Looking at the potential returns for $PANR, I found we could expect a return of between x9.4 - 14.1 on today's share price of ~130p, or between US$16 - 25p/sh in a buyout if we are able to derisk the underground assets. Here's how I came up with that value... #panr $pthrf #pthrf

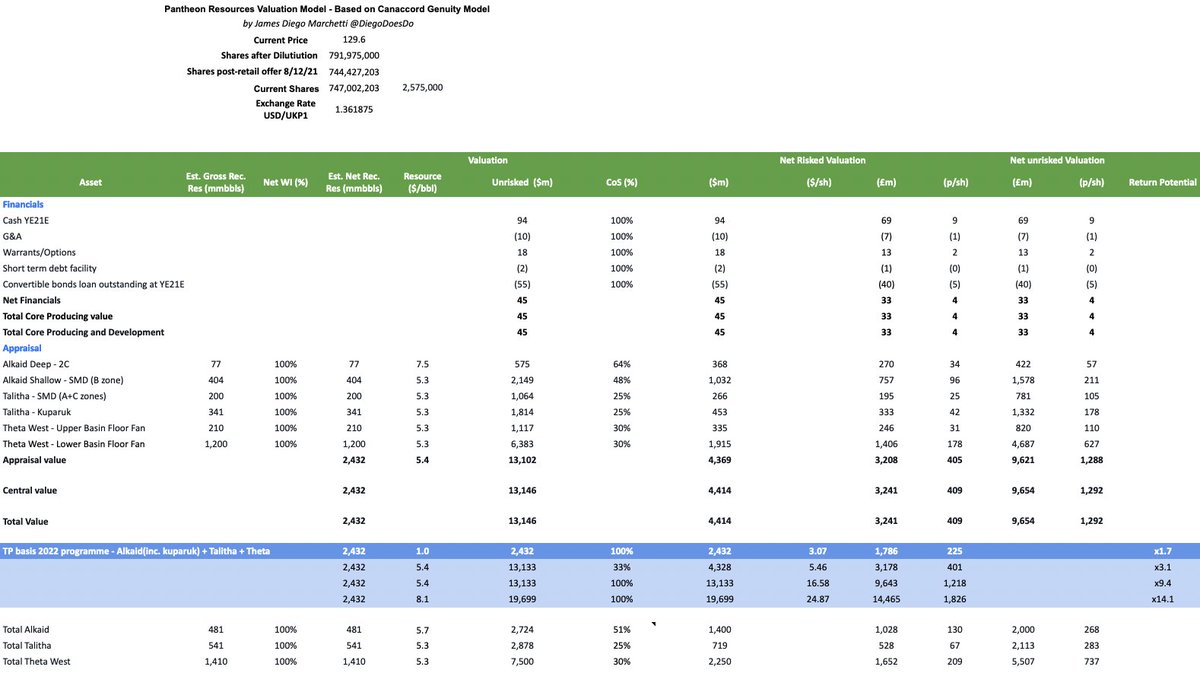

I first adjusted Canacorrd Gunuity's Dec. model to have updated data prior to trading today. Their report originally had a target of 200p, but I updated that to incl. the Kuparuk as later notes say a target of 220p - I have assumed this was included and rounded down $panr #panr

Focusing on Canacorrds TP basis section, they have a return of x1.7 at a value of $3.07p/sh, but this was highly risked at $1/bbl, which is not representative of actual sale management would approve of. $panr #panr

Using their $5.4/bbl, which is 9% of Canacorrds WTI est. price of $60, we can extend this out to $8.1 at today's oil prices($90), likewise, using Oil Search's Acquisition of Alaskan assets in 2017, we could see their ave. value of $5.4 supported. $panr #panr $pthrf #pthrf

Putting this together gives us a low-end value of $5.4/bbl as per CG and the OS Aqc. and an upside of $8.1/bbl, or between $16-25p/sh, or 9.4-14.1 times the current share price. i.e if you invested $1000 on Friday, you could see this grow to between $9,400 and $14,000 $panr #panr

This is without any resource upgrade that might come as a result of the testing we have on at the moment. It should also be noted that Telemachus mentioned $5 is a realistic price. "A buyout would likely be pitched nearer $5 per barrel…"

A lot needs to happen between a sale and today, so I wouldn't expect this in any time frame under 6-12 months, but it's certainly possible.

It should be noted I based this on @CanaccorGenuity's Dec valuation update, and have used much of their research. All prices are USD unless otherwise mentioned. #panr $panr Here is their report research-tree.com/companies/uk/o…

Also, I reference Telemachus, who is certainly much more experienced and everyone should check out his post here.. #panr $panr reddit.com/r/PantheonReso…

This is not financial advice and only an exercise in personal learning and entertainment.

If you like this, please feel free to follow @diegodoesdo as I will put out more info as it comes available on $PANR and other companies. Here is another post I made the other day showing the size potential of Theta West.

https://twitter.com/diegodoesdo/status/1494586547890683907?s=20&t=btDZ5wPDDTtDmUNIiqqJwQ

Apologies, that image was wrong, I had updated but included an old version of the image. Here is the correct amount at $5.58p/bbl

• • •

Missing some Tweet in this thread? You can try to

force a refresh