Today I’m turning over rocks using a popular heuristic to find hidden gems from the illiquid microcap universe to add to my watchlist.

I'll go through my process and the three companies:

🛵V-Moto $VMT

♻️Close the Loop $CLG

🩸Cryosite $CTE

Let's turn over some rocks 👇

I'll go through my process and the three companies:

🛵V-Moto $VMT

♻️Close the Loop $CLG

🩸Cryosite $CTE

Let's turn over some rocks 👇

@iancassel recently discussed with @TreyLockerbie his strategy to microcap investing, which I am butchering here in my investment research process. Worth the listen.

His framework includes:

📋Tailwinds

📋Scarcity

📋Story

📋Undiscovered theinvestorspodcast.com/episodes/the-b…

His framework includes:

📋Tailwinds

📋Scarcity

📋Story

📋Undiscovered theinvestorspodcast.com/episodes/the-b…

First, I ruled out mining and energy as I want long term compounders.

Then, I ruled in only profitable companies (PE<30) because I am focusing on those past the inflection point.

From 1,629 microcaps on the #ASX microcaps, it was reduced to 112.

Then, I ruled in only profitable companies (PE<30) because I am focusing on those past the inflection point.

From 1,629 microcaps on the #ASX microcaps, it was reduced to 112.

Then, I reviewed their most recent annual report and 1H22 results presentations.

If I liked the story, then I checked out Hotcopper – and focused on those with the least views/comments to find 3 potential hidden gems.

Not quite rocket science, but it was fun research.

If I liked the story, then I checked out Hotcopper – and focused on those with the least views/comments to find 3 potential hidden gems.

Not quite rocket science, but it was fun research.

V-Moto $VMT $VMT.AX is an electric scooter company.

European designed, manufactured in Nanjing China, and distributed to 53 countries. It was by far the most discussed stock on HC, so perhaps not so hidden, but a strong story.

European designed, manufactured in Nanjing China, and distributed to 53 countries. It was by far the most discussed stock on HC, so perhaps not so hidden, but a strong story.

Tailwinds for the EV market are pretty phenomenal. Although we often hear more about cars, e-scooters are huge and growing at 6-19% CAGR particularly in urbanized China, India and rest of Asia.

V-Moto has 61 distribution partners including Ducati, and a sponsorship deal with MotoGP's Moto-e.

They are focusing on ride-sharing B2B, premium branded B2C, and to a lesser extent mass market products in Asia that compete with the likes of Yamaha.

They are focusing on ride-sharing B2B, premium branded B2C, and to a lesser extent mass market products in Asia that compete with the likes of Yamaha.

V-Moto has been profitable since 1H19, is cash flow positive, and has a decent balance sheet (NTA $40m, EV=$90m).

Valuation is not a stretch with EV/EBIT(LTM)=11 or PE(LTM)=13.8, while 5-yr Revenue Growth is 38% CAGR.

Valuation is not a stretch with EV/EBIT(LTM)=11 or PE(LTM)=13.8, while 5-yr Revenue Growth is 38% CAGR.

Overall, I like V-Moto as a story stock with decent fundamentals that may have passed its inflection point.

The main risks that I'm watching is if it doesn't get new B2B contracts, fails to make inroads in India, and can't maintaining profit growth.🤷

The main risks that I'm watching is if it doesn't get new B2B contracts, fails to make inroads in India, and can't maintaining profit growth.🤷

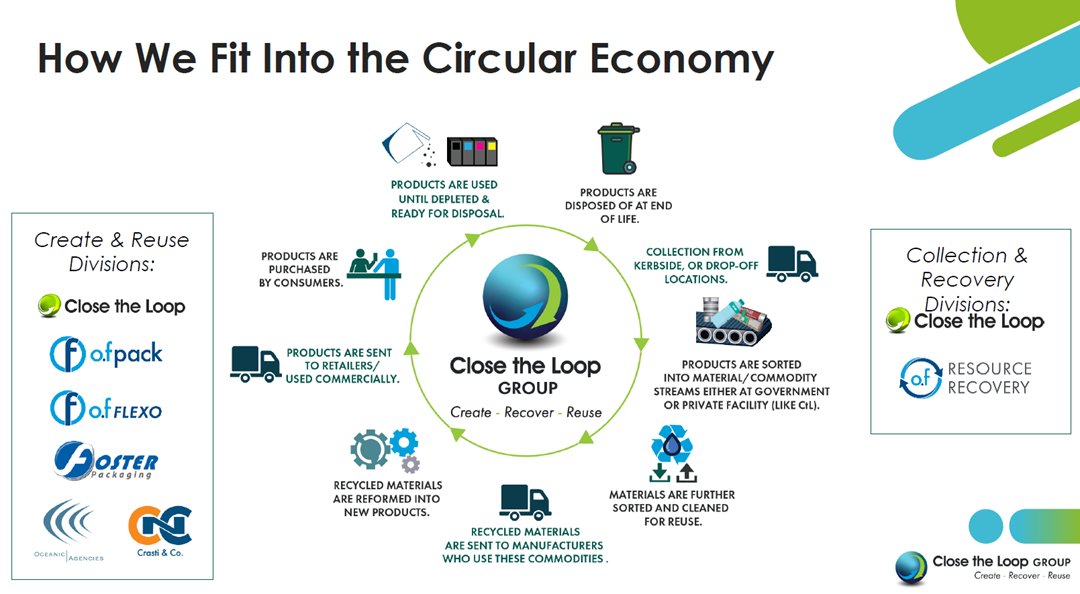

Closed the Loop Group $CLG $CLG.AX is a 20 year old business that IPO’d in Dec 21 as a pure-play sustainable packaging for the circular economy.

CLG is a serial acquirer with a range of brands, geographic footprints (US, Europe, Aus/NZ, but not really Asia) and a lot of niche products.

To be honest, this can be confusing and dilutes the story. Even the CEO fumbles around "integrated divisional synergies"🤦

To be honest, this can be confusing and dilutes the story. Even the CEO fumbles around "integrated divisional synergies"🤦

Regulatory tailwinds are creating new markets and rising global demand.

Everyone wants to recycle more plastic. Consumers around the world are driving this narrative, and governments and businesses are trying to keep up.

Everyone wants to recycle more plastic. Consumers around the world are driving this narrative, and governments and businesses are trying to keep up.

There’s scarcity for closed-loop investments, but not sustainability. Competitors such as Amcor $AMC $AMC.AX $AMCR are increasing their sustainable packaging, but don’t have the take-back / closed loop optionality.

https://twitter.com/DownunderValue/status/1427892820988153856

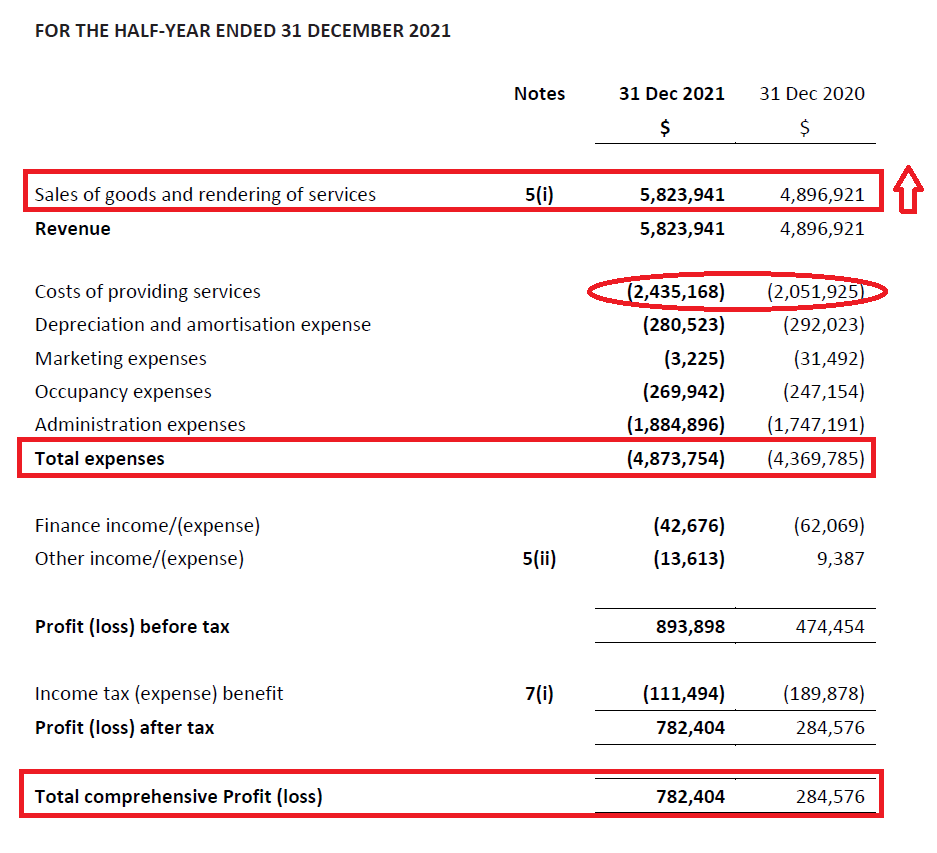

CLG smashed 1H22 out of the ballpark, exceeding prospectus forecasts.

This makes their valuation look reasonable (PE=12) *if* they can maintain their growth...

This makes their valuation look reasonable (PE=12) *if* they can maintain their growth...

The risk is that ~50% of net assets are intangibles/goodwill from their acquisitions, and pre-IPO they were growing unsustainably through one-off-grants and declining SG&A.

Overall, it’s an interesting company that could find its feet. The CEO has skin in the game and presents well. One to watch for improved valuation and to demonstrate their growth credentials.

h/t @CMicrocaps

h/t @CMicrocaps

https://twitter.com/CMicrocaps/status/1506517139108282374

Cryosite $CTE $CTE.AX for over 20 years has provided warehousing, distribution and logistics support for clinical trials and biological storage.

Their niche is that the storage can be ambient, cold, frozen or cryogenic/liquid nitrogen storage options.❄️

Their niche is that the storage can be ambient, cold, frozen or cryogenic/liquid nitrogen storage options.❄️

The clinical trials, biological storage and logistics segment has macro tailwinds as more trials take place in Aus/NZ. The modernisation of their assets has helped see six consecutive halves of increasing revenues.

Cold blood and tissue storage is like a melting ice cube (pun intended), as they stopped taking new samples in 2017 but maintain storage for 18k samples.

It’s complex accounting, but it generates revenues, deferred revenues, and profit each year, though it’s declining.

It’s complex accounting, but it generates revenues, deferred revenues, and profit each year, though it’s declining.

The growth story for Cryosite is the expansion into new verticals i.e. medical cannabis, oncology, and specialised services for big pharma. Their scarcity is the regulatory and technical niche.

Cryosite has controlled costs more recently to increase margins. It’s trading on a normalised PE=14, FCF=5%, has $5m in the bank, no debt, market cap of $22m, and could see decent growth in the coming years.

Overall, Cryosite is one to watch as it could see some decent operational leverage in the coming year(s) and establish itself in this niche.

h/t @DMXasset who flagged it to me ~25% ago.🤦

h/t @DMXasset who flagged it to me ~25% ago.🤦

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per fortnight is my commitment to FinTwit.

Questions, feedback and suggestions always welcome. DM’s open. DYOR.

Disclaimer, no positions held.

A deep dive per fortnight is my commitment to FinTwit.

Questions, feedback and suggestions always welcome. DM’s open. DYOR.

Disclaimer, no positions held.

Thanks @CMicrocaps for sharing these Q&As - here's the Close the Loop $CLG CEO chatting to Mark about their strategy.

https://twitter.com/CMicrocaps/status/1507124348183797768

• • •

Missing some Tweet in this thread? You can try to

force a refresh