About -

Dharamsi Morarji Chemical Company Limited (DMCC), established in 1919, with just 1 product & 1 mfg unit. The Company, at present,

is a leading manufacturer of speciality & bulk chemicals with

a global footprint, exports products to 25+ countries across 6 continents.

Dharamsi Morarji Chemical Company Limited (DMCC), established in 1919, with just 1 product & 1 mfg unit. The Company, at present,

is a leading manufacturer of speciality & bulk chemicals with

a global footprint, exports products to 25+ countries across 6 continents.

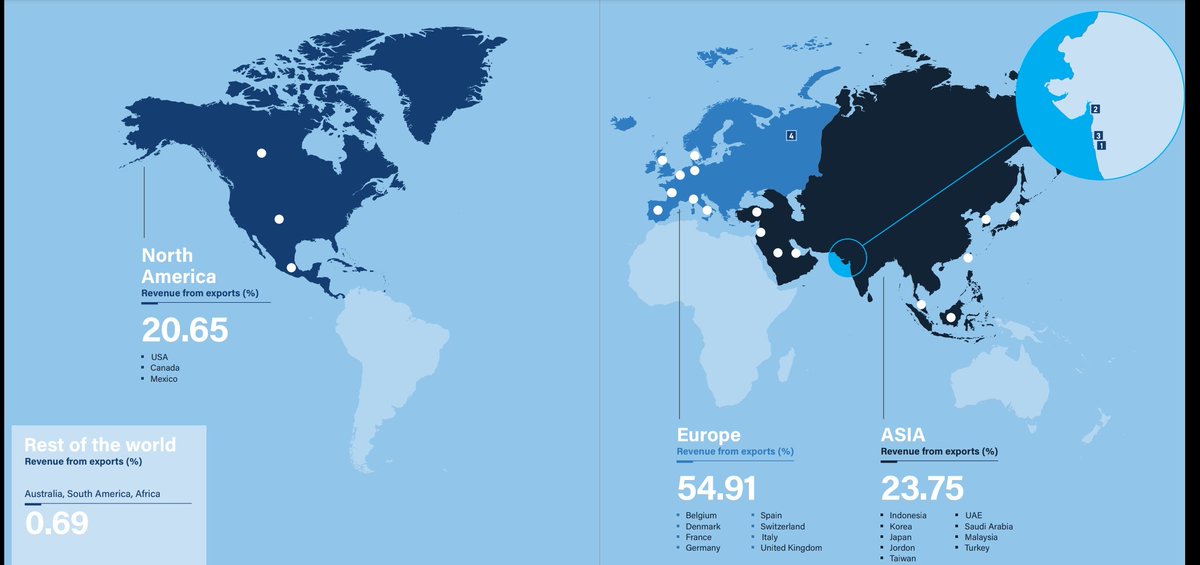

Global Presence -

DMCC has been earning 54.91% from Europe, 23.75% from Asia, 20.65% from North America and 0.69% Rest of the world.

32% of total revenue derive from

exports, 68% from domestic.

DMCC has been earning 54.91% from Europe, 23.75% from Asia, 20.65% from North America and 0.69% Rest of the world.

32% of total revenue derive from

exports, 68% from domestic.

Financials -

Q3 FY22(YoY)

Revenue were at Rs. 81.48 Cr. ⬆️72%

EBITDA at Rs. 12 Cr. ⬆️31%

PAT at Rs. 6.5 Cr. ⬆️36%

Q3 FY22(YoY)

Revenue were at Rs. 81.48 Cr. ⬆️72%

EBITDA at Rs. 12 Cr. ⬆️31%

PAT at Rs. 6.5 Cr. ⬆️36%

Product Offerings -

▪️BULK CHEMICALS: These are low margin products sold within a limited radius from the

manufacturing site. Almost 50% of this is sold in the market the remainder is

used for captive consumption.

Products:

Sulphuric acid, Oleum, Sulphuric anhydride, etc.

▪️BULK CHEMICALS: These are low margin products sold within a limited radius from the

manufacturing site. Almost 50% of this is sold in the market the remainder is

used for captive consumption.

Products:

Sulphuric acid, Oleum, Sulphuric anhydride, etc.

▪️SPECIALITY CHEMICALS: These are high margin products. These chemicals are created with extensive R&D. DMCC exports 65/70% of specialy chemicals.

Products:

Benzene sulphonic acid, Phenol sulphonic acid, Sodium benzene sulphonate, Thiopheno, Menthyl lactate, etc.

Products:

Benzene sulphonic acid, Phenol sulphonic acid, Sodium benzene sulphonate, Thiopheno, Menthyl lactate, etc.

Capex Update -

To be prepared to meet

the rising demand & the dynamic needs

of existing &

potential customers,

DMCC has decided to

undertake strategic

Capex.

To be prepared to meet

the rising demand & the dynamic needs

of existing &

potential customers,

DMCC has decided to

undertake strategic

Capex.

Clients -

DMCC exports to more than 25 countries in 6 continents. They serves a number of clients including Alkyl Amines, IPCA, Aurobindo, Dow, Deepak Nitrite, Pidilite, BASF, etc.

DMCC exports to more than 25 countries in 6 continents. They serves a number of clients including Alkyl Amines, IPCA, Aurobindo, Dow, Deepak Nitrite, Pidilite, BASF, etc.

Indian Chemical Industries -

India has one of the largest global chemical markets is

ranked 6th in the world & 4th in Asia in terms of global

sale of chemicals. Indian chemical industry is fragmented

with large, medium & small players.

India has one of the largest global chemical markets is

ranked 6th in the world & 4th in Asia in terms of global

sale of chemicals. Indian chemical industry is fragmented

with large, medium & small players.

The industry is estimated to

reach $300 Billion by FY 2024-25. In terms of demand, the

industry has grown at approx 1.3× the country’s average

GDP growth in the last 5yrs & shows a strong linkage with

its GDP.

reach $300 Billion by FY 2024-25. In terms of demand, the

industry has grown at approx 1.3× the country’s average

GDP growth in the last 5yrs & shows a strong linkage with

its GDP.

Long Term Triggers -

• The current per capita consumption of chemical products in

India is about one-tenth of the global average & is expected to

double by 2025.

• Govt introduced (PLI) scheme to promote

domestic manufacturing.

• The current per capita consumption of chemical products in

India is about one-tenth of the global average & is expected to

double by 2025.

• Govt introduced (PLI) scheme to promote

domestic manufacturing.

• Rise in demand from

end-user industries such

as food processing,

personal care &

home care is driving

development of different

segments in India’s

speciality chem

market.

• Several global oil & gas majors are turning their sights on downstream chemical opportunitie.

end-user industries such

as food processing,

personal care &

home care is driving

development of different

segments in India’s

speciality chem

market.

• Several global oil & gas majors are turning their sights on downstream chemical opportunitie.

Risks -

• Unavailability of raw material & fluctuation in prices is a

major threat to the business.

• Inability of the Company to retain its customer may affect the

financial performance.

• Unavailability of raw material & fluctuation in prices is a

major threat to the business.

• Inability of the Company to retain its customer may affect the

financial performance.

• Due to the unfavourable Govt policy, co is unable to import the raw materials needed to develop

solutions under the boron chemistry segment.

solutions under the boron chemistry segment.

Conclusion -

India's chemicals industry is in a decadal growth opportunity.

Growth will be powered by strong tailwinds in exports due to a shift in global supply chain driven by the China+1 policy of vendors & demand recovery in domestic end user segments.

India's chemicals industry is in a decadal growth opportunity.

Growth will be powered by strong tailwinds in exports due to a shift in global supply chain driven by the China+1 policy of vendors & demand recovery in domestic end user segments.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful

@caniravkaria @DrdhimanBhatta1 @SwarnashishC @shubhfin

@caniravkaria @DrdhimanBhatta1 @SwarnashishC @shubhfin

• • •

Missing some Tweet in this thread? You can try to

force a refresh