Good morning! Shall we discuss something a bit more structural, although this is a cyclical theme in 2022 across Asia, from China to India and Southeast Asia. Let's talk about #infrastructure , which is the theme of the hour & the next decade🛣️🌉🚆📶⚡️

@natixis @NatixisResearch

@natixis @NatixisResearch

https://twitter.com/NatixisResearch/status/1486276418359156740

Today, infrastructure stocks are soaring in China as hope of government policy leaning towards this sector to shore up domestic demand in sagging growth momentum.

In India, infrastructure has been a big theme & even more so after the expanded budget that prioritizes it ⏫📈.

In India, infrastructure has been a big theme & even more so after the expanded budget that prioritizes it ⏫📈.

Why is infrastructure the theme of the hour and the next 2 decades? Simply put: infrastructure is essential for the improvement of the quality of life, production of goods, services and to raise productivity of labor.

Demand for infrastructure is high & will sky rocket.

Demand for infrastructure is high & will sky rocket.

We published a research note on the rise of demand and supply of infrastructure in Asia and estimated the gap. Let's look at demand. Chart 1 below shows you the rise of population on the x-axis & the increase of urbanization in the y-axis based on UN estimates.

What do u see?

What do u see?

You should see that there will be more urbanized people in the next two decades.

Population: India will add 213m people, Pakistan 81m and Indonesia 45 million people.

In Youthful Asian economies (the ones below ex China) there'll be +462 m urbanites n top of 895 now.

So what?

Population: India will add 213m people, Pakistan 81m and Indonesia 45 million people.

In Youthful Asian economies (the ones below ex China) there'll be +462 m urbanites n top of 895 now.

So what?

While Asia, esp India, Pakistan, Indonesia, the Philippines, Bangladesh, Vietnam, China & Malaysia may have a lot of people & even more urban people in the future, the stock of infrastructure remains inadequate to meet the needs of its people currently & worse in the future.

Let's look at roads 🛣️. Did you know that India has more road per capita than China? 🇮🇳🇨🇳 . I think population is a better metric.

Roads are key for accessibility & trade & transport. Everyone has invested in road building except the Philippines & Pakistan.

Let me explain.

Roads are key for accessibility & trade & transport. Everyone has invested in road building except the Philippines & Pakistan.

Let me explain.

We take total road length & divide that by the population at that particular time to see whether road length/hm has improved.

Contrary to perception, India has invested a lot in road building. Most growth is Malaysia, Vietnam, India, China & Indonesia.

But not the Philippines.

Contrary to perception, India has invested a lot in road building. Most growth is Malaysia, Vietnam, India, China & Indonesia.

But not the Philippines.

The Philippines results aren't shocking as we know infrastructure is poor but it is rather striking in that it hasn't invested much relative to the growth of the population so both the stock & change is WORST (yes, worse than Pakistan).Absolutely & relatively worst at road infra.

That makes me sad because I like that country & its people & so its people have WORSE road than in 2005 as we have more people but not enough investment so stock of road per capital FELL. Let's talk about quality of roads. India is ahead of China in QUANTITY due to investment but

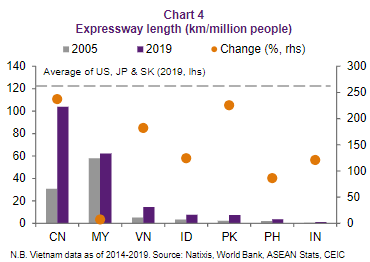

Quantity of roads doesn't account for quality of roads & in trade & transport, expressway matters because it boosts productivity by lubricating mobility.

Expressway/capita: China has invested the most (easier due to centralized gov vs India fragmented) & India worst but better!

Expressway/capita: China has invested the most (easier due to centralized gov vs India fragmented) & India worst but better!

Here you can see that everyone has built more expressway per capita in the past 15 years, which is good but there is still a lot of room for improvement, especially for India, the Philippines and Pakistan. Again, Pakistan expressway road infra is better than the Philippines.

Vietnam has invested the most in Southeast Asia on expressway building, & so its stock of expressway per capita has increased sharply and now third amongst these countries, only below China and Malaysia. Has helped its manufacturing & trade competitiveness as exports >100% of GDP

Bottom line about Youthful Asian economies + China roads:

*A lot of investment in road building in the past 15 years, EXCEPT THE PHILIPPINES & Pakistan

*Regarding expressways, China invested most & best stock, almost as good as developed

*Vietnam improved

*India needs more

*A lot of investment in road building in the past 15 years, EXCEPT THE PHILIPPINES & Pakistan

*Regarding expressways, China invested most & best stock, almost as good as developed

*Vietnam improved

*India needs more

Actually, they all need to invest more, even China to get to DM benchmark, although close. But most needed are India, the Philippines, Pakistan, Indonesia and Vietnam.

Expressways are key to transport links & trade & productivity.

What about rail?

Expressways are key to transport links & trade & productivity.

What about rail?

Let's look at rail line length, we deflate it by population to make it more comparable regarding infrastructure stock.

Sadly, only China, Malaysia & Indonesia have invested in rail infrastructure in the past 15 years on an absolute basis.

Relative to population, only CH & MA👇

Sadly, only China, Malaysia & Indonesia have invested in rail infrastructure in the past 15 years on an absolute basis.

Relative to population, only CH & MA👇

How should u read this chart? Orange dots = growth rates; bars are stock deflated by population.

Rail length is where China shines and the rest of Youthful Asia sags. Sad to see Vietnam stock WORSE relative to its rising population as no investment is made so things are worse.

Rail length is where China shines and the rest of Youthful Asia sags. Sad to see Vietnam stock WORSE relative to its rising population as no investment is made so things are worse.

But of course the Philippines & Indonesia are worst despite higher investment by Indonesia as stock level is worse. That said, Indonesia is getting up there & will surpass Vietnam if it continues w/ its rail line push. The Philippines once more WORST in infrastructure stock.

Rail is clearly a sad point for South Asia and Southeast Asia except for Malaysia (Thailand is not included because it is an aging country and we only measured Youthful Asia economies, including China as a benchmark). While China stock is best & increased, still not as good as DM

The Philippines is WORST for road & rail due to lack of investment. Asia as invested in expressways but not so much rail. More needed!

What about air infrastructure? Let's take a look at air passenger/capita. Explosive growth everywhere except Pakistan. The Philippines invested!

What about air infrastructure? Let's take a look at air passenger/capita. Explosive growth everywhere except Pakistan. The Philippines invested!

Air is key for for trade and transport & especially key for places like the Philippines and Indonesia where u can only enter via air or water. So if it wants to promote tourism, it needs to invest in air infrastructure to get people in & out. Malaysia BEST! Look at Vietnam growth

Vietnam has the best growth & second best in air passenger/capita & China third. Note that we're not talking about quality of air infrastructure at all & just people up in the air.

This gives you a sense that air infra has ways to go except Malaysia. We need more investment!

This gives you a sense that air infra has ways to go except Malaysia. We need more investment!

What about electricity? Here, I don't go into details about generation but if u look at distribution, India has the highest electricity transmission loss! Close to 20%!

Across Asia, the transmission loss has declined a lot to close to the 5% benchmark of DM but not India.

Across Asia, the transmission loss has declined a lot to close to the 5% benchmark of DM but not India.

What about digital infrastructure like fast internet? Here we look at fixed broadband subscription per capita & China is best. Vietnam is second and Malaysia third.

Worst are Pakistan & India. This is interesting b/c @elonmusk is trying to sell Starlink to India but hits a wall!

Worst are Pakistan & India. This is interesting b/c @elonmusk is trying to sell Starlink to India but hits a wall!

Finally, let's put this all together - mostly use transport infrastructure as we think it is key to economic development & life. We created a @natixis @NatixisResearch Asian Infrastructure Metric putting all these factors together to assess the relative supply of infrastructure.

How do u read this index? First, u know the subcomponents b/c I just explained to u & who's best/worst etc. These subcomponents all have equal weights to keep it simple. And then u normalize the data & sum to get composite.

Best? Malaysia! 🇲🇾 Driven by road, railroad & air

Best? Malaysia! 🇲🇾 Driven by road, railroad & air

Meaning, he countries here & why investors put money in higher skilled manufacturing such as semiconductor as the infrastructure for trade is better.

Second is China, driven by broadband, electricity, rail & road.

Third is Vietnam.

Second is China, driven by broadband, electricity, rail & road.

Third is Vietnam.

Vietnam is decent everything except railway (relative to these emerging markets but still way off the mark for DM).

Note that Malaysia, China and Vietnam are the biggest exporters in all the countries included here & good infrastructure is key to be competitive!

Note that Malaysia, China and Vietnam are the biggest exporters in all the countries included here & good infrastructure is key to be competitive!

Indonesia needs a lot more investment and also India. But the countries that need the most is the Philippines and Pakistan as the stock of infrastructure is WORST.

And they all need more if we compare to our developed markets benchmark.

And they all need more if we compare to our developed markets benchmark.

But that is now. What about the future? We know that supply is INADEQUATE to meet demand of the population now, esp the Philippines and Pakistan. MORE people will be added to woefully inadequate infrastructure!

@natixis Infrastructure Gap = existing supply + future demand 👇

@natixis Infrastructure Gap = existing supply + future demand 👇

Allow me to explain our @natixis Infrastructure Supply Gap: We take the increase of urban population into 2040 & then taking the existing supply to calculate the gap. Voila, India has the LARGEST gap due to its sizeable increase, followed by Pakistan & Bangladesh. Malaysia least.

In Southeast Asia, the Philippines and Indonesia will have a sizeable gap and also will need to increase investment as its demographic transition will add more pressure on infrastructure.

Note that all the countries below will have a GAP of infra - it's the question how BIG.

Note that all the countries below will have a GAP of infra - it's the question how BIG.

Since u guys like pictures, let me give you a summary infographic of @natixis infrastructure gap (note that this accounts for existing supply + future demand using urbanization growth).

For every transport infrastructure, the gap is BIGGEST for India so its overall gap is WIDEST

For every transport infrastructure, the gap is BIGGEST for India so its overall gap is WIDEST

But it isn't the only one - Pakistan is desperately needing more. In Southeast Asia, both Indonesia and the Philippines have rather large gaps for road infrastructure. Indonesia has a rather large gap of air and fixed broadband. In short: DEMAND GAP WIDE NOW & worse in the future

We want to end on a rather positive note, because all weaknesses are opportunities (India & the Philippines infra). Strengths are also opportunities, as Malaysia is more competitive. The good news is that governments understand this, and it's not just China infra stock rallying..

Key infrastructure projects/plans in Asia, including India's Gati Shakti that includes large spending for roads and railways in the FY2023 budget released. Vietnam is planning to beef up its road infrastructure with modernizing highways and expressways!

Sincerely,

@Trinhnomics

Sincerely,

@Trinhnomics

• • •

Missing some Tweet in this thread? You can try to

force a refresh