What the Russian invasion of Ukraine means for the world going forward:

1. Volatility begets volatility. When something crazy happens, the chance that other crazy things will happen goes up. It's not a coincidence that Canada is freezing peoples' assets and Russia invaded

1. Volatility begets volatility. When something crazy happens, the chance that other crazy things will happen goes up. It's not a coincidence that Canada is freezing peoples' assets and Russia invaded

Ukraine after the most significant event in most of our lives, Covid. To give an example of why things like this happen, other countries around the world may look at what Russia did and say "Wow, I can do that." and when they do, we get another significant event.

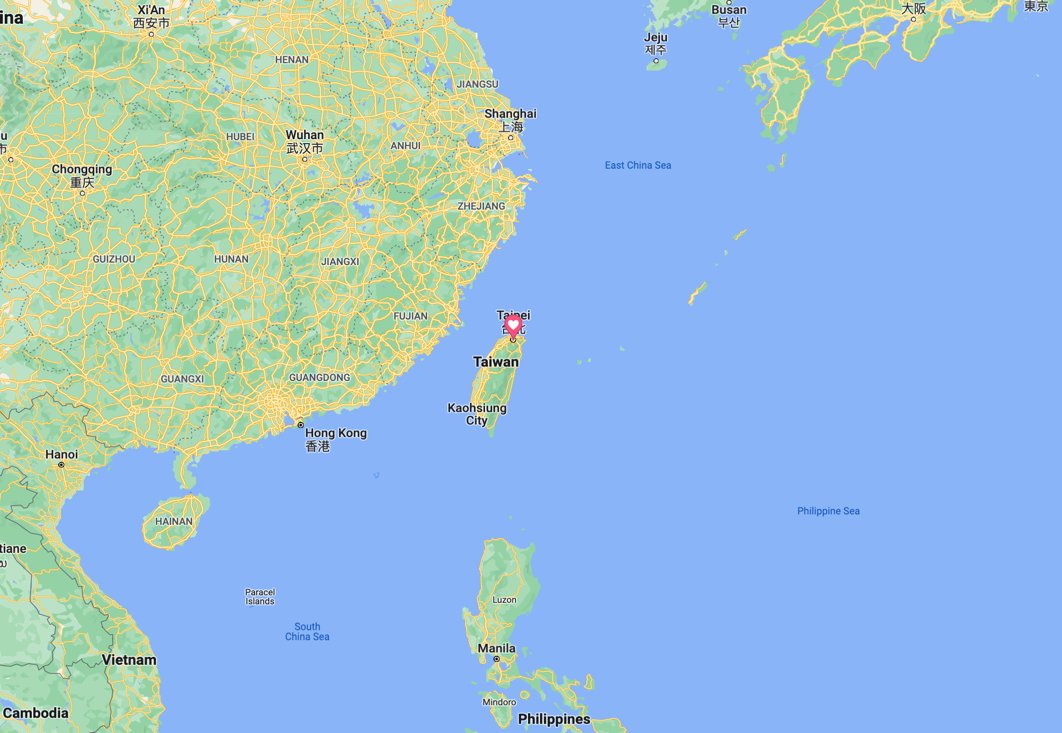

2. It's an invitation for China to take Taiwan. China can do the same exact strategy as Russia. Instead of massing troops in Belarus, Crimea, and Donbass, the Chinese can (they'll need some time for naval improvement) just mass boats, missiles, etc and then just swallow Taiwan.

Kind of like Putin didn't invade until the Olympics were over, if I were Xi, I'd ask Putin to mass troops somewhere in Europe to make it look like he was going to invade and then the Chinese take Taiwan.

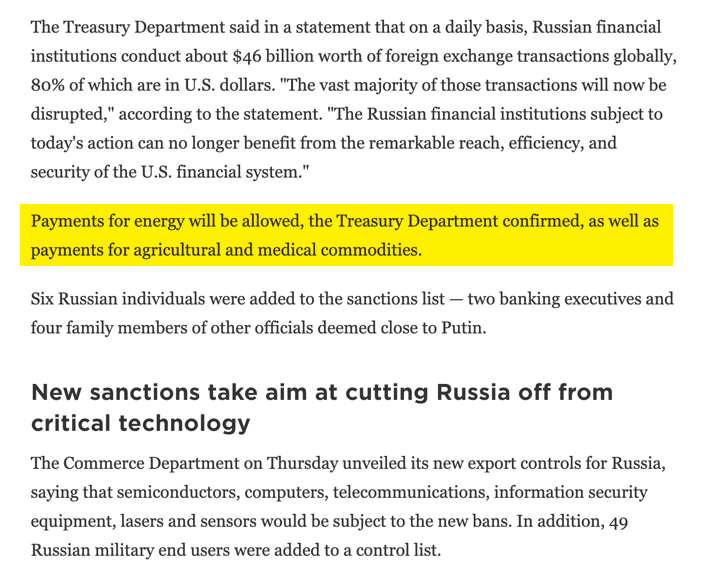

3. Inflation — so this one is interesting. Everyone thought that Russia was going to get sanctioned hard, which would drive up Russian and Ukrainian exports of fertilizer, grain, oil, and gas, but the US didn't mess with that. AFAICT the sanction response was totally toothless.

With that said, I don't know what Europe did. This invasion probably gives the Fed a reason not to hike this March which means that inflation should keep picking up steam. Wars tend to be negative GDP, but inflationary, so it's hard to say.

5. This invasion was a massive black mark on the US dollar. I think it was Krugman who said that "the dollar is backed by men with guns" — well, between Afghanistan and Ukraine, by this logic, the dollar's "backing" has taken a hit. Then, when you sanction dollar-denominated

transactions of Russian banks and Russian companies, you're asking them to use a different currency, which again, is not good for the dollar. Peace and financial transactions globally are predicated on the US being powerful enough to enforce stuff, but as the US retreats, we get

a really interesting question where countries like Argentina start to think to themselves "why do I need to pay back my dollar-denominated debt?" — maybe they don't. What is USA going to do? Sanction you? Even further, let's say you were a Ukrainian who stacked dollars because

the Ukrainian currency sucked. How do you get that money converted now with the US sanctioning Russian banks? Using the US financial system to wage war does not make the US financial system stronger; it's the opposite.

6. As Naval said, Pax Americanus is over. That means we have a few decades of uncertainty and volatility ahead of us. Could be not fun (hopefully no nuclear war). I will deal with this by staying flexible, keeping some insurance, derisking, and keeping cash and an open mind.

Americans are used to have everyone kissing their feet. That's done now. We're just players in a global marketplace now. Get used to it.

PS Biden is 81 in the last year of his term, *gulp*

(link to screenshot above)

/end thread

npr.org/live-updates/r…

PS Biden is 81 in the last year of his term, *gulp*

(link to screenshot above)

/end thread

npr.org/live-updates/r…

• • •

Missing some Tweet in this thread? You can try to

force a refresh