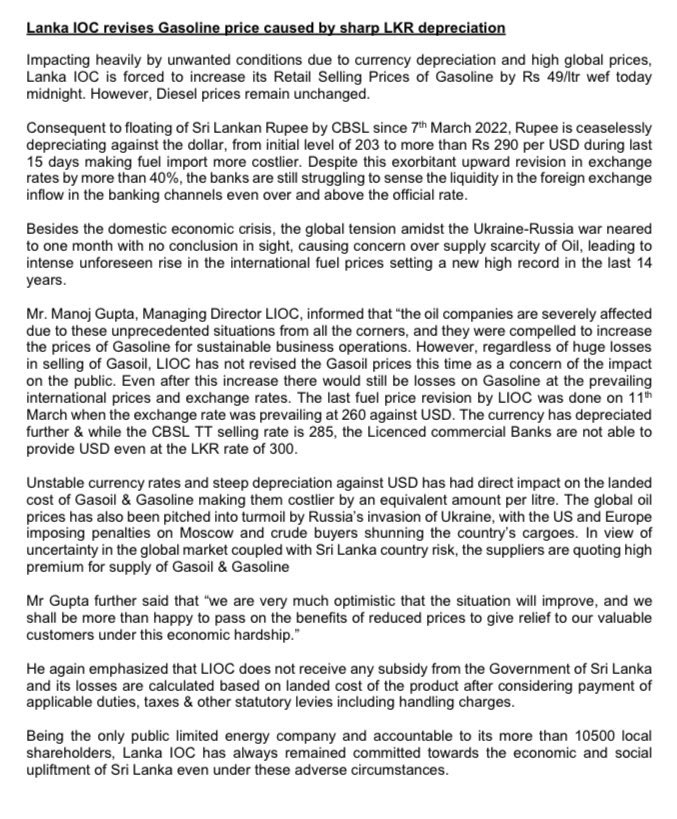

Lanka IOC increases retail selling price of all types of petrol by Rs 49 per litre from midnight today (25): IOC

LIOC “The last fuel price revision by LIOC was done on 11 March when exchange rate was prevailing at 260 against USD. The currency has depreciated further & while the CBSL TT selling rate is 285, Licenced commercial Banks are not able to provide USD even at the LKR rate of 300.”

Revised LIOC petrol retail price per litre; 92 Octane Rs 303

95 octane Rs Rs 332 effective from midnight today

95 octane Rs Rs 332 effective from midnight today

• • •

Missing some Tweet in this thread? You can try to

force a refresh