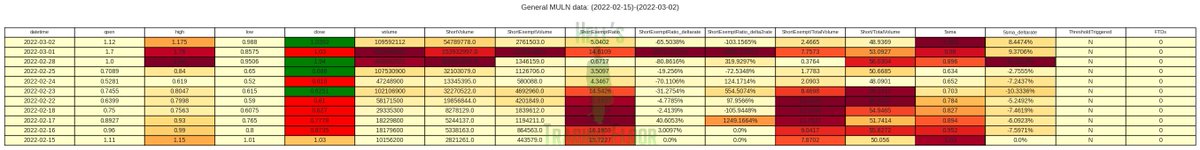

Still holding my $MULN position. The volume has already traded more than 10x the estimated float today in only the first half of the trading day. 🙄

Utilization from 25% to 99% in 3 days...

22.5M short exempts yesterday

2.76M short exempts today

That's normal... 😒

Utilization from 25% to 99% in 3 days...

22.5M short exempts yesterday

2.76M short exempts today

That's normal... 😒

Before you go any further, know that this isn't financial advice, and I'm not an expert in finance or market mechanics.

What follows is due-dilligence by a biased investor with a deep-seeded hatred for companies who defraud us daily with the data as I will soon demonstrate.

What follows is due-dilligence by a biased investor with a deep-seeded hatred for companies who defraud us daily with the data as I will soon demonstrate.

There's a lot of mis-information floating around regarding the share offering. the 228 million shares are NOT ISSUED yet. They are AUTHORIZED.

The hedge funds who have the right to purchase shares are only allowed to drawdown $2.5M maximum at a time, based on the market price.

The hedge funds who have the right to purchase shares are only allowed to drawdown $2.5M maximum at a time, based on the market price.

That means the higher the price goes, the fewer shares they can withdraw at a time.

Combine that with these 22.5M short exempts (likely to FTD), there is an immense amount of shorts who have overleveraged themselves, banking on retail selling for a loss.

app.quotemedia.com/data/downloadF…

Combine that with these 22.5M short exempts (likely to FTD), there is an immense amount of shorts who have overleveraged themselves, banking on retail selling for a loss.

app.quotemedia.com/data/downloadF…

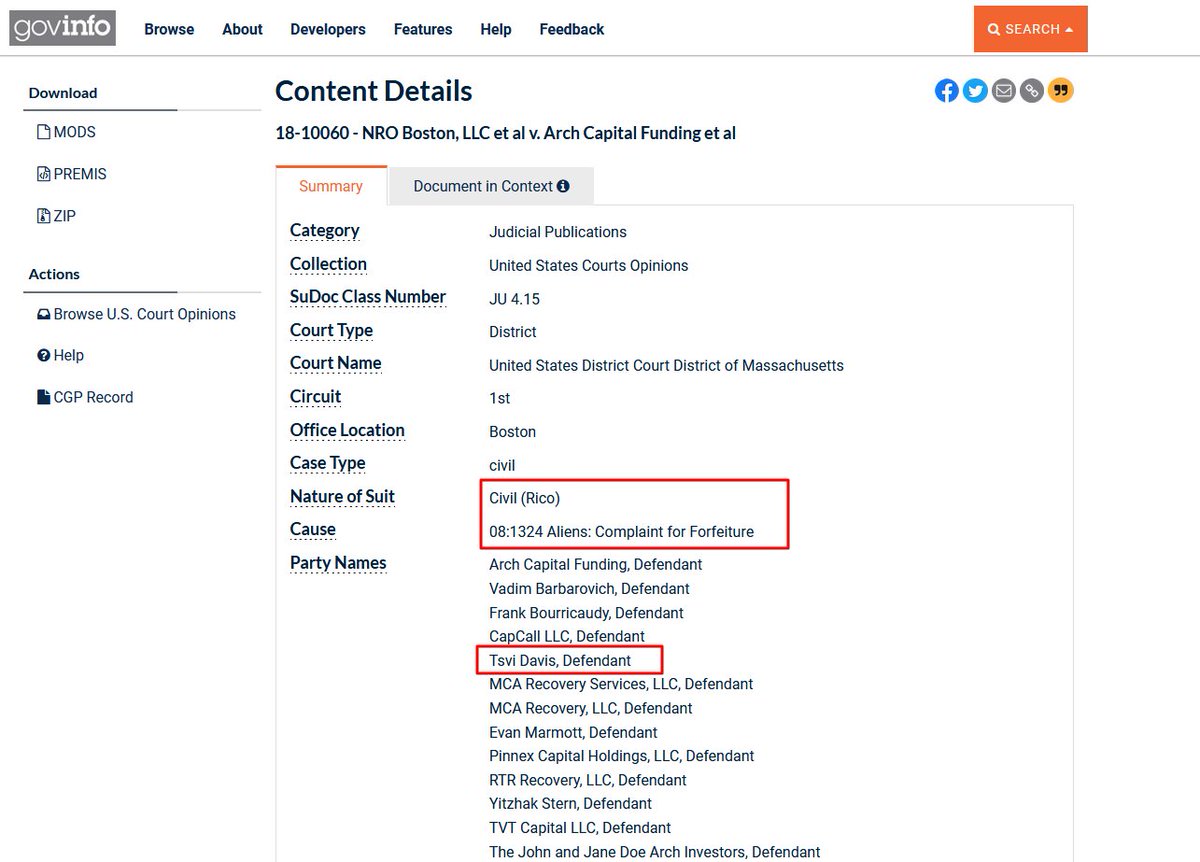

People screaming about the company diluting on retail and saying there is "no fraud" might want to look into who signed for Drawbridge Investments.

Tsai "Steve" Davis, formerly from Yellowstone Capital, which was cited in this Bloomberg article: bloomberg.com/graphics/2018-…

Tsai "Steve" Davis, formerly from Yellowstone Capital, which was cited in this Bloomberg article: bloomberg.com/graphics/2018-…

Tsai or Steve Davis from Drawbridge has a LONG history of predatory loan practices which carry back to his time with Yellowstone Capital, offering cash-advance loans which rapidly balloon into hopless situations for the lendee.

finance.yahoo.com/news/merchant-…

finance.yahoo.com/news/merchant-…

Mr. Davis also was involved in a Civil case of Racketeering against him personally and against the companies named in the memorandum of this court filing.

The case status is not classified

casetext.com/case/nro-bos-l…

The case status is not classified

casetext.com/case/nro-bos-l…

Another: Let's look at Michael Wachs, the Managing Director at Esousa Holdings LLC, who was one of the first to provide financing for $MULN since it's IPO.

He was charged for embezzlement with Chase Bank and is a convicted felon, barred from trading.

nytimes.com/1996/11/09/bus…

He was charged for embezzlement with Chase Bank and is a convicted felon, barred from trading.

nytimes.com/1996/11/09/bus…

Michael Wachs has created multiple businesses known for shady dealings and malicious lending practices, and due to his felony status, his wife has to frequently act on his behalf, especially when it comes to trading stock.

barrons.com/articles/SB105…

barrons.com/articles/SB105…

Another figure in this tale is Dahlia Harmon, who we now know from the above article is Michael Wach's sister and a Managing Member of Cobblestone Capital Partners LLC... who formerly invested in NETE, the company which merged with $MULN.

Interesting coincidence.

Interesting coincidence.

Let's also look at Ault Global Holdings, which is another "investor" of $MULN, and a relation to Michael Wachs, who also shows up in the filings related to it's Equity Line of Credit agreement.

ir.aultglobal.com/static-files/9…

ir.aultglobal.com/static-files/9…

Ault Global absorbed Digital Power Holdings (DPW) which became BitNile (NILE) after it inexplicably sold off after repeated reports of successfully achieving all of its business milestones in 2018.

finance.yahoo.com/news/ault-glob…

businesswire.com/news/home/2021…

finance.yahoo.com/news/ault-glob…

businesswire.com/news/home/2021…

DPW, due to lack of any alternatives for ATM offerings due to their abysmally low stock price, were forced into multiple financing agreements with... AULT Global Holdings

Over the next 2 years, their stock continued tanking as Ault acquired more shares through toxic financing

Over the next 2 years, their stock continued tanking as Ault acquired more shares through toxic financing

And with that $DPW was dead, and Ault created BitNile $NILE in its place, while Esousa and Ault laughed their way to the bank.

Go look through $MULN's filings, and you'll find Esousa, Ault, Drawbridge, and all their executives came from the same place.

Lehman Bros...

Go look through $MULN's filings, and you'll find Esousa, Ault, Drawbridge, and all their executives came from the same place.

Lehman Bros...

And that's just the tip of the iceberg.

The investigation has turned up far more evidence than just that.

Sharks swim in packs. These crooked, greedy fucks are colluding to drive $MULN's stock into the ground with toxic financing terms designed to destroy them.

The investigation has turned up far more evidence than just that.

Sharks swim in packs. These crooked, greedy fucks are colluding to drive $MULN's stock into the ground with toxic financing terms designed to destroy them.

Legally, $MULN's hands are tied, because...

THE TERMS OF THE FINANCING CONTRACT OBLIGATE $MULN TO DILUTE AT ESOUSA AND AULT'S REQUEST WITH NO ALTERNATIVE RECOURSE FOR FINANCING BECAUSE THEIR STOCK IS BEING SIMULTANEOUSLY SHORTED TO WORTHLESSNESS!

THE TERMS OF THE FINANCING CONTRACT OBLIGATE $MULN TO DILUTE AT ESOUSA AND AULT'S REQUEST WITH NO ALTERNATIVE RECOURSE FOR FINANCING BECAUSE THEIR STOCK IS BEING SIMULTANEOUSLY SHORTED TO WORTHLESSNESS!

As soon as I called this play out, I instantly got attacked and called a hedgie plant, pump & dumper, and an emotional bagholder.

First they ignore you, then they laugh at you, then they get angry, then you win.

I'll be holding until I get my money back. FTDs must be covered.

First they ignore you, then they laugh at you, then they get angry, then you win.

I'll be holding until I get my money back. FTDs must be covered.

If people want to blame me for whatever happens, good or bad, fine. I'll happily turn over my findings to the SEC when they come to arrest me.

If you're a retail investor who is sick of hedge funds destroying the value of your investments through fraud, pay attention.

If you're a retail investor who is sick of hedge funds destroying the value of your investments through fraud, pay attention.

$MULN can squeeze to unimaginable heights, if two things happen.

1. $200M in JUST SHARES is purchased at current market price before Friday with _no selling_ and _no scalping_. Buy and Hold. That's it.

2. The price rises above $1.80 before next Wednesday, the sooner, the better

1. $200M in JUST SHARES is purchased at current market price before Friday with _no selling_ and _no scalping_. Buy and Hold. That's it.

2. The price rises above $1.80 before next Wednesday, the sooner, the better

This is because the short exempts from the last 4 days are becoming FTDs starting tomorrow. 22.49M FTD on Mon. They will be due for cover no later than Wed

If the price is above ~$1.80 the MM takes a loss for the difference between the price of their short exempt & market price

If the price is above ~$1.80 the MM takes a loss for the difference between the price of their short exempt & market price

It's simple fucking math. They short-exempted 22.5M shares. If they did not locate those shares, they likely were sold short somewhere between $1.00 and $1.80.

A price of $1.80+ guarantees a loss for the MM... and they do not have the option but to close any FTDs by Wed.

A price of $1.80+ guarantees a loss for the MM... and they do not have the option but to close any FTDs by Wed.

22.5M * (1.00-$1.80) is a loss of $18,000,000. Every cent higher is another $225K in losses

It _is_ possible to inflict enough pain on a market maker to force them out of their position and allow the price to run.

Market makers are NOT allowed to take a directional position.

It _is_ possible to inflict enough pain on a market maker to force them out of their position and allow the price to run.

Market makers are NOT allowed to take a directional position.

They are the ones who are defrauding the market and causing this downward deathspiral for $MULN, together with the help of these loan sharks masquerading as hedge funds.

And yes... this IS a revenge trade. Revenge for 2008.

Either I lose my investment when $MULN delists or...

And yes... this IS a revenge trade. Revenge for 2008.

Either I lose my investment when $MULN delists or...

...by some stroke of fortune, enough investors see this who are willing to LOOK at what is happening in the markets...

Decide they aren't willing to tolerate it anymore...

They buy...

They hold...

They squeeze the MM...

And they win...

This play isn't done, and I'm not leaving.

Decide they aren't willing to tolerate it anymore...

They buy...

They hold...

They squeeze the MM...

And they win...

This play isn't done, and I'm not leaving.

You are absolutely going to see a ton of people telling me that I'm a hedgie planted here to distract you.

They will claim I'm stupid; I don't know what I'm talking about.

They will attempt to discredit me daily.

Do what's right for you.

I'm staying right here. Patience =🔑

They will claim I'm stupid; I don't know what I'm talking about.

They will attempt to discredit me daily.

Do what's right for you.

I'm staying right here. Patience =🔑

@threadreaderapp unroll

@TradesTrey @matt_kohrs @masked_investor @Jonnyylove @caddude42069 @Ws_Viking @ShortTheVix1 @Katniss_Trades @TaraBull808 @unusual_whales @Xx_WiReD_xX @Ryan__Rigg @MrJGBanks @jhuntermav @_tradespotting @PeteG_5 @AlderLaneEggs

Research brought to you by #HellsTradingFloor

Research brought to you by #HellsTradingFloor

• • •

Missing some Tweet in this thread? You can try to

force a refresh