The FTM 👻 ecosystem is set to 🚀 this year.

I've spent the past few weeks researching the newest dapps and protocols on Fantom.

Here are the 3 with the most potential:

I've spent the past few weeks researching the newest dapps and protocols on Fantom.

Here are the 3 with the most potential:

A Quick Overview on $FTM if you're unfamiliar:

• Led by Gigachad @michaelfkong and @AndreCronjeTech

• It's already in the top 35 projects by market cap

• 1 of the top choices for ppl who can't afford to DeFi on ETH

• Lachesis means security

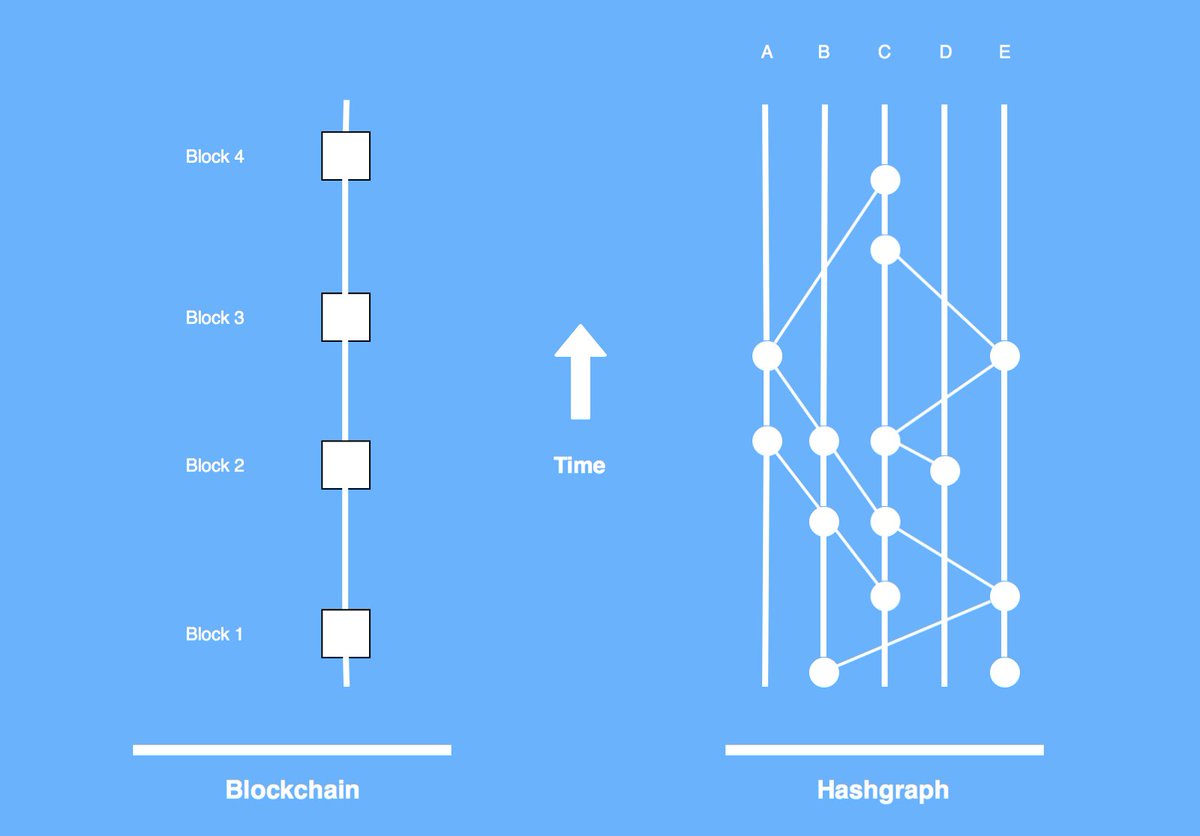

"What is Lachesis?"

• Led by Gigachad @michaelfkong and @AndreCronjeTech

• It's already in the top 35 projects by market cap

• 1 of the top choices for ppl who can't afford to DeFi on ETH

• Lachesis means security

"What is Lachesis?"

Every Layer 1 runs into scaling and gas fee issues.

To solve, they all have differing approaches.

FTM's solution are - a "leaderless" PoS mechanism.

They'll allow nodes to communicate occasionally but processes tx quick with finality.

To solve, they all have differing approaches.

FTM's solution are - a "leaderless" PoS mechanism.

They'll allow nodes to communicate occasionally but processes tx quick with finality.

ETH is expensive and slow, right?

Imagine if the biggest DeFI protocols like Maker and Aave available on other chains .

How many more people, like us could access it?

For the end users, DeFi on FTM offer higher returns with lower barriers to access.

Imagine if the biggest DeFI protocols like Maker and Aave available on other chains .

How many more people, like us could access it?

For the end users, DeFi on FTM offer higher returns with lower barriers to access.

Bullish metrics for FTM from @tokenterminal

• It's the #5 TVL and has a strong market cap / TVL ratio.

• Unique addresses around 1m

• Multichain dominancee at 59% and growing

• All metrics are going up. The price is lagging behind due to global economics.

• It's the #5 TVL and has a strong market cap / TVL ratio.

• Unique addresses around 1m

• Multichain dominancee at 59% and growing

• All metrics are going up. The price is lagging behind due to global economics.

FTM's hype has only been increasing.

This is in anticipation of Andre's ve (3,3) launch.

Andre's ve(3,3) project Solidly emissions beginning shortly.

Of the new protocols have been launching recently.

Here are the 5 most interesting ones I found:

This is in anticipation of Andre's ve (3,3) launch.

Andre's ve(3,3) project Solidly emissions beginning shortly.

Of the new protocols have been launching recently.

Here are the 5 most interesting ones I found:

DAPP #1: @beethoven_x

A one-stop decentralized investment platform on Fantom Opera.

Too often protocols just fork off of each other.

📈 Weighted Investment Pools

💵 Stable Pools

💸 Earn Protocol Fees

Let's see what they do:

A one-stop decentralized investment platform on Fantom Opera.

Too often protocols just fork off of each other.

📈 Weighted Investment Pools

💵 Stable Pools

💸 Earn Protocol Fees

Let's see what they do:

a. Weighted Investment Pools

Weighted investment pools turn the concept of an index fund on its head.

You collect fees from traders who constantly rebalance your portfolio following arbitrage.

Each pool can contain up to 8 tokens, where each token is assigned a weight.

Weighted investment pools turn the concept of an index fund on its head.

You collect fees from traders who constantly rebalance your portfolio following arbitrage.

Each pool can contain up to 8 tokens, where each token is assigned a weight.

b. Stable Pools

For certain assets that are expected to trade consistently.

They use the Stableswap AMM popularized by Curve.

These pools allow for larger trades of these assets before encountering significant price impact.

For certain assets that are expected to trade consistently.

They use the Stableswap AMM popularized by Curve.

These pools allow for larger trades of these assets before encountering significant price impact.

c. Earn Protocol Fees

Protocol fees will distributed to liquidity stakers.

Provide liquidity in one of the 80/20 BEETS weighted pools to earn 30% of the protocol fees.

50% of protocol fees will be used to build a diversified DAO controlled treasury.

Protocol fees will distributed to liquidity stakers.

Provide liquidity in one of the 80/20 BEETS weighted pools to earn 30% of the protocol fees.

50% of protocol fees will be used to build a diversified DAO controlled treasury.

I'm a big fan of Curve, Convex and I guess REDACTED wars.

$BEETS is a protocol war- strong tokenomics.

Huge demand for fBeets, with their new gauge model.

Could @beethoven_x create a new war racking in insane TVL in FTM?

$BEETS is a protocol war- strong tokenomics.

Huge demand for fBeets, with their new gauge model.

Could @beethoven_x create a new war racking in insane TVL in FTM?

DAPP #2: @LiquidDriver

First Yield Aggregator offering Liquidity-as-a-Service on Fantom.

Their aim is to become leading liquidity provider for dapps on FTM.

•Farms

•Vault Strategy

•xLQDR

Let's explore further...

First Yield Aggregator offering Liquidity-as-a-Service on Fantom.

Their aim is to become leading liquidity provider for dapps on FTM.

•Farms

•Vault Strategy

•xLQDR

Let's explore further...

a. Farms

Common to most DeFi protocols.

Users can stake their SpiritSwap, SpookySwap, and Beethoven-x LP tokens on:

liquiddriver.finance/farms

They earn $LQDR as a reward.

Anyways, lets talk about Vault Strategies (important).

Common to most DeFi protocols.

Users can stake their SpiritSwap, SpookySwap, and Beethoven-x LP tokens on:

liquiddriver.finance/farms

They earn $LQDR as a reward.

Anyways, lets talk about Vault Strategies (important).

b) Revenue Sharing Vault Strategies

LP tokens staked are deployed and used to generate yield.

Yield is redistributed to xLQDR holders.

xLQDR holders receive weekly rewards from Revenue Sharing Vaults, eg $BOO, $SPELL, $BEETS, $wFTM and $LQDR.

LP tokens staked are deployed and used to generate yield.

Yield is redistributed to xLQDR holders.

xLQDR holders receive weekly rewards from Revenue Sharing Vaults, eg $BOO, $SPELL, $BEETS, $wFTM and $LQDR.

c) xLQDR.

Locking LQDR to generate xLQDR, the yield-producing vested version of LQDR.

The longer your locking time, the higher the amount of xLQDR you receive.

Think Curve but a complete new set of bribing wars.

Andddd....

Leveraged Farming + Single Sided Vaults soon

Locking LQDR to generate xLQDR, the yield-producing vested version of LQDR.

The longer your locking time, the higher the amount of xLQDR you receive.

Think Curve but a complete new set of bribing wars.

Andddd....

Leveraged Farming + Single Sided Vaults soon

c) DAPP #3: @solidlyexchange

Founded by @AndreCronjeTech.

Solidly is an AMM based on Uniswap v2.

It allows swapping between two tokens in a liquidity pool in a fully decentralized way.

Unlike Uniswap, it supports low slippage trades between stablecoins too.

Founded by @AndreCronjeTech.

Solidly is an AMM based on Uniswap v2.

It allows swapping between two tokens in a liquidity pool in a fully decentralized way.

Unlike Uniswap, it supports low slippage trades between stablecoins too.

a) Tokenomics

Solidly token exists in two forms: the main one is SOLID (tradeable).

The other one is veSOLID which is a locked state of SOLID.

To participate in governance, SOLID needs to be locked and turned into veSOLID.

Locks can last between one month and four years.

Solidly token exists in two forms: the main one is SOLID (tradeable).

The other one is veSOLID which is a locked state of SOLID.

To participate in governance, SOLID needs to be locked and turned into veSOLID.

Locks can last between one month and four years.

b) ve(3,3)

The concept of ve(3,3) where lockers also receive a share of emissions based on the circulating supply.

The percentage of emissions received by existing lockers is below:

veSOLID.totalSupply() / SOLID.totalSupply()

Game theory at its' finest. No emission dilution.

The concept of ve(3,3) where lockers also receive a share of emissions based on the circulating supply.

The percentage of emissions received by existing lockers is below:

veSOLID.totalSupply() / SOLID.totalSupply()

Game theory at its' finest. No emission dilution.

WARNING

These are protocols with risk.

They are newer and not as tested as your Curve for example.

This is not FINANCIAL ADVICE.

My tak is:

"Hey anon, found some cool projects on ftm. check em out."

Size your bets appropriately.

These are protocols with risk.

They are newer and not as tested as your Curve for example.

This is not FINANCIAL ADVICE.

My tak is:

"Hey anon, found some cool projects on ftm. check em out."

Size your bets appropriately.

Transparency

The following projects are a part of my personal portfolio.

• Beets

@beethoven_x

• LQDR (LiquidDriver)

@LiquidDriver

I have no plans of selling these tokens anytime soon.

The following projects are a part of my personal portfolio.

• Beets

@beethoven_x

• LQDR (LiquidDriver)

@LiquidDriver

I have no plans of selling these tokens anytime soon.

Key Takeaways:

• FTM will do well this year. Great metrics, speed, low fees coming, and DEFI is booming.

• There are plenty of interesting projects being built now, of which I highlighted a few.

•Not included, but to be noted are $TAROT and $CREDIT.

• FTM boom incoming.

• FTM will do well this year. Great metrics, speed, low fees coming, and DEFI is booming.

• There are plenty of interesting projects being built now, of which I highlighted a few.

•Not included, but to be noted are $TAROT and $CREDIT.

• FTM boom incoming.

If you enjoyed this,

Please follow me @Crypto8Fi for more threads on DeFi, projects and the latest alpha.

I also write on Medium that goes more into depth on DeFi concepts.

medium.com/@crypto8fi

Please follow me @Crypto8Fi for more threads on DeFi, projects and the latest alpha.

I also write on Medium that goes more into depth on DeFi concepts.

medium.com/@crypto8fi

• • •

Missing some Tweet in this thread? You can try to

force a refresh