Zeder’s board has resolved to unbundle the company's 42.2% shareholding in Kaap Agri to its shareholders in an attempt to unlock value.

Zeder has also received several approaches from 3rd parties interested in acquiring a number of Zeder portfolio investments.

[Thread]

Zeder has also received several approaches from 3rd parties interested in acquiring a number of Zeder portfolio investments.

[Thread]

Zeder invests in the agribusiness industry.

Agribusiness refers to a range of activities and processes involved in modern food and raw material production.

Agribusiness refers to a range of activities and processes involved in modern food and raw material production.

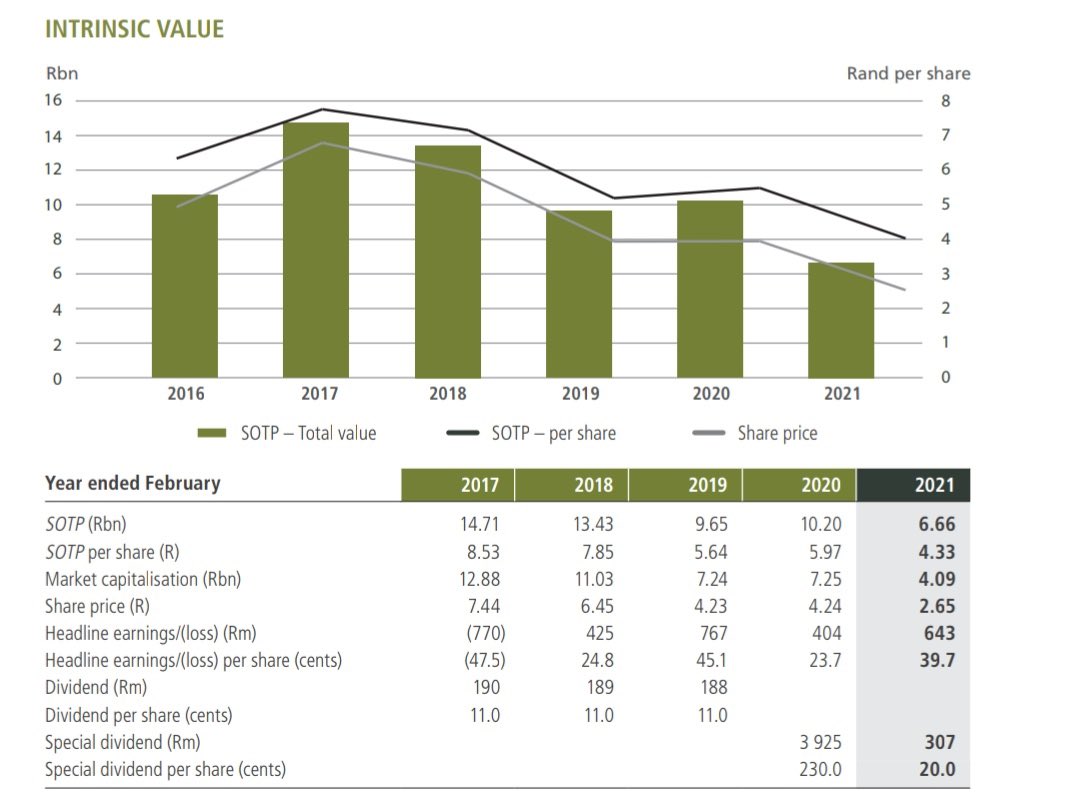

Zeder’s underlying investment portfolio was valued at R5.72bn on 28 February 2021, a decrease from the prior year, mainly due to the substantial special dividend paid following the Pioneer Foods disposal.

Zeder came into existence as the brainchild of PSG Group’s leadership team

Zeder came into existence as the brainchild of PSG Group’s leadership team

Zeder Investments listed on the JSE in 2006, with a basket of holdings in agribusinesses across Southern Africa.

PSG owns 48,6% of Zeder Investments.

Historically, Zeder’s strategy was to take non-controlling interests in a wide spectrum of agribusiness investments.

PSG owns 48,6% of Zeder Investments.

Historically, Zeder’s strategy was to take non-controlling interests in a wide spectrum of agribusiness investments.

In the last 3 years, Zeder has started selling its stakes in agribusinesses such as;

1) Pioneer Foods

2) Quantum Foods

3) The Logistics Group

1) Pioneer Foods

2) Quantum Foods

3) The Logistics Group

1) March 2020, Zeder disposed of its entire 28.6% shareholding in Pioneer Foods for R6.41bn.

As a result, Zeder has settled all its debt and related obligations and declared a special gross dividend of 230 cents per share (R3.9bn) to

shareholders, which was paid in April 2020.

As a result, Zeder has settled all its debt and related obligations and declared a special gross dividend of 230 cents per share (R3.9bn) to

shareholders, which was paid in April 2020.

Pepsico bought Pioneer Foods in a mega deal worth R26 billion.

How it went was that, Simba (Pty) Ltd, an indirect subsidiary of PepsiCo Inc acquired the entire issued share capital, excluding shares held by subsidiary companies, of Pioneer.

How it went was that, Simba (Pty) Ltd, an indirect subsidiary of PepsiCo Inc acquired the entire issued share capital, excluding shares held by subsidiary companies, of Pioneer.

The offer by PepsiCo offer of R110 a share was more than 50% of the value of Pioneer Foods’ shares in the month preceding the offer.

The deal is one of PepsiCo's biggest investments outside the US.

Pioneer Foods is the maker of Weet-Bix, Liqui Fruit, and Sasko and Bokomo.

The deal is one of PepsiCo's biggest investments outside the US.

Pioneer Foods is the maker of Weet-Bix, Liqui Fruit, and Sasko and Bokomo.

2) Zeder disposed of its entire 32.1% shareholding in Quantum Foods on 12 June 2020 for a total consideration of R308m.

3) Nov 2021, Zeder sold its entire 98.22% shareholding in The Logistics Group for a disposal consideration of up to R1 571 467 181.

The purchaser’s shareholder are ultimately controlled by investment funds, which funds are managed by African Infrastructure Investment Managers.

The purchaser’s shareholder are ultimately controlled by investment funds, which funds are managed by African Infrastructure Investment Managers.

Pre the decision to unbundle its 42.2% stake in Kaap Agri, Zeder’s remaining investments that were up for sale were;

1) Zaad (97%)

2) Capespan (96%)

3) Kaap Agri (42.3%)

4) Agrivision Africa (56%)

Unbundling now leaves;

1) Zaad (97%)

2) Capespan (96%)

3) Agrivision Africa (56%)

1) Zaad (97%)

2) Capespan (96%)

3) Kaap Agri (42.3%)

4) Agrivision Africa (56%)

Unbundling now leaves;

1) Zaad (97%)

2) Capespan (96%)

3) Agrivision Africa (56%)

1) Zaad is a strategic holding company that invests and operates in the specialised agri-inputs industry with a focus on emerging markets, especially Africa and develops, imports + distributes a broad range of agricultural seeds in Africa, Europe and other emerging markets.

Zaad concluded transaction agreements whereby it will acquire a 40% stake in EAS group of companies in Kenya, with an option to acquire an additional stake in the future.

Zaad's investment and operations are structured to participate in strategic agricultural seed and chemical.

Zaad's investment and operations are structured to participate in strategic agricultural seed and chemical.

2) Capespan is a vertically integrated fruit producer with global marketing, sales and distribution capabilities that can service and supply growers and customers in key international markets.

Capespan's controlled farming investments and operations are located primarily in South Africa and Namibia and comprise 802 hectares of grapes 296 hectares of citrus and

570 hectares, including hectares farmed for associates, of pome fruit respectively.

570 hectares, including hectares farmed for associates, of pome fruit respectively.

3) Agrivision Africa currently owns and operates two large-scale commercial farming operations and a milling business in Zambia.

During the year under review, Zeder accounted for a fair value loss of R96m in respect of its investment in Agrivision Africa.

During the year under review, Zeder accounted for a fair value loss of R96m in respect of its investment in Agrivision Africa.

Trading at a discount to the sum-of-the-parts is common for holding companies.

What 'complicates' things with holding co that have unlisted investments is the difficulty in valuing those unlisted investments.

Valuing listed investments within holding companies is often easier

What 'complicates' things with holding co that have unlisted investments is the difficulty in valuing those unlisted investments.

Valuing listed investments within holding companies is often easier

The Zeder unbundling will result in shareholders holding the Kaap Agri 42.2% stake directly, which will eliminate the current discount applied to the Kaap Agri distribution shares currently included in the sum of the parts value of the Zeder.

Kaap Agri’s 42.2% stake had an attributable value of R1.02 and accordingly comprised 21.8% of the sum-of-parts-value per Zeder share.

During FY21, Zeder accounted for a fair value gain of R355m following the increase in Kaap Agri's listed share price and earned dividend income of R16m in respect of its investment in Kaap Agri.

Read the quoted tweet for more info on Kaap Agri.

Read the quoted tweet for more info on Kaap Agri.

https://twitter.com/maanomadima/status/1484108579841921024

• • •

Missing some Tweet in this thread? You can try to

force a refresh