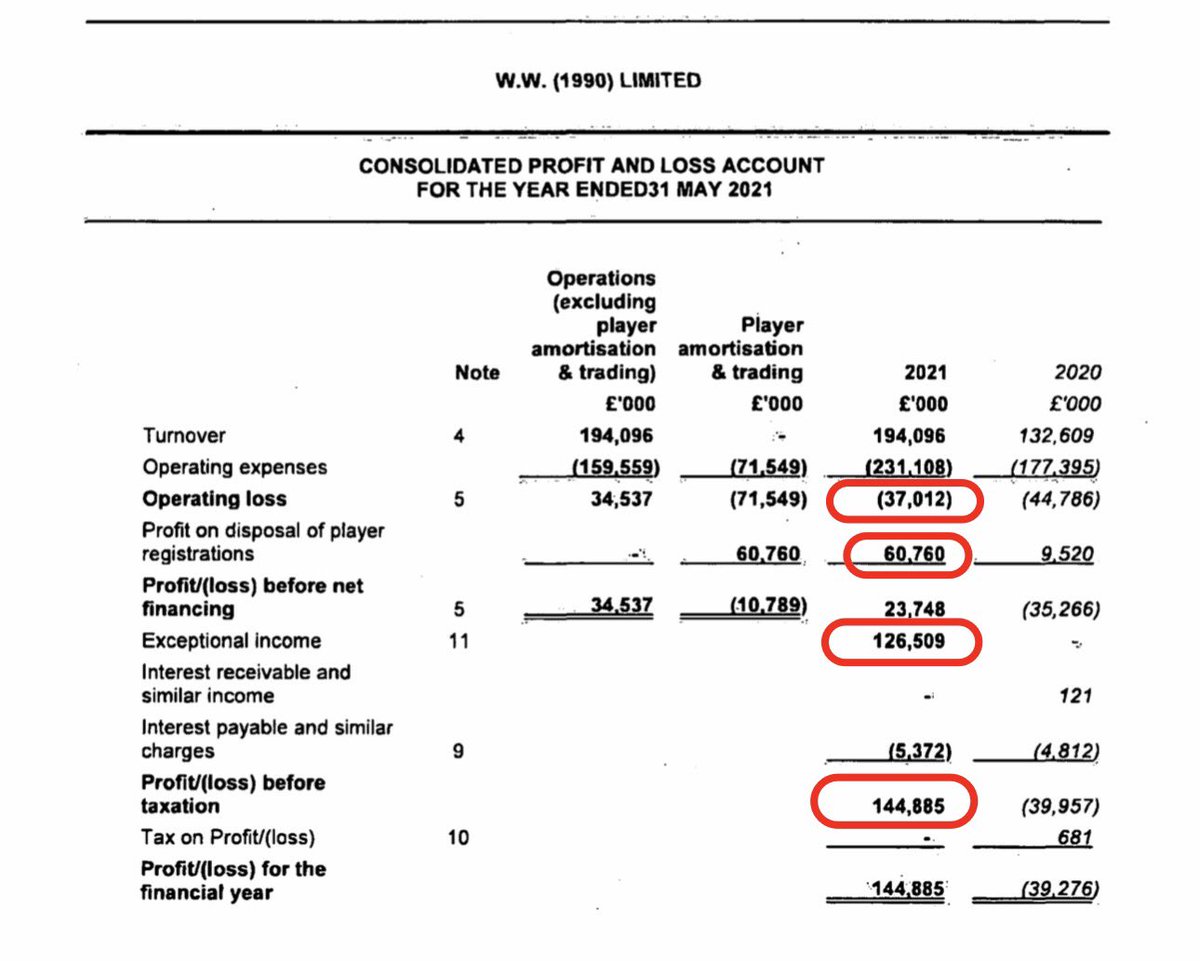

Cardiff submit 2021 accounts. Revenue up as more matches played than in previous season. Day to day losses halved to £12m although player sale profits much lower than before.

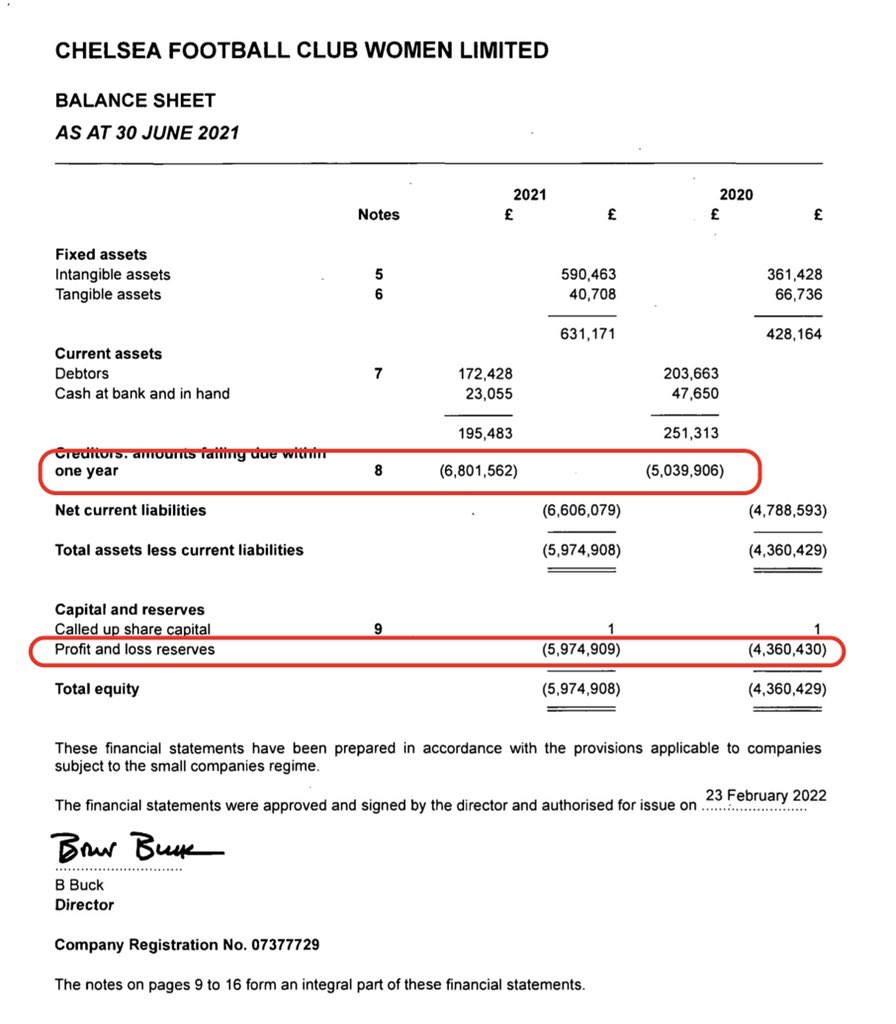

Squad book value halved to about £10m, Cardiff owe creditors £114m and have total losses over the years of £199m.

Broadcast revenue up £11.5m due to more matches played as fewer postponements due to covid. Broadcast income 88% of total. Cardiff claimed furlough of £398k. Player transfer writeoffs of over £3m in year.

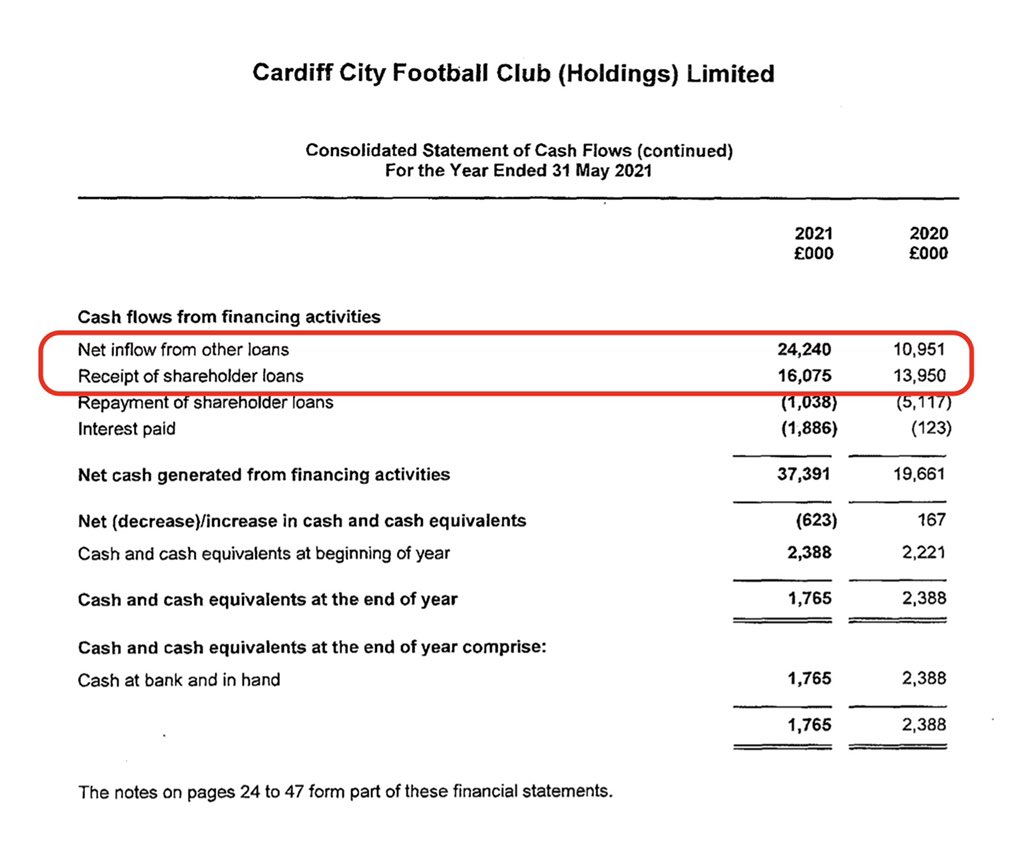

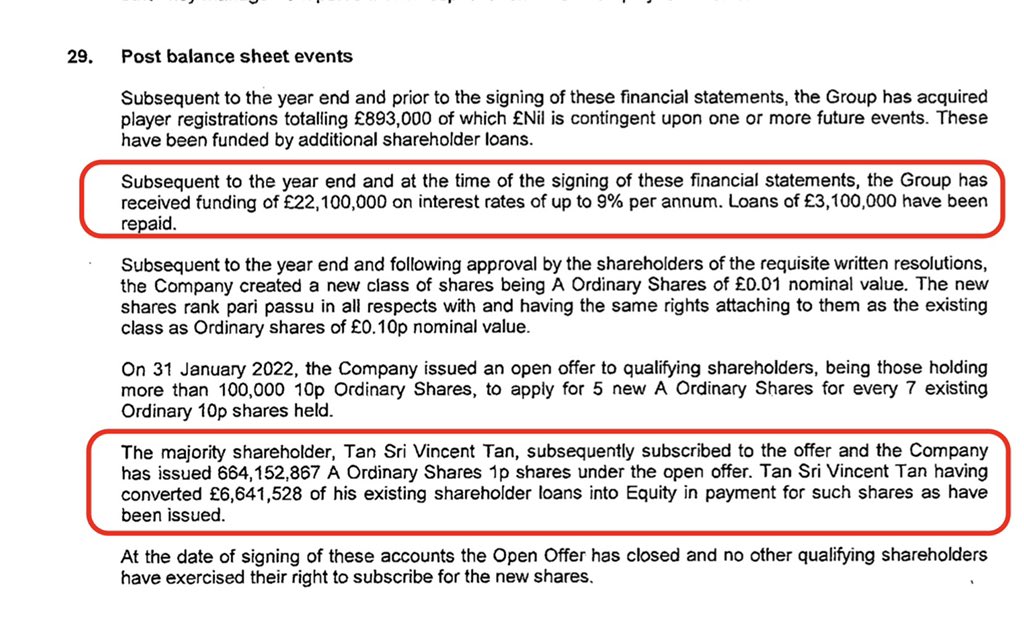

Cardiff were owed over £6m by other clubs for transfer fee instalments and owed about £93m to lenders, most of which is from shareholders and directors

Cardiff have potential add on transfers to other clubs of over £5m. Club made reference to Emiliano Sala transfer dispute but confident of winning case.

• • •

Missing some Tweet in this thread? You can try to

force a refresh