🔥pieces by @kwharrison13 on changes in VC

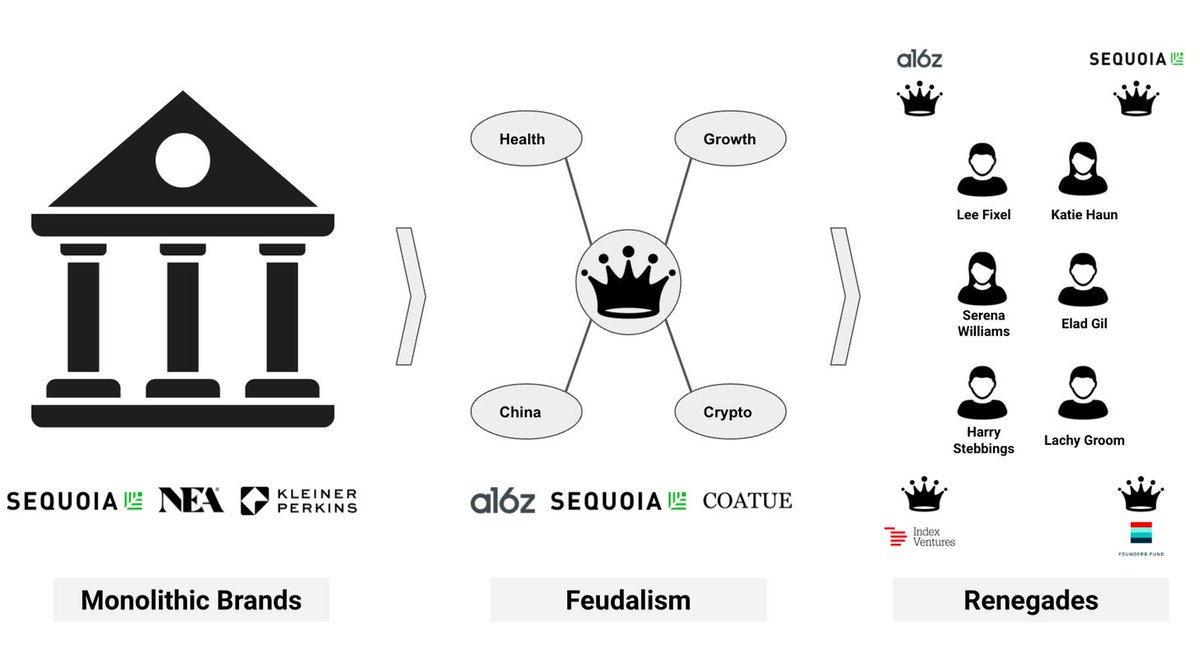

"The reallocation of trust from brands to individuals is impacting the way founders view who to invite into their companies. Influence within venture has progressively decentralized away from the core brand into renegades."

"The reallocation of trust from brands to individuals is impacting the way founders view who to invite into their companies. Influence within venture has progressively decentralized away from the core brand into renegades."

"For the longest time people thought often of VC funds as “The Firm.” Amorphous blobs that judged you harshly and spit out cash."

The Unbundling of Venture Capital

investing1012dot0.substack.com/p/the-unbundli…

The Unbundling of Venture Capital

investing1012dot0.substack.com/p/the-unbundli…

"There is a long-tail of super talented people who may not be the best investor for everyone, but for a specific group they'll be the perfect investor."

The Productization of Venture Capital

"The world is changing to become more dictated by value proposition because it reframes the question. What do founders want? They don't particularly care what stage or sector you want to focus on."

investing1012dot0.substack.com/p/productizati…

"The world is changing to become more dictated by value proposition because it reframes the question. What do founders want? They don't particularly care what stage or sector you want to focus on."

investing1012dot0.substack.com/p/productizati…

"There is power in creating a scaffolding [of best practices] because it's more than just people. There is value in preparation, rituals, and familiarity."

investing1012dot0.substack.com/p/the-professi…

investing1012dot0.substack.com/p/the-professi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh