Brighton publish 2020/21 accounts. 🔑 numbers

Income £152m (up 14%)

Wages £109m (up 6%)

Operating losses £50m (down 20%)

Player purchases £31m

Player sales £17m

Owner total investment £427m #BHAFC

Income £152m (up 14%)

Wages £109m (up 6%)

Operating losses £50m (down 20%)

Player purchases £31m

Player sales £17m

Owner total investment £427m #BHAFC

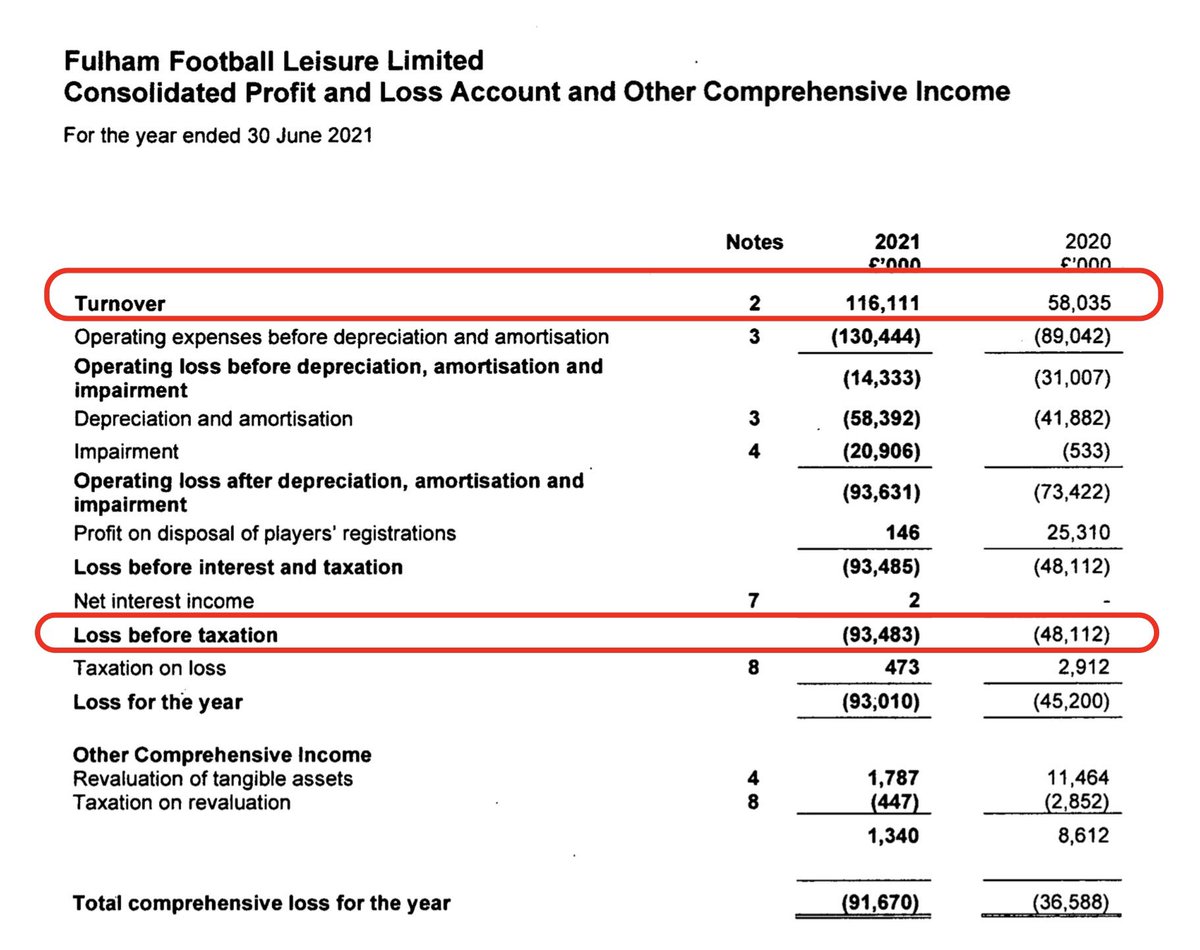

Not all clubs have published 2020/21 accounts, Brighton income record level for club despite matches BCD & broadcast rebate (about £3m). Lowest of clubs who have reported 2020/21 figures to date.

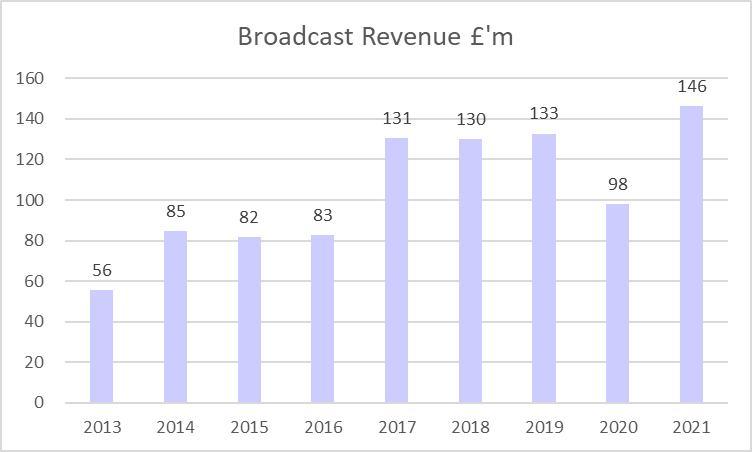

Broadcast income 81% of total for Brighton, higher than previous season as played 44 games in PL in year to 30 June 2021 compared to 32 the previous year impacted by Covid/lockdown. Still lowest of clubs reporting to date for last season though

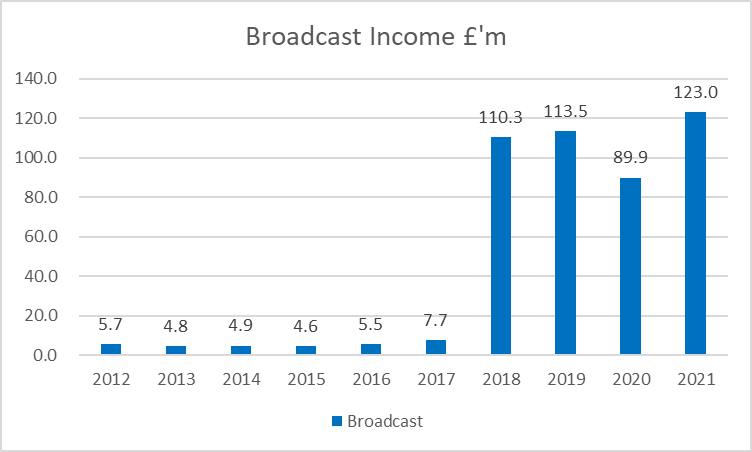

Commercial income broadly held up for Brighton in 2020/21, the overall PL position clearly distinguishes the haves from the have lesses.

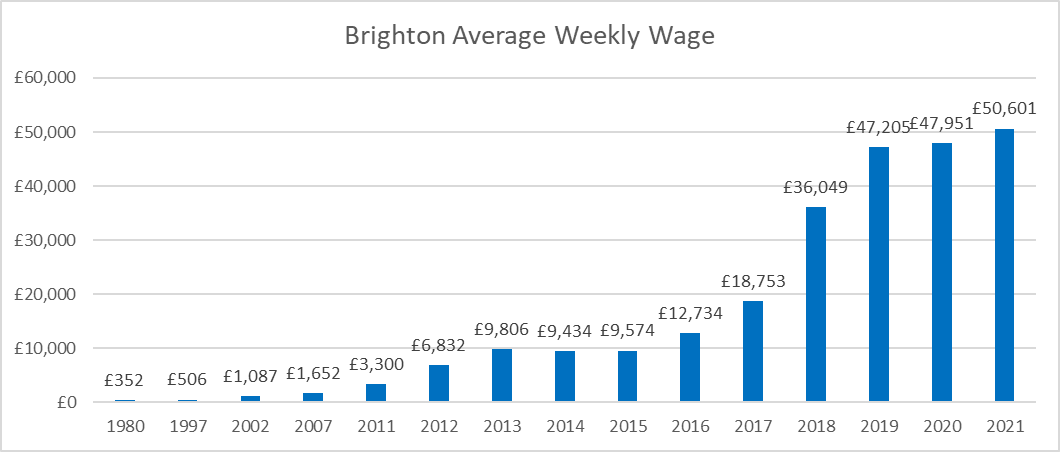

Biggest costs for clubs are wages, Brighton's increased by over £5m despite savings from matches taking place BCD. Wages £72 for every £100 of income. Again Brighton lowest of clubs to report data for last season to date.

Average weekly wage tops £50,000 for Brighton for first time, compares to £350 a week when they were first in the top division in 1979/80. Highest paid director on just over £2m, name not given but rumour is he likes mustard coloured knitwear.

Amortisation (transfers spread over contract life) little changed from previous season at £46m, but again Brighton lowest of clubs reporting to date for 2020/21. Brighton also had impairment (transfer write down) costs of over £9m on duff signings, which are unnamed #Lolcadia

EBIT losses (day to day trading excluding one off items) £50m for 2020/21, taking total losses over the years to £270m. Four seasons in the PL have resulted in them entering the top 10 loss making clubs in PL history, although clearly Covid impact has not helped #PromisedLand

Brighton earned £2.5m from covid insurance to offset losses and had player sale profits of £6.6m, probably from sale of Knockaert. Ben White sale took place after end of season.

Brighton player trading was a net spend of £14m, their lowest since joining the Premier League but not necessarily low by PL standards.

Brighton borrowed from both owner Tony Bloom and a bank in 2020/21, taking total loans to £374m, of which £337m is due to Bloom, who has also put in a further £90m via share purchases #BHAFC

• • •

Missing some Tweet in this thread? You can try to

force a refresh