Former hedge fund manager of a multi billion dollar fund. Interested in commodities & startups. Nothing should be construed as investment advice

20 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/johnpolomny/status/1632368773247250432

That coal will be impacted from falling gas prices. I’d argue that has already happened and if you read this months @Go_Rozen section on gas you will see that gas has significant structural reasons for a strong decade and the current abnormal weather and Freeport closure is not

That coal will be impacted from falling gas prices. I’d argue that has already happened and if you read this months @Go_Rozen section on gas you will see that gas has significant structural reasons for a strong decade and the current abnormal weather and Freeport closure is not

https://twitter.com/contrarian8888/status/1608230491404095488?s=20

https://twitter.com/m_eals/status/1599349268174626819Positioning bullish wise back to Aug levels

https://twitter.com/hmeisler/status/1599035336767815680

https://twitter.com/contrarian8888/status/1587955506907414541Slow down the visibility of those a/cs that were critical of a certain car company. As a result I’ve accepted the kind invitation of @Flight_Useful and will be having my own C8888 channel on Discord where i can post freely & answer Q&A. Heres the link discord.com/invite/VfwXyqs…

https://twitter.com/revhappy2/status/1584425105769103360Albeit horrendous entry point of $1-$1.5 the stock today is up >20x in 2.5 years. Not suggesting china would ever replicate that but my sense is this Hu event was the final catharsis that investors needed to dump something that just wasn’t working. It was the final shock that

Inferior today

Inferior today

https://twitter.com/econ_713/status/1582507742803030016Going to take a hell of a long time to come back. 2 EV of the sector at peak last time was 164B (2007) today its 19b. Heck SPACEX which does nothing for u (unlike offshore which is servicing a real need like finding oil) has a higher EV than the combined Offshore sector.

https://twitter.com/contrarian8888/status/1581294431012954113Highly levered bloomberg.com/opinion/articl….

Fund managers in china investing in their own funds (adding skin to the game at a time when sentiment is extremely -ve).

Fund managers in china investing in their own funds (adding skin to the game at a time when sentiment is extremely -ve). https://twitter.com/cathyyuanzhang/status/1581896010804039680

Argued for 90$ when i was buying the puts when the stock was at 175$ that seems highly reasonable. Will be an interesting week. Bottom line a lot of FANG are nothing but bond proxies and with rates rising, and with no growth, people are quickly finding that these”cant lose

Argued for 90$ when i was buying the puts when the stock was at 175$ that seems highly reasonable. Will be an interesting week. Bottom line a lot of FANG are nothing but bond proxies and with rates rising, and with no growth, people are quickly finding that these”cant lose

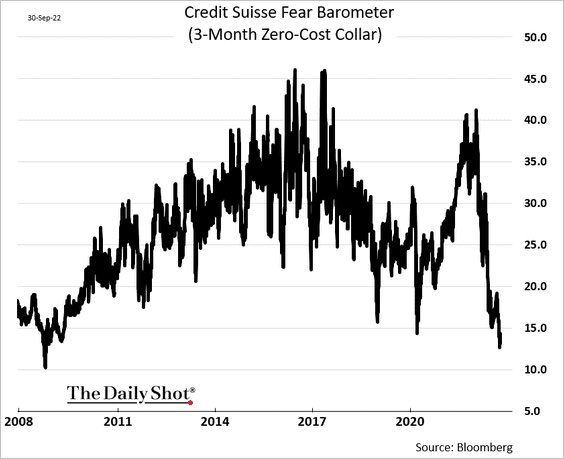

That the cost of selling a call to buy an out of the money put remains at extremely cheap levels. If people really were so so so bearish they would be selling calls even to buy deep out of the money puts given they would be convinced we would crash. As you can see downside

That the cost of selling a call to buy an out of the money put remains at extremely cheap levels. If people really were so so so bearish they would be selling calls even to buy deep out of the money puts given they would be convinced we would crash. As you can see downside

https://twitter.com/flight_useful/status/1574039256233811969Names like fruit loop of an investor. Let me be crystal clear. When i was investigating buying a large position in $PANR at 29p and i did so for a month whilst Farallon was selling in May 21 the advfn chat boards were equally -ve and @Scot126126 was the sole defender. Despite the

https://twitter.com/LowAlphaHighVol/status/15725034390826885173 oil demand is still resilient despite China being in lockdown. I wont address the first 2 as they are relatively self explanatory (and many smarter folks have posted those charts). I want to address the fact that 0 covid is IMHO nothing more than a ruse for Xi to get re-elected

https://twitter.com/koningcorp/status/1572606733587218436startengine.com/Koning So why the huge increase in sales? (A) new Koning Vera machine is a game changer -3D no breast compression and new selling model- (B) units are now sold as a scan as a service allowing much more access to breast clinics and centers and paying for each