$TQQQ buying the dip mantra never fails. Looking at flows into tqqq again hitting records- this is not what u see at the bottom- what you see at a bottom is a full revulsion & “get me out”. I understand that the market wants to go full Monty to a Powell will go dovish tilt

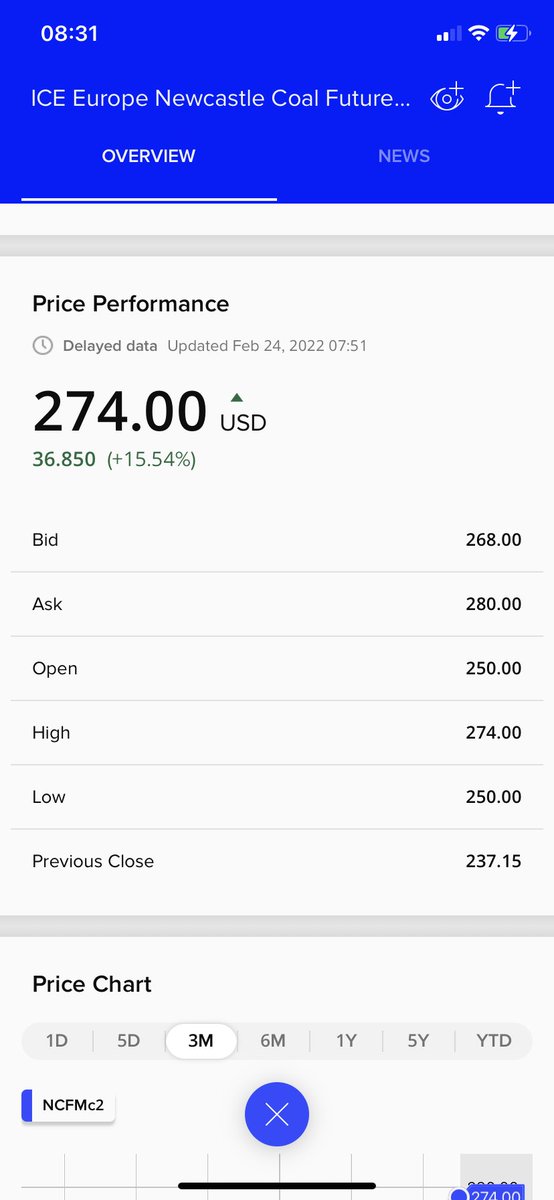

Given the Russian/Ukraine sitn. I question if that is really possible with Inflation ratcheting up with us losing Russian & Ukraine as a reliable supplier for so many commodities- just look at whats going on with coal px Wheat etc recently. I also wonder how the Russian sitn can

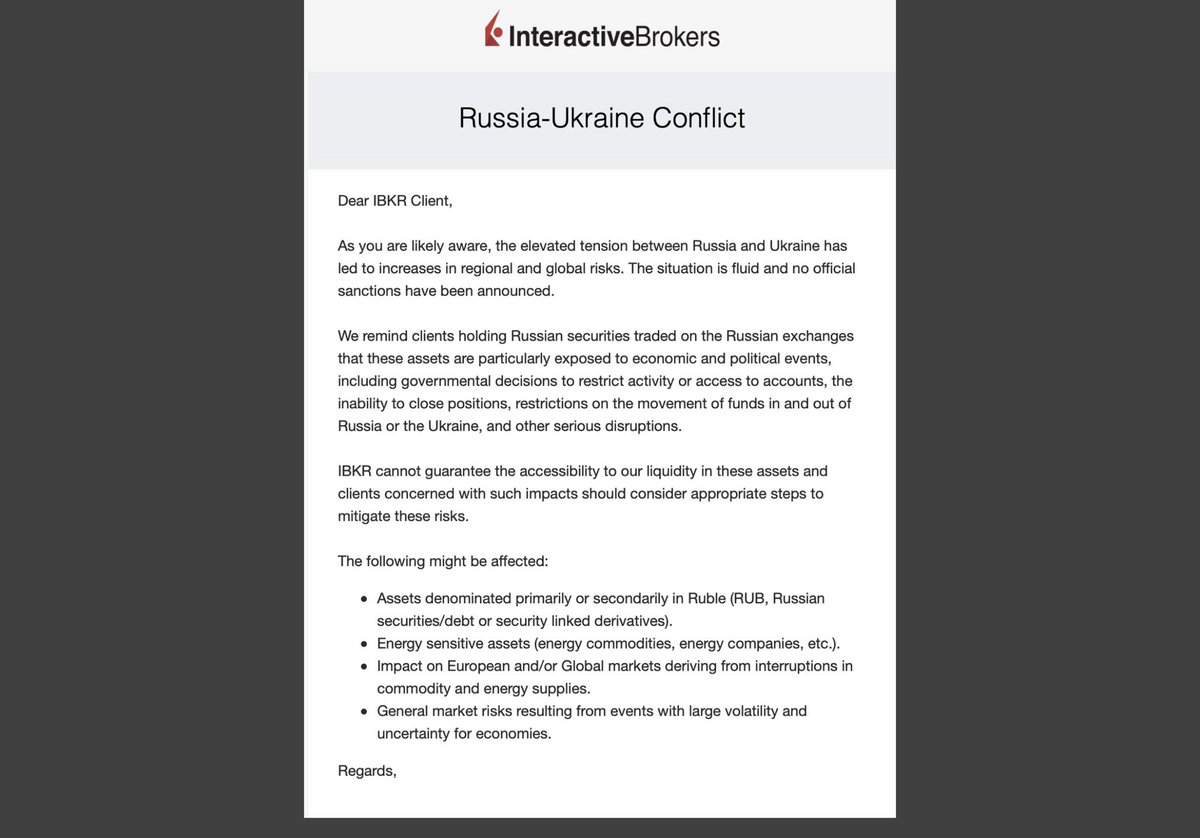

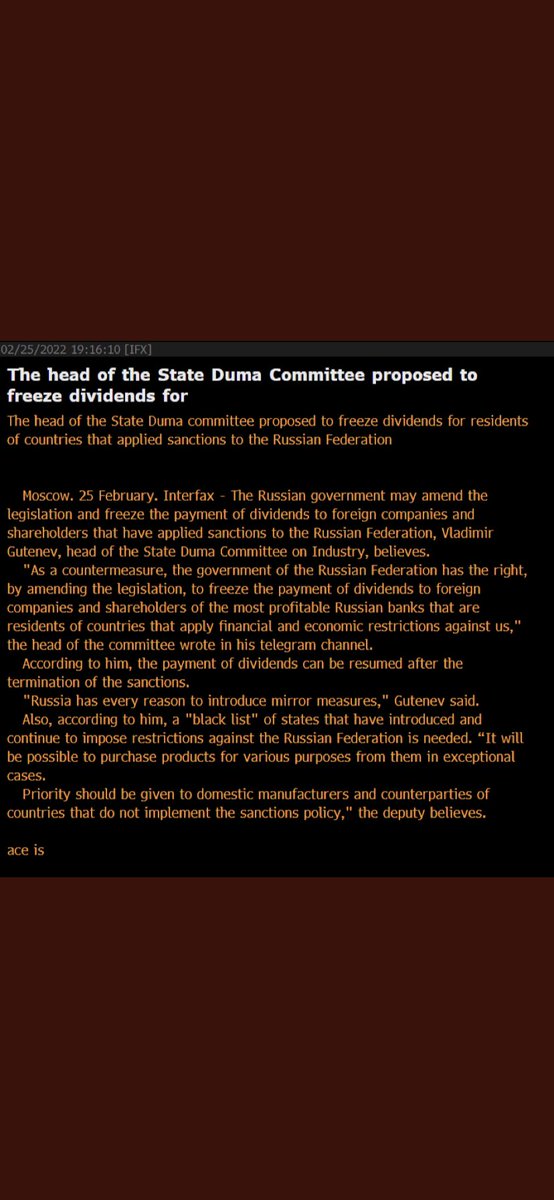

Be resolved with Putin not losing face w/o a ratcheting up of tensions including threatening of Nukes. To me were in a vol 50 environment not vol 20. Finally removing swift access to Russian banks is far more complicated and with many cross currents to so many Financials that I

Am 100% sure the politicians in Europe could not have fathomed or thought about in the last few days. A non payment by one institution can suddenly have a huge ripple effect and yet everyone has rushed to buy the dip w/o the DIP lol.

• • •

Missing some Tweet in this thread? You can try to

force a refresh