Few stocks based on Coffee Can Portfolio ☕

• HDFC Bank Ltd.

• Asian Paints

• Dmart

• Bajaj Finance Ltd.

• Ultratech Cement Ltd.

But what is Coffee Can Investing?

Let's take a look ⤵

• HDFC Bank Ltd.

• Asian Paints

• Dmart

• Bajaj Finance Ltd.

• Ultratech Cement Ltd.

But what is Coffee Can Investing?

Let's take a look ⤵

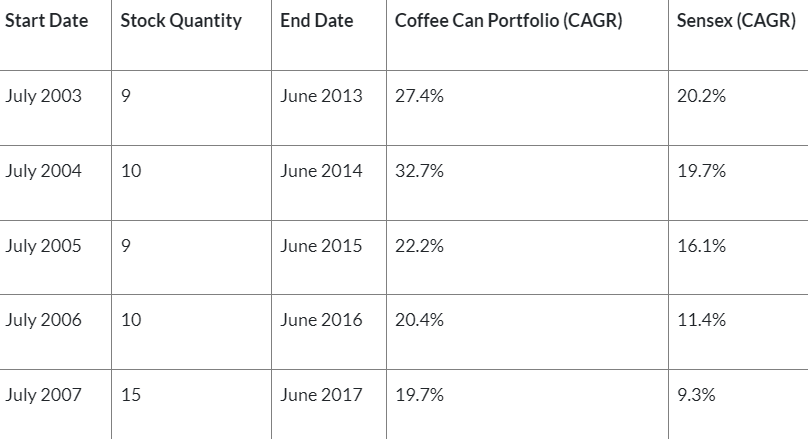

Coffee can investing refers to buying companies that have performed well consistently for a longer duration of time.

This approach is usually denoted by "Buy & Forget".

This approach is usually denoted by "Buy & Forget".

Filters to find a stock.

👉Market Cap >= 100 crores

👉Sales Growth >= 10% YOY

👉ROCE>= 15%

#Niftybank #nifty50 #stockmarkets

👉Market Cap >= 100 crores

👉Sales Growth >= 10% YOY

👉ROCE>= 15%

#Niftybank #nifty50 #stockmarkets

Find more about coffee can investing on blog.finology.in/stock-market/c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh