China’s markets are imploding. Why? Because the priority is common prosperity – not protecting profits for Western investors. Here’s what to watch 🧵 1/5

“What we are experiencing is a seismic shift in the ownership of Chinese stocks. US institutional investors are still major players… But look at what’s been happening: Chinese investors have been buying on dip” writes @shuli_ren 2/5

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

Hong Kong stocks haven’t been this oversold since 1987 -- the Hang Seng Index’s 14-day RSI, which helps measure whether an asset is in so-called overbought or oversold territory, plunged to 15. This hasn’t happened since the Wall Street crash. 3/5

Via @KevinKingsbury

Via @KevinKingsbury

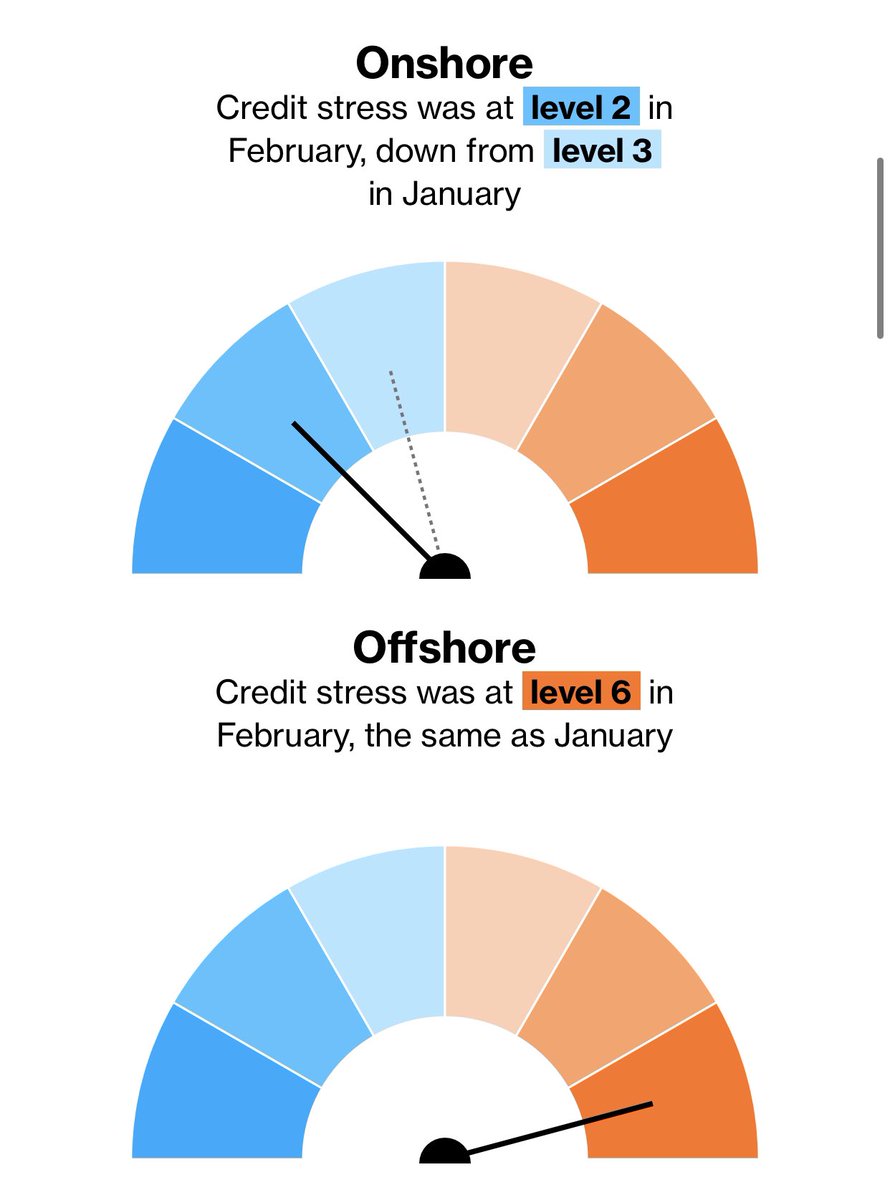

China’s offshore junk bond market is a sign of things to come – authorities obliterated what was once one of the most profitable trades for global investors. More than half developer HY bonds trade at less than 50c on the dollar. Onshore credit, by comparison, has been fine. 4/5

Meanwhile -- China’s credit-default swap levels are at their highest since early 2020 during the pandemic. More lockdowns, a slowing economy and worries over China’s entanglement Russia’s war in Ukraine is intensifying pressure. 5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh