In 2002, a young hedge fund analyst was sifting through the rubble of the dotcom bust.

Scott Shleifer had joined upstart Tiger Global, formed by Chase Coleman after his mentor Julian Robertson had shut down legendary Tiger Management at the peak of the bubble.

Scott Shleifer had joined upstart Tiger Global, formed by Chase Coleman after his mentor Julian Robertson had shut down legendary Tiger Management at the peak of the bubble.

Shleifer dug through a spreadsheet with tech stocks until he stumbled upon a group of Chinese internet companies. Sina, Sohu, and NetEase were not yet profitable but they were growing rapidly and their stock prices had imploded.

Shleifer saw growth and high incremental margins - much of future growth would fall to the bottom line.

He set up calls with management. When he heard that he was the first Western investor to call in some time he got really interested.

He set up calls with management. When he heard that he was the first Western investor to call in some time he got really interested.

He realized that within a few years these companies could be trading for as little as one or two times their profits.

He visited Coleman’s office with the words: “Sina, Sohu, and NetEase. Let’s dance.”

He visited Coleman’s office with the words: “Sina, Sohu, and NetEase. Let’s dance.”

By the summer of 2003, Tiger Global’s Chinese positions “were up between 5x and 10x.”

Next, Coleman and Shleifer divided global internet companies into segments such as “portals, online travel, and e-commerce.”

Next, Coleman and Shleifer divided global internet companies into segments such as “portals, online travel, and e-commerce.”

“The trick was to go country by country, identifying the emerging winners in each category.”

They were looking for a proven business model in an untapped new market such. “The eBay of Korea.” "The Expedia of China.”

“The this of the that,” they called it.

They were looking for a proven business model in an untapped new market such. “The eBay of Korea.” "The Expedia of China.”

“The this of the that,” they called it.

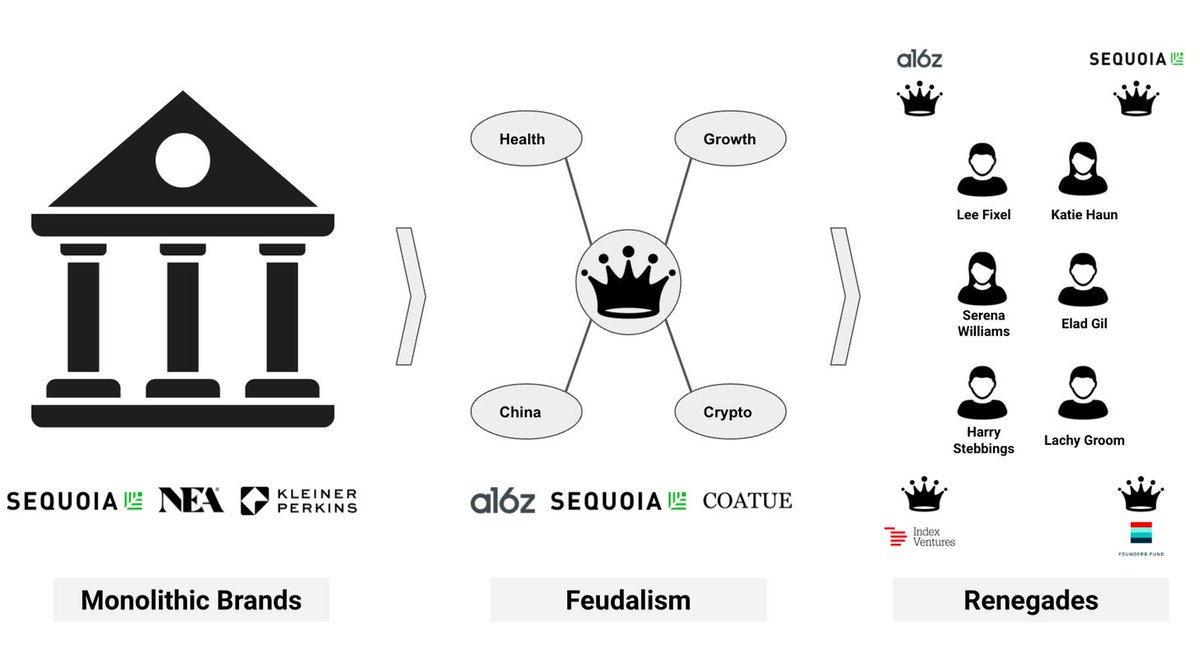

It was the seed of the firm's success as a global crossover investor shaking up venture capital.

I wrote about this story and others in my review of @scmallaby's new book.

neckar.substack.com/p/a-history-of…

I wrote about this story and others in my review of @scmallaby's new book.

neckar.substack.com/p/a-history-of…

• • •

Missing some Tweet in this thread? You can try to

force a refresh