A thread 🧵 on :

Brightcom Group : The Dark Side

Talks about corporate governance issues and business

Like Retweet for maximum reach

#bcg

#brightcom

#brightcomgroup

Brightcom Group : The Dark Side

Talks about corporate governance issues and business

Like Retweet for maximum reach

#bcg

#brightcom

#brightcomgroup

SEBI ordered Forensic Audit in Sept-21 which was not disclosed. This is the same time when company was completing preferential issue.

Even if they received reply from SEBI on 25th Feb, why it was not disclosed earlier and disclosed only after stock exch discl

Even if they received reply from SEBI on 25th Feb, why it was not disclosed earlier and disclosed only after stock exch discl

SEBI Forensic Audit covers

Impairment of Assets

Manipulation of Books of Accounts

Fund Diversion / Siphoning

Misrepresentation of information

While clarification focused only on Impairment of Assets

Also , SEBI letter not copied to NSE & BSE

Impairment of Assets

Manipulation of Books of Accounts

Fund Diversion / Siphoning

Misrepresentation of information

While clarification focused only on Impairment of Assets

Also , SEBI letter not copied to NSE & BSE

Says audited by EY but here is who audits consolidated financial statements a local CA firm.

Anyways ILFS & Satyam were also audited by Big 4..

Anyways ILFS & Satyam were also audited by Big 4..

A interview by CNBC is a must watch @CNBCTV18News

@blitzkreigm

Part 1 :

Part 2 :

@blitzkreigm

Part 1 :

https://twitter.com/blitzkreigm/status/1493500313067683842?t=tXs4Gok6hRiNY-uxEWBvdw&s=19

Part 2 :

https://twitter.com/blitzkreigm/status/1493501256802861059?t=p7b9nEeXWRSHRj08JNXVTA&s=19

Equity Dilution : company raising money through preferential issue from non promoter non existing shareholders leading to dilution for existing shareholders and promoters.

Objective : WC & acquisition

Interesting promoters are not participating no skin in the the game

Objective : WC & acquisition

Interesting promoters are not participating no skin in the the game

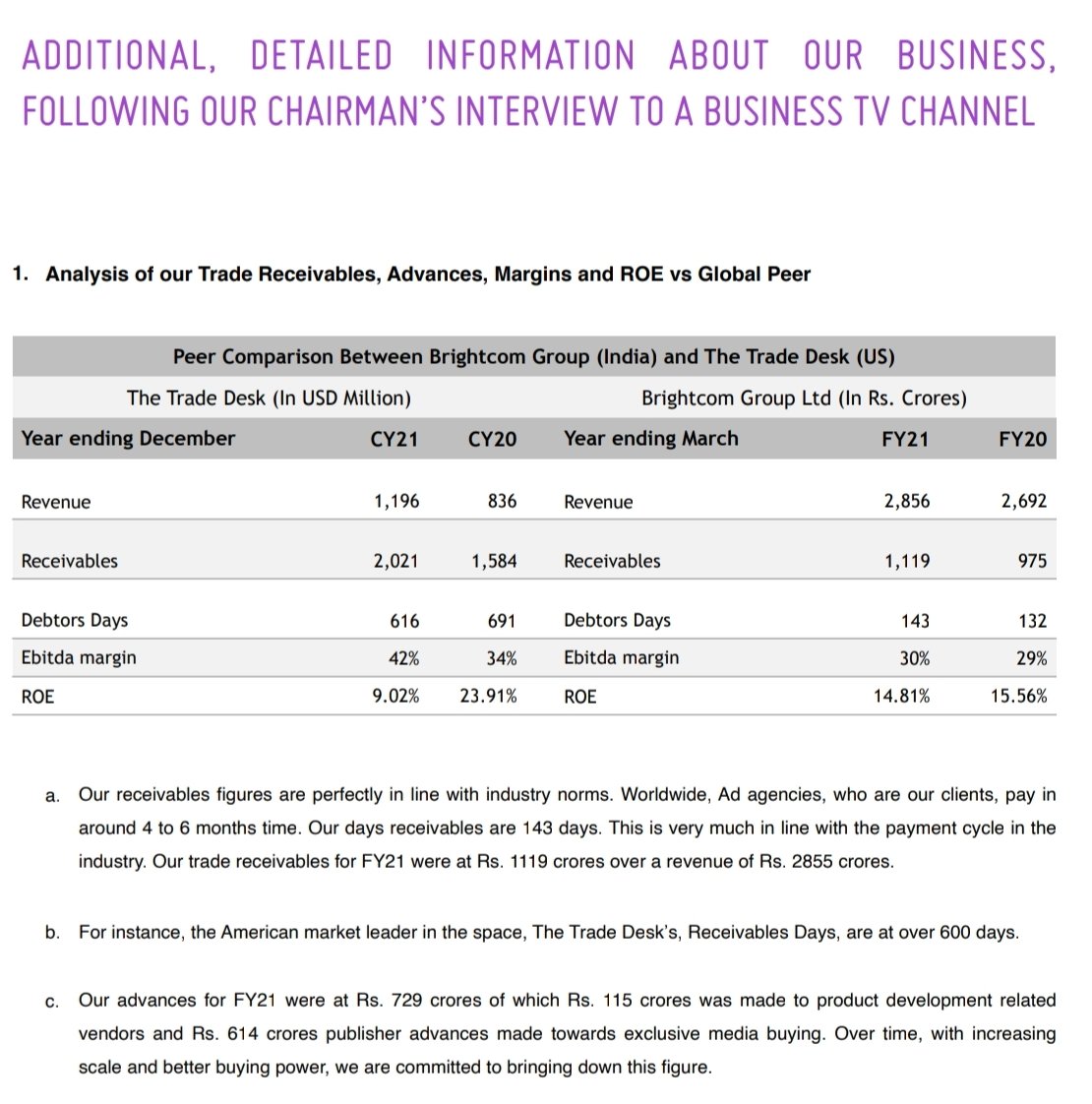

Receivables amounts to 50% of FY21 Revenue

&

Receivables Days : 76 for Affle vs 143 for BCG vs 616 for Trade Desk

Huge bad debts : 4% of PBT in FY 20

&

Receivables Days : 76 for Affle vs 143 for BCG vs 616 for Trade Desk

Huge bad debts : 4% of PBT in FY 20

The so called financial audited by EY are not disclosed, even no group company financials have been disclosed.

Ideally companies with high corporate governance disclose their subsidiary financials

Ideally companies with high corporate governance disclose their subsidiary financials

https://twitter.com/BeatTheStreet10/status/1498520228757602308?t=shcdOF46hegWG2zpFtkRSQ&s=19

How can somebody gave such exact estimate ( see their outlook vs actual performance )

Too much disclosure

Thanking SH, Shareholder milestones, Bonus rationale

( same happened in Rattanindia on Jubilant Food works deal & we know what they did in back fire )

Too much disclosure

Thanking SH, Shareholder milestones, Bonus rationale

( same happened in Rattanindia on Jubilant Food works deal & we know what they did in back fire )

Too less disclosure

Don't disclose target company on entering LOI

No subsidiary financials

Above disclosure are important when you derive most business from outside India

Don't disclose target company on entering LOI

No subsidiary financials

Above disclosure are important when you derive most business from outside India

Investment in affilates which forms 10% of total balance sheet size has no details.

These are not group companies since in consolidated financial FS are consolidated, subsidiaries are not shown as investments

Even not disclosed in related part

These are not group companies since in consolidated financial FS are consolidated, subsidiaries are not shown as investments

Even not disclosed in related part

The other side of #BCG Promoter increasing stake by acq some LLPs who were public SH raises question on integrity and whether other public SH might have influence of promoter and not disclosed.

They are definitely related hence inducted MD as partner and don't hold any oth Co.

They are definitely related hence inducted MD as partner and don't hold any oth Co.

Moreover these LLPs acquired shares via preferential issue in Nov-20 at mere price of ₹7.70

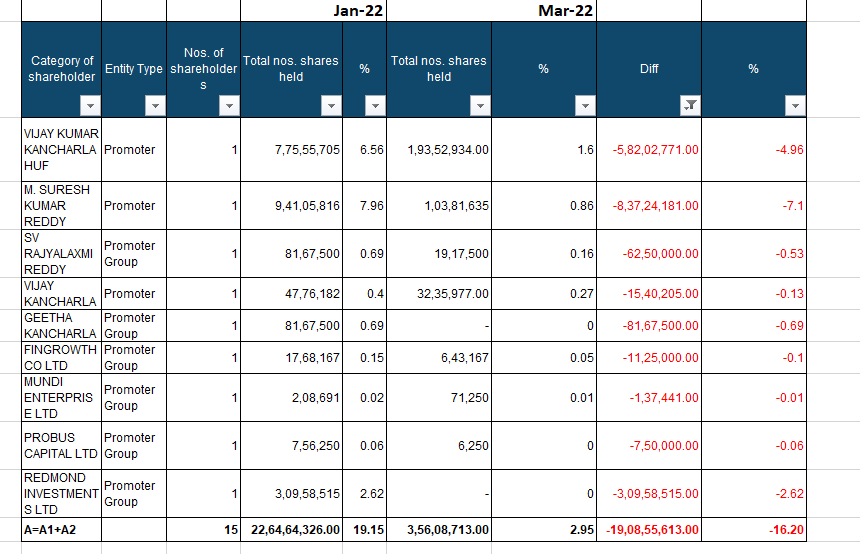

#BCG promoters sold 19cr shares (16.2%) b/w Jan-22 to Mar-22 when promoter were hiding information of Sebi Forensic Audit

Old promoters stake reduced from 19.15% to 2.95% (almost 90% stake sold)

This stake sale was never disclosed.

#brightcom #brightcomgroup

Old promoters stake reduced from 19.15% to 2.95% (almost 90% stake sold)

This stake sale was never disclosed.

#brightcom #brightcomgroup

Stake sale by BCG Promoters get no attention because promoter acquired other public share holding entities.

Stake buy was disclosed Stake Sale Not....Nice

Insights credit @tsurendar @MorningContext @SanjaySharm052

Stake buy was disclosed Stake Sale Not....Nice

Insights credit @tsurendar @MorningContext @SanjaySharm052

There are other two case of corporate governance highlighted by @tsurendar themorningcontext.com/business/sebi-…

What we feel is.. Promoters now know the outcome of Sebi audit

So they have sold their 16% stake and very smartly become partner in public shareholder LLPs so as to hide actual stake sale

A smart move but not smarter then market

So they have sold their 16% stake and very smartly become partner in public shareholder LLPs so as to hide actual stake sale

A smart move but not smarter then market

#BCG didn't credit bonus shares even if 45 days (ideally it takes 15 days) have gone from record date. They have given reason of delay in approval from exchanges to list bonus shares.

Investors left with no option but to wait for bonus shares to be credited.

Investors left with no option but to wait for bonus shares to be credited.

This is not the first time #BCG promoters not disclosed about insider trading.

In 2013-14, they did similar thing and hide information by not disclosing

Below is excerpt from SEBI order in 2019

In 2013-14, they did similar thing and hide information by not disclosing

Below is excerpt from SEBI order in 2019

Name change history of #BCG:

1999: USA Greetings

2000: Ybrant Technologies

2001: Lanco Global System

2008: LGS Global Limited

2012: Ybrant Digital

2014: Lycos Internet Limited

2018: Brightcom Group

Continuous name change and business interest (Ex entered in AI / ML)

1999: USA Greetings

2000: Ybrant Technologies

2001: Lanco Global System

2008: LGS Global Limited

2012: Ybrant Digital

2014: Lycos Internet Limited

2018: Brightcom Group

Continuous name change and business interest (Ex entered in AI / ML)

BCG acquired Lycos (former competitor to Google) in 2010 but still didn't paid $16Mn out of $36Mn. This led to New York asking BCG to give back 56% stake to erstwhile Owners.

This matter is disputed and forms 10% of revenue and 10% of total assets

#brightcom

This matter is disputed and forms 10% of revenue and 10% of total assets

#brightcom

In last 10 yrs, 3 times BCG seen run-up. At all run-ups promoter sold stake.

What's more interesting is currently promoter stake is at all time low since the current run-up was the steepest.

#BCG #brightcomgroup we cannot just win against them in their own game

What's more interesting is currently promoter stake is at all time low since the current run-up was the steepest.

#BCG #brightcomgroup we cannot just win against them in their own game

Brightcom had 3 preferential issues in since 2016 - all were priced around ₹10 per share. What's interesting is even at such low price promoters didn't participate

No slin in the game..Don't expect them to buy at current levels

#bcg #Brightcom #brightcomgroup

No slin in the game..Don't expect them to buy at current levels

#bcg #Brightcom #brightcomgroup

#BCG canceled earlier also preferential issue in Jul-21 bcoz allotment could not be done before 2021 bonus record date

Even now, bonus issue was delayed bcoz of preferential allotment needs to be completed before bonus record date otherwise they wont get bonus

Thanks @tsurendar

Even now, bonus issue was delayed bcoz of preferential allotment needs to be completed before bonus record date otherwise they wont get bonus

Thanks @tsurendar

Adding financial weakness highlighted by ET prime says trade receivables and loans & advances form major part of revenue & assets

#brightcom #bcg #brightcomgroup

#brightcom #bcg #brightcomgroup

Finally a comprehensive analysis of financial has been done by @soresearxh

https://twitter.com/soresearxh/status/1466290757883494400?t=RiJCfGmjDvIi5SBPaZoDcw&s=19

BCG don't publish so called audited financials from where they derive 90% biz, their main auditors are not well known and also they dont audit them. They rely on what mgt gives

Whether their subsidiaries FS are actually audited?

dependency on subsidiaries standalone vs conso⬇️

Whether their subsidiaries FS are actually audited?

dependency on subsidiaries standalone vs conso⬇️

BCG don't publish so called audited financials from where they derive 90% biz, their main auditors are not well known and also they dont audit them. They rely on what mgt gives

Whether their subsidiaries FS are actually audited?

dependency on subsidiaries standalone vs conso⬇️

Whether their subsidiaries FS are actually audited?

dependency on subsidiaries standalone vs conso⬇️

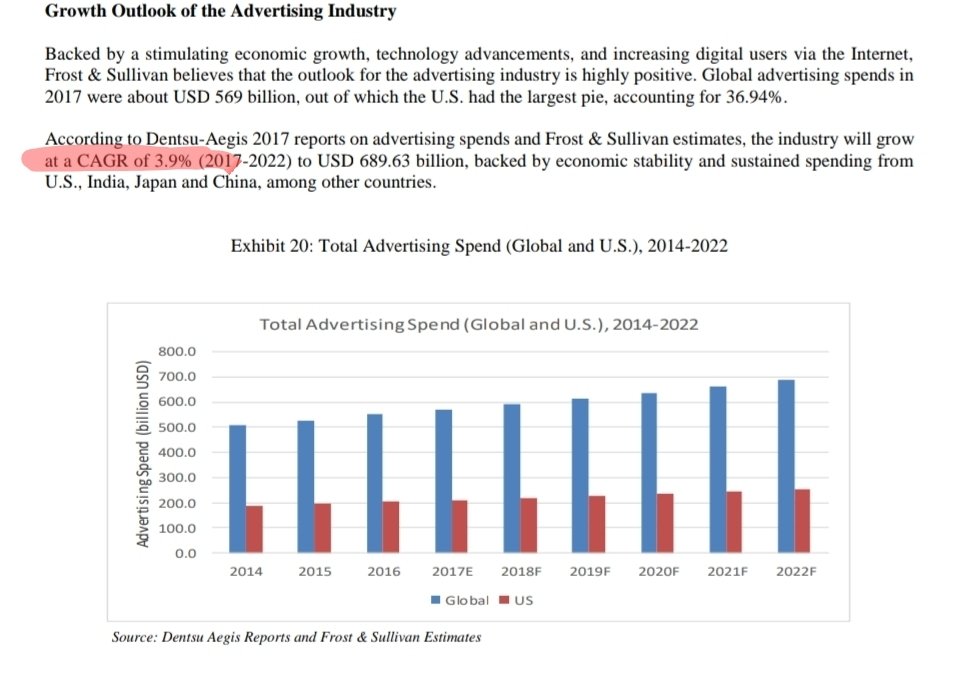

#BCG has most of its biz in foreign. I don't know what stopping them from entering in India which is fastest growing ad tech nation.

See excerpts from Affle RHP, 2017

See excerpts from Affle RHP, 2017

Ad-Tech industry is dominated by Google & Facebook with 80%market share, leaving very little room for numerous ad tech co.

Their market share in digital advertising is increasing over the yrs.

That's the risk of fighting with giants for #BCG

Their market share in digital advertising is increasing over the yrs.

That's the risk of fighting with giants for #BCG

Ad Giants who rule industry are seeing slowing Digital Ad Revenues

Facebook & Snapchat all seeing QoQ fall in revenue

wsj.com/articles/digit…

Facebook & Snapchat all seeing QoQ fall in revenue

wsj.com/articles/digit…

Analyzing Brightcom Q4 : look beyond what management showing and whats hiding

Here is fancy Q4 release

#BCG #BRIGHTCOM

Here is fancy Q4 release

#BCG #BRIGHTCOM

Beyond what management showing

P&L Analysis

Standalone Rev are flat and PAT falls

EPS halved bcoz of equity dilution & bonus issues

Didn't understand logic of raising funds & paying dividend

Their outlook for FY23 matches with actuals at all parameter? How its possible #bcg

P&L Analysis

Standalone Rev are flat and PAT falls

EPS halved bcoz of equity dilution & bonus issues

Didn't understand logic of raising funds & paying dividend

Their outlook for FY23 matches with actuals at all parameter? How its possible #bcg

Balance Sheet Analysis

Unexplained investments, other financial assets, trade rec, loans given all gone up (diversion of funds)

Borrowing remain stable or increased

#brightcom #bcg

Unexplained investments, other financial assets, trade rec, loans given all gone up (diversion of funds)

Borrowing remain stable or increased

#brightcom #bcg

Cash flow analysis

Cash flow operations significantly got negative at Standalone while halved at Consolidated level

Cash balance in India only have what raised through recent pref issue ? They generally route this money to foreign entities just like they did earlier

End

#bcg

Cash flow operations significantly got negative at Standalone while halved at Consolidated level

Cash balance in India only have what raised through recent pref issue ? They generally route this money to foreign entities just like they did earlier

End

#bcg

Jacob Narzi, President at BCG is not associated with BCG since 2018 as per LinkedIn (pic 2)

Brad Cohen, Chief Strategy Officer is also associated with ither companies (pic 3)

Interestingly no remuneration is paid to BOD apart from sitting fees( pic 4)

Brad Cohen, Chief Strategy Officer is also associated with ither companies (pic 3)

Interestingly no remuneration is paid to BOD apart from sitting fees( pic 4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh