NEW TODAY: REPEATProject.org report offers most comprehensive analysis yet of impacts of congressional budget & infrastructure bills, detailing impacts on CO2, investment, household energy costs, energy related jobs, public health, and more: repeatproject.org/docs/REPEAT_Su…

We model in detail impacts of the #BuildBackBetter Act (BBBA) now stalled in the Senate.

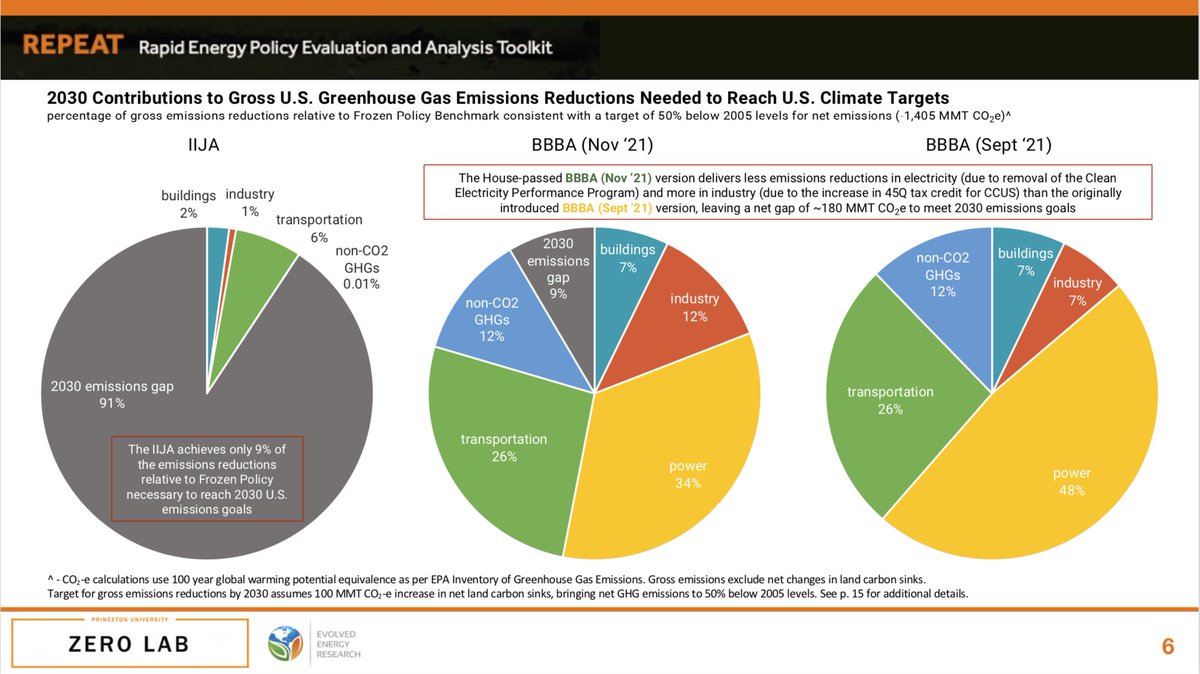

We also model the Infrastructure Investment & Jobs Act (IIJA), now law, which we find would leave annual greenhouse gas emissions 1.3 billion tons short of the nation’s 2030 climate goals.

We also model the Infrastructure Investment & Jobs Act (IIJA), now law, which we find would leave annual greenhouse gas emissions 1.3 billion tons short of the nation’s 2030 climate goals.

Indeed, we conclude that the bipartisan infrastructure law (IIJA) delivers just 9% of the emissions reductions (relative to a Frozen Policies benchmark) needed to reach 2030 US climate goals, leaving a yawning gap unlikely to be bridged by executive action and state policy alone.

As President Biden prepares to deliver his SOTU, our analysis makes it clear that Congress has only started laying the foundations w/IIJA, while passing something like the clean energy package in BBBA is critical to truly build the cleaner and more secure energy economy we need.

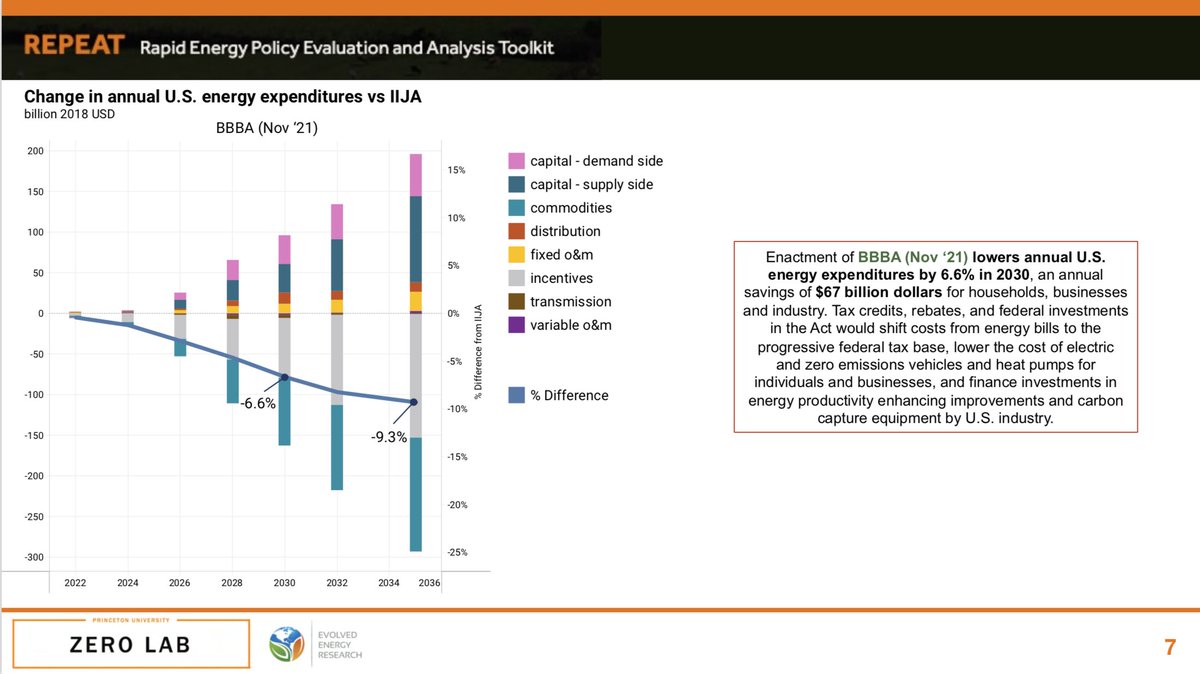

BBBA would also lower 2030 US energy expenditures by 6.6%, an annual savings of $67 billion dollars for households, businesses and industry, shifting costs from energy bills to the progressive federal tax base, lowering U.S. energy costs and helping counteract inflation.

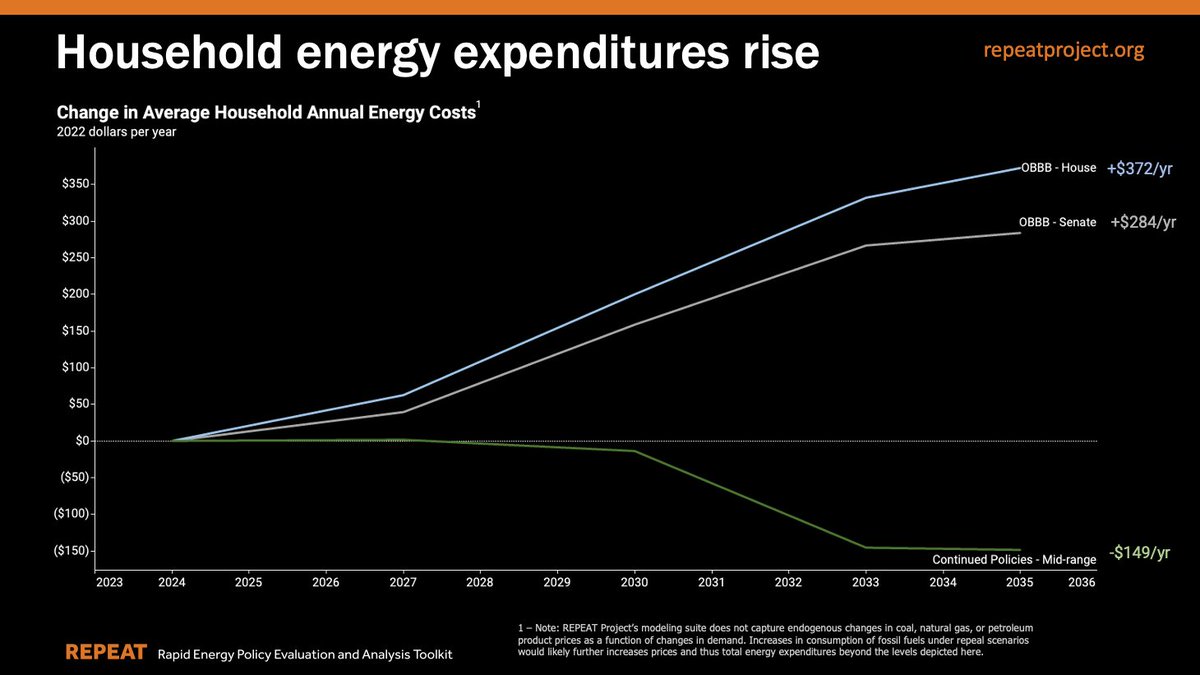

BBBA would deliver about $300 per year in lower energy costs for the average U.S. household relative to costs under IIJA alone, cutting costs for households across all regions of the country.

Passing BBBA would also increase cumulative capital investment in energy supply infrastructure by >$1.5 trillion from 2023-2030, relative to passage of the IIJA alone. That includes 10x increase in annual investment in CCUS, 3x in hydrogen & 2x in wind & solar (+$200b/yr) in 2030

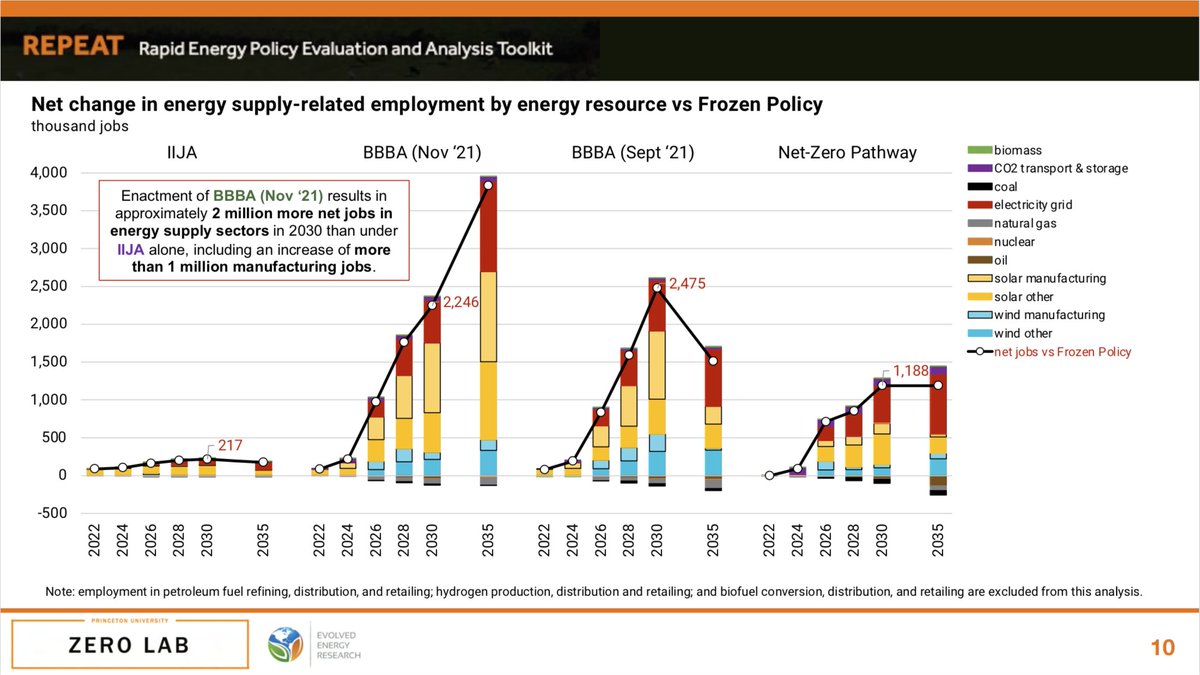

All that investment means ~2 million more net jobs in energy supply sectors in 2030. That includes >1 million manufacturing jobs, mostly in wind turbine & solar PV components & assembly, supported by new manufacturing tax credits & bonus incentives to "Buy American" in the bill.

Note that the above analysis does NOT include even more manufacturing jobs in steel and aluminum sectors to supply inputs for solar PV, wind turbine and grid related infrastructure investments, also incentivized by BBBA's bonus tax credits for domestic content.

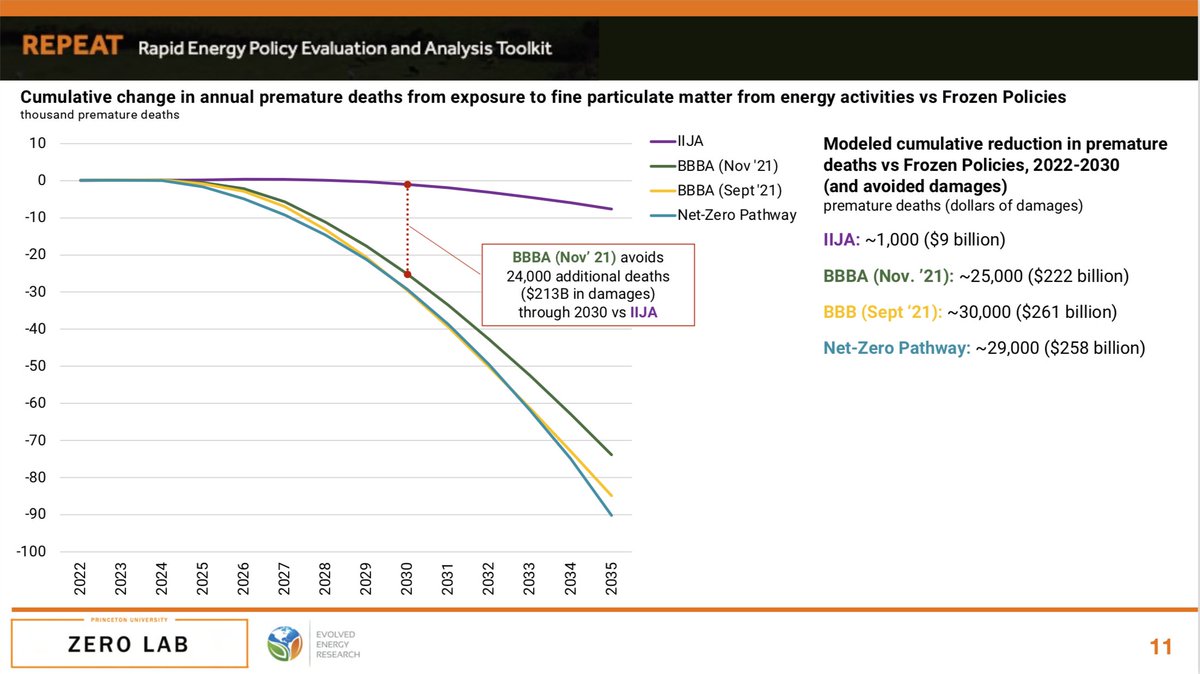

A big shift to cleaner energy under BBBA also avoids 24,000 additional deaths from exposure to fine particulate pollution from energy activities through 2030 vs IIJA (estimated at $213B in avoided damages). That means a cleaner, healthier America for ourselves and our children.

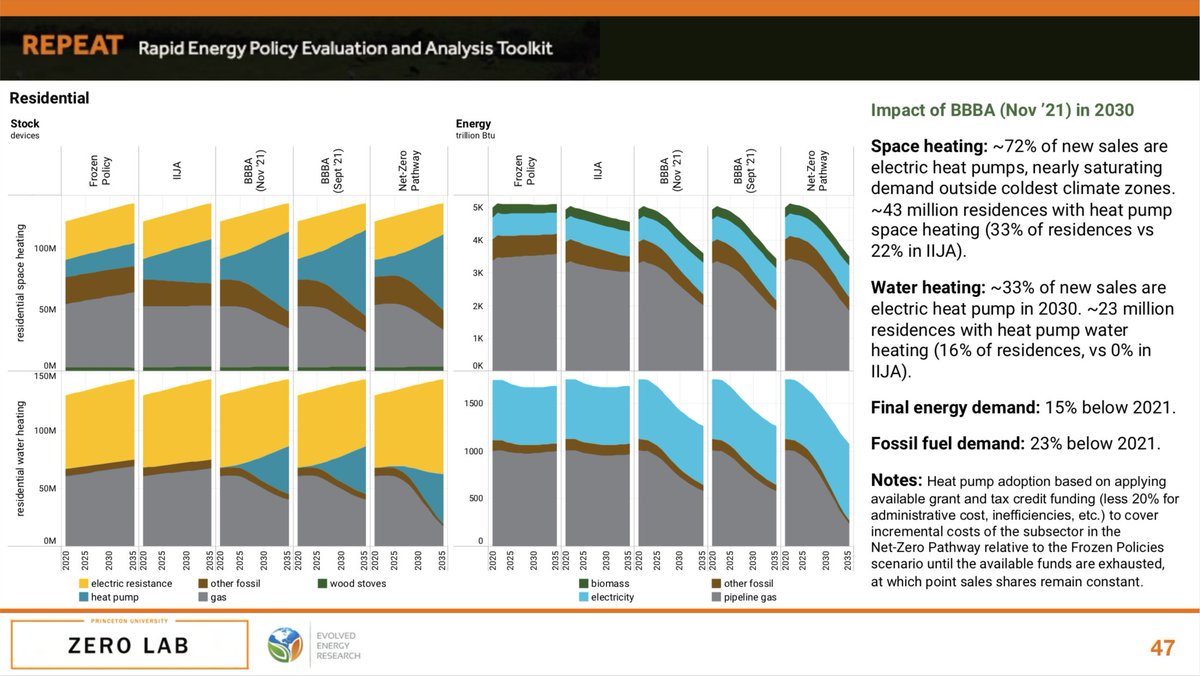

Finally, with Putin's assault on Ukraine, energy has become a central front in the conflict w/Russia. Surging US investment in EVs & heat pumps could cut oil use in transport by ~1/3rd & gas use in buildings by ~1/5th by 2030, freeing up U.S. oil & gas for export to our EU allies

We'll have more on what the REPEAT Project study implies for the rapidly shifting geopolitics of energy later this week. For now, you can find all of this + MUCH more at our repeatproject.org incl. a detailed data portal to access all quantitative outcomes under each policy

Thanks to @Hewlett_Found for financial support of REPEAT Project & to the rest of the team, including @ErinNMayfield, @evolved_energy, @NehaSPatankar @gschivley + everyone else! This was a huge effort! And we're not done yet. We'll keep focused on evolving federal bills & regs...

• • •

Missing some Tweet in this thread? You can try to

force a refresh