Today's Twitter threads (a Twitter thread).

Inside: How English libel law enables Russian kleptocrats; and more!

Archived at: pluralistic.net/2022/03/04/lon…

#Pluralistic 1/

Inside: How English libel law enables Russian kleptocrats; and more!

Archived at: pluralistic.net/2022/03/04/lon…

#Pluralistic 1/

Today (Mar 4) at 12h PT, I'm giving a keynote called Seize the Means of Computation at Poland's @StowAvangarda convention:

konline.ava.waw.pl/konline 2/

konline.ava.waw.pl/konline 2/

How English libel law enables Russian kleptocrats: Tories and Putin's cronies are both impedence-matched and comorbid. 3/

#20yrsago I just took a job with @EFF! web.archive.org/web/2002040322…

#15yrsago @RIAA student extortion site “looks forward to future business” web.archive.org/web/2007040223…

#15yrsago US detains 9-year-old Canadian web.archive.org/web/2007030407… 5/

#15yrsago @RIAA student extortion site “looks forward to future business” web.archive.org/web/2007040223…

#15yrsago US detains 9-year-old Canadian web.archive.org/web/2007030407… 5/

#15yrsago @Bruces: Cyber-greens are here washingtonpost.com/wp-dyn/content…

#10yrsago China Mieville’s London: the (authentic) city and the (banks and surveillance) city nytimes.com/2012/03/04/mag… 6/

#10yrsago China Mieville’s London: the (authentic) city and the (banks and surveillance) city nytimes.com/2012/03/04/mag… 6/

#5yrsago Snakisms: 22 philosophies expounded through the game of Snake pippinbarr.github.io/SNAKISMS/

#5yrsago Bavarian intelligence agency says Scientologists secretly took over one of the world’s top art galleries dw.com/en/scientologi… 7/

#5yrsago Bavarian intelligence agency says Scientologists secretly took over one of the world’s top art galleries dw.com/en/scientologi… 7/

Wednesday's threads: Defi and Shadow Banking 2.0; and more!

https://twitter.com/doctorow/status/14990382231374520458/

My latest book is Attack Surface, a sequel to my bestselling Little Brother books, now in paperback, wherever books are sold.

Signed copies at @darkdel:

darkdel.com/store/p1840/Co… 9/

Signed copies at @darkdel:

darkdel.com/store/p1840/Co… 9/

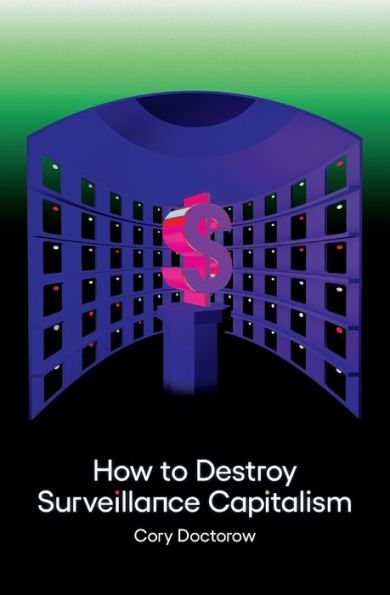

My book "How to Destroy Surveillance Capitalism" is a critique of Big Tech connecting conspiratorial thinking to the rise of tech monopolies (proposing a way to deal with both) is now out in paperback:

onezero.medium.com/how-to-destroy…

Signed copies here:

darkdel.com/store/p2024/Av… 10/

onezero.medium.com/how-to-destroy…

Signed copies here:

darkdel.com/store/p2024/Av… 10/

My ebooks and audiobooks (from @torbooks, @HoZ_Books, @mcsweeneys, and others) are for sale all over the net, but I sell 'em too, and when you buy 'em from me, I earn twice as much and you get books with no DRM and no license "agreements."

craphound.com/shop/ 11/

craphound.com/shop/ 11/

Upcoming appearances:

* Seize the Means of Computation, Konline Poland, Mar 4

konline.ava.waw.pl/konline

* Emerging Technologies For the Enterprise, Apr 19-20

2022.phillyemergingtech.com 12/

* Seize the Means of Computation, Konline Poland, Mar 4

konline.ava.waw.pl/konline

* Emerging Technologies For the Enterprise, Apr 19-20

2022.phillyemergingtech.com 12/

Recent appearances:

* The Policy Implications of Web3 (@StanfordCyber)

* Big Tech & Surveillance Capitalism (@shaunattwood):

* Bringing Back Luddites (@OhNoPodcast)

ohnopodcast.com/investigations… 13/

* The Policy Implications of Web3 (@StanfordCyber)

* Big Tech & Surveillance Capitalism (@shaunattwood):

* Bringing Back Luddites (@OhNoPodcast)

ohnopodcast.com/investigations… 13/

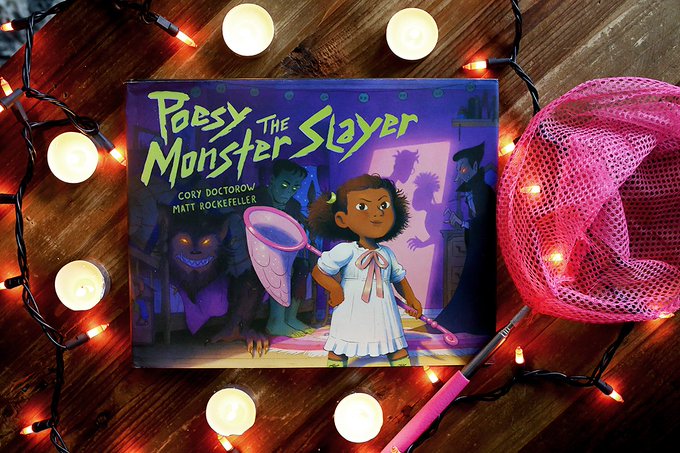

My first picture book is out! It's called Poesy the Monster Slayer and it's an epic tale of bedtime-refusal, toy-hacking and monster-hunting, illustrated by Matt @MCRockefeller. It's the monster book I dreamt of reading to my own daughter.

pluralistic.net/2020/07/14/poe… 14/

pluralistic.net/2020/07/14/poe… 14/

You can also follow these posts as a daily blog at pluralistic.net: no ads, trackers, or data-collection!

Here's today's edition: pluralistic.net/2022/03/04/lon… 15/

Here's today's edition: pluralistic.net/2022/03/04/lon… 15/

If you're a @Medium subscriber, you can read these - as well as previews of upcoming magazine columns and early exclusives on doctorow.medium.com. 16/

My latest @Medium column is: "All (Broadband) Politics Are Local: A Chance for Individuals to Make a Difference"

doctorow.medium.com/all-broadband-… 17/

doctorow.medium.com/all-broadband-… 17/

If you prefer a newsletter, subscribe to the plura-list, which is also ad- and tracker-free, and is utterly unadorned save a single daily emoji. Today's is "👢". Suggestions solicited for future emojis!

Subscribe here: pluralistic.net/plura-list 18/

Subscribe here: pluralistic.net/plura-list 18/

Are you trying to wean yourself off Big Tech? Follow these threads on the #fediverse at @pluralistic@mamot.fr.

Here's today's edition: mamot.fr/@pluralistic/1… 19/

Here's today's edition: mamot.fr/@pluralistic/1… 19/

• • •

Missing some Tweet in this thread? You can try to

force a refresh