Given emissions are starting on March 5th,

I'll try to lay out the current scenery for

• $METIS

• $MAIA

• External protocols that partner in with for @MetisDAO 's native version of @solidlyexchange :

$HERMES

🧵This will be an interesting one (1/19)

I'll try to lay out the current scenery for

• $METIS

• $MAIA

• External protocols that partner in with for @MetisDAO 's native version of @solidlyexchange :

$HERMES

🧵This will be an interesting one (1/19)

2/ On this thread, we'll cover:

3- Clarifying $HERMES & $SOLID model once & for all

8- @solidlyexchange impact on $FTM & its eco

11- Possibilities for potential partners

13- $MAIA price & TVL post-announcement

16- For $METIS

*3-7: my own understanding of the model

Let's go👇

3- Clarifying $HERMES & $SOLID model once & for all

8- @solidlyexchange impact on $FTM & its eco

11- Possibilities for potential partners

13- $MAIA price & TVL post-announcement

16- For $METIS

*3-7: my own understanding of the model

Let's go👇

3/ Before we start, its super necessary that we fully understand WHAT EXACTLY IS $HERMES, and how/why its model of incentivizing fees will not clash or compete with other AMMs models and strategies, but instead COEXIST with them, & improve the overall eco's outcome

Let's see👇

Let's see👇

4/ $HERMES model will not incentivize HIGH fees, but just ✨fees✨

High fees is what we're running away from (L1's congestion)...

If they are incentivizing the pool with the *MOST* fees, that tends to mean they're incentivizing the pool that's responsible for the most trades!

High fees is what we're running away from (L1's congestion)...

If they are incentivizing the pool with the *MOST* fees, that tends to mean they're incentivizing the pool that's responsible for the most trades!

5/ Remember that whenever you make a swap on a DEX, you have to pay a small fee.

Sometimes, you might not even notice it if you're trading small $ amounts.

Those are the fees they're talking about (and others that we'll see in a minute)

Sometimes, you might not even notice it if you're trading small $ amounts.

Those are the fees they're talking about (and others that we'll see in a minute)

6/ For AMMs partnering in, it's beautiful, since they keep a stunning 100% of da pool's fees🥴

Hold up. How does the external protocol benefits?

Rewards don't auto accrue. They must b claimed manually, there4 creating another small fee that goes 2 da external protocol/veHERMES

Hold up. How does the external protocol benefits?

Rewards don't auto accrue. They must b claimed manually, there4 creating another small fee that goes 2 da external protocol/veHERMES

7/ Rewards will be given in the form of $HERMES native token. And, as mentioned before, if 100% of $veHERMES is locked... 0% dilution, and a very lucrative move for everyone.

That... is what them crypto bros mean by incentivizing fees.

That... is what them crypto bros mean by incentivizing fees.

8/ Jan 6th was the day that it all started, when @AndreCronjeTech shared a Medium post called ve(3,3). Like I said before, I won't go that much into detail, but look at the numbers from Jan 6th (publication) vs Jan 25th (3 weeks later)

INSANE.. We talking bout Billions with a B

INSANE.. We talking bout Billions with a B

9/ As you can see, most of the $FTM eco didn't just "bounce off the dip"... it f*cking exploded and went skyhigh real quick

Also.. bc of $SOLID there's currently more tx taking place in $FTM network than in $ETH...

Imagine the potential for $METIS lightning & cheap tx🤯

Also.. bc of $SOLID there's currently more tx taking place in $FTM network than in $ETH...

Imagine the potential for $METIS lightning & cheap tx🤯

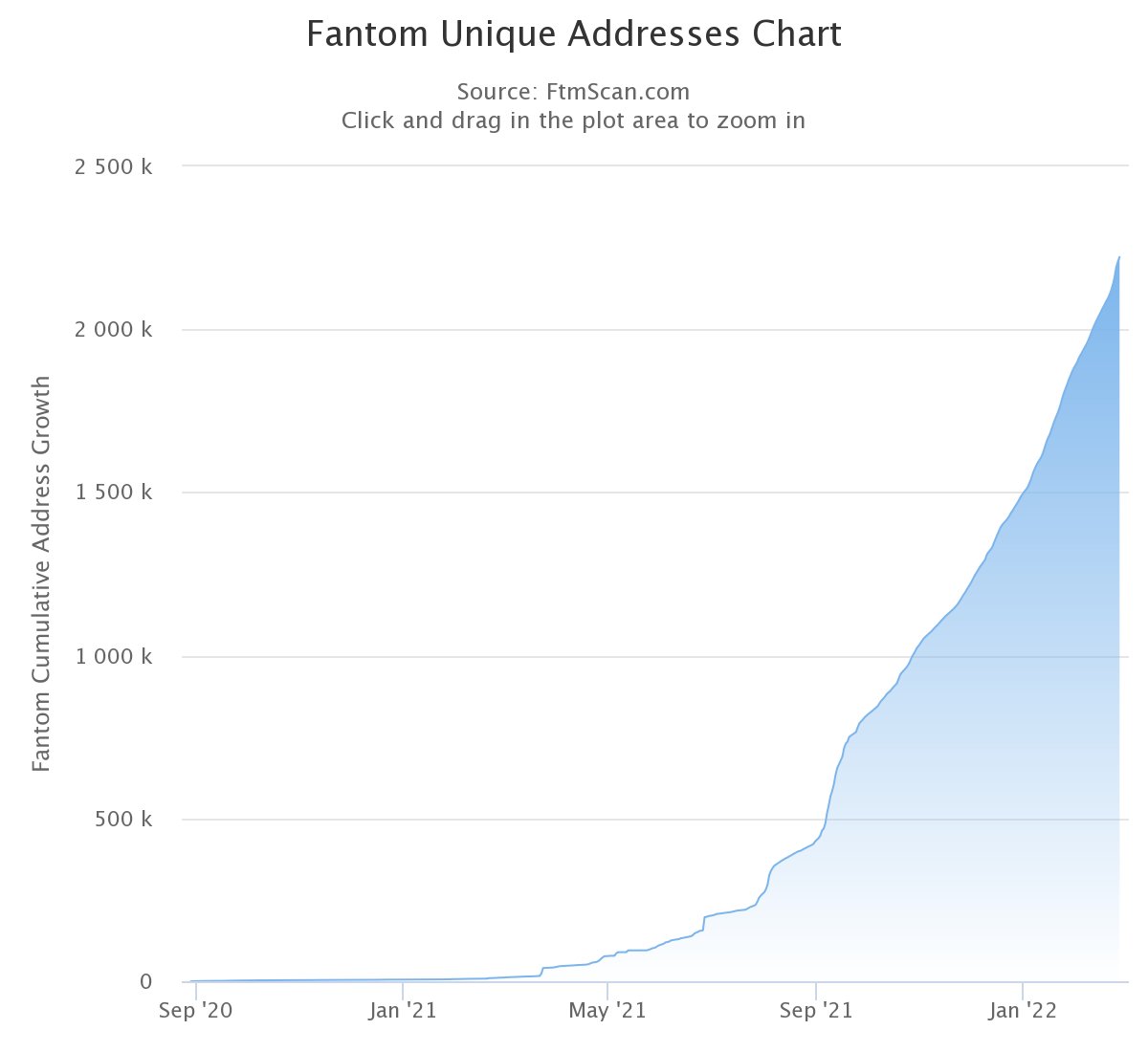

10/ Not only $FTM now stands at a $10B+ TVL and a higher daily tx count than #Ethereum, but the number of unique addresses how increased accordingly.

Fantom's network now has more unique addresses than Avax's C-Chain, & that's BIG

It grew by 800K addys since the announcement

Fantom's network now has more unique addresses than Avax's C-Chain, & that's BIG

It grew by 800K addys since the announcement

11/ If we zoom in at some of the main players of the $FTM eco, we'll see that they've had some last 72hrs VERY out of the ordinary ( $SOLID emissions started 3d ago)

$SPIRIT: +167%

$BOO: +75%

$WeVe: +150% (wasnt a main dex; is a main player in $SOLID)

Whole FTM eco is green rn

$SPIRIT: +167%

$BOO: +75%

$WeVe: +150% (wasnt a main dex; is a main player in $SOLID)

Whole FTM eco is green rn

12/ This model won't hurt "competitors" because other AMMs are not competitors... they're beneficiaries.

13/ $MAIA price and TVL since announcement

I'll attach a pic of Yesterday's Stake n Chill dashboard, and one of Today's.

Bear in mind that while it doubled, that was $4M(millions with an M), and if $HERMES succeeds to the degree of $SOLID, the upside is still absolutely absurd

I'll attach a pic of Yesterday's Stake n Chill dashboard, and one of Today's.

Bear in mind that while it doubled, that was $4M(millions with an M), and if $HERMES succeeds to the degree of $SOLID, the upside is still absolutely absurd

14/ A more detailed thread on $MAIA was released a few days ago, but what I'll say Today, is that the fee-incentivized model was already proven a roaring success (so far) in $FTM

@MaiaDAOMetis will own 25% of $HERMES supply forever, so I'd say staking $MAIA is very underrated rn

@MaiaDAOMetis will own 25% of $HERMES supply forever, so I'd say staking $MAIA is very underrated rn

15/ The pump in TVL & tx count we saw in $FTM was not constant/stable, so even if we see a big increase in both areas 4 $METIS followed by them numbers droppin: it's part of the drill

There's snapshots, & there's emissions (later on), so we'll prob see a big rise>drop>real rise

There's snapshots, & there's emissions (later on), so we'll prob see a big rise>drop>real rise

16/ Ngl, @MetisDAO Goddess is pretty cute, but she's not the reason u kept using Andromeda Network & became a native of $METIS eco

Real reason is: transacting in Andromeda is a DELIGHT

Fast, cheap, super secure.

Once users from other chains try it, you think they won't stay?

Real reason is: transacting in Andromeda is a DELIGHT

Fast, cheap, super secure.

Once users from other chains try it, you think they won't stay?

17/ If a big number of users come to $METIS for $HERMES, they will most likely stay using Andromeda.

Literally, why would you go back to other chains? $METIS would grow EXPONENTIALLY (probs billions)

(NOT TRYING TO BASH ON ANY CHAIN: There's other chains I also like A LOT)

Literally, why would you go back to other chains? $METIS would grow EXPONENTIALLY (probs billions)

(NOT TRYING TO BASH ON ANY CHAIN: There's other chains I also like A LOT)

18/ LOT OF IFs, but:

A few days ago I was having a chat with @AdrianStarr108 on @MetisDAO and he said something interesting

Given $METIS tx costs & scalability after dec storage is deployed, Andromeda could become a blockchain hub

Imagine how many users could decide to stay...

A few days ago I was having a chat with @AdrianStarr108 on @MetisDAO and he said something interesting

Given $METIS tx costs & scalability after dec storage is deployed, Andromeda could become a blockchain hub

Imagine how many users could decide to stay...

19/ Terminamos, amigos.

If you liked the thread, don't forget to Like/RT the first tweet and/or Follow!

If you have any additions or corrections you'd want to make, please do! Goal is 2 be well informed

Shoutout to @MetisDAO , @MaiaDAOMetis for delivering non stop. Lets get it

If you liked the thread, don't forget to Like/RT the first tweet and/or Follow!

If you have any additions or corrections you'd want to make, please do! Goal is 2 be well informed

Shoutout to @MetisDAO , @MaiaDAOMetis for delivering non stop. Lets get it

@MetisDAO @MaiaDAOMetis 6-7/ The goal of this model is 2 maximize capital efficiency, since the pools that are responsible 4 the most trades r also going 2 be the 1s attracting the most liquidity! Meaning:

• Less slippage

• High APYs 4 LPs

• Literally everyones happy

Funds r being used correctly🤝

• Less slippage

• High APYs 4 LPs

• Literally everyones happy

Funds r being used correctly🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh