIRIT

18/ When you swap your $SPIRIT for $linSPIRIT, LD swaps the SPIRIT on SpiritSwap for inSPIRIT (confusing, i know..)

At the end of the day, this all boosts rewards for xLQDR holders

At the end of the day, this all boosts rewards for xLQDR holders

19/ In fact, that is essentially what @LiquidDriver stands to gain from winning the Spirit Wars - more benefits for xLQDR holders

20/ 🗺 Roadmap / Upcoming Features

LD has a lot on it's plate moving forward but the team has been delivering so far. Here's some major upcoming points

- extending collabs w/ other FTM protocols

- Shadow Farms (see below)

- Building a bribe tool to benefit xLQDR holders

LD has a lot on it's plate moving forward but the team has been delivering so far. Here's some major upcoming points

- extending collabs w/ other FTM protocols

- Shadow Farms (see below)

- Building a bribe tool to benefit xLQDR holders

21/ Shadow Farms

This is an interesting concept that seems to be right around the corner

These farms will AUTO-COMPOUND governance tokens from several DEXs making it more profitable to stake on LD than the OG farms

This is an interesting concept that seems to be right around the corner

These farms will AUTO-COMPOUND governance tokens from several DEXs making it more profitable to stake on LD than the OG farms

22/ 📚 Additional Resources

Always start with the docs. The Liquid Driver docs go further in depth on the concepts we talked about here

docs.liquiddriver.finance

Always start with the docs. The Liquid Driver docs go further in depth on the concepts we talked about here

docs.liquiddriver.finance

23/ Liquid Driver explainer by @FTMAlerts

I'm a sucker for a good explainer and you can't get better than the folks at FTM Alerts

I'm a sucker for a good explainer and you can't get better than the folks at FTM Alerts

24/ I promised you Spirit Wars resources and it doesn't get better than these excellent threads by @crypto_klay

He starts with the origin story: Curve Wars...

He starts with the origin story: Curve Wars...

https://twitter.com/crypto_klay/status/1475995973151338497

25/ Part II gets into the nitty gritty of the developing Spirit Wars

https://twitter.com/crypto_klay/status/1477346893680185346

26/ and if you REALLY have some time on your hands get into Klay's thoughts on what could come next in the wars

https://twitter.com/crypto_klay/status/1480671518103277568

27/ if you prefer to research in article form this Medium post by @RichmoreCapital on @dd_invest gives a good overview

medium.datadriveninvestor.com/enter-the-spir…

medium.datadriveninvestor.com/enter-the-spir…

28/ Now that you're familiar with the Spirit Wars (and the Curve Wars before them) get a better understanding of what exactly "bribes" are by the one and only @AndreCronjeTech

andrecronje.medium.com/bribing-vecrv-…

andrecronje.medium.com/bribing-vecrv-…

29/ It was already linked above but the Liquid Driver Discord community is a great way to get information straight from the dev team on a regular basis

discord.gg/UaYMZ9vX

discord.gg/UaYMZ9vX

30/ Liquid Driver's own Medium page played a big role in this thread as well liquiddriver.medium.com

31/ and finally, if you like what you've seen here and are thinking about investing some funds into Liquid Driver, check out this video on staking strategies by @milesdeutscher (not financial advice)

32/ As always, if you've made it all the way to the end, thank you from the bottom of my heart for reading, but also for arming yourself with research.

The only way WAGMI is if we DYOR

The only way WAGMI is if we DYOR

• • •

Missing some Tweet in this thread? You can try to

force a refresh