0/ Is today’s move in BTC the start of a breakout, or are we getting faked out?

ETH seems to be stealing the show with ETH/BTC confirming a breakout of a downtrend since early Dec.

Don’t miss this week’s Crypto Roundup to filter the noise & hone in the signal 🧵👇

ETH seems to be stealing the show with ETH/BTC confirming a breakout of a downtrend since early Dec.

Don’t miss this week’s Crypto Roundup to filter the noise & hone in the signal 🧵👇

1/ 43k is a minor level in #btc the big hurdle to break is around 46k. Obvious chart resistance this also lines up with short term holder cost basis as per @WClementeIII latest newsletterhttps://twitter.com/WClementeIII/status/1504842948135034882?s=20&t=i1YZlMRU56qNPasZuY79sA

2/ Interesting perspective from @woonomic on the death of the 4Y cycle in BTC, shorter cycles have been observed since 2019.

https://twitter.com/woonomic/status/1444331560925163526?s=20&t=8_Gyvj074CyPqJ0Z24Pp6g

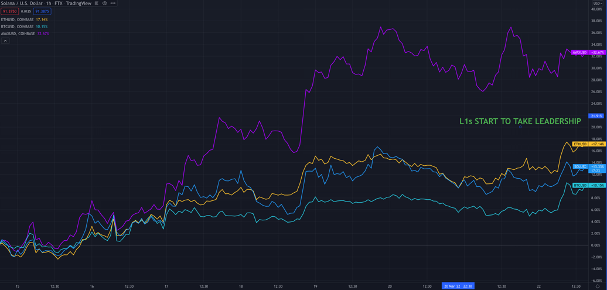

3/ ETH finally waking up as ETH/BTC breaks above downtrend and L1s take the baton this week. AVAX leads the way ahead of Barcelona Summit.

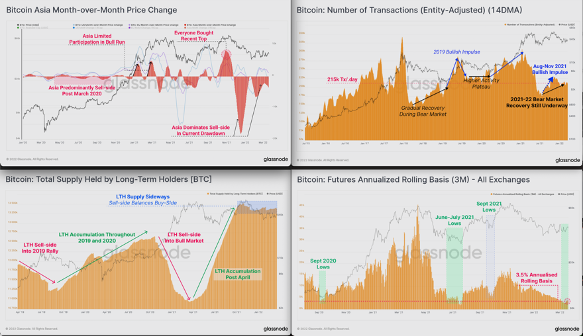

4/ Key takeaways from @glassnode this week:

Asia prominent on the sell side since late last year, Transaction count stable but not rising, LTH balances relatively high so less liquid supply if beta chase kicks in, Quarterly futures basis very low suggests are people well hedged

Asia prominent on the sell side since late last year, Transaction count stable but not rising, LTH balances relatively high so less liquid supply if beta chase kicks in, Quarterly futures basis very low suggests are people well hedged

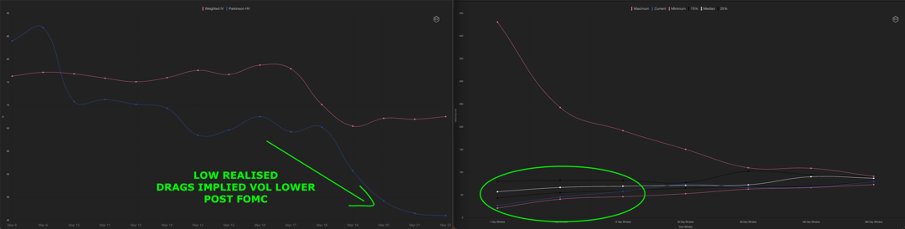

5/ Crypto realised vol collapsed taking implied with it post-FOMC. IV-RV spread still high though as front caught a bid on potential upside break.

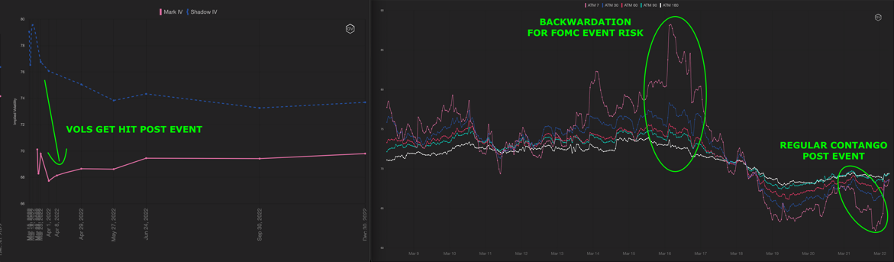

6/ Standard IV crush taking curve from inverted to contango post events last week. Realised needs to tick up, otherwise contango will get much steeper into Easter I suspect. DOV flows will keep coming regardless.

7/ ETH vs BTC implied vol spread got very tight providing opportunity for RV trades. Personally I like owning ETH calls vs BTC calls naked in Apr 20 delta space.

8/ Skew flattened back sharply, especially in ETH which had been the favoured protection asset. This type of shift in skew can often lead a move as sentiment shifts.

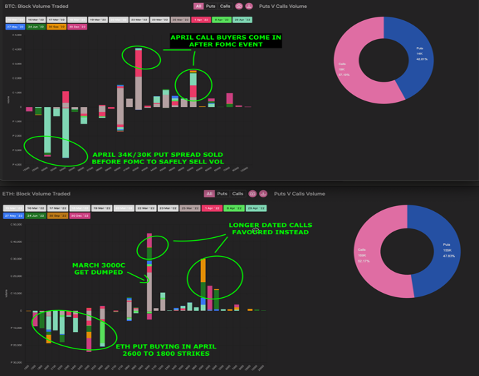

9/ In option flows, Mar ETH calls dumped in favour of longer dated, BTC Apr 34k/30k put spread sold ahead of FOMC, worked amazingly, April call buyers 42k-50k strikes for breakout participation. ETH Apr downside still active.

10/ Thanks to @PelionCap @fb_gravitysucks @QCPCapital and @GenesisVol for helping me stay on top of things and be sure to check out the new CRYPTO INSIGHT video that drops Thursday. Link to last week

11/ If you like this thread pls RT and be sure to try out our community by joining our FREE Discord group chat (discord.com/invite/dsnhDWS…) to join the conversation and get info like this & more in real-time.

We also have a FREE crypto option webinar (link in profile)

We also have a FREE crypto option webinar (link in profile)

• • •

Missing some Tweet in this thread? You can try to

force a refresh