Crude Impact On Chemical Sector 🧪🧪oil

Like & Retweet For Max reach !

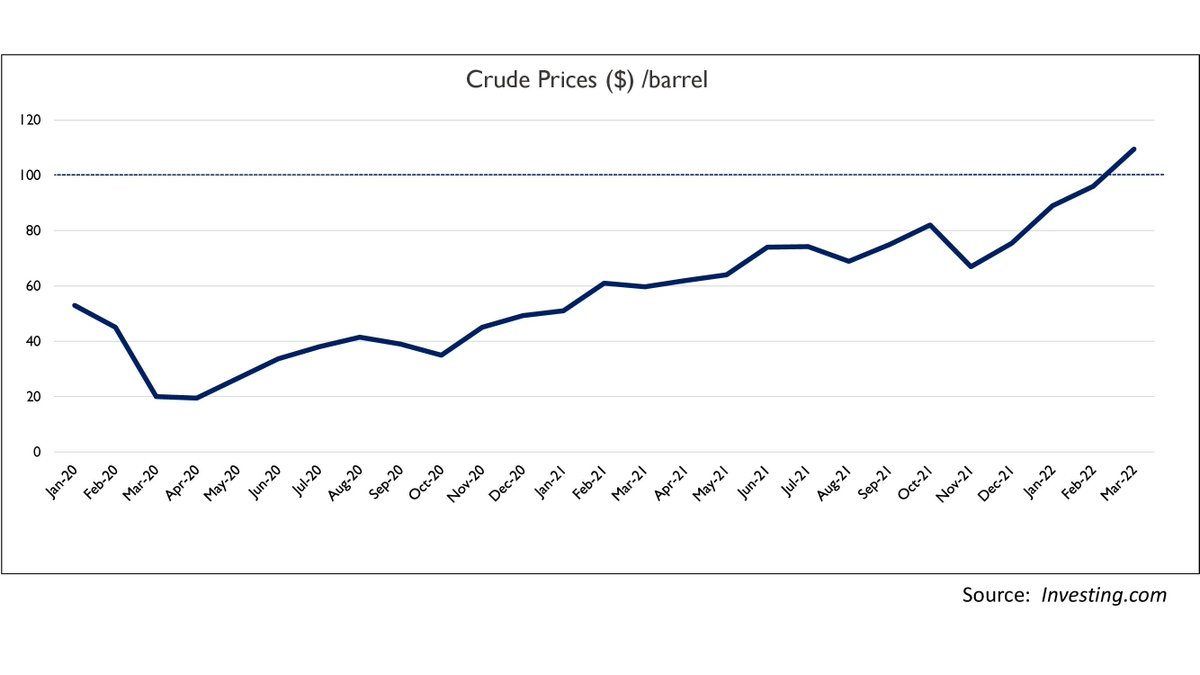

The crude oil prices have made new highs and are sustaining above 100$/ barrel levels. Due to global tensions and supply disruption challenges, the natural resource is expected to continue the uptrend.

Like & Retweet For Max reach !

The crude oil prices have made new highs and are sustaining above 100$/ barrel levels. Due to global tensions and supply disruption challenges, the natural resource is expected to continue the uptrend.

The uptrend in crude oil prices will have a direct impact on the petrochemical derivatives and downstream products of crude oil, thus impacting the margins in the chemical sector.

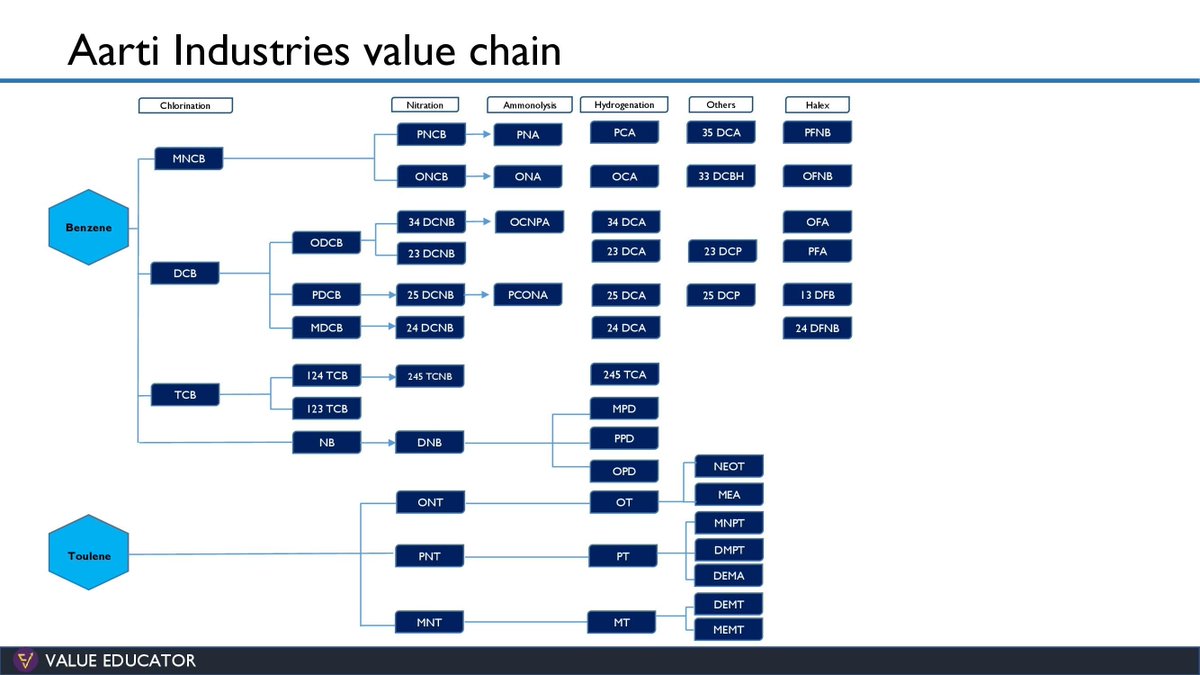

The aromatic compounds such as benzene, toluene, xylene etc are direct petrochemical derivatives, thus higher dependency of the chemical companies on the petrochemical value chain will result in margin erosion.

To understand the impact of crude prices on margins, we should understand value chains of them.

#Aartiindustries ltd uses benzene and toluene as their key starting materials to manufacture the forward integrated products. For example, PNCB is used by pharmaceutical companies to manufacture Para amino phenol which is an Intermediate for paracetamol.

So the incremental prices will be absorbed by the PNCB manufacturers and might be passed on with a lag in quarter.

The #vinatiorganics ltd have their value chain starting from acrylonitrile, toluene and propylene, all belonging to the petrochemical family. The acrylonitrile is used to manufacture the key export product for vinati i,e ATBS.

With the increase in crude prices and freight cost, margins for the products might be volatile. If we look at the raw material cost as a percentage of revenue, the contribution has increased from the range of 40-45% to 50-55% mark.

#Valiantorganics ltd have benzene and phenols as KSM thus as discussed above the margins will take the hit. Valiant is one of the intermediate manufacturers for paracetamol drugs. Valiant organics manufacturing PAP from PNCB while chloro phenols are manufactured from phenol

#Deepaknitrite ltd is largely dependent on the petrochemical derivative as it uses toluene, benzene, xylene, E-hexanol and other derivatives as KSM. The margins could be sustainable only if they pass on the prices.

The diversified value chain will drive the revenues however margins sustainability is expected to be low.

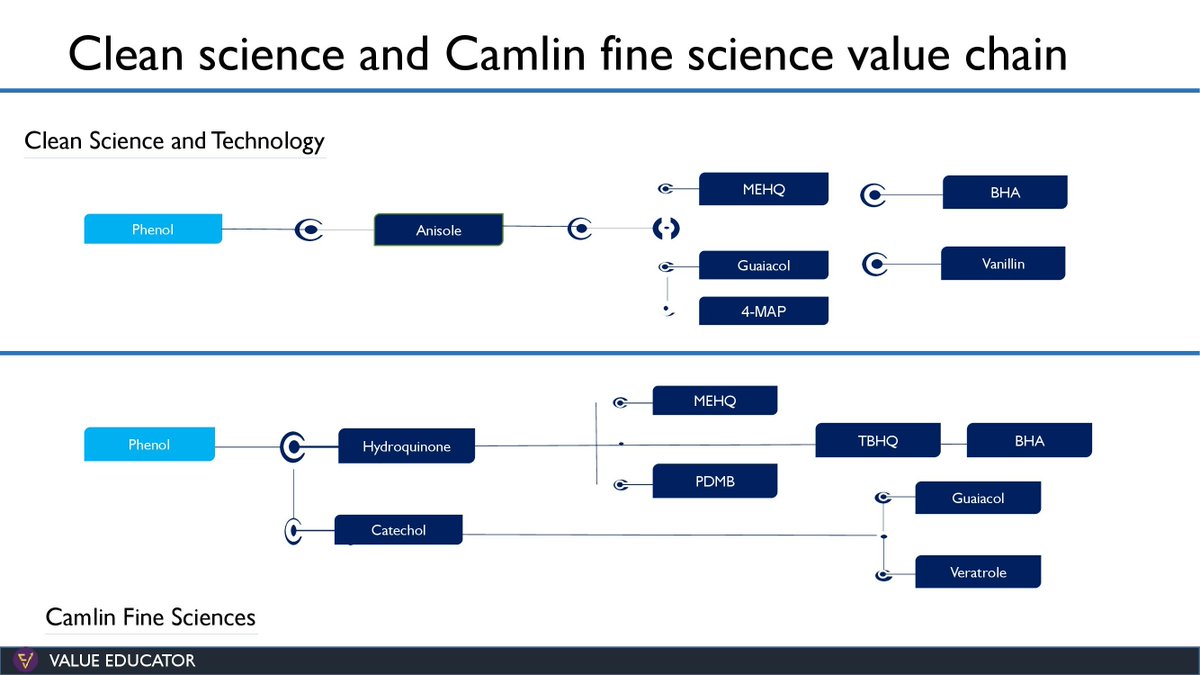

The #Cleanscienced and #Camlinfinescience both have similar value chains. The products manufactured are the same with the KSM being phenol, however the process is different. CSTL uses anisole route whereas CFS uses hydroquinone route.

The CFS stands at a competitive disadvantage as margins in anisole route seems to be higher. With increase in prices and competitive disadvantage, camlin is expected to have more hit in profitability compared to clean sciences.

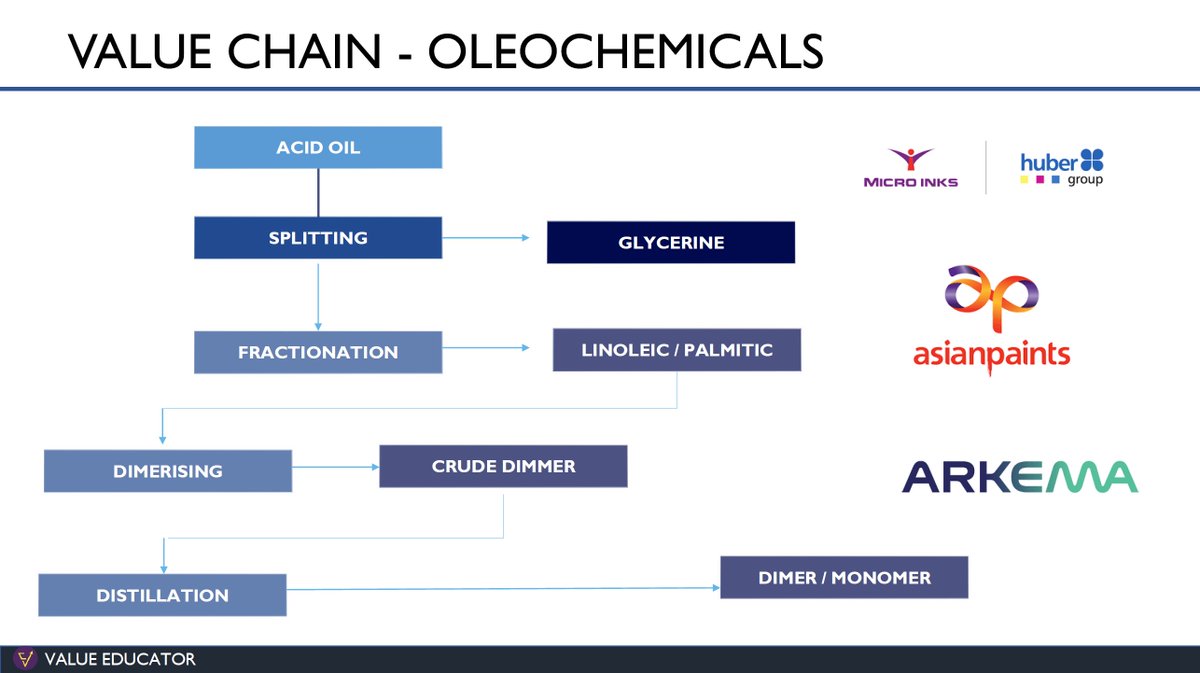

#FairchemOrganics is dependent on the vegetable, soybean and palm oil as KSM, but it is been observed that as the crude oil prices rises, the rule of elasticity comes in and consumers shift from petrochemicals to oleochemicals thus driving the prices of vegetable and pam oils.

#FineOrganics Raw material is palm oil. Palm oil also follows the similar trend of crude, so it is expected that margins of fine organics may get impacted.

The halogen chemistry of fluorine is not related to crude derivatives as the KSM is hydrogen fluoride (HF) which is derived from fluorspar. The company follows the elemental products strategy where the KSM is fluorine but the other reactants are functional groups such as phenols

and alcohols which are derivatives of crude. Thus the margins for companies like Navin fluorine international ltd, SRF and Gujarat fluorochemicals will be impacted but not on the steep curve.

The amines belong to the functional group of carbon and hydrogen chains. The organic chemistry will be affected by crude prices as ammonia is reacted with alkyl halides to manufacture amines.

Alkyl amines ltd and Balaji amines ltd will experience contraction in margins if the incremental prices are not passed on successfully.

The Paushak ltd uses Chlorine and carbon monoxide as KSM to manufacture phosgene, however the other reactants used are petrochemical derivatives which will impact the cost of production for a few products. The monopolistic competition might help in retaining the margins.

The Neogen chemicals ltd have the value chain of bromine. The bromine is derived from brine which is not a crude derivative, but functional groups of alcohols and aromatic compounds will impact the profitability. Neogen chemicals have a competitive advantage over Chinese bromine

manufacturers because of low availability of brine in china. Besides, the increase of revenue contribution from CSM business gives visibility for sustainable margins.

• • •

Missing some Tweet in this thread? You can try to

force a refresh