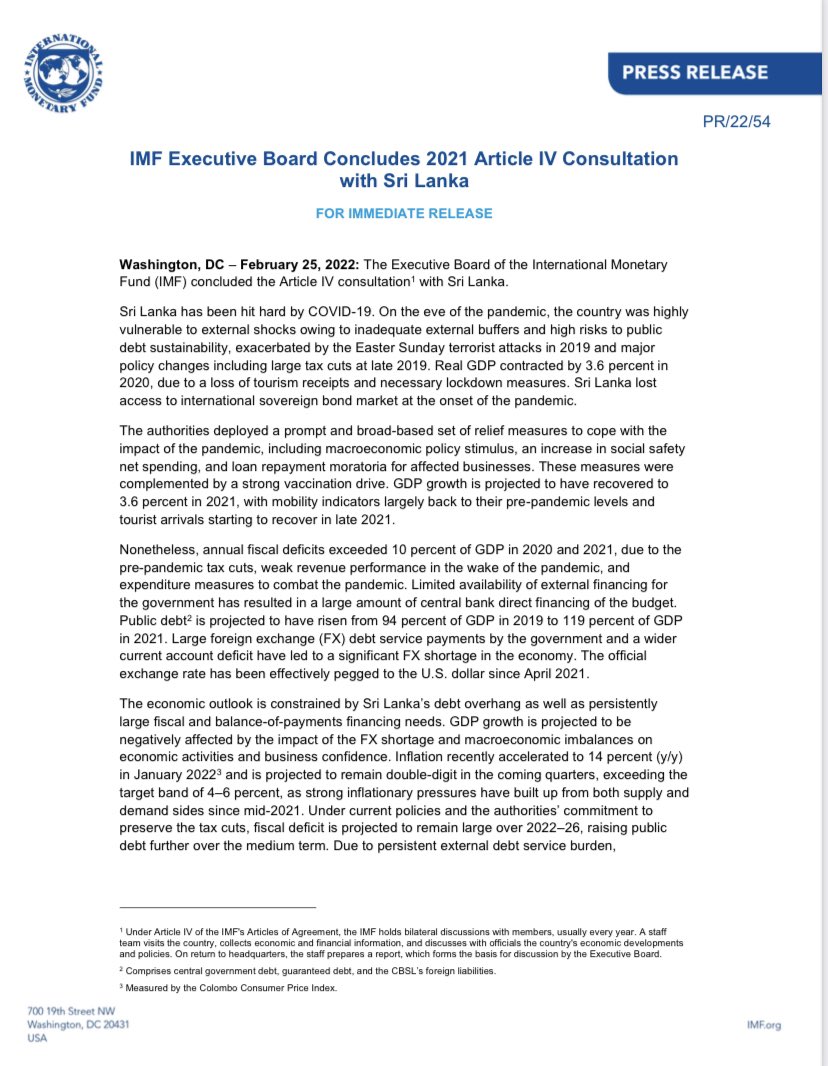

IMF’s Sri Lanka: 2021 Article IV Consultation Staff Report says that COVID-19 severely hit the economy, causing a loss of tourism receipts and necessitating several strict lockdowns. Pre-pandemic tax cuts and the impact of COVID-19 led to fiscal deficits larger than 10 percent of

GDP in 2020 and 2021 and a rapid increase in public debt to 119 percent of GDP in 2021. Sri Lanka’s access to international capital markets was lost in 2020, prompting a decline of international reserves to critically low levels and large-scale direct lending to the government by

the Central Bank of Sri Lanka (CBSL). External debt repayments and a widening current account deficit have led to foreign exchange (FX) shortages, while the official exchange rate has been de facto fixed since April 2021. Inflation is on the rise, reaching double digits

in December 2021, reflecting imported inflation, supply shocks, and a pickup in domestic demand amid loose monetary policy.

IMF says that- the country was highly vulnerable to external shocks owing to inadequate external buffers and high risks to public debt sustainability, exacerbated by the Easter Sunday terrorist attacks in 2019 and major policy changes including large tax cuts at late 2019.

Real GDP contracted by 3.6 percent in 2020, due to a loss of tourism receipts and necessary lockdown measures. Sri Lanka lost access to international sovereign bond market at the onset of the pandemic.

annual fiscal deficits exceeded 10 percent of GDP in 2020 and 2021, due to the pre-pandemic tax cuts, weak revenue performance in the wake of the pandemic, and expenditure measures to combat the pandemic.

Limited availability of external financing for the government has resulted in a large amount of central bank direct financing of the budget. Public debt2 is projected to have risen from 94 percent of GDP in 2019 to 119 percent of GDP in 2021.

Large foreign exchange (FX) debt service payments by the government and a wider current account deficit have led to a significant FX shortage in the economy. The official exchange rate has been effectively pegged to the U.S. dollar since April 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh