Genex $GNX $GNX.AX a renewable energy play with battery, pumped hydro and firming capacity has gone into a trading halt to raise capital at a 40% discount to 52-week highs.

Let's take a quick look 👇

Let's take a quick look 👇

You can find the original deep dive and updates here.

And don’t forget, if you click on my profile and then go to moments/index, you will see the full library of deep dives and updates.

And don’t forget, if you click on my profile and then go to moments/index, you will see the full library of deep dives and updates.

https://twitter.com/DownunderValue/status/1438317805833621506

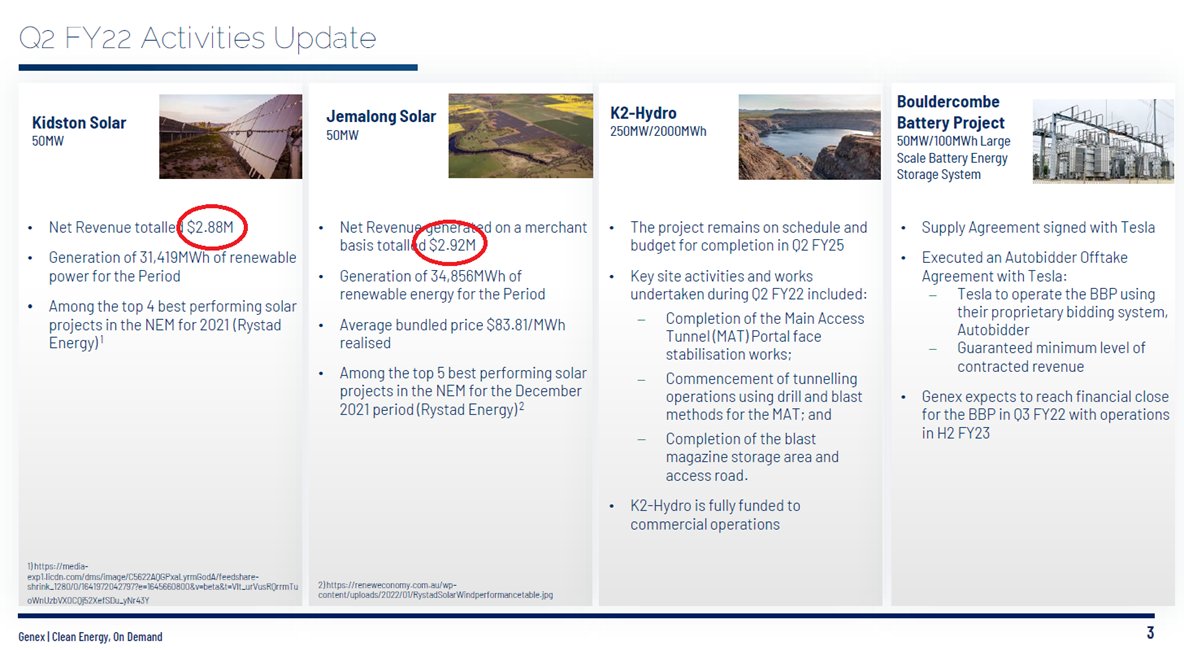

To be honest I was pretty happy with their recent report.

Revenue ahead of schedule for Kidston Solar ($11.5m annualized vs $10.6 expected) and Jemalong ($11.7 vs $10m ).

Revenue ahead of schedule for Kidston Solar ($11.5m annualized vs $10.6 expected) and Jemalong ($11.7 vs $10m ).

The most recent cap raise is to fund the Bouldercombe battery project with Tesla, and meet capital requirements. The batteries have great margins, but require a lot of CAPEX upfront - something Genex is lacking in.

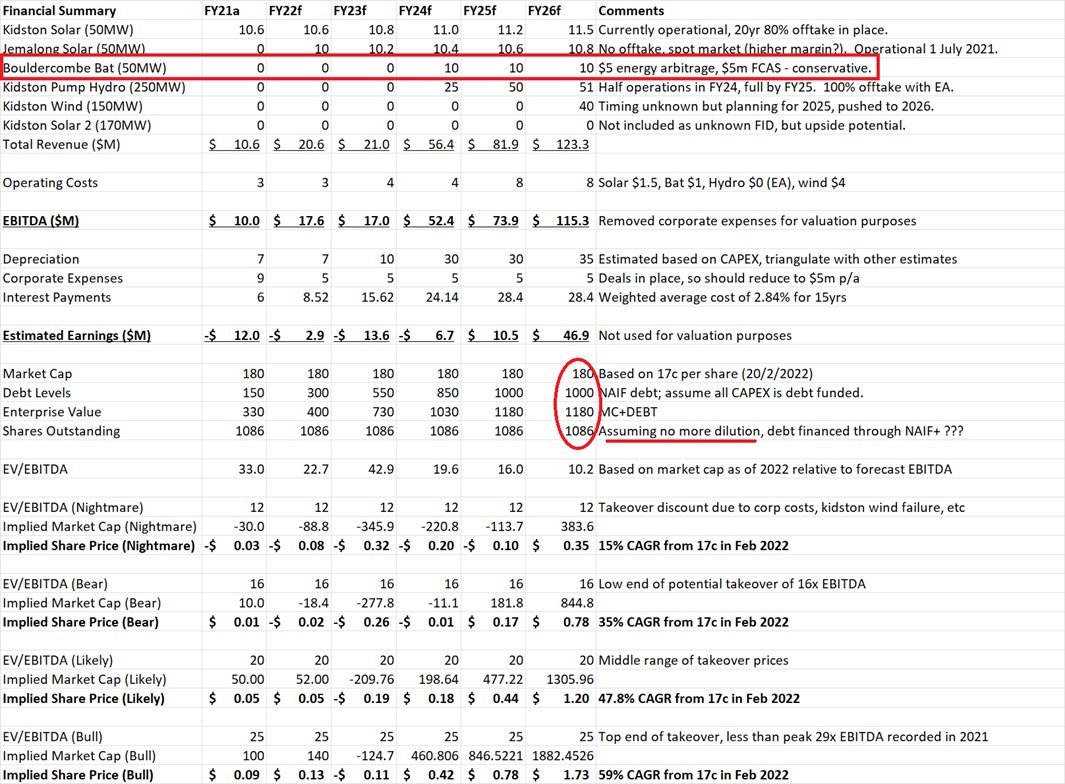

Prior to the cap raise the asset valuations were looking really good. The risk was always shareholder dilution and capital requirements - but with +$600m loans from NAIF and $200m from ARENA and QldGov in grants, it seemed to be de-risked.

And here's the shareholder value destruction when you cap raise at 15c for $40m. Note EV remains the same, the change in returns is all because of diluting existing shareholders.

Still, looks like one can get decent returns. What was 35% may now be 29% CAGR.

Still, looks like one can get decent returns. What was 35% may now be 29% CAGR.

h/t to @abroninvestor @OutsideCapital_ and @giginator_ who are following, and advised me on this🙄

I'll cop this lesson the hard way, though fortunately I positioned well and may look to average down if the board stops empire building on high CAPEX batteries.

I'll cop this lesson the hard way, though fortunately I positioned well and may look to average down if the board stops empire building on high CAPEX batteries.

Oh I should be clear on this that @abroninvestor red flagged a risk to me that I overlooked, and didn't advise or recommend. Sorry that wasn't clear.

@giginator_ and @OutsideCapital_ are in the same boat as me 😬

@giginator_ and @OutsideCapital_ are in the same boat as me 😬

Mike Cannon-Brookes might be pretty busy this week. So I wonder if he will have the time to participate in the next Genex $GNX.AX capital raise, at 15c vs 27c in March 2021? 🤔

fool.com.au/2021/03/25/gen…

fool.com.au/2021/03/25/gen…

• • •

Missing some Tweet in this thread? You can try to

force a refresh