1/

Get a cup of coffee.

In this thread, I'll walk you through the economics of an internet newsletter.

If you want to start your own newsletter (or are just curious about what it takes to run one), this thread will give you some useful pointers.

Get a cup of coffee.

In this thread, I'll walk you through the economics of an internet newsletter.

If you want to start your own newsletter (or are just curious about what it takes to run one), this thread will give you some useful pointers.

2/

These days, it seems like everybody has a newsletter to plug.

And with platforms like Substack, Medium, Beehiiv, Revue, Ghost, etc., setting up a newsletter has never been easier.

These days, it seems like everybody has a newsletter to plug.

And with platforms like Substack, Medium, Beehiiv, Revue, Ghost, etc., setting up a newsletter has never been easier.

3/

Previously, only large publications (eg, National Geographic, Time Magazine, etc.) could scale to worldwide audiences.

But today, thanks to the internet, a motivated *individual* who has unique insights can aspire to that same reach.

Previously, only large publications (eg, National Geographic, Time Magazine, etc.) could scale to worldwide audiences.

But today, thanks to the internet, a motivated *individual* who has unique insights can aspire to that same reach.

4/

The internet has made it relatively easy to:

a) Find a worldwide audience of people interested in a "niche" area,

b) Distribute content to this audience cheaply, and

c) Collect money from this audience (or monetize via ads, etc.) securely, with only a small overhead.

The internet has made it relatively easy to:

a) Find a worldwide audience of people interested in a "niche" area,

b) Distribute content to this audience cheaply, and

c) Collect money from this audience (or monetize via ads, etc.) securely, with only a small overhead.

5/

These conditions, of course, are ripe for newsletters to thrive. So, we're seeing a whole bunch of them.

Also, from the standpoint of those who are *writing* these newsletters, they can look like a very attractive business or side gig -- both operationally and financially.

These conditions, of course, are ripe for newsletters to thrive. So, we're seeing a whole bunch of them.

Also, from the standpoint of those who are *writing* these newsletters, they can look like a very attractive business or side gig -- both operationally and financially.

6/

For one thing, a newsletter doesn't require much *capital* to start.

Anyone who has a laptop (or even a smartphone) and an internet connection can start a newsletter.

In investing parlance, this is the ultimate "capital light" business.

For one thing, a newsletter doesn't require much *capital* to start.

Anyone who has a laptop (or even a smartphone) and an internet connection can start a newsletter.

In investing parlance, this is the ultimate "capital light" business.

7/

Second, newsletters have super high operating margins.

For every $100 collected from paying subscribers, maybe the platform (eg, Substack) takes $10. Credit card processing is perhaps another $5. Miscellaneous expenses may be another $5.

That's an 80% operating margin!

Second, newsletters have super high operating margins.

For every $100 collected from paying subscribers, maybe the platform (eg, Substack) takes $10. Credit card processing is perhaps another $5. Miscellaneous expenses may be another $5.

That's an 80% operating margin!

8/

Moreover, all the operating margin is generated in *cash*.

Subscribers typically pre-pay. So, there are no receivables.

And there's no physical goods changing hands. So, no inventory.

And we have almost no fixed assets. So, ~zero capex.

It's all Free Cash Flow!

Moreover, all the operating margin is generated in *cash*.

Subscribers typically pre-pay. So, there are no receivables.

And there's no physical goods changing hands. So, no inventory.

And we have almost no fixed assets. So, ~zero capex.

It's all Free Cash Flow!

9/

Plus, the business is highly *scalable*.

Writing a newsletter for 10,000 subscribers takes roughly the same effort as writing one for 1,000 subscribers.

And platforms like Substack can comfortably handle such loads, with almost no technical know-how on the writer's part.

Plus, the business is highly *scalable*.

Writing a newsletter for 10,000 subscribers takes roughly the same effort as writing one for 1,000 subscribers.

And platforms like Substack can comfortably handle such loads, with almost no technical know-how on the writer's part.

10/

And IF a newsletter "takes off", there's potential to generate pretty significant cash for the writer.

It's a "low risk, high reward" type bet.

For example, if a newsletter gets 2,000 subscribers paying $10/month, that's $192K/year pre-tax (at our 80% operating margin).

And IF a newsletter "takes off", there's potential to generate pretty significant cash for the writer.

It's a "low risk, high reward" type bet.

For example, if a newsletter gets 2,000 subscribers paying $10/month, that's $192K/year pre-tax (at our 80% operating margin).

11/

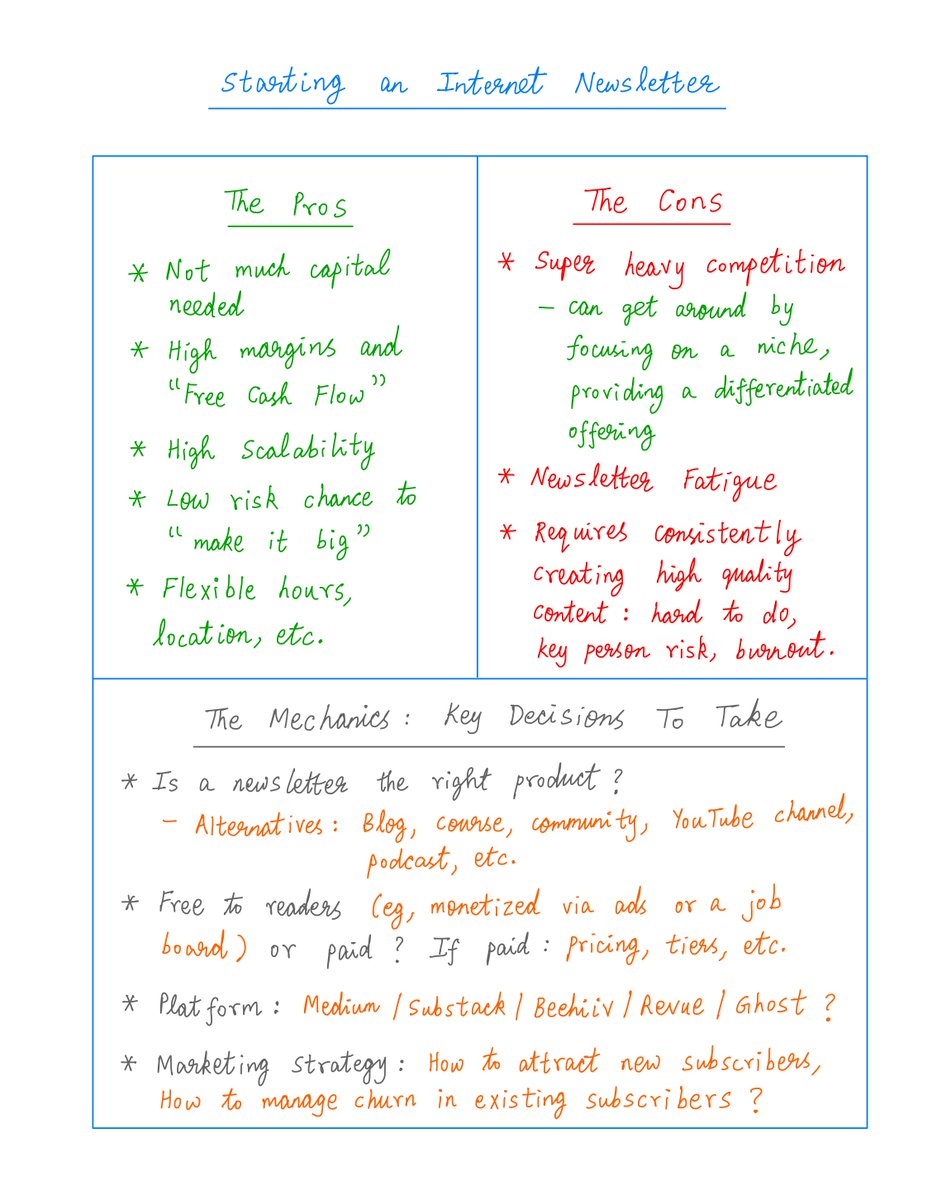

So, we have:

- Capital lightness,

- High operating margins,

- Great Free Cash Flow conversion,

- High scalability, and

- The possibility of "taking off".

Plus, work hours are flexible and the business can be run from virtually anywhere in the world.

These are the "pros".

So, we have:

- Capital lightness,

- High operating margins,

- Great Free Cash Flow conversion,

- High scalability, and

- The possibility of "taking off".

Plus, work hours are flexible and the business can be run from virtually anywhere in the world.

These are the "pros".

12/

But of course, many people have realized that newsletters have these favorable financial and operational characteristics.

So, there's heavy competition.

There's a ton of newsletters out there. And they're all hoping to capture a slice of this economic pie.

But of course, many people have realized that newsletters have these favorable financial and operational characteristics.

So, there's heavy competition.

There's a ton of newsletters out there. And they're all hoping to capture a slice of this economic pie.

13/

For a newsletter to succeed in this competitive environment, it should STAND OUT.

For example, it could focus on a niche area not served by many other newsletters.

And the writer should consistently share unique and interesting insights to keep the audience engaged.

For a newsletter to succeed in this competitive environment, it should STAND OUT.

For example, it could focus on a niche area not served by many other newsletters.

And the writer should consistently share unique and interesting insights to keep the audience engaged.

14/

This is a "risk" with newsletters.

For the *writer*, it's NOT a "create once, monetize forever" type deal. Unlike writing a book. Or producing a TV show.

No, with a newsletter, the writer has to create great content *consistently* -- week after week, month after month.

This is a "risk" with newsletters.

For the *writer*, it's NOT a "create once, monetize forever" type deal. Unlike writing a book. Or producing a TV show.

No, with a newsletter, the writer has to create great content *consistently* -- week after week, month after month.

15/

And for most people, that's very difficult.

Without a constant stream of great content, subscribers will start canceling their subscriptions -- ie, "churn".

And if this churn is not offset by new subscribers, the business will eventually die.

And for most people, that's very difficult.

Without a constant stream of great content, subscribers will start canceling their subscriptions -- ie, "churn".

And if this churn is not offset by new subscribers, the business will eventually die.

15/

So, we have:

- Heavy competition,

- Need for *consistently* great content, which is difficult for most writers, and

- Need to continuously offset churn with new subscribers, which requires great content and a good marketing strategy.

These are the "cons".

So, we have:

- Heavy competition,

- Need for *consistently* great content, which is difficult for most writers, and

- Need to continuously offset churn with new subscribers, which requires great content and a good marketing strategy.

These are the "cons".

16/

To learn more about starting/running a newsletter, I recommend listening to this ~50 min @InfiniteL88ps episode featuring Linda Lebrun (@SubstackLinda).

Linda works at Substack, and is super thoughtful and knowledgeable.

(h/t @jposhaughnessy)

infiniteloopspodcast.com/linda-lebrun-t…

To learn more about starting/running a newsletter, I recommend listening to this ~50 min @InfiniteL88ps episode featuring Linda Lebrun (@SubstackLinda).

Linda works at Substack, and is super thoughtful and knowledgeable.

(h/t @jposhaughnessy)

infiniteloopspodcast.com/linda-lebrun-t…

17/

And later today (Sun, Mar 20, at 1pm ET), we'll have the wonderful Riz (@borrowed_ideas) on Money Concepts.

Starting from scratch, Riz has built a successful investing newsletter (MBI Deep Dives), with ~1500 subscribers and ~$168K in annual revenue.

callin.com/link/tsqnWnhukc

And later today (Sun, Mar 20, at 1pm ET), we'll have the wonderful Riz (@borrowed_ideas) on Money Concepts.

Starting from scratch, Riz has built a successful investing newsletter (MBI Deep Dives), with ~1500 subscribers and ~$168K in annual revenue.

callin.com/link/tsqnWnhukc

18/

Each month, Riz takes a company and analyzes it in detail -- its economic characteristics, moat, future prospects, valuation, etc.

He then shares this analysis with his newsletter subscribers.

You can subscribe to Riz here ($12/month, $100/year):

mbi-deepdives.com/plans/subscrib…

Each month, Riz takes a company and analyzes it in detail -- its economic characteristics, moat, future prospects, valuation, etc.

He then shares this analysis with his newsletter subscribers.

You can subscribe to Riz here ($12/month, $100/year):

mbi-deepdives.com/plans/subscrib…

19/

If you're still with me, thank you very much!

I hope this thread helped you appreciate both the opportunities and the challenges that come with running a newsletter.

Please stay safe. Enjoy your weekend!

/End

If you're still with me, thank you very much!

I hope this thread helped you appreciate both the opportunities and the challenges that come with running a newsletter.

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh