1/ The value proposition of #Bitcoin just became even more evident to a lot of people.

No wonder #BTC pumped over 30% since the Russian invasion a week ago!

The world it starting to quickly see that Bitcoin is a real solution to very real problems.

Here's why, a thread 👇

No wonder #BTC pumped over 30% since the Russian invasion a week ago!

The world it starting to quickly see that Bitcoin is a real solution to very real problems.

Here's why, a thread 👇

2/ The reactions to the war in Ukraine, including the Western sanctions, have highlight one MAJOR shortcoming of the current financial system.

Transactions and bank accounts can be FROZEN overnight and can be almost UNIVERSAL in their reach.

What does that mean? 👇

Transactions and bank accounts can be FROZEN overnight and can be almost UNIVERSAL in their reach.

What does that mean? 👇

3/ Such actions impacted regular people, banks, a central bank, oligarchs, the rich in general and so on.

In one word, EVERYONE is at risk of losing ACCESS to their wealth in traditional finance.

Even Switzerland did it, a neutral country.

Examples next 👇

In one word, EVERYONE is at risk of losing ACCESS to their wealth in traditional finance.

Even Switzerland did it, a neutral country.

Examples next 👇

4/ Ukraine closed markets, halted electronic money, limited withdrawals.

Russia introduced capital controls. Visa/MasterCard disabled cards for users.

EU/CH froze 🇷🇺 central bank assets, companies assets and accounts of elite.

This never happened at this scale. What next? 👇

Russia introduced capital controls. Visa/MasterCard disabled cards for users.

EU/CH froze 🇷🇺 central bank assets, companies assets and accounts of elite.

This never happened at this scale. What next? 👇

5/ There are some rich people in China, Saudi Arabia and may other places with a LOT of money at similar RISK.

Access and usage of traditional finance has been weaponized now! Oops. 😱

This is just the tip of the iceberg. Where does #Bitcoin fit in? 👇

Access and usage of traditional finance has been weaponized now! Oops. 😱

This is just the tip of the iceberg. Where does #Bitcoin fit in? 👇

6/ Politics aside, #Bitcoin solves a very big problem right now:

It provides unrestricted access to a system of payments and store of value that is censor resistant!!!

It allows ANYONE to transact, save and store value as they please.

Pieces are falling together now, no? 👇

It provides unrestricted access to a system of payments and store of value that is censor resistant!!!

It allows ANYONE to transact, save and store value as they please.

Pieces are falling together now, no? 👇

7/ This is the MOST BULLISH realization possible for a lot of rich people around the world.

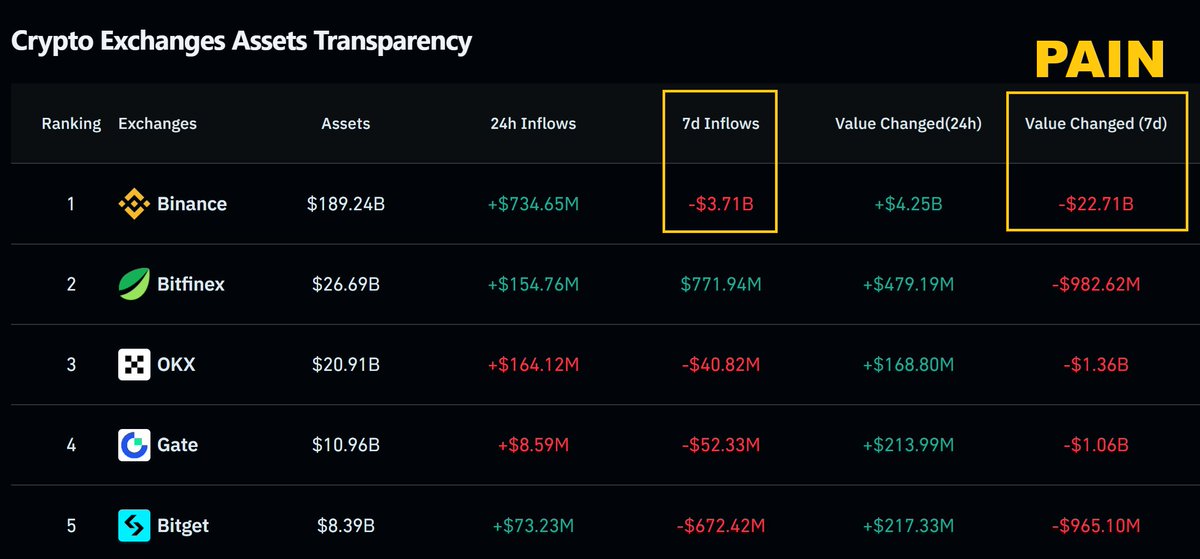

What will they do next? They will get exposure to #Bitcoin, LOTS OF IT.

BILLIONS of exposure. Just in case... 👇

What will they do next? They will get exposure to #Bitcoin, LOTS OF IT.

BILLIONS of exposure. Just in case... 👇

8/ Even more striking, BTC has NOT changed since 2009, but suddenly its features come at a HUGE premium.

No one needed BTC in 2009 to transact, but in a post-2022 world, #BTC just became indispensable!

Plus, since 2009, adoption exploded making BTC a CREDIBLE alternative! 👇

No one needed BTC in 2009 to transact, but in a post-2022 world, #BTC just became indispensable!

Plus, since 2009, adoption exploded making BTC a CREDIBLE alternative! 👇

9/ To me, these recent & unfortunate events, just kicked BTC adoption into a higher gear!

Crypto is here to stay and #Bitcoin's future seems set. Deniers and bears lost.

BTC will continue to be volatile, but this is gonna be quite a ride. Enjoy and stay in touch 👇

Crypto is here to stay and #Bitcoin's future seems set. Deniers and bears lost.

BTC will continue to be volatile, but this is gonna be quite a ride. Enjoy and stay in touch 👇

10/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Here's another example, just that now, it is the billionaires doing it.

https://twitter.com/GucciXBT/status/1267923363231485952?s=20&t=uGQhg2lJ8HRRtA9m6wpqFA

• • •

Missing some Tweet in this thread? You can try to

force a refresh