(1/16)

Monetary Tightening-

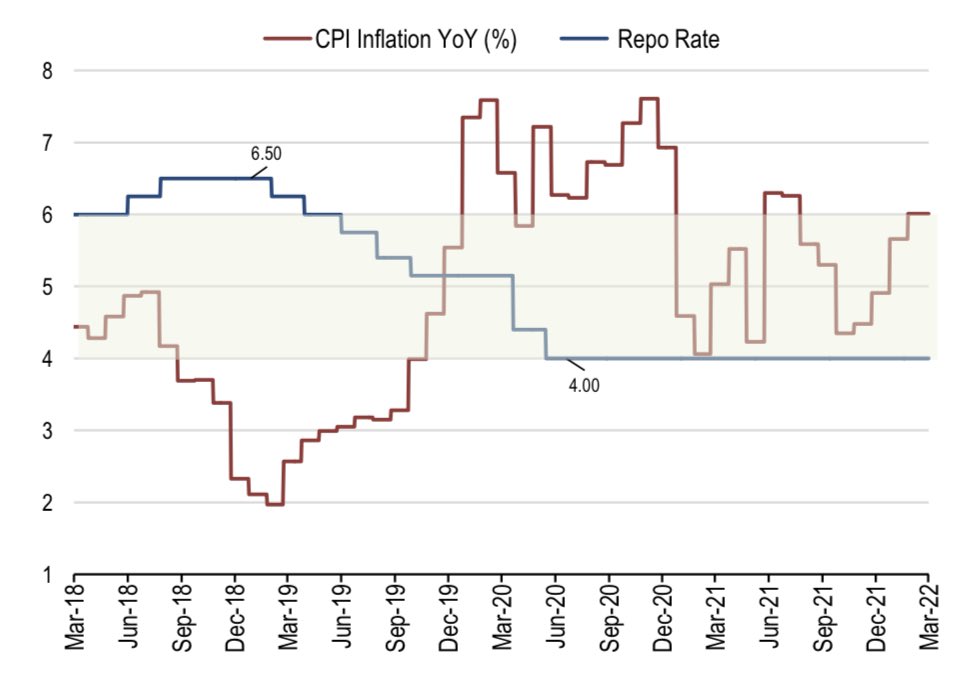

• Higher commodity prices and ongoing currency devaluation will push inflation and accelerate monetary tightening.

• Over the past year, inflation has largely remained near 6% & has been inching up beyond that in recent data.

Monetary Tightening-

• Higher commodity prices and ongoing currency devaluation will push inflation and accelerate monetary tightening.

• Over the past year, inflation has largely remained near 6% & has been inching up beyond that in recent data.

(2/16)

• Surplus Liquidity-

The system has been in surplus liquidity since FY20.

The RBI had gradually begun absorbing liquidity since Dec-2021 and now if inflation spirals up, it will be forced to accelerate monetary tightening.

• Surplus Liquidity-

The system has been in surplus liquidity since FY20.

The RBI had gradually begun absorbing liquidity since Dec-2021 and now if inflation spirals up, it will be forced to accelerate monetary tightening.

(3/16)

Energy imports-

How does it affect banks?

India is dependent on imports for its energy needs (>4% of GDP). Higher crude prices would add to inflationary pressures.

This can force RBI to use its monetary hand to curb demand side inflation by cutting down on credit.

Energy imports-

How does it affect banks?

India is dependent on imports for its energy needs (>4% of GDP). Higher crude prices would add to inflationary pressures.

This can force RBI to use its monetary hand to curb demand side inflation by cutting down on credit.

(4/16)

Credit Growth-

Credit growth was up by 9% in Q3FY22 on YOY basis. It was primarily driven by Retail and SME sector.

However, higher inflation & commodity prices can put a dent on the growth. And we can see a pullback mainly in Auto and housing sector.

Credit Growth-

Credit growth was up by 9% in Q3FY22 on YOY basis. It was primarily driven by Retail and SME sector.

However, higher inflation & commodity prices can put a dent on the growth. And we can see a pullback mainly in Auto and housing sector.

(5/16)

Why Auto & SME are important for Finance sector?

1. Auto and SME loans make up 15-35% of loans

2. Auto loans make up a huge part of total loans in NBFCs. Some NBFCs have more than 90% exposure in Auto

3. SME loans also constitute a big part in NBFCs

Why Auto & SME are important for Finance sector?

1. Auto and SME loans make up 15-35% of loans

2. Auto loans make up a huge part of total loans in NBFCs. Some NBFCs have more than 90% exposure in Auto

3. SME loans also constitute a big part in NBFCs

(6/16)

A look at Home Loans-

Home loans have seen healthy growth over the past couple of years (10-30% of loan books for the banks). With the potential rise in rates and uncertainty over future rate increases, we may see some impact on loan demand.

A look at Home Loans-

Home loans have seen healthy growth over the past couple of years (10-30% of loan books for the banks). With the potential rise in rates and uncertainty over future rate increases, we may see some impact on loan demand.

(7/16)

Maintaining Asset Quality-

Key reason for the expectation of stable retail asset quality is that banks have undergone through 2 COVID waves where most of the weak accounts have slipped. Also, fresh lending in segments like unsecured was held back by large players.

Maintaining Asset Quality-

Key reason for the expectation of stable retail asset quality is that banks have undergone through 2 COVID waves where most of the weak accounts have slipped. Also, fresh lending in segments like unsecured was held back by large players.

(8/16)

A look at Corporate Profitability-

1. Corporate Profitability is expected to trim down due to rise in input prices.

2. But Corporates have been deleveraging consistently which will reduce the risk.

3. Aggregate Interest Coverage Ratio is also at a 10 year high!

A look at Corporate Profitability-

1. Corporate Profitability is expected to trim down due to rise in input prices.

2. But Corporates have been deleveraging consistently which will reduce the risk.

3. Aggregate Interest Coverage Ratio is also at a 10 year high!

(9/16)

Other Data

1. NPA coverage is healthy across banks

2. Stressed loans for NBFCs are still 5-10% above pre- Covid levels

3. Provision coverage is above pre-Covid for most of the NBFCs

4. Liquidity buffer for the NBFCs is healthy

Other Data

1. NPA coverage is healthy across banks

2. Stressed loans for NBFCs are still 5-10% above pre- Covid levels

3. Provision coverage is above pre-Covid for most of the NBFCs

4. Liquidity buffer for the NBFCs is healthy

(10/16)

Funding Costs-

Funding costs have fallen sharply over the past 2 years, with the cost of deposits down ~1.5% & now < 4% for the larger banks. The cost of deposits for smaller banks remains 1-1.5% higher vs the larger banks.

Funding Costs-

Funding costs have fallen sharply over the past 2 years, with the cost of deposits down ~1.5% & now < 4% for the larger banks. The cost of deposits for smaller banks remains 1-1.5% higher vs the larger banks.

(11/16)

Savings Account Growth-

Banks have seen strong CASA growth, with the CASA share increasing YoY to 45-50% for most banks. Smaller banks continue to offer premium rates on savings deposits, aiding faster improvement in Savings account growth.

Savings Account Growth-

Banks have seen strong CASA growth, with the CASA share increasing YoY to 45-50% for most banks. Smaller banks continue to offer premium rates on savings deposits, aiding faster improvement in Savings account growth.

(12/16)

Banks carry adequate liquidity buffers-

In the face of Covid-19 uncertainty, banks had ramped up liquidity buffers much above the regulatory requirement of 100% and even with some drawdown in 3Q22 with improving growth, they continue to carry surplus LCRs at 120-160%.

Banks carry adequate liquidity buffers-

In the face of Covid-19 uncertainty, banks had ramped up liquidity buffers much above the regulatory requirement of 100% and even with some drawdown in 3Q22 with improving growth, they continue to carry surplus LCRs at 120-160%.

(13/16)

What led to the underperformance of the Banking Sector-

1. Higher FII ownership has directly impacted the stock price, as we saw a huge FII outflow.

2. Higher rates expectations may have been largely priced in

What led to the underperformance of the Banking Sector-

1. Higher FII ownership has directly impacted the stock price, as we saw a huge FII outflow.

2. Higher rates expectations may have been largely priced in

(14/16)

Attractive Valuations-

Valuations are at a discount to 5year average for most banks except ICICI despite the healthy outlook on asset quality.

Even in case of monetary tightening,large private banks with strong NIM outlook and healthy asset quality looks attractive.

Attractive Valuations-

Valuations are at a discount to 5year average for most banks except ICICI despite the healthy outlook on asset quality.

Even in case of monetary tightening,large private banks with strong NIM outlook and healthy asset quality looks attractive.

(15/16)

Conclusion-

We last saw rising rates in Mar-2010, when the repo rate increased by 375bp over 18 months to 8.5%. Even during that period, the banking system continued to see healthy growth of 15-20% from FY09-14.

So is there any reason to worry now?

Conclusion-

We last saw rising rates in Mar-2010, when the repo rate increased by 375bp over 18 months to 8.5%. Even during that period, the banking system continued to see healthy growth of 15-20% from FY09-14.

So is there any reason to worry now?

(16/16)

Which bank do you think will outperform the rest?

@caniravkaria @ishmohit1 @AvadhMaheshwar2 @mehrotra_saket @harshmadhusudan @ArjunB9591 @datta_arvind @AnishA_Moonka

Comment down below!

Which bank do you think will outperform the rest?

@caniravkaria @ishmohit1 @AvadhMaheshwar2 @mehrotra_saket @harshmadhusudan @ArjunB9591 @datta_arvind @AnishA_Moonka

Comment down below!

• • •

Missing some Tweet in this thread? You can try to

force a refresh