I have to thank @trader_ferg for helping me discover @LT3000Lyall & lyall’s jan 28 blog on the background on the Russian/Ukraine situation is must reading as opposed to all the garbage you see on twitter with half baked analysis lt3000.blogspot.com/2022/01/us-vs-…

https://twitter.com/LT3000Lyall/status/1497071606329327618

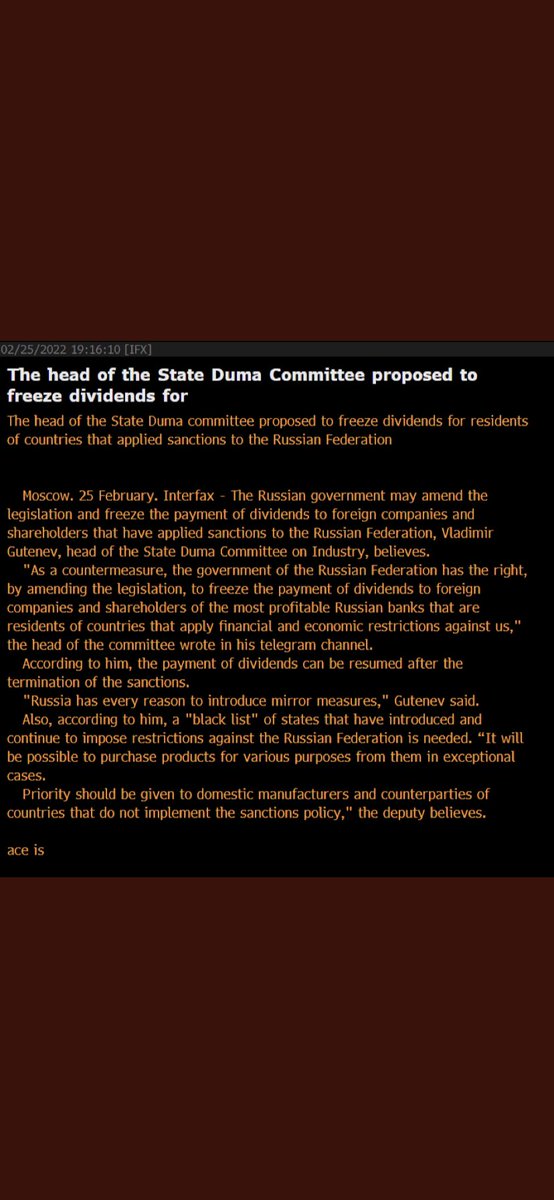

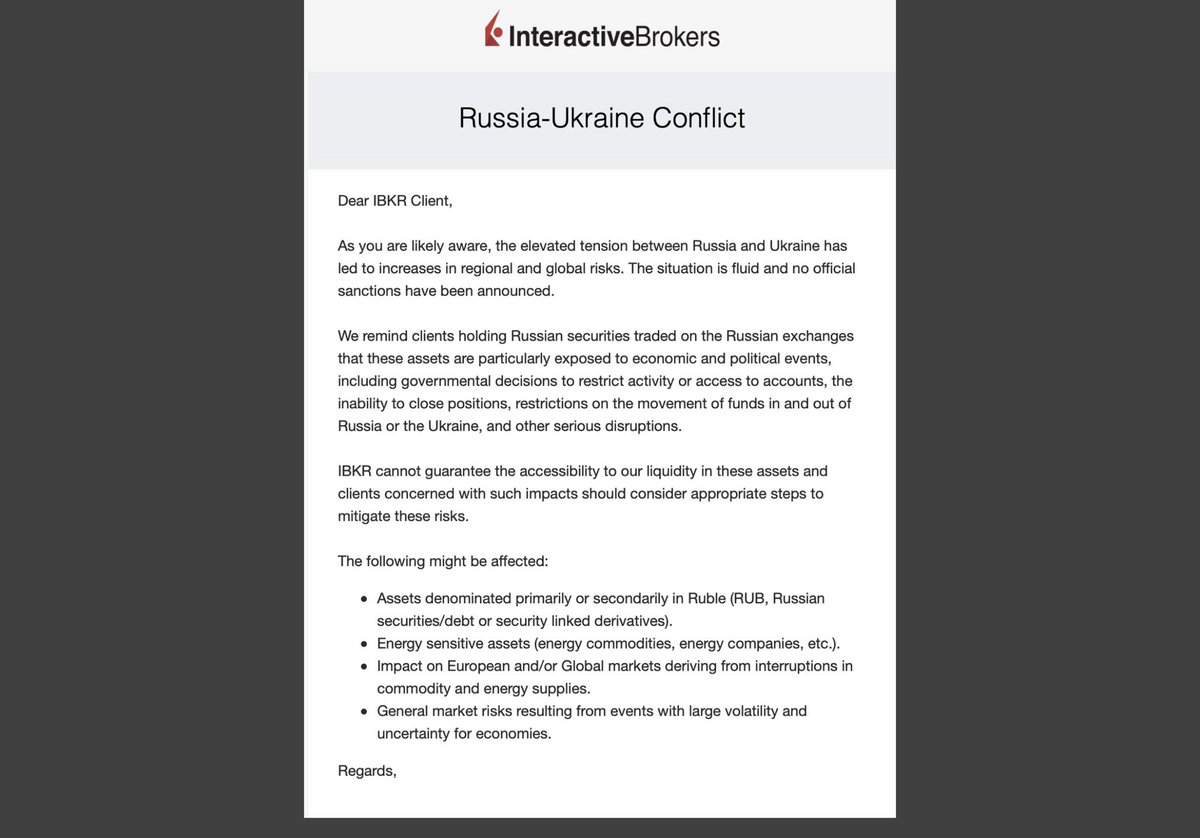

It is clear there is high risk, the situation is fluid, and by no means am i not saddened by the suffering undergoing by innocent Ukrainians. That being said, when assets are trading at such a depressed valuation (eg $SBER at 1.5x per), the pulpit of “warnings” be it IBKR

Or Mr famous “hell is coming” @BillAckman who cried on TV during the depths of covid whilst quietly buying stocks warning about Russian banks. Again who knows how the situation unfolds, but when local Moscovites are willing to value a bank at a 50% premium to westerners one

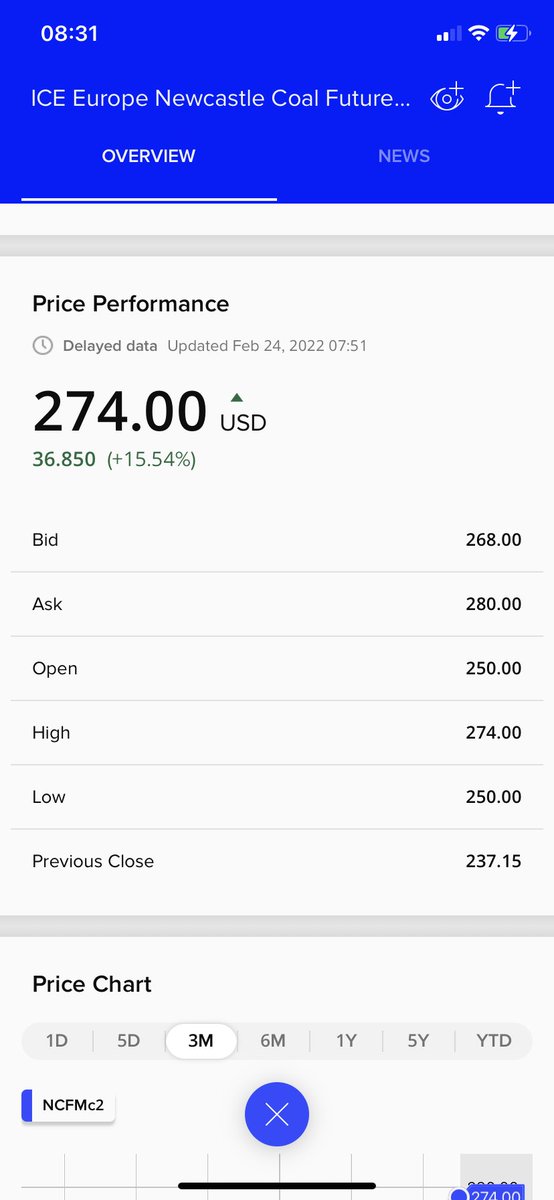

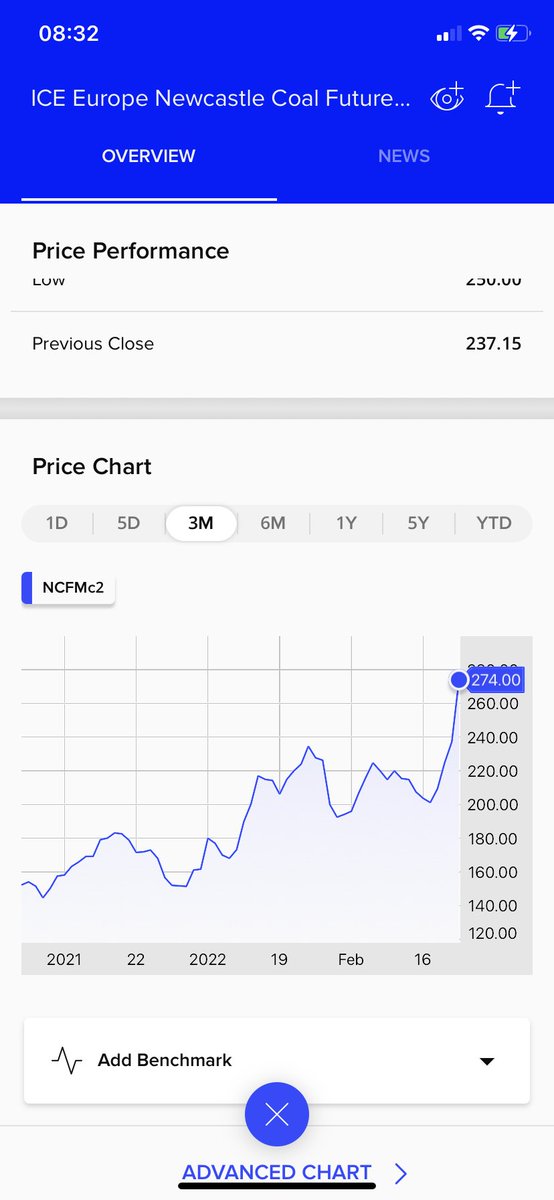

Has to take notice. And although the west may impose sanctions i have to question how likely that is with Germany opposed & firmly exposed given their gas imports, & many countries including India trying to find a back door for Russian exports.

Sometimes the biggest risks are not when its so clearly in your face & hence “ in the price”. I would argue any of @CathieDWood holdings & in particular $tsla has far more risk and downside then $sber at 1.5x per. But then im a contrarian or a fool at heart.

https://twitter.com/LT3000Lyall/status/1497158920577568770

• • •

Missing some Tweet in this thread? You can try to

force a refresh