Folks, here's our Money Concepts episode on Value vs Growth -- and why Buffett says Value and Growth are "joined at the hip".

It's ~1 hour, 45 minutes of audio.

If that's too much, please scroll down for the key highlights!

Link: callin.com/link/xIhjVCyqNM

It's ~1 hour, 45 minutes of audio.

If that's too much, please scroll down for the key highlights!

Link: callin.com/link/xIhjVCyqNM

As investors, it's key to understand that NOT all growth is "good".

Sometimes, Growth *creates* Value.

Other times, Growth *destroys* Value. This typically happens when Growth comes at the cost of too much *Capital*.

Sometimes, Growth *creates* Value.

Other times, Growth *destroys* Value. This typically happens when Growth comes at the cost of too much *Capital*.

So, the first concept to understand is this:

Growth is NOT free. It almost always requires *Capital*.

Here's a couple of examples. Starbucks and Tesla:

Growth is NOT free. It almost always requires *Capital*.

Here's a couple of examples. Starbucks and Tesla:

In most *traditional* businesses, the Capital required for Growth typically takes 2 forms:

1) Working Capital, and

2) Fixed Assets.

1) Working Capital, and

2) Fixed Assets.

But in many *modern* businesses (eg, software and subscription businesses), the Capital required for Growth takes the form of:

1) Sales & Marketing, and

2) R & D expenses.

These investments DON'T show up on the Balance Sheet.

Instead, they go through the Income Statement.

1) Sales & Marketing, and

2) R & D expenses.

These investments DON'T show up on the Balance Sheet.

Instead, they go through the Income Statement.

Here's a "Tale of 3 Businesses" that I constructed to illustrate how Growth can either *create* or *destroy* value.

I'm narrating it in 6 parts because Twitter doesn't allow me to upload videos longer than 2 minutes and 20 seconds.

Part 1 of 6.

I'm narrating it in 6 parts because Twitter doesn't allow me to upload videos longer than 2 minutes and 20 seconds.

Part 1 of 6.

Part 2 of 6.

Part 3 of 6.

Part 4 of 6.

Part 5 of 6.

Part 6 of 6.

I hope this gave you a greater appreciation for the interplay between Growth and Value.

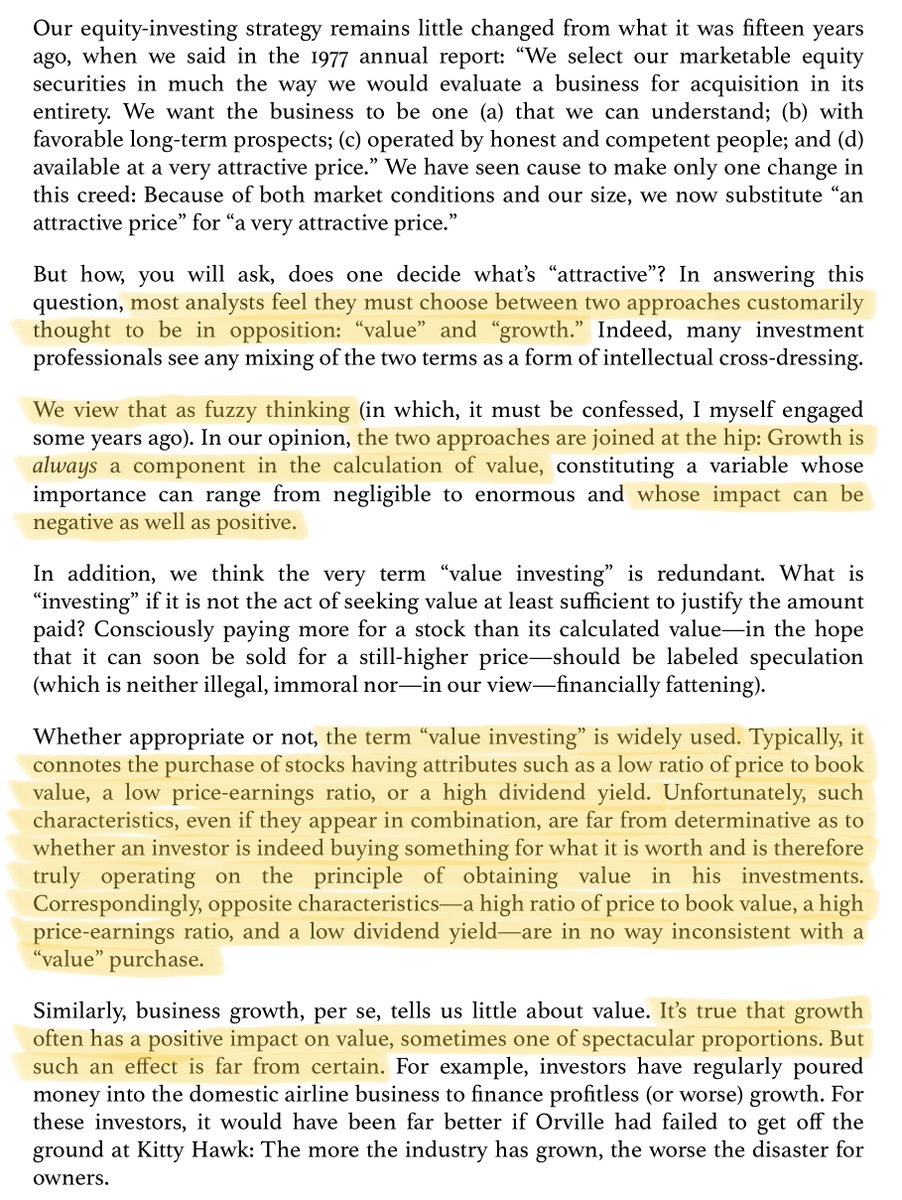

Here's what Warren Buffett said about it in his 1992 letter:

Here's what Warren Buffett said about it in his 1992 letter:

About Money Concepts

We're a virtual investing club. Our goal is to help each other become better investors.

We meet Sundays at 1pm ET via @getcallin, to discuss all things investing.

Join us. Get the app. Subscribe. Tell your friends.

It's FREE.

callin.com/show/money-con…

We're a virtual investing club. Our goal is to help each other become better investors.

We meet Sundays at 1pm ET via @getcallin, to discuss all things investing.

Join us. Get the app. Subscribe. Tell your friends.

It's FREE.

callin.com/show/money-con…

• • •

Missing some Tweet in this thread? You can try to

force a refresh