“Over the long-term, holding overnight has been where the bulk of returns have historically come from in the stock market versus open to close movement.”

Overnight risk is rewarded over the long-term.

Overnight risk is rewarded over the long-term.

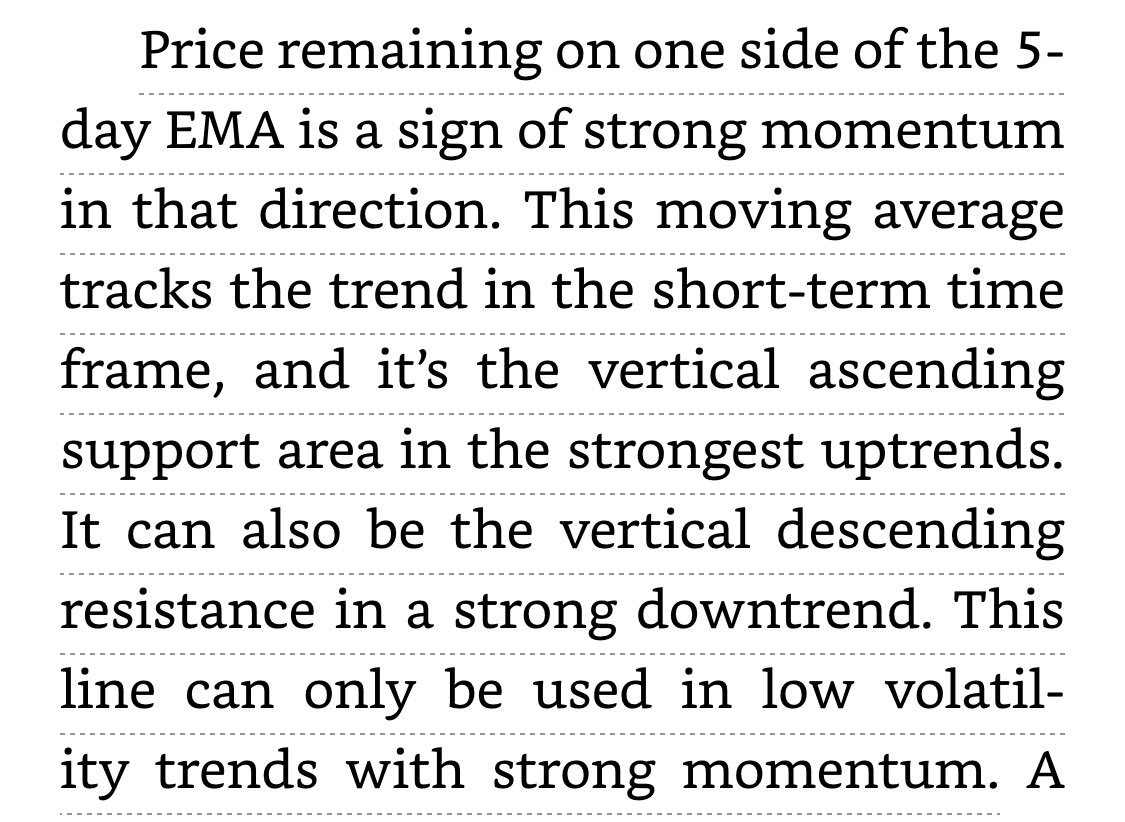

“Swing traders should focus backtesting on shorter-term moving moving averages combinations like the 5-day EMA, 10-day EMA, 20-day EMA, and 30-day EMA crossovers to capture moves in price.”

“The most important thing that a swing trader can do to be profitable is backtest their potential signals for a good risk/reward ratio before trading. It is also crucial to manage trades in real-time by minimizing losing trades and maximize winning trades.”

“The core of profitable swing trading is creating a positive expectancy trading system through risk/reward ratios. You must expect to make more than you lose after every series of ten to twenty swing trades.”

“The goal is to catch a profitable swing in price action, not be picky about how it happens.”

“Fundamentals can tell you what to trade, and technicals can tell you when to trade them.”

My rules of 20 for stocks:

EPS greater than +20% for the previous 4 quarters

Annual earnings per share over +20% for 5 years.

Price 20% from highs

+20 million share float

Institutions own +20%

ROE over +20% as it shows the company has an excellent return on capital

EPS greater than +20% for the previous 4 quarters

Annual earnings per share over +20% for 5 years.

Price 20% from highs

+20 million share float

Institutions own +20%

ROE over +20% as it shows the company has an excellent return on capital

“The key to swing trading is finding the stocks with the best tradable swings for your signals and trading style.”

“If you like to enter breakouts from trading ranges, you need stocks that have strong directional momentum. If you prefer to buy support and sell resistance, you need stocks that tend to trade inside a defined price range and have breakouts that lead to new price ranges.”

“In a bull market, a swing trader should stay focused on buying dips back to support and buying initial resistance breakouts as both price action strategies can capture swings higher in price.”

“Trade the price action of the market you are in, not your opinion about what it should be.”

Book link: amzn.to/37d34oH

Book link: amzn.to/37d34oH

• • •

Missing some Tweet in this thread? You can try to

force a refresh