🧵Warner Bros. Discovery Thread 🧵

The combined entity of Warner Bros. and Discovery is expected to spend $22B on content in 2022, per Wells Fargo/@xscreenmedia. WBD is projected to generate $52B in revenue in 2023 & carry an estimated enterprise value of $150 billion, per @FinancialTimes.

Per Discovery’s earnings reports, 67% of its $2.79B in 2020 revenue came from domestic networks. Even as a decaying model, it enables WBD to mine some value from linear business, which still stands at ~70M customers in the U.S. (with ~6M cutting the cord per year).

The unification brings together entertainment brands such as CNN, TBS, TNT, HGTV, Food Network, Discovery Channel, Warner Bros. movie studio, and streaming services HBO Max (74M subs) and Discovery+ (22M subs).

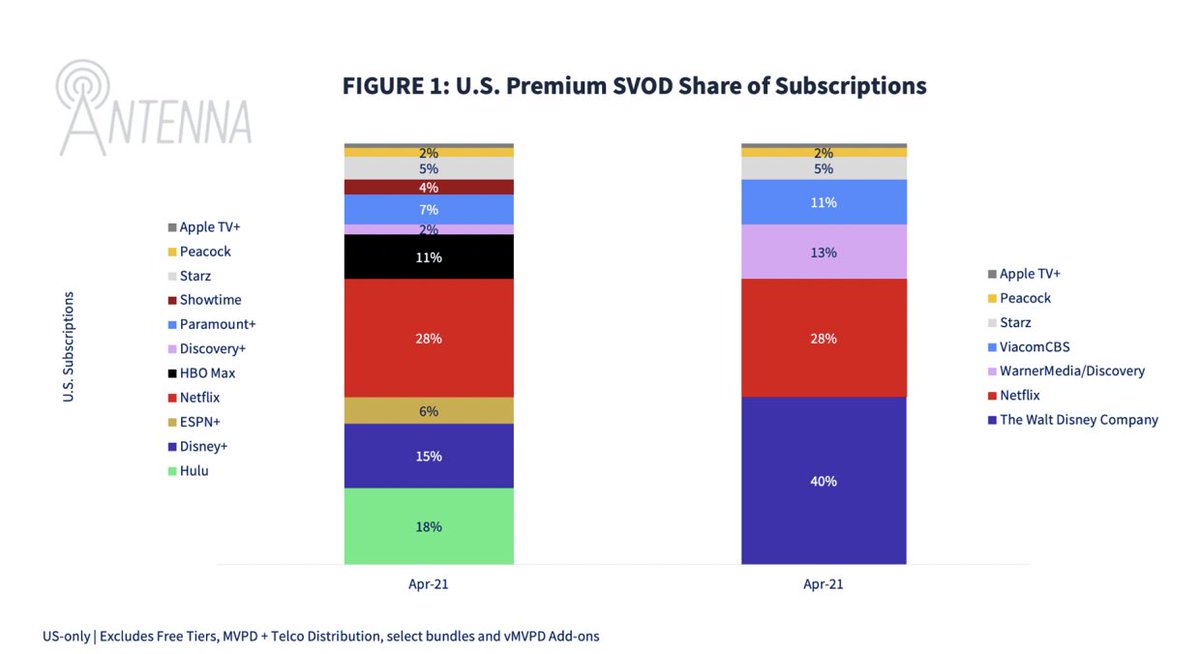

The combination of WarnerMedia and Discovery Inc. would have assumed the third largest share of total streaming subscriptions as of mid-2021, according to transactional data firm @AntennaData.

In terms of new demand, measured by gross subscriber adds, a combined Discovery+ and HBO Max would own 28% share in the first half of 2021, per @AntennaData.

But how will the combined content fare together, particularly in streaming?

WBD is projected to start out in second place in US corporate demand share (behind Disney), per @ParrotAnalytics, which bodes well as they work to bring their full catalog onto in-house SVOD platforms.

WBD is projected to start out in second place in US corporate demand share (behind Disney), per @ParrotAnalytics, which bodes well as they work to bring their full catalog onto in-house SVOD platforms.

Discovery+ (6.6%) was the 7th largest streaming platform by demand share in the US in Q4 2021. HBO Max (10.9%) was the 3rd biggest platform the US last quarter. Merging the two services creates a top 3 streamer behind Hulu and Netflix in demand share.

Reality/Documentary comprises just 4% of #HBOMax's audience demand & 70% of Discovery+'s, per @ParrotAnalytics. ~60% of Discovery’s catalog released over the last 3-to-5 years is lifestyle/reality whereas these genres make up just 3% of the WarnerMedia catalog, per @Diesel_Labs.

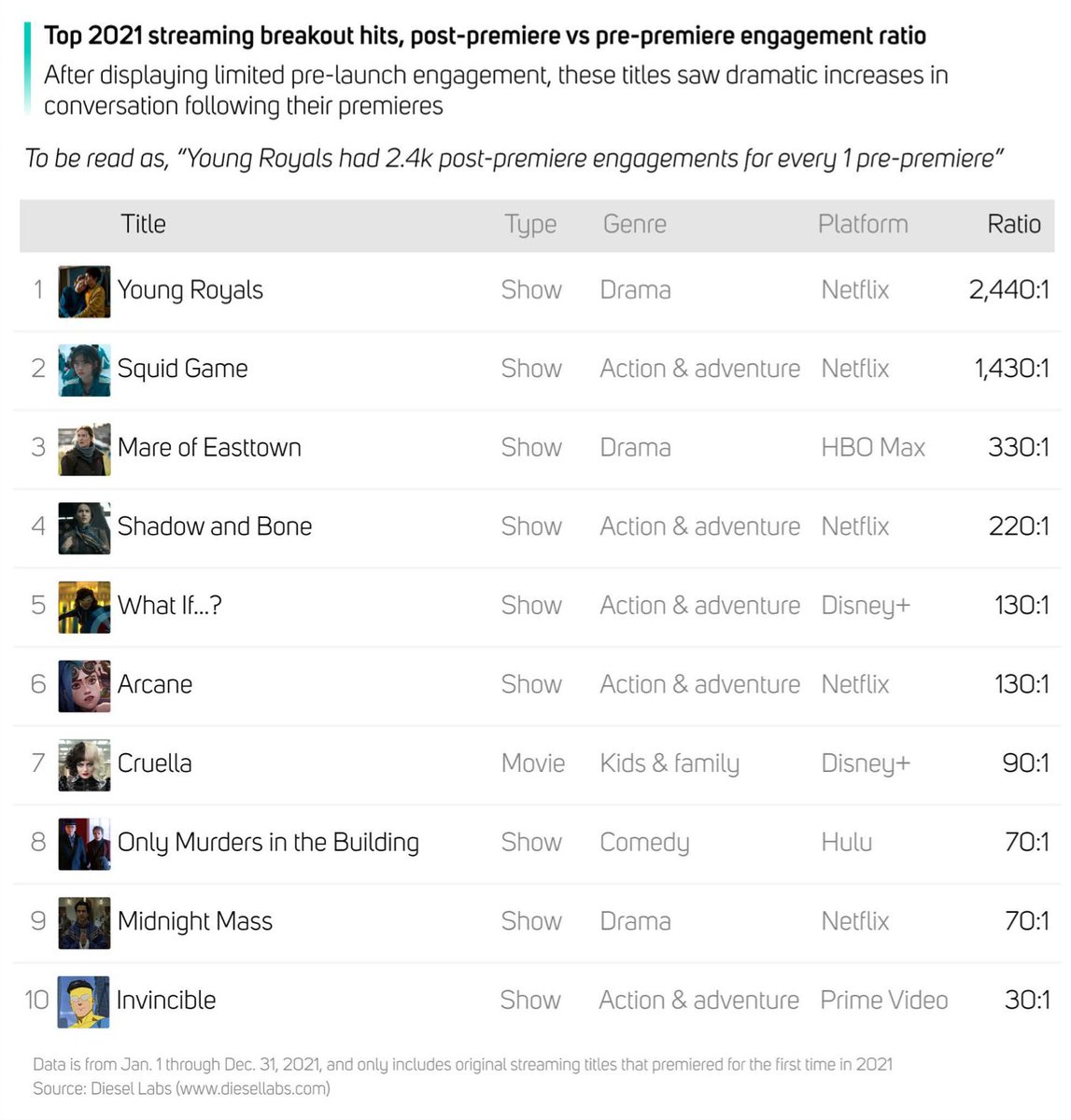

Together, WarnerMedia and Discovery own 26% of all new titles (across shows and movies) in 2021—overtaking the previous leader Netflix who owns 24% of all new titles, per @Diesel_Labs. Discovery is strong with volume, but generates little social engagement, an area WM excels.

But the WarnerMedia/Discovery audiences only overlap modestly with 3.9% of people engaging with content from both companies. In other words, there's a small audience that demands both. This is a potential roadblock to a Disney-like bundle of two services (Max and Discovery+).

It’s unclear if there’s a significant enough audience who would be interested in having access to both catalogs in a bundle, especially if it is more expensive than HBO Max ($9.99 ad supported, $14.99 ad free) today. Then again, pricing narratives change quickly (see: Netflix).

Both bundling HBO Max and Discovery+ as separate entities and integrating them into one supersized service come with pros/cons. I lean towards the latter, especially w/ the widespread belief Hulu will eventually be folded into D+ in the US and Star is already under D+ overseas.

Messed up the HBO Max reality/docmentary number a bit. But my point was that it is a smaller % of their overall content catalog, and an area that Discovery+ is excels in.

• • •

Missing some Tweet in this thread? You can try to

force a refresh