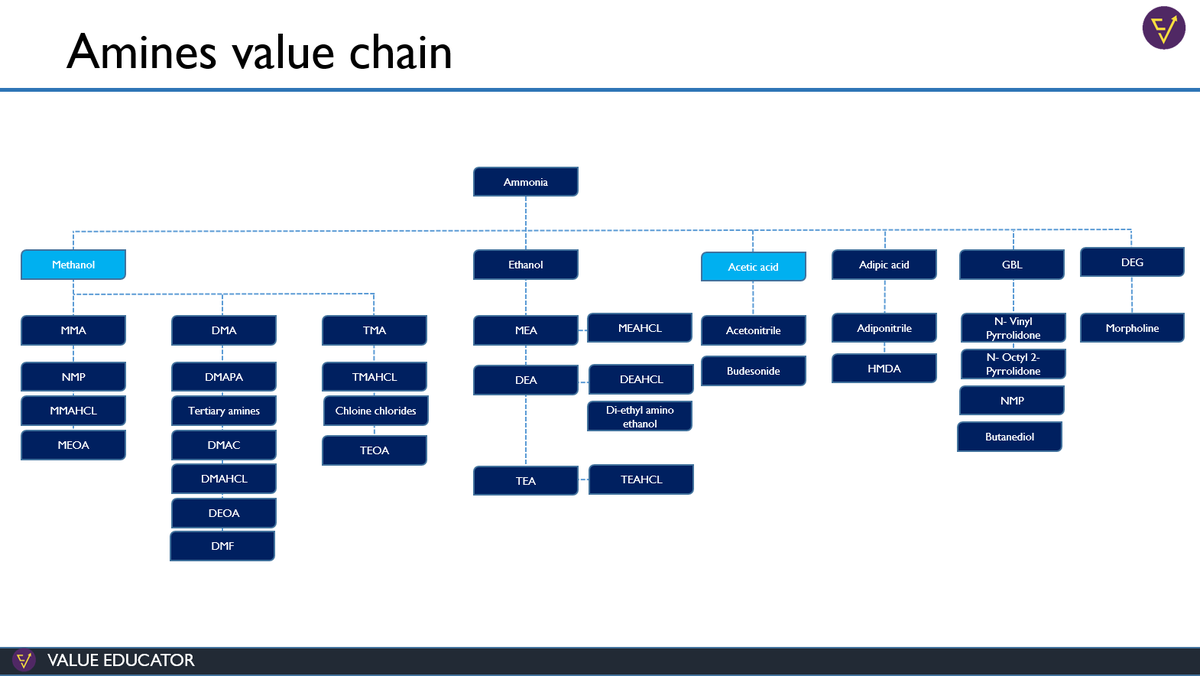

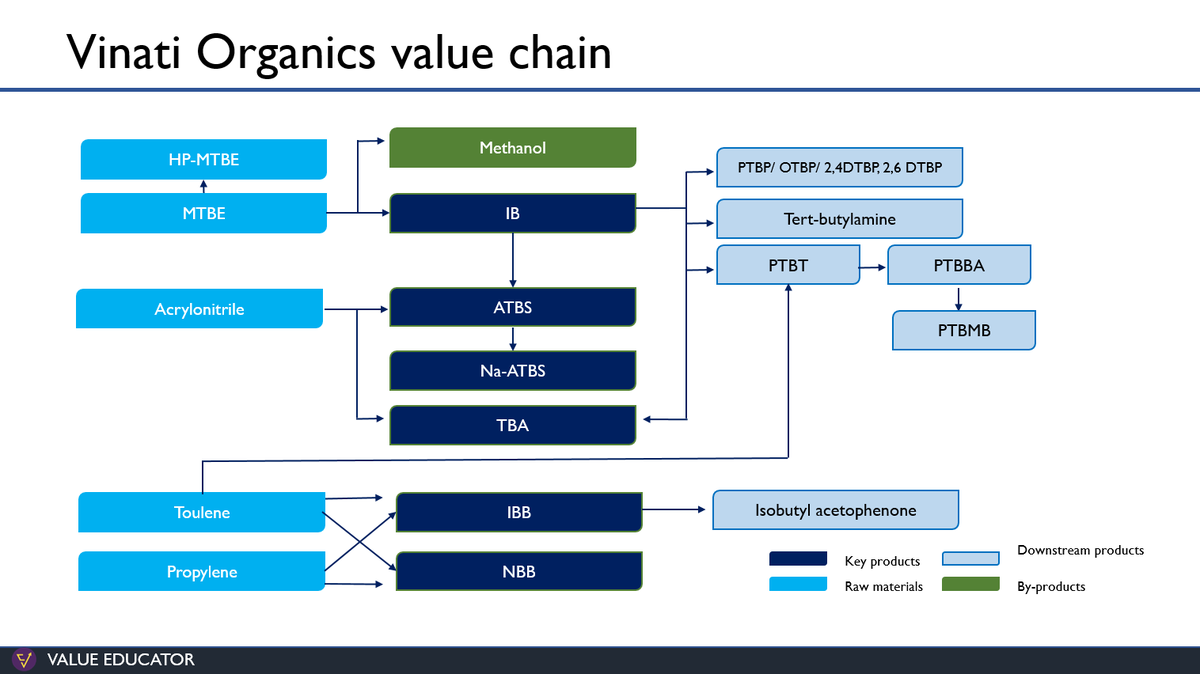

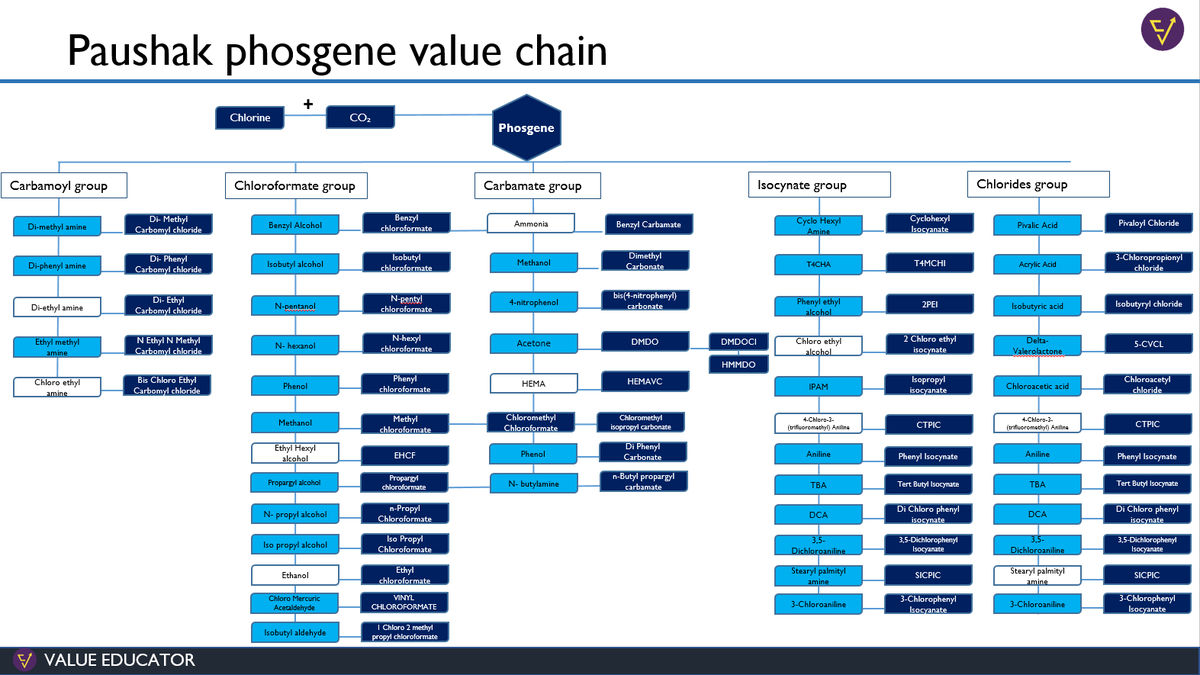

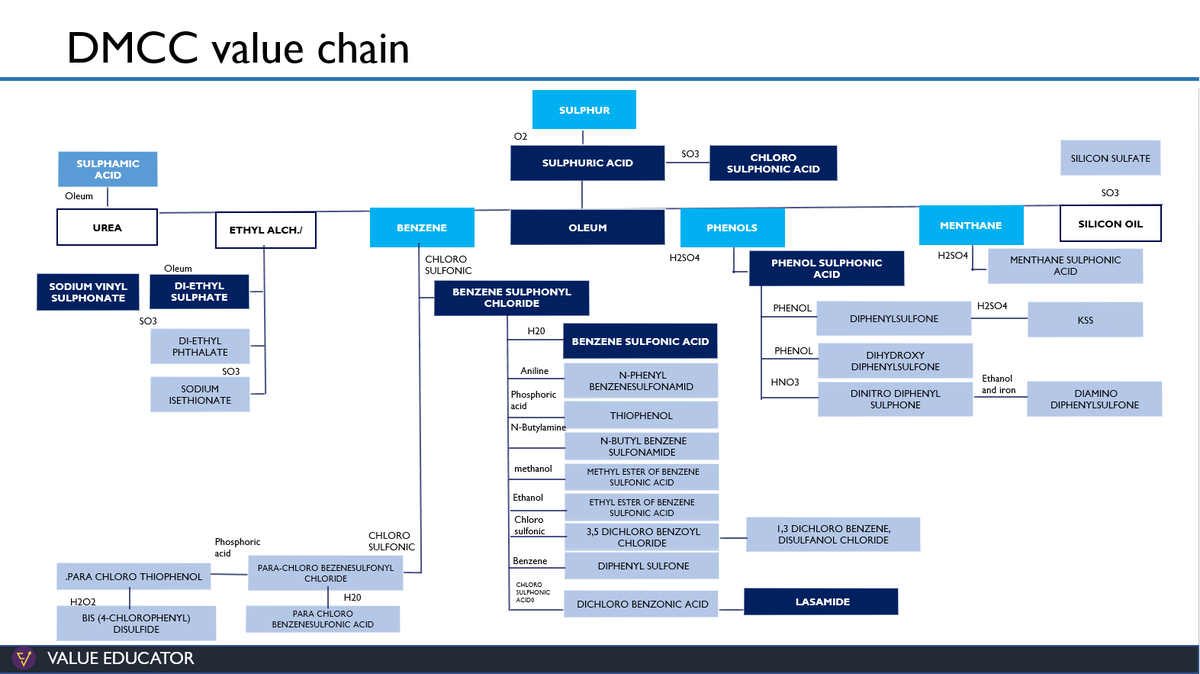

To understand the strength of a chemical business, it is very important to understand the chemistry, to understand it one should study the value chains of those businesses.

In this 🧵 we have studied value chains of various businesses

Like & Retweet for better reach 🧪👨🔬

In this 🧵 we have studied value chains of various businesses

Like & Retweet for better reach 🧪👨🔬

• • •

Missing some Tweet in this thread? You can try to

force a refresh