Beginning of real-estate upcycle? what if an ancillary is set to grow faster and still cheap?

Let's deep dive into Greenply and understand the multiple tailwinds ahead in this thread 🧵🧵

#StocksToBuy #valueinvesting

Let's deep dive into Greenply and understand the multiple tailwinds ahead in this thread 🧵🧵

#StocksToBuy #valueinvesting

Contents:

1) What's Wood panel

2) Industry Business model and players

3) Demand drivers

4) The Trigger - what's changing

5) Financials & Valuation

6) Antithesis

1) What's Wood panel

2) Industry Business model and players

3) Demand drivers

4) The Trigger - what's changing

5) Financials & Valuation

6) Antithesis

Lets und the products and business first

1) Wood panel Industry:

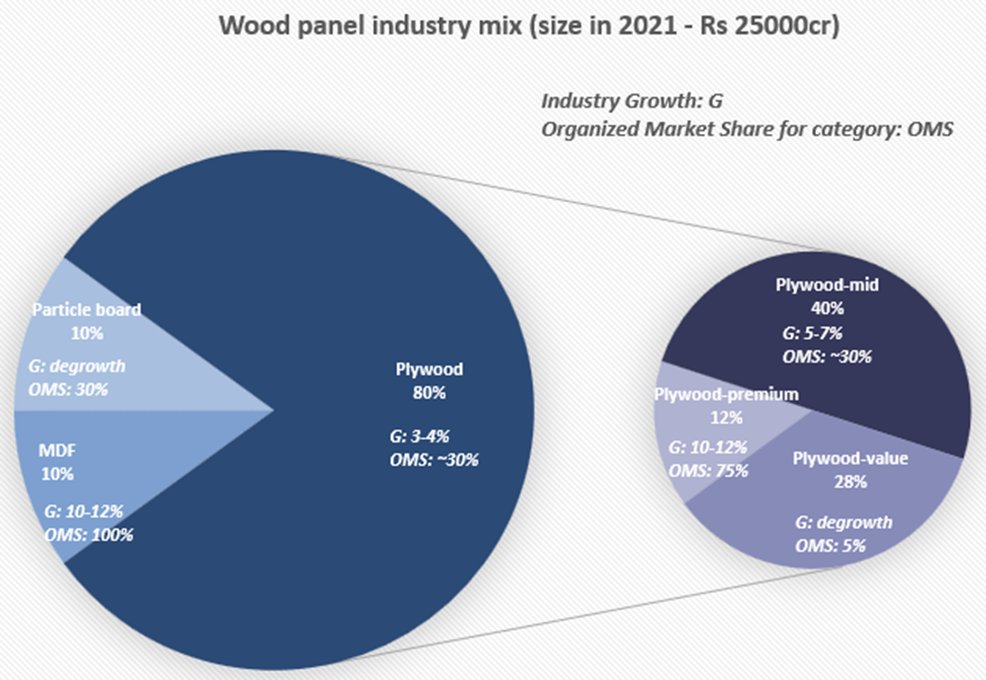

Industry is primarily plywood (80%) with some shares with MDF and particle board.

a) Plywood: made of thin veneers from rolling wood logs - mostly Eucalyptus. Veneers are pressed with glue to make dense plywood

1) Wood panel Industry:

Industry is primarily plywood (80%) with some shares with MDF and particle board.

a) Plywood: made of thin veneers from rolling wood logs - mostly Eucalyptus. Veneers are pressed with glue to make dense plywood

1b) MDF & Particleboard: woodchips are processed in automated plants - mixed with resins & chemicals and pressed. MDF is 30-55% cheaper than plywood - so applications r growing rapidly

check out the process 👇

check out the process 👇

2) Business model:

MDF is capital intensive but high margins at higher utilizations. So price war begins if utilizations drop - classic cyclical.

Plywood is more labour intensive but low margin. ROCE is high and less cyclical👇.

The synergy comes from same distribution channel

MDF is capital intensive but high margins at higher utilizations. So price war begins if utilizations drop - classic cyclical.

Plywood is more labour intensive but low margin. ROCE is high and less cyclical👇.

The synergy comes from same distribution channel

3) Demand drivers:

a) Unorganized weakening: Paint industry got consistent growth after killing the unorganized sector. in this upcycle of RE, similar changes are happening for other ancillaries. Woodpanel's share in ancillaries r also low vs others. TAM looks to be large.

a) Unorganized weakening: Paint industry got consistent growth after killing the unorganized sector. in this upcycle of RE, similar changes are happening for other ancillaries. Woodpanel's share in ancillaries r also low vs others. TAM looks to be large.

3b) Newer applications: MDF is replacing value-plywood as found replaceable applications with cheaper price. Premium plywood is more real-estate linked which is waking up. Mid segment is gradually replacing 70% unorganized.

3c) Furniture value chain: Furniture is a 1.5L cr industry in India growing at 15%. Organized is just 20% but growing at 40%+. Thanks to ecom and pick up of urban furniture all over India during Covid.

3d) Interior lifestyle: penetration of modular kitchens, wardrobes grows

3d) Interior lifestyle: penetration of modular kitchens, wardrobes grows

4) The Trigger: Lets dig into Greenply now

a) Shift in focus: Changed strategies to be more growth focused from FY21 - reshaped dealerships + penetrated semiurban for mid segment growth (unorganized heavy) + put up capex for premium segment growth + reshaped internal teams

a) Shift in focus: Changed strategies to be more growth focused from FY21 - reshaped dealerships + penetrated semiurban for mid segment growth (unorganized heavy) + put up capex for premium segment growth + reshaped internal teams

4b) Increasing asset light model: Instead of trading plywood to capture demand, they outsourced exclusive manufacturing contracts - so able to manage quality while leveraging on their brands. This is not easy but very ROE accretive and pro-growth - the Maruti way.

4c) Premium plywood greenfield: Sandila plant has 2.2x asset turn as using only 1/3rd of land but capex includes land+staff quarters etc

Strategic location to capture North India while Centuryply focuses on South. UP belt also has raw material close by for them -Margins accretive

Strategic location to capture North India while Centuryply focuses on South. UP belt also has raw material close by for them -Margins accretive

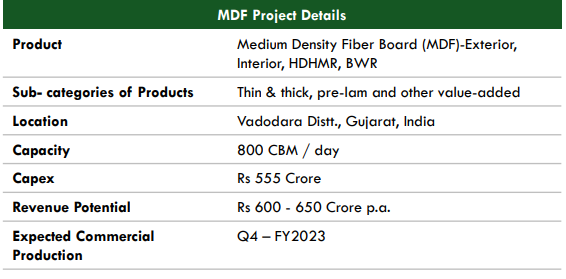

4d) Foray into MDF: greenfield of 240k cbm capacity in Vadodara to come in FY24. MDF cd improve margin make ROCE more cyclical. Well they made a lot of shareholders wealth when divested Greenpanel (family MDF business) earlier. Eng wood:Ply mix is 20:80 in India vs 65:35 globally

5) Financials & Valuation:

Vol: guides 5-7% growth over industry as all set to hit unorganized.

Realization and Margins: passes on with 1 quarter lag - so near term margins look low when RM increases. Guides 13-14% OPM if RM remains here.

Vol: guides 5-7% growth over industry as all set to hit unorganized.

Realization and Margins: passes on with 1 quarter lag - so near term margins look low when RM increases. Guides 13-14% OPM if RM remains here.

5a) OPM is lower than Greenpanel and Centuryply. But, that's because Fixed asset turnover is higher in plywood business while Century is a mix & Greenpanel is MDF. Here is a comparison of the three large players

5b) So ROCE is better way to look at the business which is lower than Century still higher than Greenpanel; while PE is yet to catch up. Ideally, improving margins from new plants with gradual market share driven growth shd be the key behind PE catchup.

6)Antithesis:

a) MDF is cyclical and oversupply could be risky. FY24 is going to see 53% increase in domestic MDF capacity. SO if demand doesn't grow in 20%+ CAGR, realization could decline in short term (similar to what happened in 2018)

a) MDF is cyclical and oversupply could be risky. FY24 is going to see 53% increase in domestic MDF capacity. SO if demand doesn't grow in 20%+ CAGR, realization could decline in short term (similar to what happened in 2018)

6b) RM price inflation is a risk. Wood panel industry uses phenol and some other chemicals which is a pain point already. For passing them on, brand pull is needed. So all these players spend 3-3.5% of sales in brand building.

Disc-invested & not a reco. Pls do ur owndue dilignce

Disc-invested & not a reco. Pls do ur owndue dilignce

Pls RT for max reach and help us continue the hard work.

Source: Annual reports, ET, Livemint and many other

Thanks @varinder_bansal for the informative call with Greenpanel here.

Source: Annual reports, ET, Livemint and many other

Thanks @varinder_bansal for the informative call with Greenpanel here.

wd love ur feedback

@caswapnilkabra,@ishmohit1,@cautkarshpandey,@Vivek_Investor,@BahirwaniKrish,@StocktwitsIndia,@sahil_vi,@saketreddy,@suru27,@mishika_chamria,@Arunstockguru,@NeilBahal,@alphaspotcap,@AnishA_Moonka,@vivbajaj,@MultipieSocial,@Falak_Kalyani,@AdityaD_Shah,@Finstor85

@caswapnilkabra,@ishmohit1,@cautkarshpandey,@Vivek_Investor,@BahirwaniKrish,@StocktwitsIndia,@sahil_vi,@saketreddy,@suru27,@mishika_chamria,@Arunstockguru,@NeilBahal,@alphaspotcap,@AnishA_Moonka,@vivbajaj,@MultipieSocial,@Falak_Kalyani,@AdityaD_Shah,@Finstor85

• • •

Missing some Tweet in this thread? You can try to

force a refresh