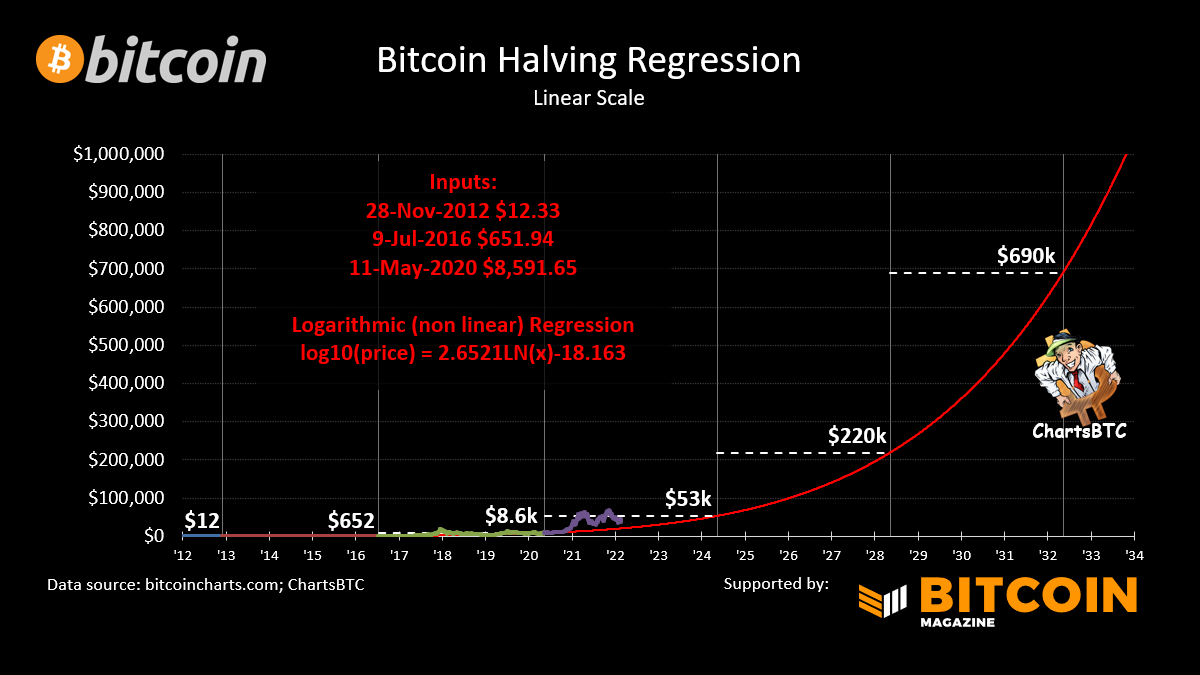

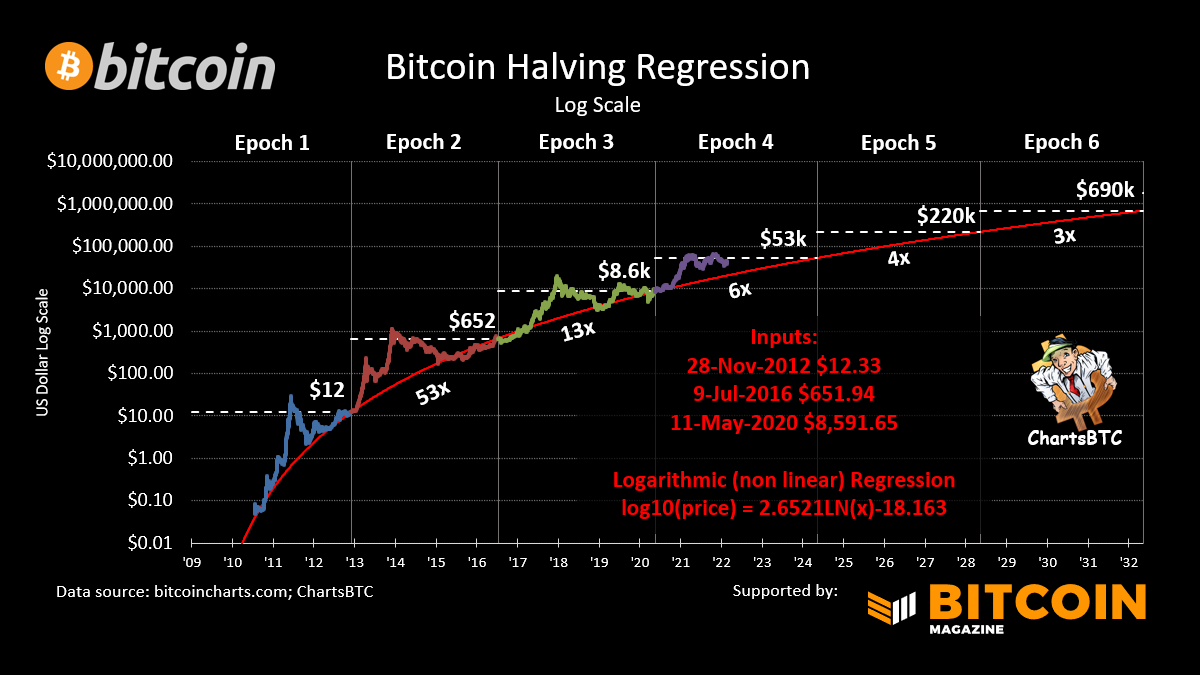

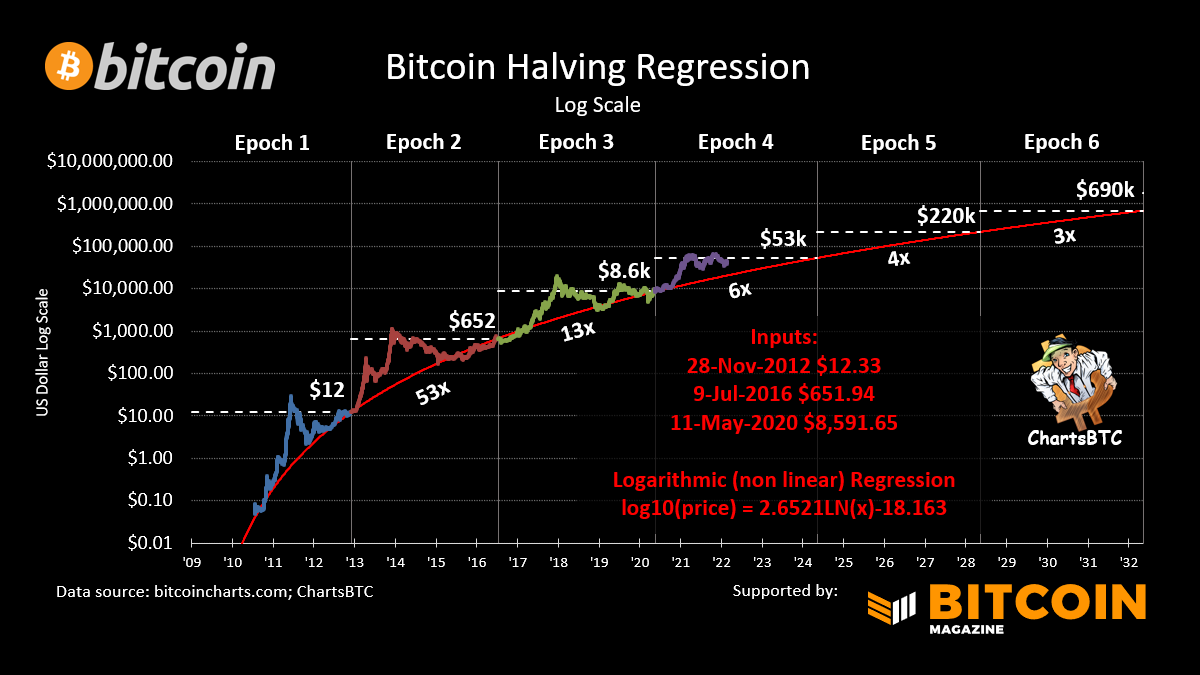

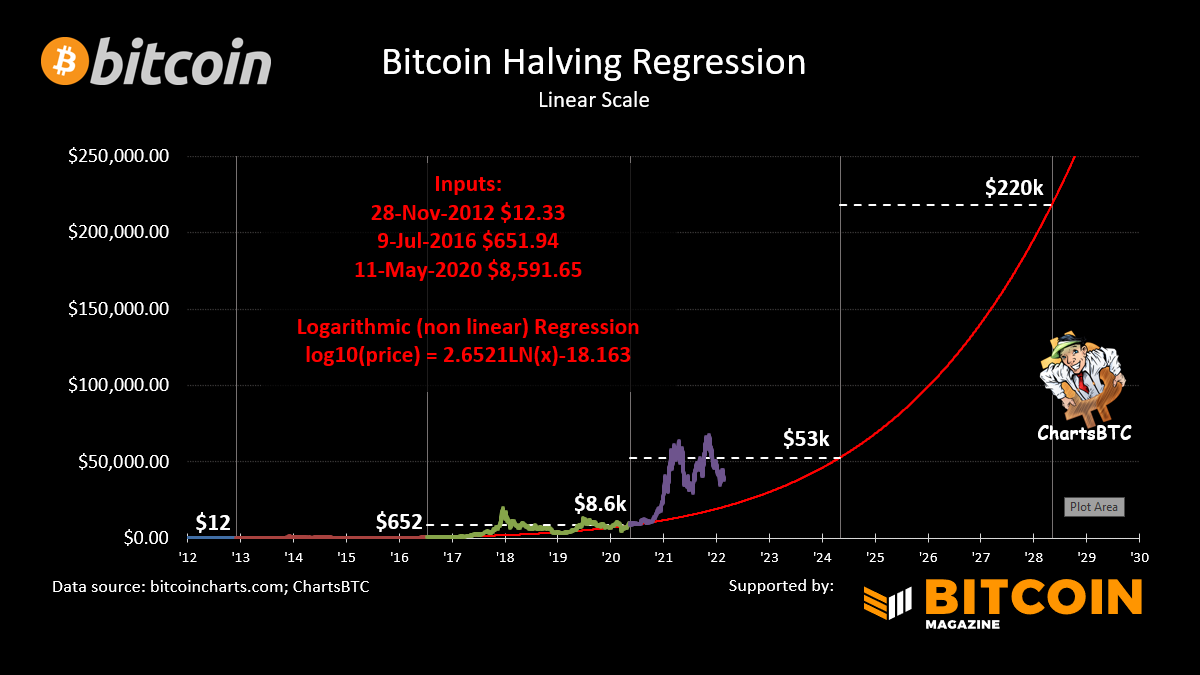

#bitcoin halving regression - There are many #bitcoin regression curves but what if we excluded the blow off tops and crashes and ran it only on just the 3 halving prices? This is the result.🧵 /1

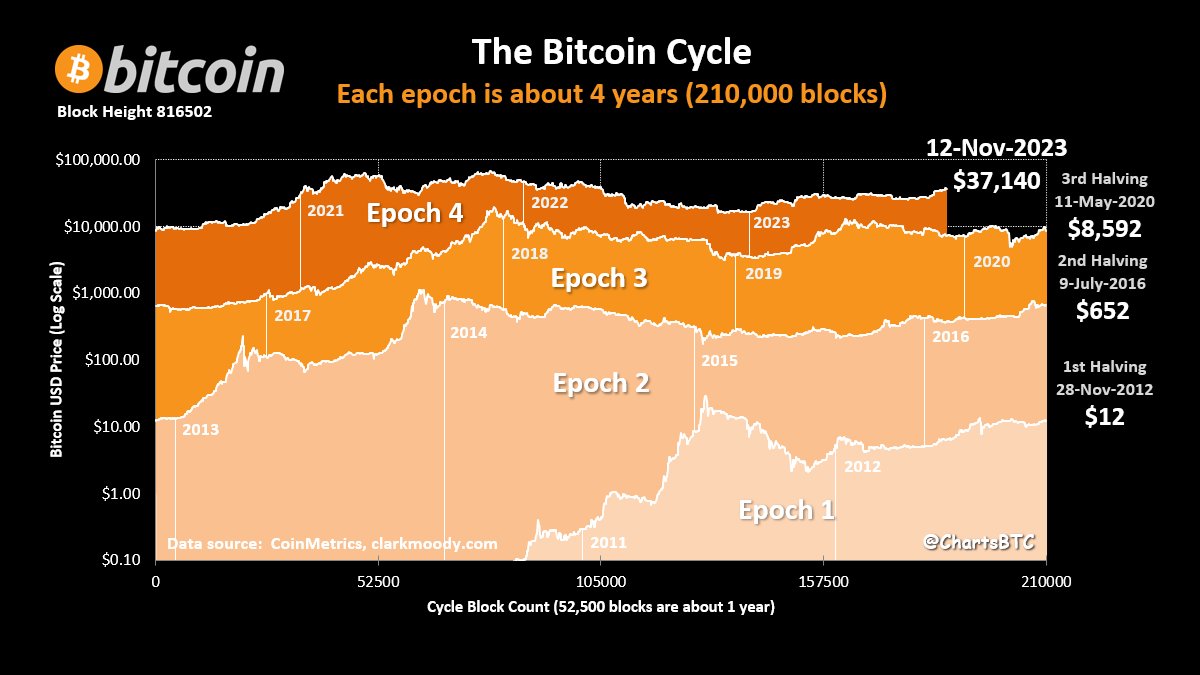

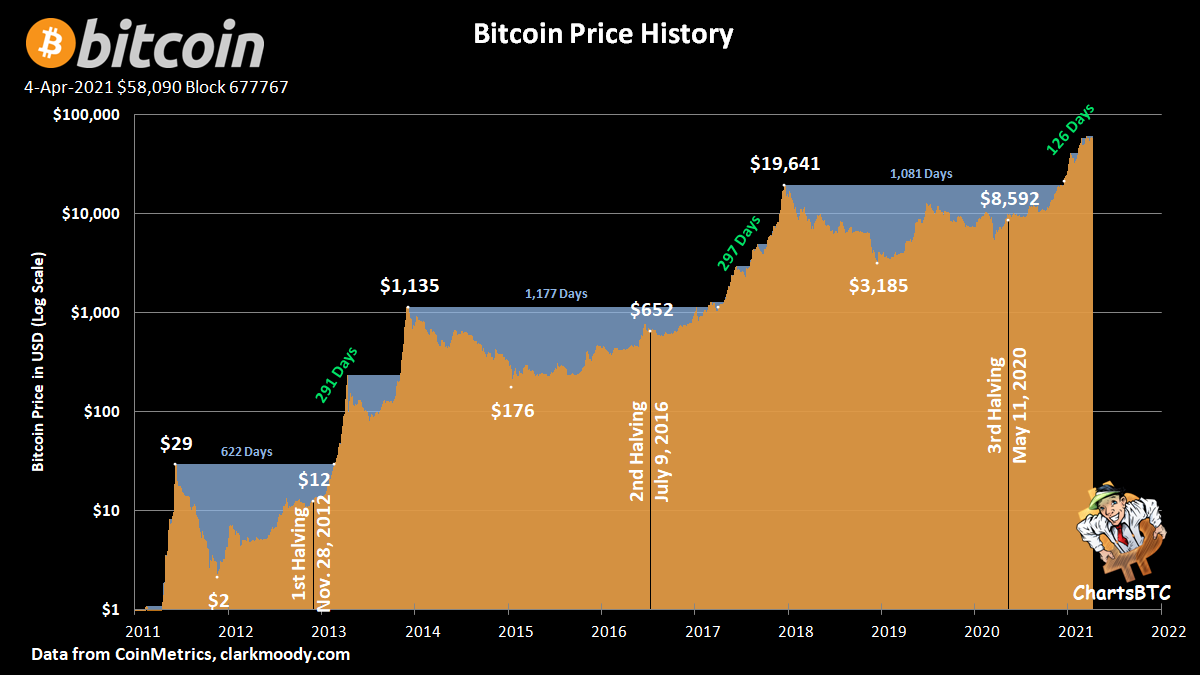

It follows the lower bound of bitcoins price history surprisingly well. By definition, this type of model will show diminishing returns with an estimated increase of 6x this epoch, 4x next epoch and 3x for the one after that. /2

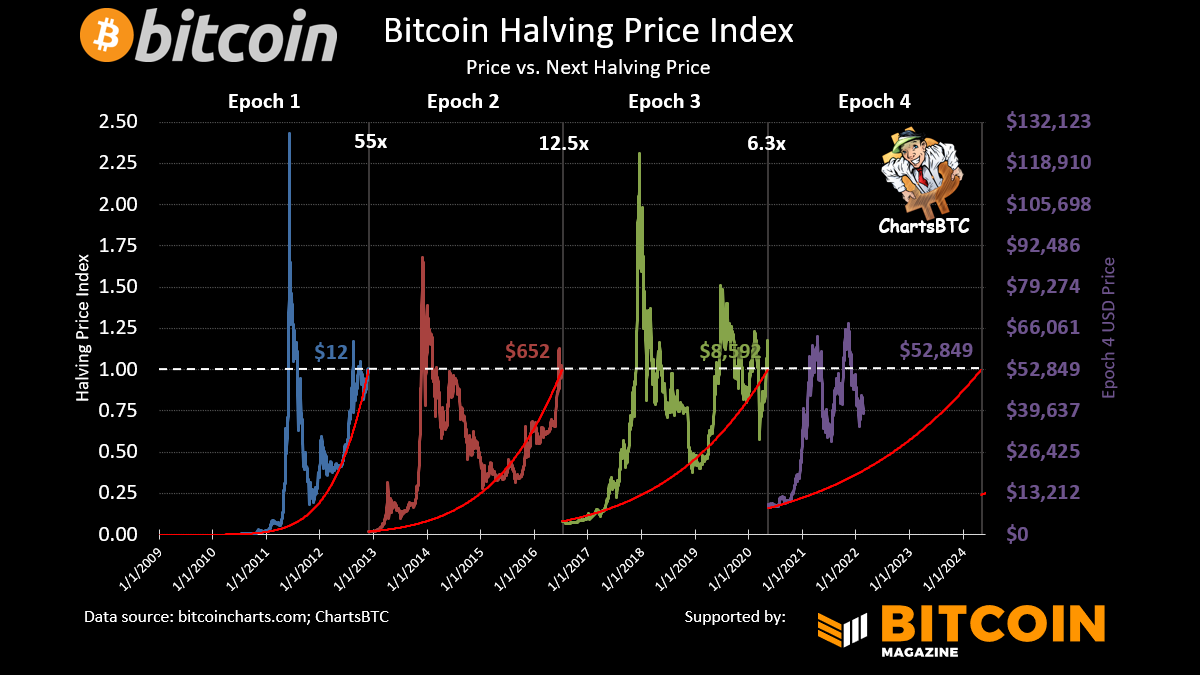

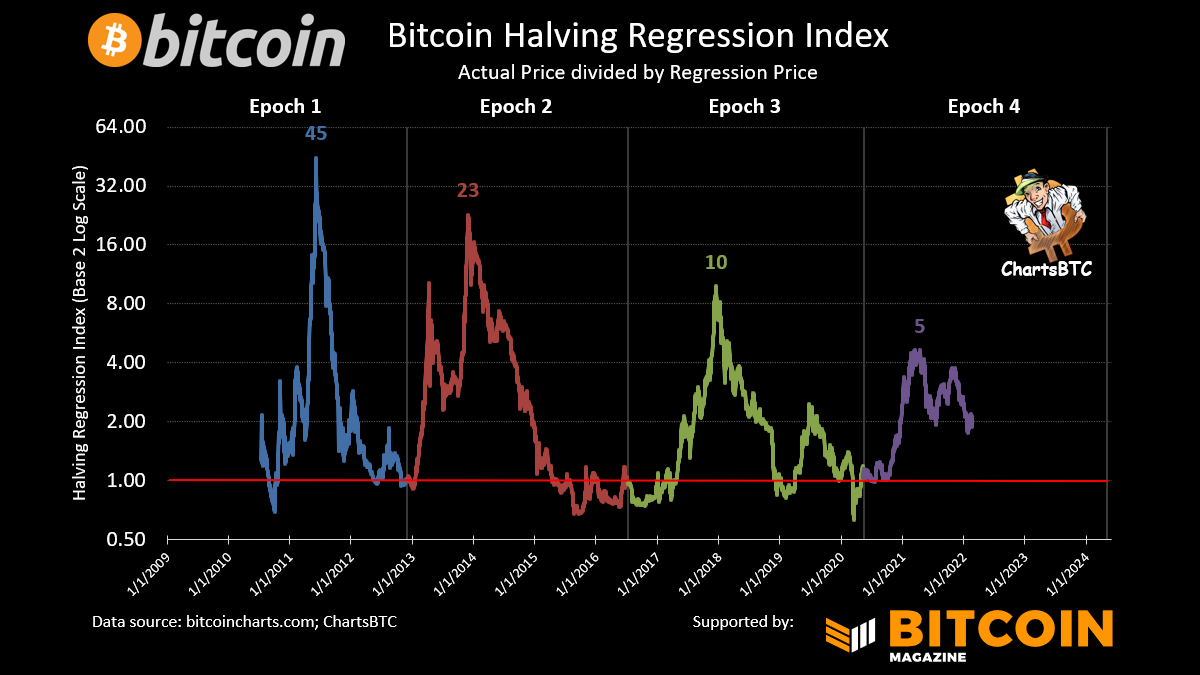

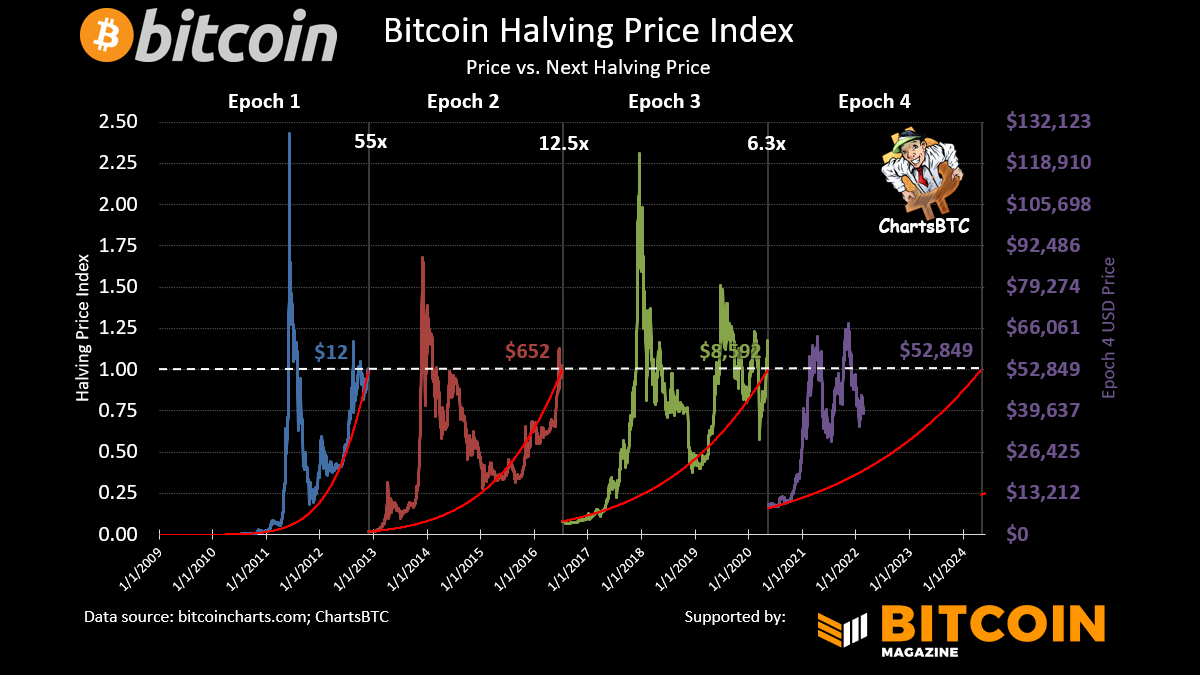

Dividing the curve by the actual price produces this result showing the peaks are getting less extreme. /3

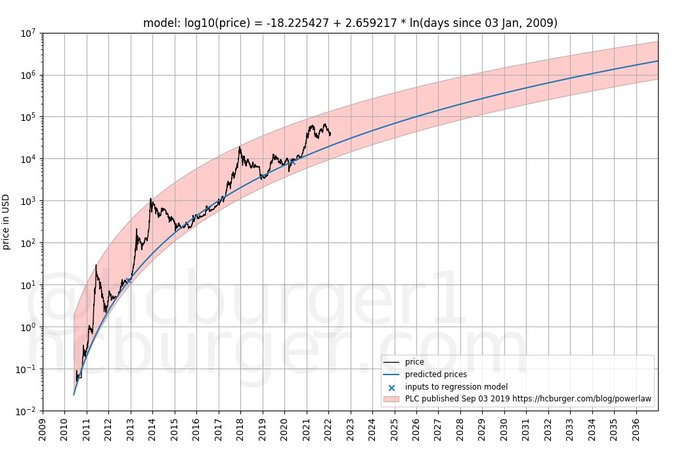

I’d like to give a huge thanks to @hcburger1 for his input. He also compared it to his model and it fit well. Give him a follow and check out his work… /6

medium.com/quantodian-pub…

medium.com/quantodian-pub…

medium.com/quantodian-pub…

medium.com/quantodian-pub…

Disclaimer time: I think this is an interesting reference point for a long term #bitcoin hodler like myself but that’s all. Congrats, you made it to the end! /7

• • •

Missing some Tweet in this thread? You can try to

force a refresh