1) With Russia being partly blocked from the SWIFT international payments system.

All eyes (in the Chinese financial system) are on the Chinese clearing and settlement system CIPS.

A primer on what it is and potential implications for the future of dollar hegemony:

All eyes (in the Chinese financial system) are on the Chinese clearing and settlement system CIPS.

A primer on what it is and potential implications for the future of dollar hegemony:

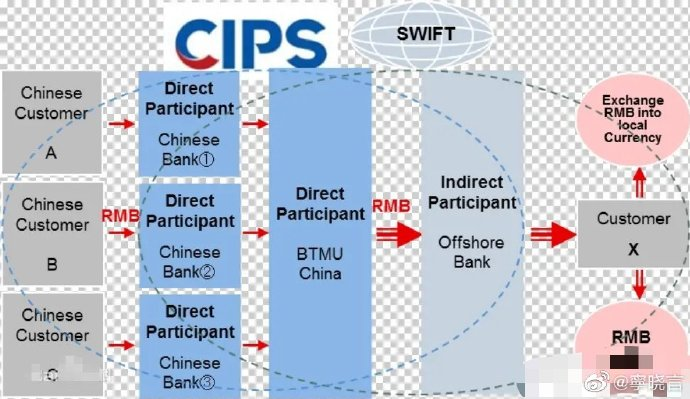

2) In a nutshell, CIPS is China's version of CHIPS and potentially SWIFT. It settles international claims in RMB, but was been using SWIFT as its communication system since 2016.

It was created as a domestic alternative to the CHIPS + SWIFT system to bypass US scrutiny

It was created as a domestic alternative to the CHIPS + SWIFT system to bypass US scrutiny

3) Backed by People's Bank of China (PBOC), CIPS was launched in 2015 to internationalise yuan use. It allows global banks to clear cross-border yuan transactions directly onshore, instead of through clearing banks in offshore yuan hubs.

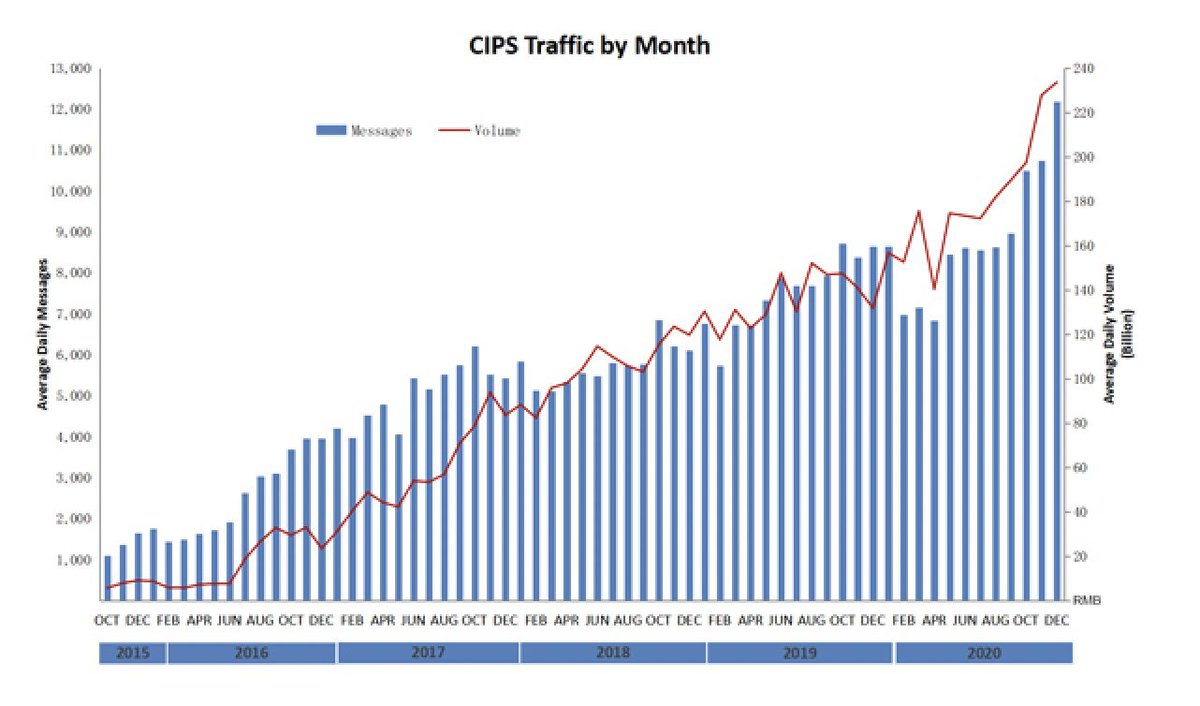

4) It's far smaller than SWIFT.

As of Jan 2022, CIPS has 1,280 financial institutions in 103 countries / regions connected . CIPS processed around 80 trillion yuan ($12.68 trillion) in 2021.

SWIFT is used by 11,000 financial institutions across 200 countries or regions.

As of Jan 2022, CIPS has 1,280 financial institutions in 103 countries / regions connected . CIPS processed around 80 trillion yuan ($12.68 trillion) in 2021.

SWIFT is used by 11,000 financial institutions across 200 countries or regions.

5) Not only is it smaller, but potentially may never become equal to SWIFT + CHIPs given that 40% of the world's international payments are in dollars, and only 3% are in yuan.

However, some Russian banks' lack of access to SWIFT might a big push for its adoption

However, some Russian banks' lack of access to SWIFT might a big push for its adoption

6) China is Russia's biggest trade partner for both exports and imports. In 2020, 17.5% of the trade between the two countries were settled by yuan, an improvement from the 3.1% in 2014, according to CSC.

Recently more Russia banks have signed up to the CIPS

Recently more Russia banks have signed up to the CIPS

7) The bull case for CIPS is that it gets the messaging service up and running, and stops using SWIFT. Russia and other countries facing dollar hegemony heat signs up and Yuan (and esp e-CNY) gets a shot at becoming the next settlement currency in the world

8) However, the switch-over is going to be slow. CIPS only has 100 employees in Shanghai today and nowhere ready to take on an international institution in one bite.

Russia also has their own cross-border payment system called SPFS that was launched in 2014.

Russia also has their own cross-border payment system called SPFS that was launched in 2014.

9) But the SWIFT sanctions are a definite wake-up call for countries. When payment systems are politicised, then you have to be sure you're on the right side of the leviathan at all times.

I write threads on Chinese tech and also a newsletter on the topic as well. Follow along if you'd like, thannnnks

lillianli.substack.com

lillianli.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh