1/#Roblox (#RBLX) LT Comp Thread

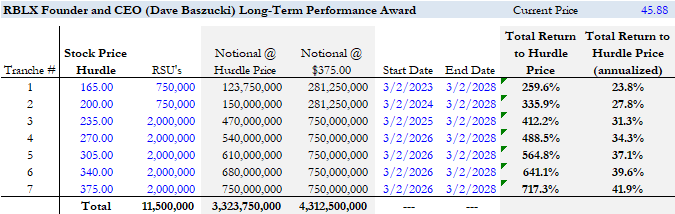

RBLX CEO David Baszucki has a $3.3-$4.3bln LT equity comp plan that pays out if #RBLX shares are $165-$375 by March 2028. David cut his base salary to $0 (prior $800k) at the IPO. All of his compensation out to 2028 is via equity/RSU/options.

RBLX CEO David Baszucki has a $3.3-$4.3bln LT equity comp plan that pays out if #RBLX shares are $165-$375 by March 2028. David cut his base salary to $0 (prior $800k) at the IPO. All of his compensation out to 2028 is via equity/RSU/options.

2/The prize is in a "Founder and CEO Long-Term Performance Award" that will grant David 11.5mln Class A shares if #RBLX exceeds seven price hurdles between $165-$375 a share by March of 2028. The notional value in RBLX shares at the hurdle price for each tranche is $3.3bln.

3/At the top end tranche #RBLX price of $375 the award is worth $4.3bln.

S-1: "Mr. Baszucki was particularly receptive to receiving the Founder and CEO Long-Term Performance Award as he believes that he should only be rewarded if we achieve significant long-term performance".

S-1: "Mr. Baszucki was particularly receptive to receiving the Founder and CEO Long-Term Performance Award as he believes that he should only be rewarded if we achieve significant long-term performance".

4/I'd be highly receptive of that arrangement too! Sign me up.

The LT award is in addition to some other outstanding options/RSU's as well as Baszucki's current ~64mln shares. Adding all together #RBLX's CEO has a large incentive to create long term value for #RBLX shareholders

The LT award is in addition to some other outstanding options/RSU's as well as Baszucki's current ~64mln shares. Adding all together #RBLX's CEO has a large incentive to create long term value for #RBLX shareholders

5/With #RBLX at ~$46/share, upside to get to the $165-$375 tranches is +260%-720% by March of 2028 (24%-42% annualized). It would also put RBLX well over $100bln-$250bln in market cap in just ~6yrs.

This would be quite the accomplishment.

#Roblox #RBLX

This would be quite the accomplishment.

#Roblox #RBLX

• • •

Missing some Tweet in this thread? You can try to

force a refresh