I FUCKING KNEW IT! $MULN market makers are borrowing a ton of shares out of the market in order to cover their FTDs they created when they shorted the living shit out of it to get the price down to this point.

The Utilization went from 35% to 75% overnight! By tomorrow: 99%+!

The Utilization went from 35% to 75% overnight! By tomorrow: 99%+!

Before you read any further, know that NONE of this is financial advice, and you should absolutely not take what I say at face value. Do your own research and make sure you understand this data.

What follows is extremely high-risk, and should stay away if you don't understand.

What follows is extremely high-risk, and should stay away if you don't understand.

I'll try to explain as best I can, but the TL;DR is that I believe $MULN stock is being targeted by a malicious fund and is being hammered by a colluding/malicious market maker (MM) to drive the stock price down.

ONLY MMs have access to short exempts!

ONLY MMs have access to short exempts!

If $MULN's stock price gets pushed to just $1.00, all of these short exempts will FTD for a huge loss, and they'll be forced to buy them AT MARKET PRICE within T+2 trading days!

They are all out of options, but the SP has to get to $1 or more, the higher the better.

They are all out of options, but the SP has to get to $1 or more, the higher the better.

If you do not know what Short Exempts are, or you do not fully understand them, watch this video, and it will explain everything in detail, and you will understand _why_ these numbers are so excessive.

I know it's long, but please bear with me.

I know it's long, but please bear with me.

The following video describes my first encounter with $MULN and why I am so interested in its potential for a squeeze.

There is a SIGNIFICANT risk of dilution, but that same risk also creates an incredible opportunity for retail to profit and shove a 🌵up hedge funds & market makers collective 🍑

Watch this video to get an understanding of the filings, risks & potential:

Watch this video to get an understanding of the filings, risks & potential:

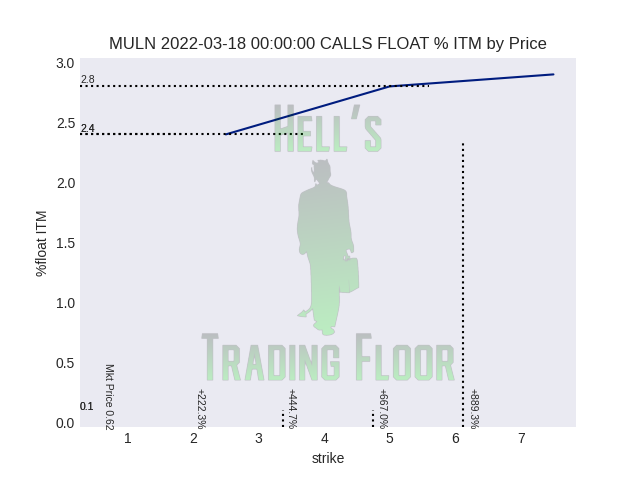

Here are graphs of the prices, moving averages, volume spike and short exempts relative to volume and short volume. This is NOT normal market making behavior. They are doing something fraudulent as fuck to $MULN right now, and if the price goes up against them, they're fucked.

Here are the raw numbers of float, Short Interest, and DTC, as of Jan 30.

Float (Jan 30, 2022): 19.8M

Shares Short (Jan 30, 2022): 666.44k

Days-to-cover (Jan 30, 2022): 1.4

Short % of Float (Jan 30, 2022): 5.23%

Float (Jan 30, 2022): 19.8M

Shares Short (Jan 30, 2022): 666.44k

Days-to-cover (Jan 30, 2022): 1.4

Short % of Float (Jan 30, 2022): 5.23%

I must reiterate, this is an extremely high-risk trade, and nobody should consider any investment without first evaluating all the risks and understanding their own risk tolerance.

Don't listen to me. Don't trade based on this information alone.

Do your own DD. Plz plz plz...

Don't listen to me. Don't trade based on this information alone.

Do your own DD. Plz plz plz...

That's all I've got on this one for now. I'm fully tapped into this one. Best of luck to all.

Godspeed.

Godspeed.

P.S. Options won't help here. There is no liquidity there. Buying shares DIRECTLY FROM THE EXCHANGE is the only thing that will actually allow for real price discovery here.

I'm not telling you what to do. Not financial advice... but if you're gonna buy, BUY FROM NASDAQ ONLY

I'm not telling you what to do. Not financial advice... but if you're gonna buy, BUY FROM NASDAQ ONLY

• • •

Missing some Tweet in this thread? You can try to

force a refresh