Today we had a meeting of @RenewEurope to discuss Ukraine. I share here a few proposals on #EconomicWarfare I prepared for the Group to discuss (link at end).

Given the failure of Putin´s initial plans, tough economic sanctions are crucial NOW.

#EconTwitter

THREAD 1/12

Given the failure of Putin´s initial plans, tough economic sanctions are crucial NOW.

#EconTwitter

THREAD 1/12

Starting point: this is warfare, even if economic-- thus we, the EU countries (and US!), will need to incur serious costs. No free lunch.

My view is that there we must act on 4 axis:

- Swift

- Central Bank Assets

- Oligarchs money

- Energy: Zero-gas

2/12

My view is that there we must act on 4 axis:

- Swift

- Central Bank Assets

- Oligarchs money

- Energy: Zero-gas

2/12

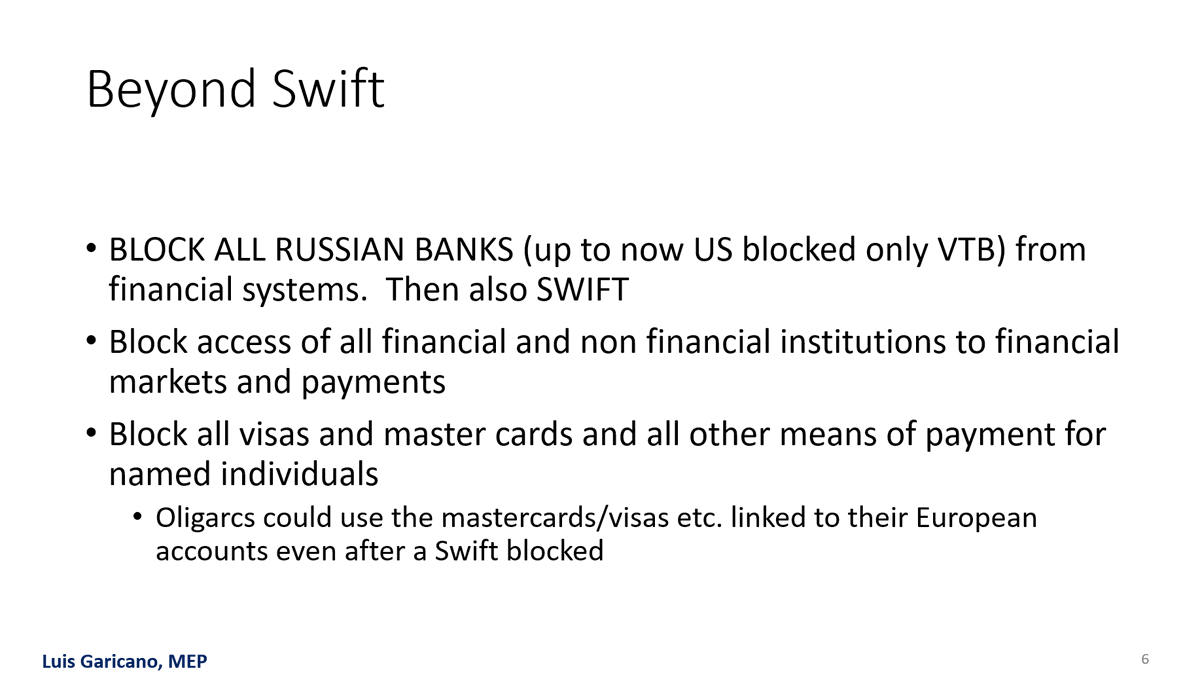

First: SWIFT, paired with several other measures, including blocking alternative payment systems linked to bank accounts, and blocking access of all banks to the financial system (more on energy later!).

Painful to Putin: EXTREMELY

Painful to us: VERY

3/12

Painful to Putin: EXTREMELY

Painful to us: VERY

3/12

Second, cut off Russian Central Bank, block its assets abroad.

Putin has done a huge effort diversifying away from US Dollars etc but there is a huge amount (10% is 60 bn in Europe) to seize just in EU, probably GER.

Painful to Putin: Very

Painful to us: Little (short run)

4/12

Putin has done a huge effort diversifying away from US Dollars etc but there is a huge amount (10% is 60 bn in Europe) to seize just in EU, probably GER.

Painful to Putin: Very

Painful to us: Little (short run)

4/12

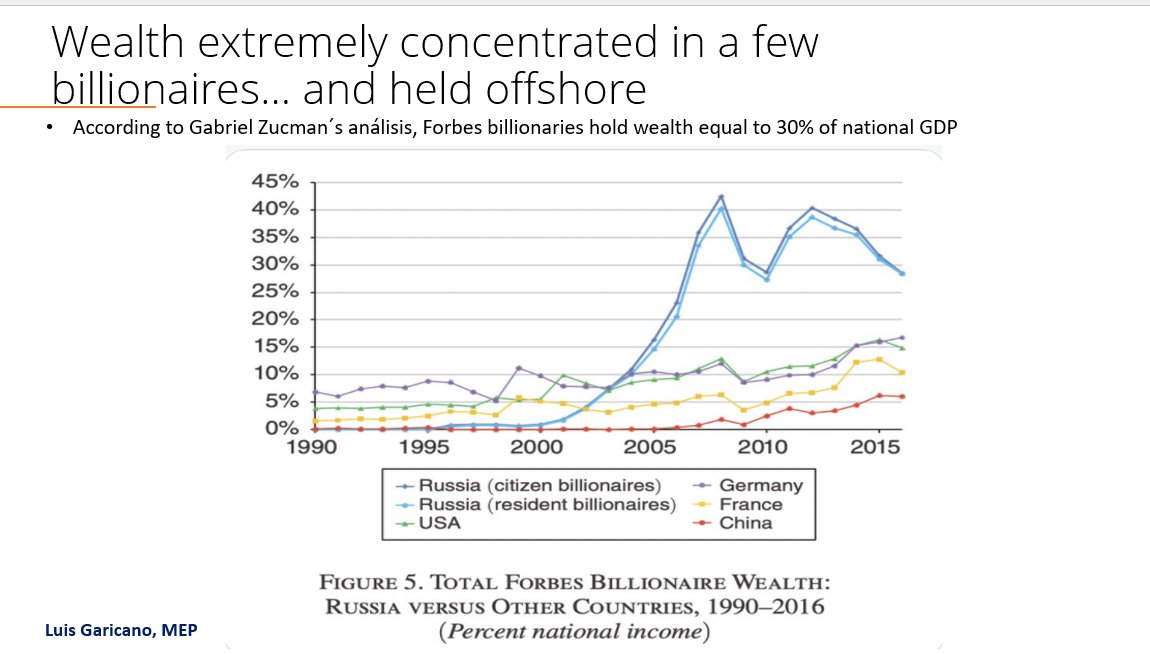

Third: @gabriel_zucman @PikettyLeMonde confiscatory tax on assets of oligarchs.

Their two key insights

- Wealth in Russian is extremely concentrated

- It is held offshore in extremely high proportion

5/12

Their two key insights

- Wealth in Russian is extremely concentrated

- It is held offshore in extremely high proportion

5/12

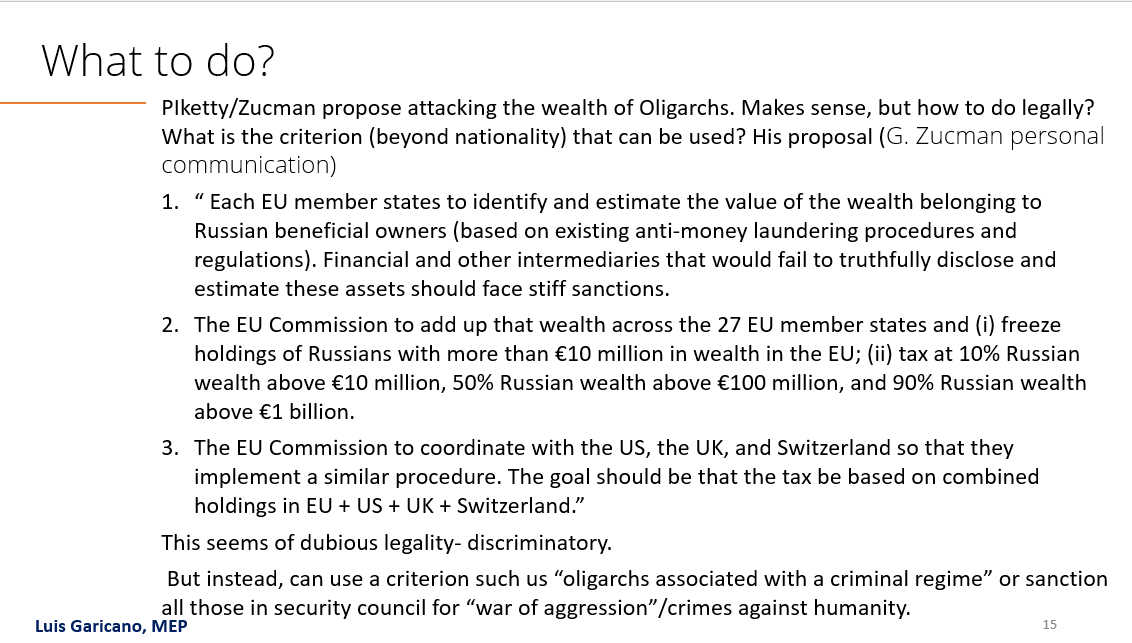

So how to do it? Zucman, in personal commmunication proposes a tax (left slide). PIketty in blog too. Legally, sounds dubious.

So here is a new idea. Everyone linked to this war of aggression is a war criminal. A lot of regime honchos seen on TV supporting aggression.

6/12

So here is a new idea. Everyone linked to this war of aggression is a war criminal. A lot of regime honchos seen on TV supporting aggression.

6/12

This has never been done, but there is no reason why it cannot be done- e.g. there is space for this in the Guideliness of the Council.

Painful to Putin: Hugely

Painful to us: Not at all

7/12

Painful to Putin: Hugely

Painful to us: Not at all

7/12

Final idea: Zero-gas.

Starting point here is that we are subsidizing this war.

WE, the EU citizens are the evil people givin Putin the cash for this crazy advanture.

8/12

Starting point here is that we are subsidizing this war.

WE, the EU citizens are the evil people givin Putin the cash for this crazy advanture.

8/12

We can survive 0-gas.

Winter is almost over, we have huge LNG surplus capacity, we need to bring back nuclear and other closed plants (yes, thermal plants) but we can do it.

WE CANNOT CONTINUE PAYING FOR THE WAR EFFORT OF PUTIN!

9/12

Winter is almost over, we have huge LNG surplus capacity, we need to bring back nuclear and other closed plants (yes, thermal plants) but we can do it.

WE CANNOT CONTINUE PAYING FOR THE WAR EFFORT OF PUTIN!

9/12

One caveat: this shock is very asmmetric. Different countries incur very different costs. Thus Europe needs to absorb the cost of this policy with a new facility modeled after NextGEn.

Like Covid, we are facing a one off, massive supply shock. Europe needs to absorbe it.

10/12

Like Covid, we are facing a one off, massive supply shock. Europe needs to absorbe it.

10/12

I know it is a pain to read slides like this.

Here is a link to the full PDF . I hope it can stimulate a good discussion

12/12 dropbox.com/s/0g599p297cbu…

Here is a link to the full PDF . I hope it can stimulate a good discussion

12/12 dropbox.com/s/0g599p297cbu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh