@Mullen_USA, I have some suspicions regarding what is happening to $MULN stock. I am just a humble, amateur stock investor, but I have reason to believe your stock may be the target of a malicious, naked shorting scheme.

Kindly refer to for details.

Kindly refer to for details.

https://twitter.com/Mullen_USA/status/1494431962441867266

If you are unaware, naked shorting is the practice of selling a short share without locating a borrower. Essentially, the share is not borrowed from the market before it is sold.

This inflates the supply and devalues the stock.

In your case, a market maker is participating.

This inflates the supply and devalues the stock.

In your case, a market maker is participating.

Evidence of this can be found on FINRA's Short Volume Data in regards to your stock, in the form of "Short Exempts."

Short Exempts are a tool of market makers to supply a buyer with a share, IN THE EVENT THAT NO SHARES ARE AVAILABLE TO BORROW, AND DURING SHORT SALE RESTRICTIONS.

Short Exempts are a tool of market makers to supply a buyer with a share, IN THE EVENT THAT NO SHARES ARE AVAILABLE TO BORROW, AND DURING SHORT SALE RESTRICTIONS.

Short Exempts are, by definition, rare exceptions for rare circumstances, and a market maker is likely profiting on your rapidly falling stock price, which they are assisting a malicious short-seller in performing.

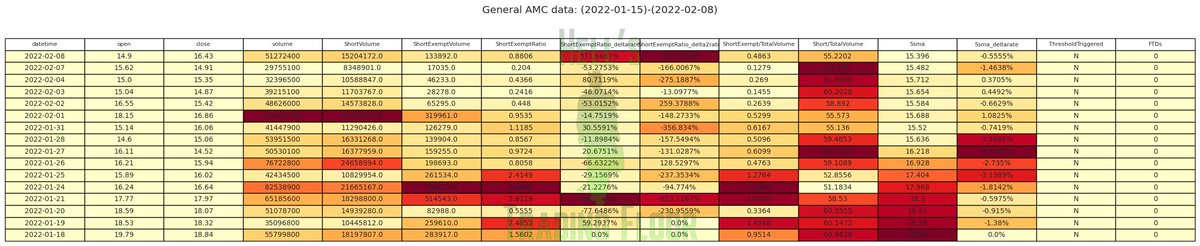

Attached is a table which details the FINRA data, which you will notice includes the short volume and short exempts against your stock.

Note the RAPID increase in short exempts from February 4th onward, but going as far back as Nov 4, 2021.

Note the RAPID increase in short exempts from February 4th onward, but going as far back as Nov 4, 2021.

As a new investor in your company, I urge you to take action and reach out to the @SECGov and @SEC_Enforcement as soon as possible.

And while I understand any skepticism on your part that I am just a "meme stock" retail investor, please do not dismiss this warning as hear-say.

And while I understand any skepticism on your part that I am just a "meme stock" retail investor, please do not dismiss this warning as hear-say.

While I cannot guarantee any explanation or provide definitive proof of malicious actions being taken against your company via the stock market, I firmly believe this is the case, as evidenced by this tremendous discrepancy in the Short Exempts against your stock.

For what it's worth, I specifically invest in companies which I believe are naked shorted. I believe you are being targeted...

This is a humble, personal promise, that since learning this is happening to you, I will be a loyal investor in your company going forward indefinitely

This is a humble, personal promise, that since learning this is happening to you, I will be a loyal investor in your company going forward indefinitely

Thank you for your time, and good luck to you.

Feel free to reach out to me directly if you wish to discuss this further, in private.

Sincerely,

True Demon, AKA "The Devil's Stock Broker" of #HellsTradingFloor

Feel free to reach out to me directly if you wish to discuss this further, in private.

Sincerely,

True Demon, AKA "The Devil's Stock Broker" of #HellsTradingFloor

@DavidMichery Please let me know if you'd like to talk about this.

As I understand it, this company is your baby. I would like to help you protect it.

As I understand it, this company is your baby. I would like to help you protect it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh